Key points

- All trustees should adopt a fully documented integrated risk management (IRM) approach to their scheme, with workable contingency plans and suitable triggers in place.

- Practising IRM will highlight problems early on, and the sooner trustees act, the greater the prospects of protecting the scheme’s position. Trustees should regularly review these risk management and governance procedures to make sure they’re fit for purpose.

- Engaging regularly with the employer and with other creditors (where applicable) will help trustees to identify and manage key risks early on

- If trustees delay putting robust scheme protections in place, other stakeholders, such as lenders, will be in a better position to exert control over and extract value from a distressed employer, potentially to the detriment of the scheme.

- Trustees should remain alert to pensions scams or unusual transfer activity and prepare a communications strategy to support savers when they are facing uncertainty

- If an employer is facing the prospect of insolvency, trustees should refer to the Pension Protection Fund (PPF)’s contingency planning guidance for employer insolvency

Introduction

Pension scheme employers can become distressed as a result of circumstances impacting a whole economy (such as the COVID-19 pandemic), the sector or industry they operate in, or specific factors affecting their business. When an employer faces distress, this can influence whether savers receive their full pension.

As a trustee, you are the first line of defence for savers and their pension schemes, and it is vital that you remain alert and prepared, and that you are ready to act as the impact of any employer distress develops.

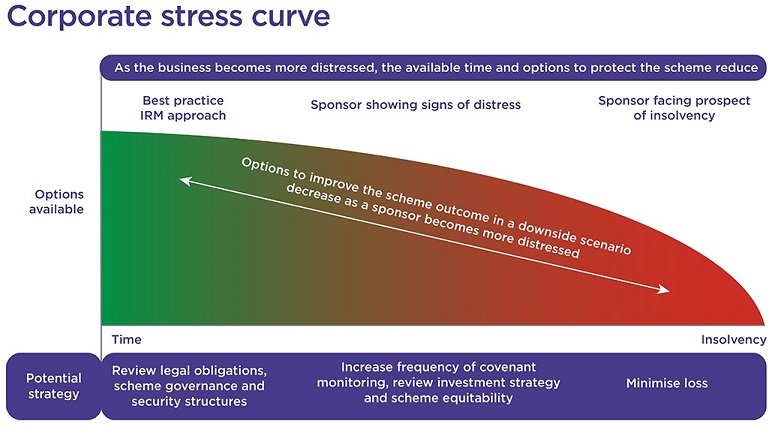

Actions taken by employers when experiencing financial distress can result in significant scheme losses. It is during these times that options available to protect savers and their pension schemes reduce as the employer moves along the stress curve towards insolvency, as shown in Diagram 1. We therefore expect you to adopt risk-based principles on an ongoing basis to identify risks earlier, act sooner, protect savers and minimise potential scheme losses.

Diagram 1: Corporate stress curve

This guidance includes some common examples (see Annex 3) based on what we have seen to date. You can also see our high-level checklist (see Annex 4) to use during periods of employer distress.

Although this guidance aims to follow the natural cycle of the stress curve, please note that all aspects may be relevant, and it should be considered holistically. It does not cover all actions that you should take, which is why it’s important for you to seek appropriate advice to fully consider the options available to you and the scheme when engaging with your scheme employer.

While we have to take a risk-based approach and we can’t get involved in every situation, if you believe you are unable to protect savers and there is still a material risk to the scheme, you should contact us.

Throughout this guidance we refer to taking appropriate advice. While we recognise that you can make many day-to-day decisions without advice, there will be situations where taking advice is the right thing to do, particularly where there are difficult decisions to make and the decision is material for the scheme or employer. While paying for advice at a time of financial distress may feel uncomfortable, you need a good understanding of your options to protect the scheme and its savers.

Best practice IRM approach

Taking decisive action before an employer shows signs of distress increases the chances of mitigating downside risk in the future. While the list below is not exhaustive, it sets out the main actions you should already be taking as part of the proper governance of your scheme, and which may reduce the risk of potential scheme losses due to an employer restructuring, refinancing or insolvency.

Understand your legal obligations to the scheme

Make sure you have a good understanding of (and, if appropriate, seek professional advice on) the following:

- the employer’s legal obligations to the scheme (ie under the scheme’s trust deed and rules, pensions, and insolvency legislation)

- the possible outcome for the scheme in a hypothetical insolvency

You should already have considered the legal obligations of your scheme’s sponsoring employers as part of your regular employer covenant assessment. A good understanding of the legal position will also help you assess the scale of the risk to the scheme posed by an employer insolvency. This will highlight potential options to strengthen the scheme’s position before the employer shows signs of financial distress. Once an employer has become distressed, options to improve the scheme’s legal position may be limited.

For an overview of the areas you should consider, see Annex 1.

Ensure effective risk management processes are in place

Effective risk management requires documented and workable contingency plans to mitigate key risks. Where possible, legally enforceable contingency plans (with specific trigger points) represent the best protection for schemes. Where this is not possible, you should at least agree the actions that should be taken if these risks arise.

When issues do arise, you should review the scheme’s key risk areas to make sure this still satisfies the overall scheme objective. Ultimately, the employer underwrites investment and funding risk held within the scheme, so if the scheme bears too much risk relative to the employer covenant, it’s more likely that the scheme objective will not be met.

