The Pensions Regulator’s Corporate Plan 2021-24 sets out our direction for the next three years, with a particular focus on the first year.

Published: 19 May 2021

Chair and CEO joint foreword

Welcome to our Corporate Plan, which sets out our plans for the next year and our direction over the next three years. It is closely aligned with our recently published Corporate Strategy, which sets out five strategic priorities:

- Security – pension savers’ money is secure

- Value for money – pension savers get good value for money

- Scrutiny of decision-making – decisions made on behalf of pension savers are in their best interests

- Embracing innovation – the market innovates to meet pension savers’ needs

- Bold and effective regulation – we are a bold and effective regulator

Last year, we had to re-prioritise our plans for 2020-21 due to the COVID-19 pandemic and we remain in a position where we must be as flexible and adaptable as possible to reflect the ongoing impact of the pandemic.

Our Corporate Strategy sets out our commitment to put the pension saver at the heart of what we do. This means savers who are building their pension pots can expect us to enhance the quality of their savings outcomes. Savers who have built up pension pots and are in or approaching retirement can expect us to protect the money they have saved.

This Corporate Plan articulates the activity we will prioritise in light of the commitments made in our strategy, which builds on the work we have done to be the clear, quick and tough regulator we are. It also recognises the continued impact of COVID-19, the changes that will be coming to the pensions landscape through the Pension Schemes Act 2021 (PSA 2021) and the ongoing internal transformation of our regulatory systems and automatic enrolment (AE) delivery model. Our approach is therefore to combine the vitally important work that continues, alongside new initiatives that we believe are the most important areas of focus for our efforts in the first three years of our 15-year strategy.

Our responsibilities are increasing as a result of the PSA 2021. We therefore have to consider carefully where we deploy our budget and resources, as our funding is more constrained and that is likely to remain the case over the term of this Corporate Plan. In the current climate, it is more important than ever that we remain efficient, risk-based and proportionate in the work we do and the actions we take and, indeed, the actions and work we won’t or can’t do. This will mean taking some difficult prioritisation decisions about where to focus our resource, based on our ambition to reduce risk to savers. However, by being flexible, realistic and clear about what we can and should achieve, we can adapt to both the challenges of the pandemic and our budgetary constraints.

The effect of COVID-19 on savers, employers and schemes

Every aspect of our work has been impacted by the pandemic. For savers, employment has been affected and much uncertainty remains. Many employers are facing challenging economic circumstances and some schemes are in vulnerable financial positions. Our current focus on defined benefit (DB) funding in the wake of the pandemic will be maintained, and we will flex our resource to accommodate work with a greater number of distressed employers, where needed.

As the number of savers through AE tops 10.4 million, some 1.7 million employers are making provision for their employees’ retirement income. Throughout the pandemic, we have expected employers to make the right contributions in full and on time. We have phased out temporary administrative easements put in place during 2020 and we continue to monitor the picture through our data. It is vital that savers feel their money is secure. While most members of defined contribution (DC) schemes have long investment horizons, there remains the risk in this uncertain time that shorter-term volatility may impact savers through reactive investment decisions, deciding to opt-out or becoming more susceptible to scams promising better returns. We expect trustees to review with their advisers what actions (if any) might be necessary to take for their schemes and savers.

The pandemic has heightened the risk of savers being scammed and losing the pension pots they have accumulated over their working lives. Pension scams remain a priority component of our strategic response to making sure that savers’ money is secure. Work in this area includes continuing to lead Project Bloom and collaborating with the Financial Conduct Authority (FCA) and the Money and Pensions Service (MaPS) on DB transfers.

People

Our team has been magnificent in dealing with the changes caused by the pandemic, operating remotely and adapting to our new regulatory priorities. Like many others across the UK, they have also had to deal with challenging personal circumstances such as sickness and caring responsibilities. We would like to thank our team for their dedication and focus through what has been a truly challenging 12 months. The coming months will no doubt continue to present uncertainties and further challenges, and we continue to be committed to supporting our staff and their wellbeing. Their commitment remains very high and is crucial to our ongoing performance and success.

At the end of March 2021, Mark Boyle, our Chair, stepped down after seven successful years in post. Over that time, both the pensions landscape and TPR have changed hugely. Mark has been an outstanding Chair of our Board, steering us through these changes expertly. It has been a pleasure to work alongside Mark, and we wish him every success in the future.

Charles Counsell, Chief Executive

Sarah Smart, Chair

Our purpose: current and future context

We exist to make workplace pensions work for savers. Our Corporate Strategy sets out our long-term framework with a 15-year view and our statutory objectives provide the remit and the foundations for the strategy. In developing our Corporate Strategy, we considered the impact of the unprecedented challenges created by the pandemic and discussed our direction and priorities with our stakeholders and the wider industry.

The basis of this Corporate Plan is derived from the framework set out by our strategy. From the five strategic priorities in the strategy, we have developed an activity roadmap for 2021-24, with a specific focus on 2021-22. Our five strategic priorities are derived from our analysis of the different types of saver and the outlook of the major changes that will happen over the next 15 years.

We recognise that in a rapidly evolving pensions world, how we anticipate change and identify and successfully mitigate future risk is a fundamental part of adjusting our focus over time. We remain tough on those who flout the law and their responsibilities, and supportive of those who are struggling. We will guide employers and trustees to take the best course of action to achieve value for their savers, working with government and our regulatory partners where needed.

