Market oversight: How well pension schemes are prepared for LDI risk and what trustees need to know

To deliver good long-term outcomes for pension savers, we expect all schemes to have high standards of investment governance and risk management. Trustees should make decisions which protect savers in variable and evolving economic conditions and risk landscapes.

In April 2023 we published guidance to help trustees manage risks associated with leveraged Liability Driven Investment (LDI) strategies. The guidance drew on lessons learned from the gilt market disruption in late 2022.

Since that guidance, we have collected data from the annual scheme return to better understand how LDI is positioned to safeguard itself against future market disruptions.

This report sets out the steps pension schemes and the investment industry have made to improve operational resiliency.

The size and duration of LDI exposures have reduced materially since the end of 2021 when long-term interest rates reached a low point. This means that day-to-day changes in the value of LDI are much smaller than they have been historically.

The LDI sector has made significant steps to improve resilience following the gilt crisis in 2022. Regulatory intervention, strengthened governance and enhanced risk management practices have strengthened the sector’s ability to withstand market shocks. Key areas of improvement include:

- compliance with interest rate buffers

- improved recapitalisation processes

- increased focus on liquidity

Our data also highlights where greater focus is needed in future, including:

- diversification of collateral assets

- resilience testing to ensure robust risk management in adverse market scenarios

This report is in line with our prudential approach to regulation where we monitor and take action to tackle risks both at an individual scheme level, as well as wider risks which may impact the pensions market as a whole.

Published: 18 September 2025

On this page:

- How gilt markets have changed

- How pensions schemes are faring

- What our data shows and what we expect of trustees

- How well trustees are meeting the guidelines

- Where trustees can continue to improve

How gilt markets have changed

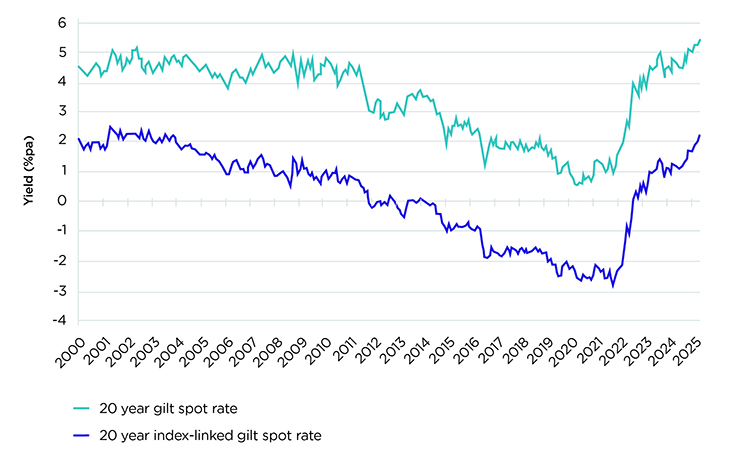

The charts below show how gilt yields have changed since 2000. Gilt yields followed global long-term rates and declined over a multi-decade basis to the end of 2021. However, a fast reversal began from 2022 which saw all the decline seen over 20 years reversed in just over three years. Economic and financial shocks caused by the Technology Media and Telecoms Boom, the Global Financial Crisis, Brexit, and the COVID-19 pandemic happened in the time of falling long-term rates, only for interest rates to begin increasing from 2022 when inflation, sovereign debt concerns, and timid expectations of economic growth resulted in a re-pricing of developed market government bonds.

Figure 1: Real and nominal gilt yields

Source: Bank of England

Figure 1 shows real and nominal gilt yields at 20-year terms, % p.a. from January 2000 to May 2025.

How pension schemes are faring

Higher long-term interest rates have improved UK defined benefit pension funding levels as liability values have fallen more than asset values. Improvements in funding positions have prompted a potential shift in investment strategy. The key focus has been to increase exposure to matching assets away from growth assets and reduce leverage within LDI mandates. Within return-seeking assets, trustees have been re-considering their exposure to less liquid assets, as they prioritise liquidity and resilience.

The rise in long-term interest rates has also had a profound impact on the LDI market. The key changes have been a fall in the size of the LDI market from about £1.5 trillion at the end of 2021 to about £0.7 trillion at 31 March 2025 (TPR estimates). The duration of LDI exposure has also fallen significantly from about 20 years to 13 years driven by the passage of time and the impact of significantly higher real interest rates. Both these changes mean that daily volatility in leveraged LDI assets is more than 50% lower now than it was at the end of 2021.