Read more about Integrated Risk Management

Review your scheme governance

A trustee board with the right mix of experience, structures and processes in place is more likely to make decisions effectively, manage scheme risks, and protect the scheme.

You should review various aspects of scheme governance protocols on an ongoing basis, particularly the following:

Trustee skills and experience

You should continuously review the skills and experience on the board to ensure there is sufficient collective knowledge to navigate the risks to the scheme throughout its journey plan. Where there are gaps in knowledge, you should arrange further training and consider whether your scheme might benefit from appointing a trustee with additional experience to plug the gap and / or a professional trustee. Read more about your required Trustee Knowledge and Understanding.

Conflicts on the trustee board

Managing conflicts of interest is a foundation of good trustee decision-making. When faced with a distressed employer, managing conflicts of interest may become more challenging, especially for those who hold senior roles within the sponsoring employer. It will be important to identify conflicts of interest and manage these effectively. To do this you should refresh your knowledge of our conflicts of interest guidance and make sure you have the right arrangements in place to manage any conflicts before you spot any signs of employer distress. In some circumstances it may not be possible to manage the conflict of interest, and resignation and / or the appointment of an independent trustee may be the only option. Read more about conflicts of interest.

Clear documentation and record-keeping

Clear documentation of your decisions is part of good scheme governance, not least because poor record-keeping can lead to poor decision making and significant additional costs. It also distils matters to a series of key points, giving you a clear overview of what is important and why. A better understanding of risks leads to better decisions. Read more about record-keeping.

Agreed information-sharing protocol

Ensuring that you and the sponsoring employer (and wider group, where applicable) are clear on what information should be shared and when is important for effective covenant monitoring. During periods of heightened distress, when the employer’s time is stretched, information sharing can be overlooked. Having a legally enforceable information sharing agreement agreed in advance should ensure you are given sufficient visibility of events affecting the scheme. Read more about information sharing protocols.

Monitor the covenant to identify and mitigate employer risk

Monitoring the covenant on an ongoing basis gives you an opportunity to engage with management regularly and identify and understand key covenant risks.

You should review and challenge financial forecasts and stress test assumptions as a part of the monitoring process. You should also review the employer’s financial forecasts to see how they will meet future banking covenant tests and review the timing of debt maturities so key future financing risks can be monitored.

Objectively stress testing the employer covenant will help you to determine the potential impact of stressed scenarios on the employer and its resilience to cope with adverse market conditions.

You will also be able to define what scenarios might result in concern or a covenant downgrade and the likelihood of these scenarios occurring. These risks should be built into a robust risk management framework, with contingency plans in place to mitigate the risk of adverse scenarios on the scheme.

For more information, read Assessing and monitoring the employer covenant.

Seek appropriate advice

When making decisions that are material for the scheme or employer, you should consider taking advice. Professional advice can highlight options or problems that may not be clear and, by supporting good decision-making, can help save money in the longer run.

Taking advice on any of the areas described in this section before an employer shows signs of distress can help you to secure a positive scheme outcome before other stakeholders compete for value alongside the scheme, when options may be significantly reduced.

Employer showing signs of financial distress

Knowing your employer’s industry challenges

Key warning signs of financial distress may include:

- cash flow constraints

- credit downgrades

- removal of trade credit insurance

- disposal of profitable business units

- loss of a key customer contract

You can find an overview of potential distress warning signs in Annex 2.

The specific warning signs may vary according to the nature of your employer’s business and the industry in which it operates. For instance, when monitoring a listed company, it might be appropriate to review capital erosion and share price movement. Conversely, in a privately-owned manufacturing business, reviewing order book or margin deterioration might be more applicable.

As the financial health of an employer declines, other stakeholders are likely to seek to reduce their own exposure to the business (ie by taking new security, imposing harsher payment terms, or seeking additional collateral) which could erode the money available to meet payments to the scheme, as well as potentially reducing the value the scheme would receive in an insolvency process. Trading performance which breaches banking covenants could give lenders the ability to enforce more onerous conditions on employers. Understanding the employer’s ability to meet future banking covenant tests is therefore a key area of employer covenant monitoring.

Early engagement with the employer can enhance the prospect of the scheme being treated fairly alongside other stakeholders, so that savers’ interests are protected as far as possible. You may decide to support the employer’s turnaround plans where these appear achievable, but it’s important to ensure that the scheme has fair protections in place alongside other stakeholders.

Increasing the frequency of covenant monitoring in distressed scenarios

As outlined above, you should adopt proportionate ongoing covenant monitoring between valuations, as employer covenant strength can change quickly. When an employer suffers covenant deterioration it’s appropriate to increase the frequency and intensity of covenant monitoring to reflect the heightened risk profile.

The risk profile will determine the frequency of monitoring, but the nature of this monitoring should be reviewed so you can take appropriate action. For instance, if your sponsoring employer has shown signs of financial distress and key covenant risks have materialised, you should shift the focus of the covenant monitoring from long-term forecasts to shorter-term financial information (for example monthly management accounts, short-term cash flow forecast, headroom on banking covenants / liquidity, key operational information). Don’t wait for formal confirmation of a covenant downgrade at an actuarial valuation before taking mitigating action. If you have robust contingency plans with specific triggers, action can be taken as soon as a threshold is met.