Managing risk and strategic direction

The pandemic

Over the past year, the COVID-19 pandemic has triggered the largest economic shock of modern times. At its lowest point, the UK economy fell by over 20%, reflecting an unprecedented freezing of work activity, business cash flows and consumer spending.

As we progress through 2021, and at the time of writing, the economic outlook is one of gradual recovery. Although the vaccine rollout provides hope of a normalisation of activity over the coming months, we expect there to be ongoing economic impacts and significant uncertainties that remain.

Firstly, commercial and social trends, from online retailing to home working, have been accelerated through the crisis and these trends will have ramifications across UK jobs or sectors ranging from high street retailing to transportation and commercial property.

Secondly, the national corporate and personal debt accumulated over the year may have longer-term implications on growth, business profitability and productivity.

Finally, while the outlook for recovery remains positive, we are conscious of the risk of future COVID-19 setbacks that may necessitate further restrictions on economic activity. These downside risks have the potential to affect everything from the opportunities to save for a pension, to the performance of workplace pensions or the ability of employers to support them.

The pensions landscape

As our short- and long-term approaches are defined in part by the risks we identify, we must continue to monitor the pensions landscape as we see - and better understand - the ongoing impacts of the pandemic. Our strategic analysis has also highlighted some overarching trends we believe will shape the future of retirement saving. These include the following:

- The balance of the marketplace is shifting and will continue to change as a result of the fallout and recovery from the pandemic. In addition, there is the increased risk of employer insolvencies, brought about by the trading adjustments from the UK’s departure from the EU.

- While the proportion of DB memberships continues to reduce, their assets increase and will continue to do so over the long term. We will maintain a focus on these schemes, including new and emerging models.

- Employers may seek to revise their operations and their investments during economic uncertainty or where they are experiencing financial constraints. The importance of environmental, social and governance (ESG) factors in the decisions employers take will grow (including the demand for stewardship of investments, issues around climate change and diversity and inclusion). This is driven by legislation and increased consumer/ saver interest and demand.

- As the nature of work and retirement changes, saver and societal priorities will continue to change; impacted also by the furlough scheme, unemployment and other financial stresses that influence people saving into pensions or drawing on their existing funds.

- The DC market is growing and consolidating, and while we regulate all workplace DC schemes, we will continue to vary our approach as needed. We focus part of our relationship supervision work in this area, and support consolidation.

- There will be consolidation and innovation in the market. We have put in place an interim regime for superfunds, for the period before legislation is in place. Under this regime, superfunds will be assessed against our published guidance in key areas, to ensure savers in schemes transferring are protected. We will continue to work with the Department for Work and Pensions (DWP) to develop specific legislation for superfunds, as well as the regulations, and authorisation and supervision framework for collective DC schemes.

- Technology and data will drive and enable change. The development of the pensions dashboards will drive an increased focus on administration and investment in technology in the market, and change the way savers engage with their pensions.

- Regulatory frameworks will evolve, including in areas like climate change where we can expect significant change. We will continue to engage with the industry to find common agreed solutions, using our expertise and learnings to work with government on future policy.

Our assessment of the risk landscape is fundamental to how we develop and deliver our Corporate Strategy and prioritise the areas of focus in this Corporate Plan. We will continue to keep this under review.

Our strategic priorities and one-year and three-year roadmap

Below, we detail the main areas of focus under each strategic priority for the first year of this plan, and then how we will move forward across years 2 and 3.

We, like many other organisations, have constrained resources available to deliver on our ambitions. Our ongoing challenge is to strike an appropriate balance between our capacity and competing priorities.

Over the course of the second and third years of this Corporate Plan, we intend to broaden our work under the five strategic priorities as set out below, depending on how different risks manifest themselves. We will need to be flexible about how we undertake this work and we will address the risks depending on changes in the landscape and the resources we have available.

Security

The PSA 2021 contains important changes that will come into force over the coming months and years. These enable us to use our powers more efficiently and introduce additional deterrents against behaviour that puts savers’ benefits at risk.

Our work in this area continues steadily across the three-year period, but we have broken down the main aspects into year 1, and years 2 and 3, to show how the work will progress over time and where our main focus points will lie.

Figure 1 below depicts an activity timings plan for the work under Security. There is a date range across the top of the chart from left to right showing three consecutive financial years: 2021-22; 2022-23, and 2023-24. This date range is used to show where the activity (shown in swim lanes below) starts and ends.

Year 1 (2021-22)

Extending our reach via new powers, supervision, enforcement, and AE and DC provision

New powers

The PSA 2021 provides a strong package of measures, including the introduction of enhanced civil and criminal sanctions. It also extends our powers for information-gathering, including being able to compel people to attend interviews, and gives us broader powers to conduct inspections. In addition, it strengthens our contribution notice power by introducing two new grounds by which we may issue a contribution notice, and introduces changes to the notifiable events regime to ensure it works as an early warning system.

We will continue to prepare so we are fully equipped to use our new powers from October 2021, and the changes to the notifiable events regime when these provisions are commenced in 2022. This will include updating our codes and publishing new guidance to reflect our new powers and related secondary legislation. We will work with industry to ensure these powers are understood.

Supervision

Our supervision team will start work on an outreach programme with administrators, maintaining a focus on effective governance, administration and scheme funding. Supervision of master trusts will continue to be an important means of ensuring that savers (including those who have been automatically enrolled) continue to be protected. As we are in a period of considerable volatility, we will keep our frontline resourcing under review and be prepared to be flexible where we focus our efforts.