Performing a detailed review of the scheme’s position in distressed scenarios

As an employer starts to show signs of distress, you should take steps to understand the potential returns to the scheme in a theoretical insolvency.

You need to understand the position of other creditors (including contingent liabilities that will fall due in a default scenario). With complex group structures you’ll also need to understand the inter-company trading and financing positions, as these could have a material impact on what the scheme might get in an insolvency. This is likely to require specialist advice from a restructuring professional and you should review whether your existing covenant adviser has the appropriate skills to carry out this role.

We would expect that other creditors will be completing similar analysis, and it may be possible to obtain access to this analysis on a common platform basis to reduce costs. The employer should also have increased its performance monitoring and forecasting to reflect increased trading risk and much of the information you might need may already have been produced for the employer’s board.

Reviewing your investment strategy in distressed scenarios

Investment risk is a key consideration for all trustees of DB schemes, but this risk can become more significant when there are concerns regarding sponsor distress. Many investments rely on a medium to long term-horizon to smooth out short term volatility (for example, holding equities).

Unfortunately, employer insolvency can crystallise short-term investment losses, so if your employer is showing signs of distress, you should review the scheme’s investments and consider the following:

- a Value at Risk assessment (this is a measurement that estimates the risk of an investment), a stress test scenario, or an equivalent that typically captures a fall in growth / risky assets combined with a fall in bond yields

- what level of investment risk is supportable

- the level of interest rate / inflation hedging in the scheme and whether this should be increased (within the leverage constraints of the scheme) if the level of downside investment risk is unsupportable

- a contingency plan if the level of risk in the scheme needs to be reduced because of a sudden deterioration in the covenant. This might include:

- reviewing investment governance to make sure you can react quickly to a potentially fast-changing situation

- deciding on the de-risked asset allocation that should be targeted and the level of interest rate / inflation hedging associated with such a strategy

- ensuring you understand any additional asset classes (such as liability-driven investments) and prepare for the hiring of any new investment managers

Understanding the role of other stakeholder interests in distressed scenarios

The most active parties in situations of corporate stress are generally lenders and other financial stakeholders, such as trade credit insurers or credit card processors. Actual or forecast banking covenant defaults will give lenders the ability to negotiate improvements in their position which can be detrimental to the scheme. As corporate stress levels increase, these stakeholders could seek to:

- reduce the undrawn amount of cash or credit from a banking facility. This can be through formal reductions in overdraft limits or revolving credit facilities, or restrictions on the use of credit available (which are less visible but have the same impact)

- increase agreed schedules of debt repayment, either from a greater share of employer cashflow or from asset disposals

- seek security for existing debt

You should review changes to the scheme employer’s capital structure, including debt maturities and new money coming into the employer, and understand the terms of the refinancing agreement before it’s finalised. This way you can properly assess the impact on the scheme.

Taking specialist advice is important when an employer has complex financing arrangements, involving multiple parties.

Considering employer requests for scheme easements in distressed scenarios

When faced with financial distress, an employer may seek various easements from the scheme as part of a wider restructuring process. These requests may include deferring deficit repair contributions (DRCs) over a longer period or releasing scheme security.

When faced with either of these scenarios, you should ensure you fully understand the scheme’s legal position and obligations of the sponsoring employer in this context (see Annex 1). This can be a complex process and you’re likely to benefit from professional advice.

You should re-familiarise yourself with the scheme’s trust deed and rules and any other legally binding agreements with the employer to understand the rights and protections in place. For instance, think about whether it’s appropriate to call a valuation, to use contribution powers or to enact / reset contingency plans already in place.

We expect you to be engaging in regular, open discussions with your employer. Before agreeing to extend the scheme’s recovery plan, make sure that the scheme is being treated fairly and that shareholders and other creditors are sharing the burden proportionately. This is in addition to seeking other forms of security for the scheme to mitigate risk.

The pension scheme may be one of several financial stakeholders competing for value in a distressed business. Make sure you read our IRM guidance and find out whether contingent assets or other protections may be available to support the scheme, particularly if other creditors are competing for assets or seeking concessions from the scheme.

An employer may make a formal request for a scheme to release security over an asset(s). This may be because the employer wishes to sell the asset or to secure funding against that asset. You should consider any such request very carefully as this would affect the scheme's position if an insolvency occurs at some point in the future. It’s very unlikely that security release is in your savers’ best interests, so it will be important for you to obtain full legal and financial advice from specialist advisers and fully document all decisions.

Information sharing in distressed scenarios

When employers are encountering challenging situations and future uncertainty over the viability of their business, there will be competing demands on time and resource across the key management team. However, they still need to provide you with the information you need in a timely manner, in accordance with their legal obligations[1]. Equally, you should be open with the employer as this will make for better decision-making, benefitting the employer and the scheme savers.

In stressed circumstances, the employer’s executive board will be preparing focused trading information and closely reviewing liquidity. Cash flow will normally be reviewed more frequently (for example rolling 13-week cash flows), alongside banking facility covenant tests to monitor the potential timing of any forecast breaches. You should seek to understand what information is being produced by management for this purpose and align information requests where possible. This will ensure the information is pertinent as well as minimising additional demands on management time.

You should be open with the employer and be able to demonstrate why the requested information is needed. The pension scheme is generally one of the most significant creditors of an employer and should be treated as such, which is why agreeing an information sharing protocol upfront can be beneficial. Having non-disclosure agreements in place may also be a useful tool to resolve any concerns with employers about sharing sensitive information.

Transaction activity in distressed scenarios

Corporate stress or reduced share prices can trigger corporate transactions. When considering a corporate transaction, you should review the impact on the employer’s ability to continue paying scheme contributions, as well as the impact on the scheme recoveries in an insolvency scenario.

Examples of corporate activity that might cause material detriment could include:

- injection of additional debt into the scheme employer, either to fund a transaction or to provide further capital to rescue a company, particularly where the additional debt is secured

- security (of any type) to another existing unsecured creditor

- proceeds from the employer selling off parts of the covenant not being shared fairly with the scheme

- refinancing where the employer is distressed and consequently has reduced options to introduce new capital. In this scenario, financing costs can be higher because of heightened lender risk, which may in turn reduce free cash flow available to fund the scheme

- sale of a scheme employer to a third party. In this scenario, you should also be mindful of any restructuring / reorganisation or introduction of debt following the transaction which may affect the scheme’s position and understand whether the proposed application of sale proceeds is appropriate

You can see further examples of how corporate activity can affect pension schemes in Annex 3.

If you consider that a transaction will cause, or has already caused, material detriment to your scheme’s position, you should seek mitigation. However, options for mitigation can be limited if your employer is distressed, and you may need to take professional advice to make sure you’ve explored all available alternatives. Read our Clearance guidance in relation to detrimental events if you’re worried that a transaction might have a materially detrimental impact on the scheme.

In distressed scenarios, pension schemes are often a key stakeholder, so employers may consider scheme-related options, for example a regulated apportionment arrangement (RAA) or a company voluntary agreement (CVA), which could facilitate a wider restructuring of the employer, while also securing the best possible outcome for savers.

If these are being considered, you should contact us and the PPF as early as possible. This is because an RAA needs TPR approval, for which we will usually require a full application for clearance. RAAs also require the PPF to indicate no objections. The PPF also has a vote in any CVA involving an employer of a DB scheme. Read more about the principles we expect to be followed for RAAs and note 5 of the PPF’s guidance on CVAs.

Communicating with savers in distressed scenarios

You should have well-established channels to communicate regularly and effectively with savers as part of your ongoing scheme governance, and ensure savers know who to contact with any scheme-related queries.

You should also consider how to communicate with savers during periods of employer financial distress. If your employer is experiencing financial difficulty, it might be reported in the public domain or visible to employees, causing savers to worry about whether their pension is safe.

Communicating with your scheme’s savers and making sure they understand the protections in place and the steps you are taking can help to alleviate these concerns. Considering a communications strategy in advance can help a trustee board to manage these situations and ensure everyone is clear on the steps to take. Read more on how to communicate with savers when they are concerned about the scheme employer.

Being alert to scams and unusual transfer activity in distressed scenarios

If scheme savers become concerned about their pension, they may start considering options, including taking Cash Equivalent Transfer Values (CETVs), which might not be in their best interest and could expose them to pension scams. As a trustee you play an important role in educating and protecting them.

You should actively monitor the number of requests for CETV quotes you receive, and which advisers are supporting the savers’ request. If you identify unusual or concerning patterns, such as spikes in CETV requests or the same adviser across a multitude of requests, please contact the FCA on dbtransferschemeInformation@fca.org.uk

Read more information about protecting savers from pension scams.

Footnotes for this section

- [1] Regulation 6 of the Occupational Pension Schemes (Scheme Administration) Regulations 1996

Employer facing the prospect of insolvency

Before taking specific action if an employer insolvency is looking likely, you should take professional advice from specialist restructuring advisers to make sure that all options to protect the scheme’s position have been explored.

You may want to investigate enforcement options if your scheme has security structures in place, so make sure you know how to enforce such security if you’ve explored all other options and insolvency is imminent.

You should be familiar with the PPF’s contingency planning guidance and engage with them if an employer is expected to become insolvent, to understand what practical steps will need to be taken to prepare the scheme for PPF assessment.

These practical steps involve:

- reviewing steps to realise charges and assets contingent on the employer’s failure

- putting in place contingency plans for documents and data held on company premises

- reviewing employers for PPF entry purposes

- putting in place contingency plans for payroll and banking independent of the employer

- making sure a complete set of governance documents is held

Restructuring plans for employers in financial difficulty

The Corporate Insolvency and Governance Act (CIGA) came into force on 26 June 2020. This Act introduces new procedures for distressed companies, including a ‘restructuring plan for companies in financial difficulty’ and the ability to arrange a payment holiday (called a moratorium). For more information, read the Corporate Insolvency and Governance Act factsheets on GOV.UK.