We will continue to streamline our approach to support master trusts as we assess and manage the impacts of the pandemic and use what we've learned since the authorisation and supervision regime commenced.

Master trusts are required to complete a Supervisory Return. This is an annual statutory request for information, aligned with the authorisation criteria, and forms part of our ongoing assessment of schemes and whether they can remain authorised. In addition to our ongoing master trust supervision work, we will issue our third COVID-19 impact questionnaire during the summer.

Our expert risk panel has been set up to understand, explore and recommend potential mitigations to risks that exist across the master trust industry. The panel will manage an industry-level financial dashboard and investment modelling tool. In addition to enhancing our ability to monitor industry performance, these tools will enable us to more effectively forecast, anticipate and track emerging or inherent strategic risks within the industry and associated poor outcomes for savers.

We anticipate an increase in the need for engagement and oversight of schemes via trustees with sponsoring employers who may be experiencing financial distress and complex decisions. As a result, with finite resource, other supervision work may need to become leaner and more focused where possible.

Our enforcement activity remains critical to our regulatory approach with a range of ongoing activity across DC schemes, pension scams and DB funding. We will continue to address poor scheme governance across all scheme types. Our scrutiny of governance standards and ability to enforce where required supports good trustee decision-making, which in turn improves value for money. We continue to use our powers and tools including prohibiting and appointing trustees and imposing monetary penalties where appropriate.

During 2021, we will balance any increase in the number of investigations we undertake against being ready to implement our new contribution notice and information-gathering powers that are expected to come into force in October 2021.

AE and DC pension provision

More people are now saving more money into defined contribution (DC) pension schemes and this is largely due to AE. There are now around 18.2 million memberships in DC schemes.

Master trusts have played a major role in the success of AE and the introduction of the mandatory authorisation and supervision of these schemes has been vital to better protect over 16 million savers in master trust schemes.

We will continue to work with trustees, employers, providers, the DWP and the FCA to achieve consistent quality standards and levels of member protection across all work-based DC pensions.

We will also continue to assess schemes to ensure that employers engage with their duties when they first apply and at the three-yearly re-enrolment point. In addition, our rolling programme of compliance validation inspections will target all sizes of employer to check ongoing compliance with AE. We will continue to work with pension schemes to ensure they are monitoring and recovering missing contributions to DC schemes and to take action on reports of material payment failures directly with employers. In addition, we will continue to work with our stakeholders to ensure advice and support around AE compliance and to influence future policy and product developments.

Where we become aware of breaches of law, we may take enforcement action. We have a range of statutory powers, including compliance notices, civil penalties, and removing and appointing trustees. We will continue to use our powers under section 89 of the Pensions Act 2004, publishing information on cases where we have exercised or considered exercising our powers.

Scams

We are working with our partners on the multi-agency Project Bloom task force to deliver a more focused and joined-up approach to tackle pension scams. We will target criminal behaviour by working with industry and our Project Bloom partners to disrupt scam activity. We will also continue to pursue individuals through the courts, both to punish criminal behaviour and recover assets. We will incorporate the use of our new powers to continue our work in this area.

Through our ‘Pledge to Combat Pension Scams’ campaign, working in partnership with the Pension Scams Industry Group (PSIG), we are calling on trustees, providers and administrators to play a greater role by communicating with savers, carrying out due diligence on transfers and reporting suspected scams to Action Fraud. We will support the DWP’s work on regulations limiting the statutory right to transfer, reducing the likelihood of money being moved into scam schemes. We will also not hesitate to bring enforcement action where appropriate, including recovery under the Proceeds of Crime Act 2002 (POCA).

Years 2 and 3 (2022-23 and 2023-24)

Continuing work around our new powers, an increased focus on cyber security, supervision, and AE and DC provision

New powers

We will continue to embed the application of our new powers under the PSA 2021 as we see cases come in from 2022 onwards, adjusting our approach and resources accordingly.

Cyber security

We are already engaged with master trusts and some administrators in relation to cyber security, but we will take a more active role in helping the market understand and tackle cyber risks. We recognise that cyber-security is an all-important component in protecting savers and we will engage with other regulators, cyber-security experts and industry to identify what further steps can be taken to mitigate the risk. This may include providing further guidance, particularly for schemes that do not have resources available to engage specialist advice.

Scams

In years 2 and 3, we will continue to keep our approaches under review, using a combined intelligence picture and delivering enforcement and communications interventions working with our partners in Project Bloom.

We will also review and renew our pension scams strategy. This will assess what we do and the impact it is having, and we will take into account recommendations made to the Work and Pensions Select Committee in 2020 where necessary. This work is particularly important given the heightened risk to savers as a result of the pandemic, where many may feel they need to access the money from their pension or are attracted by the promise of a better financial return.

Supervision

The work of our frontline regulatory teams will be dependent on the changing economic and risk picture. We have described how, during the first 12 months of this plan, we will focus on our supervision teams providing a regulatory response to the effects of COVID-19, through ensuring our monitoring and oversight focuses on the impact of the pandemic for employers who sponsor DB schemes. We anticipate that this focus will change in the following two years to revert to a more holistic supervisory approach, but it will depend upon the economic circumstances at the time and the risks we see emerging at that point. There are provisions made in the PSA 2021 that have a substantial impact on our enforcement activity. We will continue to embed these provisions, which include the new criminal offences, the new contribution notice tests, the new information-gathering provisions, and the enhanced civil sanctions.

AE and DC pension provision

We will continue to improve the efficiency and effectiveness of our work to ensure savers are automatically enrolled and contributions are paid to DC schemes, taking into account the changing economic and policy context and the needs and expectations of savers as AE matures to become a long-term component of the pensions landscape. This will include working with government to support related initiatives and policy work and get more people saving from different groups.

During years 2 and 3, master trust supervision will remain at the core of our approach to regulating DC schemes and mitigating significant risks that arise in this area of the market. We will maintain close relationships with master trusts to ensure they continue to meet authorisation standards and that we have early warning of any significant risks.

Value for money

We believe savers’ money must be suitably invested, costs and charges must be reasonable and good quality services and administration are provided to all.

Savers in DB schemes have the promise of a certain level of income at retirement. However, significantly more people are saving into DC schemes where the retirement income amount is dependent on the level of contributions and the performance of investments - as well as the decisions made on approaching retirement by the saver.

Value for money was one of two priority areas in our joint strategy with the FCA published in October 2018. We will be using our powers to help drive value for money for savers and this includes setting and enforcing clear standards and principles where relevant.

Our research indicates that smaller DC schemes are often less able to meet standards of good governance and administration. The economy of scale of bigger schemes often means savers will benefit in a variety of ways, and therefore we encourage consolidation as a means of improving saver outcomes. Further to the introduction of the regulations from October this year, we will seek to ensure that schemes consolidate where they are unable to achieve value for money.

Savers are also less likely to receive good value for money when they have multiple small pots with varying performance and charging structures. Improved saver engagement through tools such as the Pensions Dashboards could help to address these issues in the longer term by putting the saver in control of consolidating their savings. However, there is more that industry can do now to address the existing stock of small pots and to prevent the problem continuing, and we support the DWP's Small Pension Pots Working Group.

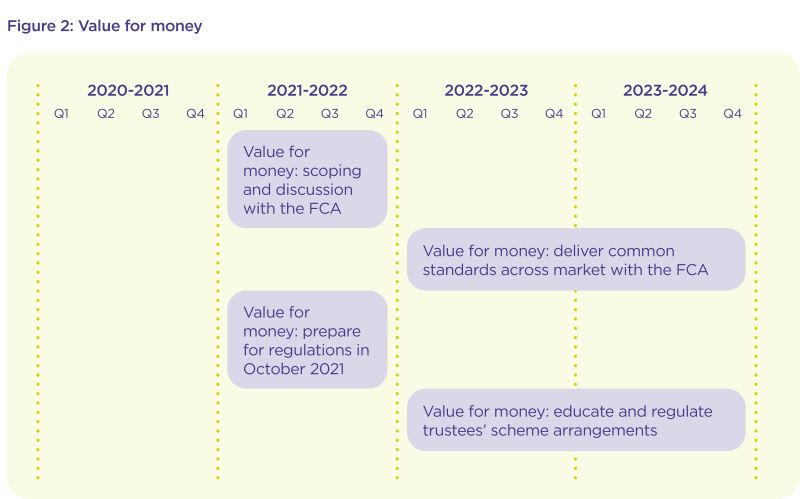

Figure 2 below depicts an activity timings plan for the work under Value for money. There is a date range across the top of the chart from left to right showing three consecutive financial years: 2021-22; 2022-23, and 2023-24. This date range is used to show where the activity (shown in swim lanes below) starts and ends.

Year 1 (2021-22)

A focus on developing a broader understanding of value for money

In year 1, we will increase our focus on this strategic priority, developing a broader understanding of value for money: its components, risks, and opportunities. This development will build on our current joint work with the FCA and ongoing dialogue with government.

Our exploratory work around value for money will include considering the merits and practicalities of a common, cross-industry standard and the development of benchmarks and we will publish a joint discussion paper with the FCA. We believe value for money assessments will be key to ensuring DC pensions deliver the best possible retirement outcomes for savers, and we have been guided by our stakeholders and industry on the importance of this work.

Following the DWP’s 2019 consultation ‘Improving outcomes for members of DC pension schemes’, regulations in relation to value for money assessments and consolidation of smaller DC schemes will come into force in October 2021. Statutory guidance in this area will be updated to help trustees and advisers ensure they understand what is required of them and that they are able to take the necessary action to comply with the law.

Years 2 and 3 (2022-23 and 2023-24)

Continuing to work with trustees and our regulatory partners to establish cross-industry standards

During years 2 and 3, we will continue to work with the FCA to deliver common standards across the market. This will follow the joint discussion paper with the FCA on value for money, which invites discussion from the industry but does not set out a finalised framework. Clear, cross-industry standards would help drive positive change, particularly in the context of a smaller number of DC occupational schemes with large numbers of savers.

Continuing our work from year 1, we will work with trustees so they can assess value for money in relation to their scheme, and in accordance with the regulations.

Scrutiny of decision-making

The decisions that trustees and employers make are vitally important to savers in all types of pension scheme.