CIGA sets out a renewed focus on business rescue and survival. This may be good for pension schemes that are reliant on the long-term employer covenant, but there are potentially new risks that will need to be addressed. The CIGA rules are complex, and you should seek specialist advice from a restructuring professional in this scenario, as the challenges faced will be case-specific.

As part of your ongoing covenant monitoring, you should request a copy of the turnaround plan and review this alongside specialist restructuring advisers to understand the potential impact of plans on the scheme.

Notifiable events

As a trustee, you should be aware of the notifiable events regime, which provides an early warning of possible insolvency or underfunding, giving us the opportunity to assist or intervene before a scheme enters a PPF assessment period. Some events must be notified by trustees and some others by employers. You should bear in mind that the notifiable events regime does not replace the importance of engaging early with your employer as outlined in this guidance.

Read about how to notify us under this framework.

Annex 1

Legal obligations to the scheme

You should consider and, if appropriate, seek advice on who has a statutory and / or contractual obligation to the scheme. This may be under pensions legislation, the scheme’s trust deed and rules (read more on identifying your statutory employer) or any other legally enforceable agreement (such as a guarantee). You should also look at how those obligations may be called upon or enforced.

In particular you should consider:

- if the employer (or employers) is part of a group of companies, the group’s legal structure, where the employers sit in that structure, and where the value lies in the structure and whether it is accessible to you

- the scheme’s current funding position, including the size of any deficit on a PPF, ongoing funding and solvency basis and, where there is more than one employer, the proportion of the scheme’s deficit likely to be attributable to each employer on a section 75 basis

-

the details of the funding arrangements for the scheme. These include:

- the scheme’s schedule of contributions

- recovery plan and any guarantees and / or security

- asset backed contribution agreements

- profit sharing arrangements

- non-binding support (for example memoranda of understanding and letters of comfort)

- concessions already granted by the trustee (for example contribution holidays or reductions in DRCs)

- relevant legislation governing scheme funding. Read more about funding DB benefits

- the ‘balance of powers’ under the scheme’s trust deed and rules. This includes who has the power to set contribution rates, who has the power to wind up the scheme and in what circumstances, who has the power to appoint a trustee and the process for amending the trust deed and rules

- the obligations on the employer to provide information to the scheme, both in law and as set out in any legally binding agreement (for example an information sharing agreement) and the timing of providing that information

- the eligibility of the scheme for entry into the PPF

- if any sponsoring employer is incorporated or based abroad, the impact that this could have on the insolvency procedures available, enforcement of the scheme’s claim in the insolvency and / or the eligibility of the scheme for entry into the PPF

Annex 2

Warning signs of corporate distress

Trading performance:

- declining revenues, margins, and low profitability / losses: falling revenues put pressure on profits and cash flows (particularly for businesses with fixed cost bases), while margin erosion could point to a business either lowering prices or taking on less profitable work

- loss of of custom: customers may lose confidence and seek alternative supply if they have doubts over an organisation’s ability to keep operating. It is important to understand the impact on liquidity, the build-up of creditors and the risk to solvency

- order book deterioration: an order book is a good indication of future confidence in a business. Order book deterioration indicates lower demand for a company’s goods

- loss of trade credit: suppliers may start to offer less favourable credit terms or demand upfront cash payments before agreeing to supply a company

- defaulting on key creditor payments: organisations experiencing financial distress will need to delay payments to creditors to manage cash flow. If trade creditors increase proportionately to cost of sales, this may indicate a company has financial difficulties

- profit warning (listed businesses only): a profit warning is an official statement to the stock exchange from a publicly listed company that says that it will report full-year profits materially below management or market expectations

- withdrawing annual market guidance (listed businesses only): in uncertain times, listed businesses may decide to withdraw future guidance until they are better able to produce reliable guidance

Financial flexibility:

- cash flow issues: working capital constraints may result in a lack of employer investment

- inability to refinance debt within one year of maturity date: companies may find refinancing challenging if banks deem a business to be high risk, which can create an issue if a company needs to repay debt obligations in full at a specific date. This can put pressure on liquidity and lead to companies taking on expensive debt that places further pressure on profits and cash

- bank covenant breaches: if an organisation defaults on the primary terms and conditions in its lending facilities, the lender can demand immediate repayment of all its outstanding debt. Actual or forecast covenant defaults can be used by lenders to seek increased protections by reducing lending or asking for more security

- withdrawal of credit facilities: a lender may decide to reduce its own exposure if an organisation is distressed, by reducing credit facilities

- reductions in available trade credit insurance: this can have a major impact on the trade credit available to the employer, significantly reducing liquidity

- changes in terms by credit card processors: businesses taking payment for goods or services well in advance of delivery rely on credit card processors releasing the funds to them promptly. Where credit card companies have concerns about solvency, they may hold back funds

- capital erosion: financial decline often stems from lower profitability which can reduce balance sheet strength, placing pressure on cash flow

- high leverage: if a business has a high net debt to equity ratio, it is likely to have higher financing costs which need to be serviced, creating greater demands on profits and cash generated

- high interest payments: the healthier a business is, the cheaper it can borrow money because it is viewed to be lower risk. High debt costs relative to competitors or increasing debt costs can indicate that the bank considers a business to be risky