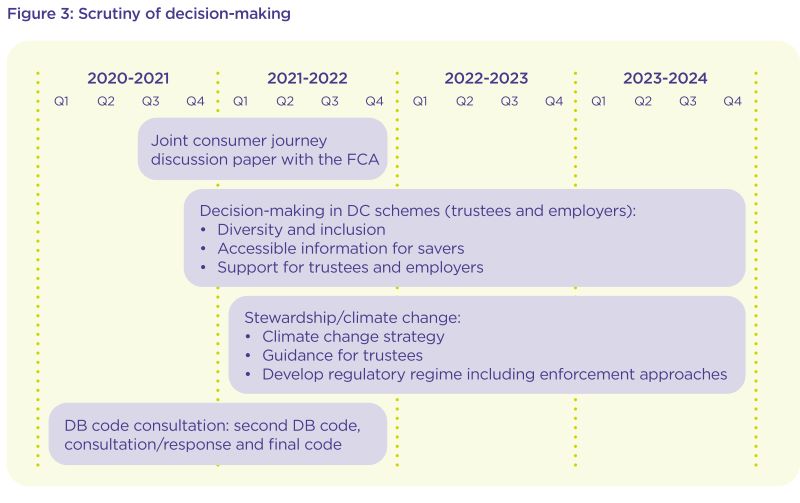

Figure 3 below depicts an activity timings plan for the work under Scrutiny of decision-making. There is a date range across the top of the chart from left to right showing three consecutive financial years: 2021-22; 2022-23, and 2023-24. This date range is used to show where the activity (shown in swim lanes below) starts and ends.

Year 1 (2021-22)

A focus on good decision-making for employers

We work to support savers in making good decisions about their retirement savings, so they achieve the best possible outcome at, and through, retirement. Our joint discussion paper with the FCA on the pensions consumer journey will ask the industry for its views on how to encourage greater engagement from savers and support them in their pension choices. This will include establishing where greater emphasis may be required to support employers and trustees in the decisions they make, which in turn will improve and protect good saver outcomes.

DB funding and the importance of active and responsible stewardship, particularly around climate change

Our first consultation on a DB funding code of practice launched in March 2020 and closed in September 2020. A second consultation will follow during the latter part of 2021–22 and will contain more detail around our proposed revised code of practice.

We will assess the range of decisions trustees and employers make on behalf of savers and the degree of support they offer to help savers make the right retirement decisions. We will also continue to work across industry and with other regulators to improve access and the provision of support for savers.

We have set up an industry working group to look at ways of encouraging the industry to ensure its trustee boards are made up of people with diverse backgrounds, knowledge, skills and perspectives. This group’s work includes gathering and sharing examples of best practice and agreeing a clear definition of ‘diversity and inclusion’.

We have developed an Equality, Diversity and Inclusion Strategy that looks out across the period of this corporate plan and sets out our intended direction and activity. We will publish our strategy in the coming months.

We believe active, responsible stewardship within the pensions and wider financial sector and the need to achieve responsible asset management will continue to increase in importance in response to financially material risk from global threats such as climate change and biodiversity loss. Our climate change strategy details how we intend to help trustees meet the resulting challenges, managing risks appropriately. Additionally, the UK joint regulator and government TCFD taskforce (of which TPR is part) has published a report and roadmap outlining the UK’s approach to implementing the recommendations of the Taskforce on Climate-related Financial Disclosures. As part of this, regulators across the entire UK investment chain are committed to disclosure of climate-related information by 2025.

Huge impetus in this area is to be gained by new pensions legislation in the shape of the PSA 2021, which creates a framework for action and will drive development right across the market.

Further to the new climate change regulations and during year 1 of this Corporate Plan, we will publish guidance on our regulatory expectations and develop a regulatory approach to the new requirements, including a new enforcement regime.

Years 2 and 3 (2022-23 and 2023-24)

A focus on good decision-making for employers

Years 2 and 3 will see our work build in respect of employers’ decisions. For DC schemes, this will include considering the information employers and savers need (and when) to make appropriate decisions in support of the best retirement outcomes possible. For DB schemes, employer decisions are also important, albeit the nature of the decision-making will be different. We will continue our dialogue with stakeholders, trustees and employers about the roles different employers play in supporting saver outcomes and how they might be better supported in the long term.

Those supplying pension products to the market must work to support savers to make good decisions that are right for their circumstances. We will work alongside a range of providers, stakeholders and other regulators such as MaPS and the FCA to ensure there is clear, easily accessible information, guidance and advice to meet savers’ needs.

DB funding

We expect our final revised DB code of practice to be in place by December 2022 and it will apply to schemes that have valuation effective dates from that point onwards. The new regulatory approach (FastTrack or Bespoke) outlined in our first consultation is a step change, which will detail how schemes can meet the requirements under the PSA 2021 to have a funding and investment strategy for how benefits will be delivered in the long term. We will publish the new code and be ready with appropriate processes and systems in place.

Embracing innovation

We encourage innovation and believe the market should meet and keep pace with savers’ needs. Our focus in this area includes emerging scheme models. We will continue to work with the market as DB alternatives to ‘traditional’ schemes develop, as well as decumulation products in DC trusts and the establishment of collective DC schemes.

We will facilitate the development of technology and the sharing of good practice – collaborating with the market to enhance security, efficiency, transparency, simplicity and choice.

We will seek to strike a balance between encouraging the positive aspects that innovative new technology and products bring, while ensuring they provide the protection savers deserve and supporting the development of legislation with this aim.

Against this strategic priority, the areas of focus for us over the next three years and beyond will be fulfilling our role in support of the development of the pensions dashboards. We will also continue to assess and subsequently supervise superfunds as part of our interim regime while we continue to support the DWP in developing a legislative framework for superfunds. We will also consider the broader market and any future role we may have in master trust decumulation.

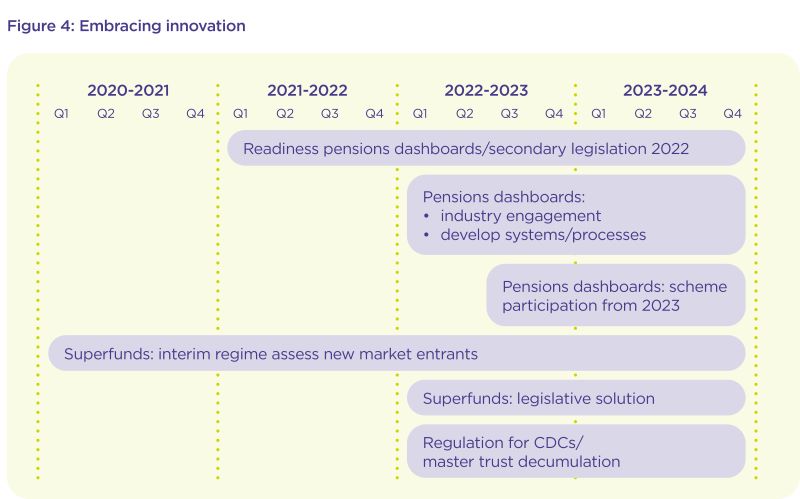

Figure 4 below depicts an activity timings plan for the work under Embracing innovation. There is a date range across the top of the chart from left to right showing three consecutive financial years: 2021-22; 2022-23, and 2023-24. This date range is used to show where the activity (shown in swim lanes below) starts and ends.

Year 1 (2021-22)

Establishing the framework around the pensions dashboards and keeping our interim superfunds regime under review

Dashboards

The PSA 2021 has created a legislative framework for pension schemes to provide data to a dashboard ‘ecosystem’. The DWP has assigned the delivery of the technological infrastructure to MaPS’s Pensions Dashboards Programme (PDP). We are one of four key delivery partners alongside the PDP, DWP and FCA, and our role is to prepare those we regulate to meet their duties and monitor and enforce these duties when they are live. Scheme participation will be staged from 2023 and the timeline for this will be set out in secondary legislation in 2022.

We will support the DWP in establishing the policy and legislative framework, define the principles for our operational approach, and commence the design work. We will work with the PDP to develop the technological framework and align our communications strategy with the PDP and the FCA.

As the work on the dashboards develops, we will explore how pension scheme administration can work more effectively, and how investments in innovation can create efficiencies that benefit savers.

Superfunds

We have been engaging with those seeking to offer alternatives to DB schemes. Throughout 2021-22, we will continue to assess superfunds wishing to enter the market against our guidance to manage risks and seek to ensure savers are protected in the period before specific legislation is in place.

We will also continue to work with government (and the DB consolidation cross-government group) throughout the year to keep our interim regime under review. We’ll use our experience to support the DWP in continuing to develop the legislative framework for superfunds, which we anticipate being introduced from 2022-23.

We remain ready to assess new entrants to the market and will also engage with schemes considering transacting with a superfund. In some instances, this may include considering clearance applications from ceding schemes.

Years 2 and 3 (2022-23 and 2023-24)

Developing the pensions dashboards, and continued engagement around DB superfunds and collective DC schemes with industry and government

Dashboards

Over the next few years, we will engage proactively with industry as it prepares to comply with the legislative framework, and regulate compliance with the new duties as they come in. Our engagement and guidance will evolve as thousands of schemes, supported by several hundred administrators, connect to the dashboards’ infrastructure.

In anticipation of duties going live for the first schemes in 2023, we will develop our systems and processes for monitoring compliance, as well as our compliance and enforcement policy.

We see the development of the dashboards as an opportunity to engage with industry to drive up data standards and build a focus on the work of administrators and administration software providers.

Superfunds and other innovative DB models

Our work will continue across years 2 and 3. We will continue to engage with industry and other regulators as differing and new models emerge, to ensure they are suitable for savers. We will also continue to play a role in work on developing specific legislation in this area.

Collective defined contribution schemes and master trust decumulation

The PSA 2021 creates a new sub-set of money purchase benefits to allow pooled pension arrangements (known as collective DC schemes). We will have a key role in respect of collective DC schemes, by authorising and supervising entrants to the market. This will require specific resource and will draw heavily from our experience authorising and supervising master trusts.

We have been working with the DWP while they have been developing regulations since 2020. We will continue to have a significant role and this will include supporting the continuing development of secondary legislation, as well as codes and guidance. We will also work with the DWP in exploring the potential for a regulatory framework for master trust decumulation, taking into account the broader picture of the DC market in future years.

Bold and effective regulation

In our Corporate Strategy, we set out our analysis over a 15-year period and we acknowledge that much can change in that time – and not all of it in the way we predict. We will continue to take a strategic approach to assessing what is happening around us and what that means for the work that we do across each three-year period of our Corporate Plan.

We have committed to be ‘bold innovators of our own regulatory approach’. We will continue to put our expertise to best use, being clear, quick and tough, and anticipating and preventing issues before they materialise.

Figure 5 below depicts an activity timings plan for the work under Bold and effective regulation. There is a date range across the top of the chart from left to right showing three consecutive financial years: 2021-22; 2022-23, and 2023-24. This date range is used to show where the activity (shown in swim lanes below) starts and ends.

Year 1 (2021-22)

Delivering and completing our major change programmes

We have prioritised delivery and completion of our major programmes of change. During year 1 these are as follows:

- Concluding the exit from our contract for a range of services for AE from Capita in September 2021 and moving these services - including bulk enforcement and communications – in-house, alongside a new contact centre contract.