- asset impairments or write-downs: key business assets are tested for impairment on a regular basis. An asset is impaired if its projected future cash flows are less than its carrying value on an organisation’s balance sheet. When an asset value is written down on the balance sheet, there is also a loss recorded on the income statement

Key events:

- credit grade downgrade or withdrawal: independent credit rating agencies monitor the financial health of organisations. If an organisation is downgraded, this can be a good indicator that it is experiencing financial distress

- rapid fall in share price: the value of a listed business is measured by its share price. Declines in share price can point to lower investor confidence in a business or concerns over future profitability and performance

- disposal of business unit or division: selling off assets or business units / divisions (especially profitable divisions) can indicate a business is facing financial distress. This is because it highlights a requirement to get more cash into the residual business. It is important to understand how proceeds will be applied, as this can reduce the covenant available to the scheme

- loss of senior managers: key staff may decide to leave due to low morale or to preserve their own reputation. This can also lead to poor operational performance and lower service quality

- suspension of dividends: suspending dividends may be required for underperforming businesses to retain cash in the business. Equally, you should be concerned by your employer paying dividends that are not covered by operating cashflow generated by the business, thereby diminishing the value of the covenant

- failed attempts to sell the business: this can point to financial distress if a potential buyer decided not to pursue a transaction following announcements of a potential deal

- high profile legal case: press reports of a legal case can cause reputational and financial damage

- sector / regulatory change: strategic change to adapt to certain sector / regulatory developments (for example food packaging or traceability) could create additional cost for a business without a proportionate increase in revenue

- corporate fraud: fraud is more prevalent in distressed businesses and is used to prop up a business’s finances. It is often driven by individuals (such as directors) who are motivated to avoid an insolvency

- qualified audit report or late filing of accounts at Companies House: it is common for businesses experiencing financial difficulty to delay filing financial information that shows poor performance

Scheme-related:

- irregular timing of payments to the pension scheme, including late payments

- DRC deferral requests

- requests to amend the Schedule of Contributions

- resignation of employer-nominated trustee board savers

- information not being freely shared

- infrequent updates from the employer

- inaction of agreed risk triggers

- significant changes to the trustee board

Annex 3

Case examples

The examples below illustrate how a scheme’s position can worsen because of corporate activity and highlights the importance of trustees remaining alert and engaging early to protect a scheme’s position during times of distress. The risks and actions outlined in the examples are not intended to be exhaustive.

Example 1 — Lenders seeking security ahead of the scheme

The sponsoring employer has experienced an acute reduction in trade, and income has materially fallen. They have responded by cutting costs wherever possible, but still need more money to fund the turnaround plan of the business, including further restructuring.

The employer has applied for a bank loan to finance the restructure and turnaround plan. They currently have an unsecured overdraft facility, and the bank has offered a new term loan which will partly be used to repay the overdraft as well as to finance the turnaround. The new term loan has been offered on a secured basis which will rank ahead of all other creditors including the pension scheme. If the turnaround plan fails and insolvency occurs, the scheme will suffer a shortfall and the shortfall will be larger because of the newly secured debt. As part of the restructuring and turnaround plan, the employer has asked to reduce DRCs and extend the recovery plan.

Guidance: In these circumstances we expect the trustees to understand and consider the following:

- The legal obligations of the employer to the scheme — the trustees need to understand who has legal obligations to the scheme, and what their responsibilities are, see Annex 1 for further information.

- The current funding position of the scheme — on each of the ongoing, PPF and solvency bases.

- The key different scenarios for the employer that could flow from its current situation and proposal, such as:

- ‘do nothing and insolvency follows in X time’

- the expected projection if the bank loan is agreed based on reasonable assumptions going forwards

- the expected projection if the bank loan is agreed but the downside risks of the assumptions play out

- the expected projection if the bank loan is agreed and forward-looking assumptions play out favourably

- The financial position of the scheme in the different scenarios — what is the expected return on insolvency now, and how would that change if the bank loan is agreed in the reasonable, downside and upside cases? Is the employer request necessary and reasonable?

- Achievability of the turnaround plan — are the assumptions used and likelihood of the plan being successful credible and in the interests of the scheme? For example, a business with long-term contracts may be able to predict its future performance with some degree of confidence, but if a business reliant on a few key contracts loses one or more of them, that could be a significant set-back.

- How does the scheme’s position develop or change throughout the turnaround plan — does the scheme’s position get worse before it gets better and are those risks acceptable? For example, the grant of security may mean that the scheme’s insolvency outcome worsens considerably, but the scheme has a reasonable expectation of DRCs for the duration of the three-year business plan, compared with ‘doing nothing’ and getting the pre-security grant insolvency outcome but DRCs only for the short period before expected insolvency. When considering the bank loan, is the trade-off with the worsened insolvency outcome in the short-term worthwhile given the strength of the business’s prospects to support the scheme into the future? These questions need to be considered for each of the key scenarios the employer faces.

- What upside and downside protections are available to protect the scheme in different scenarios and what value will these protections provide? For instance, does the scheme have contingent funding arrangements in place that could provide additional scheme contributions when downside risk materialises? Can a negative pledge be introduced to prevent a profitable employer from being sold without trustee consent?