- Delivering major upgrades to our internal and externally-facing IT systems, including:

- a range of improved internal systems to support data management and analysis, information sharing, CRM and casework

- a new scheme return portal to replace Exchange in stages

Our TPR Future programme fundamentally changed the way we regulate, and the major upgrades we are making will help us work efficiently, share information effectively and make the best possible use of the data we hold. These improvements have ramifications for the way we work across the board, but especially in our frontline regulatory work with employers and trustees. The information we require from schemes online will be much easier to provide and those who contact us directly will benefit from a more efficient service owing to vital upgrades to systems that underpin our customer support function.

We have made resource provision for two regulatory initiatives to commence during the first year of this plan. The focus areas for each are dependent on the largest risks we believe we can successfully mitigate with this approach, but it is likely that one regulatory initiative will address the regulatory impacts of the pandemic on employers.

Years 2 and 3 (2022-23 and 2023-24)

Completing our system upgrades

We are planning a number of upgrades to our systems over the course of this Corporate Plan, which are interdependent and form the heart of our change programme. These upgrades will help us test our new and existing powers, aid our people development and improve the way we use data.

During years 2 and 3, the delivery of this work will continue, alongside embedding ways of working for the components delivered during year 1. This will include the final version of a data platform with self service functions and the final phase of delivery for our scheme return portal.

Measuring our performance and tracking our progress

We currently have four key outcomes that we measure annually and 14 key performance indicators (KPIs) for 2021-22. These are set out below. We intend to revisit our key outcomes and the indicators associated with them over the next year to ensure they align fully with our corporate strategy. This year they remain broadly stable – and we have updated them to reflect our revised activity in line with budget and resourcing constraints, and the need to operate effectively throughout the term of the plan.

The current KPIs will be used to evaluate our performance for the first year of the Corporate Plan. They cover each of our five strategic priorities, plus measures around our people and our core regulatory activity. KPI measures will adapt each year to align to our work plan.

Our measures reflect the fact that we are in a period of transition, particularly in the first year of this plan. For example, we are bringing AE-related services in-house, upgrading our regulatory IT systems and building the foundations for major new work such as pensions dashboards and working with the FCA on value for money.

Key outcome indicators (KOIs)

Our KOIs are broad measures that we use to track trends and market shifts over time, unlike our KPIs which track our progress and performance across 2021-22.

| Outcome | Measure |

|---|---|

| Participation An increase in participation of workplace pensions |

Proportion of jobholder population that has been put into a qualifying scheme |

| Proportion of employers that make contributions to schemes before they become significant late payments | |

| Protection Protection of members and the Pension Protection Fund (PPF) |

Proportion of savers in DB schemes that are demonstrating good governance |

| Aggregate funding ratio for DB schemes | |

| Accountability Those we regulate are held to account |

Tracking schemes that have not taken any action on their record-keeping in the last three years |

| Proportion of schemes that have been subject to a risk-targeted regulatory intervention |

|

| Confidence People’s confidence in the security and quality of workplace pension savings increases |

Proportion of savers in pension schemes who are confident in pensions compared to other forms of saving |

Key performance indicators (KPIs)

Our KPIs this year are focused on the key strategic areas for annual performance. Owing to the combination of existing and developmental work, they comprise a blend of both quantitative-based and milestone or progress-based measures.

| Strategic priority | KPI measure |

|---|---|

| Security Strategic goal: Savers’ money is secure |

Employers are continuing to re-declare and new employers are making their declarations for the first time in line with their duties for AE |

| We will extend our supervision coverage across a greater number of savers | |

| We will be ready to implement our new powers under the PSA 2021 from October 2021 | |

| We will undertake activity that contributes to the prevention and disruption of pension scams | |

| Value for money Strategic goal: Savers get good value for their money |

We will work with our partners at the DWP and the FCA to define a set of cross-industry standards on value for money and begin the process of embedding the DWP’s new framework for small schemes |

| Scrutiny of decision-making Strategic goal: Decisions made on behalf of savers are in their best interests |

We will complete our second phase of consulting on principles for a revised DB code with a view to finalising the code in 2022 |

| We have launched our climate change strategy and will develop a regulatory approach to the new climate change legislation, including sharing our expectations publicly | |

| Embracing innovation Strategic goal: The market innovates to meet savers’ needs |

We will continue to apply the interim regime for superfunds in order to protect the interests of savers and the PPF in the period before specific legislation is in force. We will continue to work with government to develop legislation in this area. |

| We will support the pensions dashboards initiative and deliver on our remit as defined by government | |

| Bold and effective regulation Strategic goal: TPR is a bold and effective regulator |

We will continue to maintain performance across employer- and scheme-facing services as we transition to our new AE delivery model |

| We will deliver new systems to support our regulatory functions | |

| We will implement two new regulatory initiatives based on our core regulatory risk assessment | |

| Our people | We have high employee engagement |

| Our team is able to work effectively, whether that is solely at home, solely in the office or a combination of both |

People and structure

Diversity and inclusion

We recognise the important role diversity and inclusion plays in supporting us as a regulator and an employer. Our Diversity and Inclusion Committee leads our internal and external diversity and inclusion agenda, providing direction and taking decisions on diversity and inclusion matters and championing inclusion throughout the organisation.

The Committee is responsible for achieving our 2020-21 equality objective to develop a four-year diversity and inclusion strategy and action plan, ensuring all elements of our internal and external diversity and inclusion obligations and aspirations are identified, with accompanying strategy, action plans and measures put in place to monitor progress. This includes monitoring whether we are complying with our responsibilities under the Public Sector Equality Duty.

Structure and resource allocation

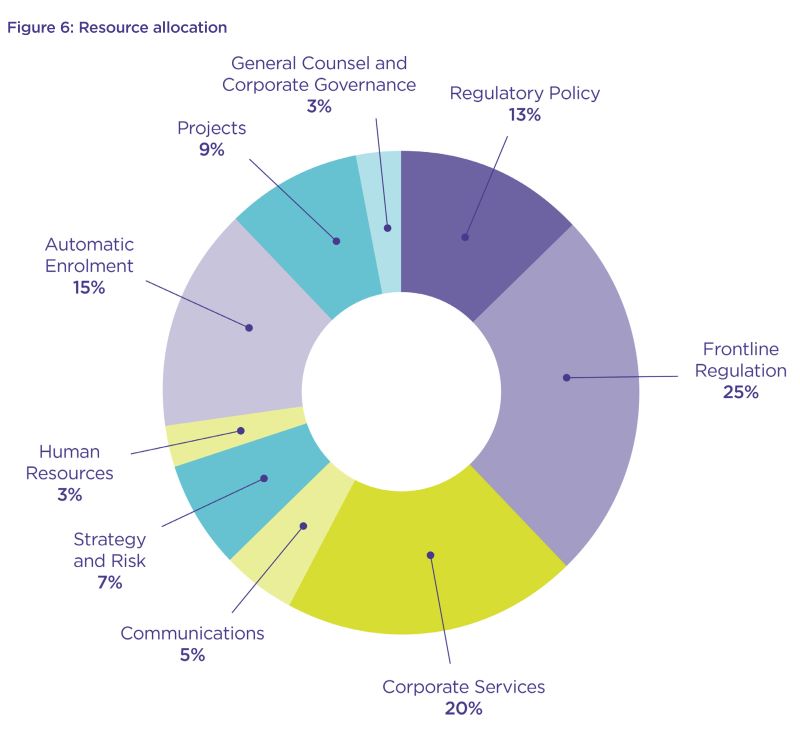

We expect our resources to be allocated across the organisation in 2021-22 as follows. Figures 6 below shows how the total number of TPR staff are split across different directorates. This is depicted as: 13% in Regulatory Policy, 25% in Frontline Regulation 20% in Corporate Services, 5% in Communications, 7% in Strategy and Risk, 3% in HR, 15% in Automatic Enrolment, 9% in Projects, and 3% in General Counsel and Corporate Governance.

Financial summary

Funding

Our funding is derived from two main sources: a grant-in-aid from the DWP, which is recoverable from a scheme levy relating to Pensions Act 2004 duties, and a separate grant-in-aid from general taxation relating to the AE programme arising from Pensions Act 2008 duties. We have agreed funding with the DWP for the year 2021-22.

Excluding the impact of capital adjustments and depreciation, our baseline funding for our levy-based activity is in line with 2020-21. However, including these adjustments, it is a reduction of £1.5 million compared to last year as per Table 1 below.

Funding is included to continue work relating to our Systems to Support Regulatory Activity (SSRA) programme. This is a major investment to support our new regulatory operating model and replace some of our legacy IT systems and supporting infrastructure. The budget also includes activity in relation to the PSA 2021 and the PDP, for which we have been given responsibility for preparing those we regulate to meet their duties, along with monitoring and enforcement, and activity relating to emerging DB superfunds. An increase in the overall staffing levels to support the above work in addition to the ongoing regulatory activities is reflected in the plan.

The AE funding agreed for 2021-22 is £46.6 million, an increase of £8.2m compared to last year. This increase is due to the costs associated with the end of our current outsourced contract for the delivery of AE services and the costs of transitioning to delivering these services in-house.

2020-21 financial results

We spent £102.5 million in 2020-21, £2 million below the original budget agreed with the DWP of £104.4 million. The main reasons for this are lower publicity expenditure and lower project expenditure offset by higher regulatory case expenditure. An accounting adjustment agreed with the DWP to capitalise a multi-year software license increased our actual spend by £2.8 million, to a total of £105.3 million.

2021-22 budget

The total 2021-22 budget is an increase of £6.7 million against the full year spend for 2020-21. The main reason for this is the cost of the AE transformation programme as insourcing and procurement of services, as the outsourcing contract ends in September 2021.

We have not included future years expected costs in this plan. A three-year spending review is expected in the summer and we will revisit the longer-term plan with the DWP during that process.

The AE costs will reduce over the next three years, following the completion of the current transformation programme as we insource more of the activity.

Table 1: 2020-21 financial results and 2021-22 budget

| £ millions | 2020-21 (actual*) |

2021-22 (budget) |

|---|---|---|

| Levy | 66.8 | 65.3 |

| Automatic enrolment | 38.5 | 46.6 |

| Total | 105.3 | 111.9 |

*subject to audit

We will continue to support and work with the DWP in its review of the Pensions General Levy.

Average payroll staff numbers

The 2020-21 and 2021-22 average payroll FTE staff numbers are shown below. We have limited our planned growth moving into the current financial year and we will manage further constraints around the growth of staff numbers over the course of the year, prioritising and adjusting recruitment plans accordingly.

The increase in staff numbers for AE is due to the in-sourcing of some services at the end of our outsourced contract with Capita in September 2021.

| 2020-21 | 2021-22 | |

|---|---|---|

| Levy | 527 | 594 |

| Automatic enrolment | 222 | 311 |

| Total | 749 | 905 |