- Is the level of investment risk being run still aligned to the risk appetite of the trustees and employer? Can the level of investment risk be supported by the employer and / or the scheme?

- Is the scheme being treated fairly compared to other stakeholders? Is the scheme the only creditor being asked to provide flexibilities? If not, what is each creditor getting in return for their forbearance and is this fair given the ‘ask’ and the ‘risk’ they each face? What are the terms and conditions of the existing debt and the new bank loan – are there any restrictive terms or covenant tests attached, and if so, what are the consequences if these are not met (see example below: Lender enforcing security ahead of the scheme) and how will this impact the scheme?

Restructuring scenarios can be complex with multiple stakeholders involved. Other creditors such as banks will be represented by experienced personnel and advisers. It is important for the trustees to consider if they have the requisite skills and knowledge to represent the scheme’s interests. In some cases, the trustee board may consider it appropriate to supplement their number with an additional trustee with restructuring expertise.

Where appropriate, the trustees should take professional advice to ensure the impact on the scheme is fully understood and all options have been considered and explored to safeguard against potential downsides for the scheme.

If the trustees have concerns detriment is not being mitigated and the scheme is not being treated fairly, they should engage with the employer to address this. If they are unable to resolve the position satisfactorily with the employer, they should contact us.

Example 1 continued — Mitigation and DRC easements

As part of the restructuring and turnaround plan, existing unsecured debt is being repaid and replaced with secured debt. In addition, the employer has requested for DRCs to be reduced and the recovery plan extended.

Guidance: The trustees should be aware of their ability to negotiate reasonable protections which arise from employer requests for concessions — for example the reduction in agreed DRCs — and should ensure they use this to achieve appropriate protections for the scheme.

In this example, existing unsecured debt is being replaced with secured debt which will rank ahead of the scheme in insolvency. This change will be detrimental — possibly materially so — to the scheme. The trustees should consider the effect of the employer’s request on both an ongoing and insolvency basis. A measure that enables the survival of the employer may be beneficial to the scheme in one sense (for example its ability to continue to pay DRCs) but detrimental in another (for example the scheme’s expected outcome if insolvency occurs). The trustees should seek appropriate mitigation for any detriment caused. Mitigation in the form of cash is unlikely to be available during periods of employer distress, so other forms of mitigation may need to be considered, these could include the following:

- security alongside the bank / lenders. In some cases, the banks may have restrictions on this, and the trustee may be offered second ranking security. This will not be as valuable as security alongside the banks, but it can give protections to the scheme ahead of other unsecured creditors. The trustees should assess the likely value of second ranking security and understand the restrictions on that security. They should seek limitations on further borrowing under the first ranking security to protect against further reductions in the value of second ranking debt

- security over assets that are free from any creditor claims

- guarantees or other contingent asset arrangements

- negative pledges (ie pre-agreed commitment from the employer that certain future acts — such as changes in security arrangements; additional debt being taken or dividend distributions — will not be performed without the consent of the trustees). The trustees should be aware that this does not provide them with value but does protect against further value loss

- the trustees should understand covenants contained in the proposed banking facilities and what level of risk there is of breach, based on reasonable downside scenarios. This will enable them to monitor performance against these covenants following the restructuring

The trustees should ensure they understand the value of the mitigation offered to the scheme and whether it is appropriate and sufficient to mitigate the detriment caused.

Where they agree to any deferral / reduction of DRCs, the scheme is exposed to greater risk and is effectively contributing to the financing of the turnaround. In such circumstances, we would expect the scheme to share in the protections other lenders receive for these amounts including security over assets, the provision of guarantees which may extend across the group, and information sharing. As outlined previously, it may also be possible to share in any upside connected to the restructuring exercise, where additional scheme contributions are made subject to pre-agreed indicators.

In some cases, the repayment structure to new debt may be preferential when compared to repayment proposals for deferred / reduced DRCs. Therefore, it may be appropriate to extend some of the protections described above to DRC amounts deferred / reduced. In any case, the trustees should ensure that the scheme is being treated fairly in terms of risk profile and use of cash going forward.

Example 1 continued — Lender enforcing security ahead of the scheme

In this example the bank has only agreed to provide the secured loan facility on the proviso that the employer is able to meet certain covenant tests during the period of borrowing. Unfortunately, the employer has failed to meet those covenant tests and the bank acquires the ability to enhance its position by enforcing further security and restricting spending in certain areas. These conditions formed part of the lending facility agreement.

This additional security has strengthened the bank’s negotiating power and removed assets available to secure other creditor positions, including the scheme. In addition, the new spending restrictions imposed by the bank mean that employer affordability is limited, effectively applying a cap on the level of contributions that can be paid to the scheme meaning the recovery plan will need to be extended. Failure to meet these conditions would result in the bank being able to demand immediate repayment of the total loan, precipitating the employer’s insolvency.

Guidance: The trustees should be aware that although banking covenants can trigger employer default, they do not overrule existing agreements between the employer and the scheme. This example demonstrates why it is important that trustees fully understand the terms and conditions of existing and proposed lending agreements and any covenant tests that are attached to them, as well as the scheme’s own rights and powers. Understanding lending agreements and covenant tests should be worked into the scheme’s IRM frameworks so that trustees can identify issues and act before they occur. Trustees should consider whether it is reasonable to agree to restructurings (where concessions are sought from the scheme) in the context of the covenants contained in the restructured facilities.

During times of economic uncertainty and corporate stress, lenders will look to protect and strengthen their positions to reflect the increased risk profile of the employer(s) and, where applicable, the wider group. Below are some actions that lenders may take during a refinancing or due to non-compliance of covenant tests which can negatively impact the employer covenant supporting a scheme.

- taking tangible fixed charge security if currently unsecured / under-secured, or generally strengthening existing security at the expense of other creditors (for example a mortgage on a freehold property)

- improving guarantee / recourse structure, further strengthening their recourse to value in insolvency or from disposals and improving their negotiating position

- reducing existing lending facilities available to the employer such as revolving credit facilities is effectively a repayment of debt ahead of other creditors. This removes risk to the bank and restricts liquidity available to the employer, weakening its ability to support the scheme

- increasing interest costs to reflect heightened employer risk profile reduces liquidity available to support the scheme

- introducing new or tighter covenant tests

- amending credit agreements to include restrictive terms which might impact payments to the scheme

- providing more debt into the capital structure on a secured / senior basis for purposes which do not directly benefit the scheme, creating further subordination and potential recovery dilution

This is not an exhaustive list, and we would encourage the trustees to work with advisers where appropriate to determine what action might be appropriate in the circumstances. Reviewing proposed facility documentation is important as it highlights the changes made which may be detrimental to the scheme.

Example 2 — Employer selling a valuable business

The employer is part of a wider complex group. To assist with liquidity concerns a decision has been made to hive off and sell a profitable non-core division of the business which provides direct covenant support to the scheme. The intention is for sale proceeds to be used to repay group debt which ranks equally with the scheme, and to finance capital investment in the wider group which does not form part of the direct covenant.

Guidance: Hiving off part of the business that provides direct support to the scheme will likely be detrimental and may be materially so. The trustees need to understand the impact of the transaction (both the immediate impacts and the longer-term consequences), including what might constitute appropriate mitigation. See the above example on mitigation for further information.

Where sale proceeds are being used to reduce bank debt, we would expect the trustees to ensure that the scheme is being treated fairly. This will generally mean receiving a share of the sale proceeds which is proportionate to the debt repaid, based on the scheme’s s75 deficit. The trustees will need to understand what recourse the scheme has (for example legal rights) in this scenario compared to other creditors. They may also require specialist legal and financial advice to produce an insolvency estimated outcome statement for before and after the event, as this would provide an indication of how the funds would flow and what the scheme might expect to receive. Negotiations may be complex, and the trustees may have more leverage than they realise. For instance, the trust deed and rules may contain a strong wind-up power in the event of the business sale, the trustees may have the power to set higher employer contribution rates than those in the schedule of contributions, or they could commission a new actuarial valuation.

Using sale proceeds to fund capital investment in the wider group may constitute covenant leakage where value is lost, and no direct benefit is provided to the covenant to the scheme. This is likely to be detrimental and may be materially detrimental. We expect the trustees to engage with the employer to understand how this investment will impact the direct covenant. It may be appropriate for the trustees to obtain mitigation for covenant leakage, for example by extending the direct covenant to other entities within the group via a guarantee or taking direct security.

Annex 4

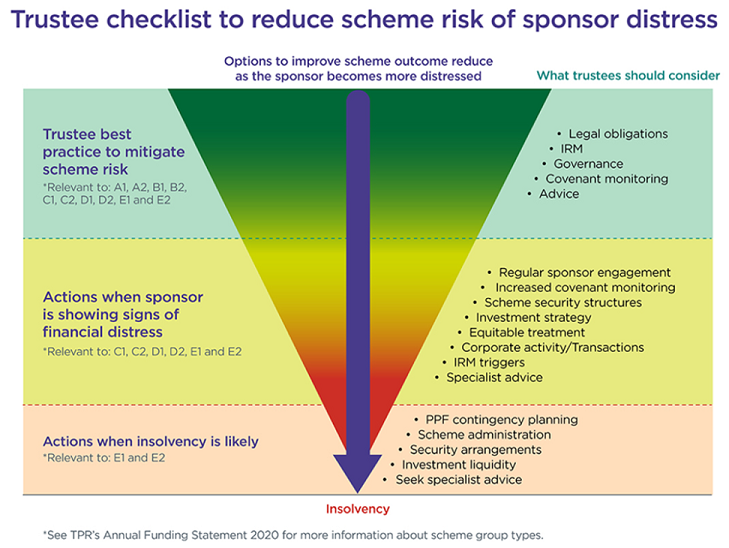

Read a transcript of the trustee checklist to reduce scheme risk of sponsor distress.

How to use this graphic

This graphic sets out key actions for trustees to take, depending on the financial health of your scheme’s employer. You should be adopting best practice principles to protect your scheme from potential downside risk in the future and review various aspects of this approach if your scheme employer shows signs of financial distress.

If insolvency is inevitable, you need to take the right action to meet your legal duties to scheme savers, so we recommend that you familiarise yourself with the details of each section.