Prior to October 2022, LDI mandates operated with different degrees of interest rate headroom. However, leverage in LDI mandates was generally higher and interest rate headroom was about 150 basis points, which would require more frequent re-collateralisation in an environment of rising interest rates. Following volatility seen in the gilts market in September and October 2022, LDI managers have increased minimum resilience by raising rate buffers to about 300 basis points. This has reduced the impact of further yield rises and improved day-to-day liquidity management.

Quantitative summary of the LDI market as shown by the data TPR has collected

LDI usage by pension schemes

Table 1: LDI usage by pension schemes as recorded in the 2025 and 2024 Scheme return

|

Type of LDI vehicle |

2025: Total (%) |

2024: Total (%) |

|---|---|---|

|

Pooled |

1,957 (42%) |

2,114 (43%) |

|

Segregated |

469 (10%) |

472 (10%) |

|

Both |

3 (0%) |

14 (0%) |

|

None |

2,281 (48%) |

2,267 (47%) |

|

Total |

4,710 (100%) |

4,867 (100%) |

Table 1 shows that in 2025 4,710 pension schemes responded to the annual scheme return, of which 2,429 have an LDI mandate, split between 28 managers. Over 80% of the LDI mandates by Assets Under Management are managed by five managers.

What our data shows and what we expect of trustees

Stress testing LDI mandates

We expect trustees to only invest in leveraged LDI arrangements which have put in place an appropriately sized buffer. This would include an operational buffer specific to the LDI arrangement to manage day-to-day changes, in addition to a 250 basis points minimum buffer to provide resilience in times of market stress.

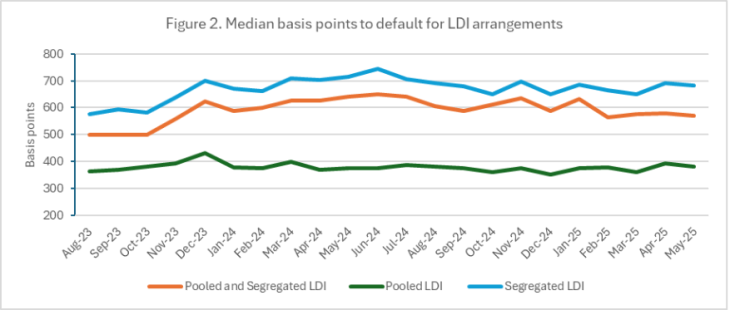

We have been monitoring the level of the buffers as measured by the average interest rate increase until default.

Figure 2: Median basis points to default for LDI arrangements

Figure 2 shows the resilience of both pooled and segregated LDI mandates since August 2023. LDI arrangements remained resilient in January 2025 when gilt yields increased during a period of higher volatility.

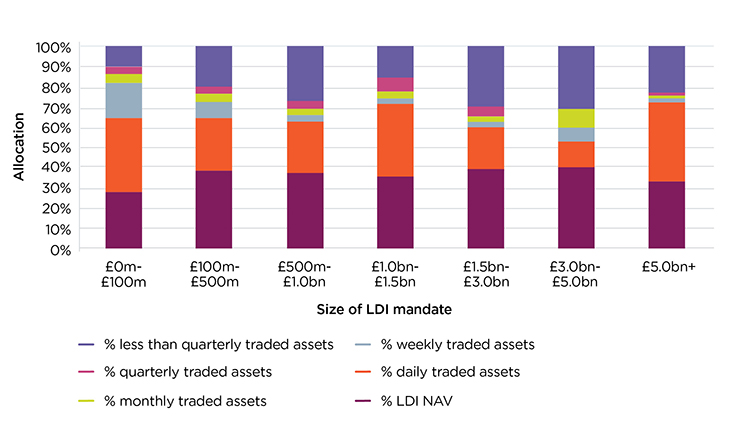

Understanding the liquidity profile of pension schemes

LDI arrangements are structured such that any immediate loss due to yield changes can be met by the interest rate buffers. If the interest rate buffer drops below minimum requirements, trustees may be called upon to provide additional cash to replenish the buffer.

Trustees are required to develop clear procedures to promptly restore depleted buffers within five days, ensuring timely asset liquidation or reallocation.

We expect trustees to understand the thresholds or conditions under which cash calls occur and to put in place and document processes for meeting such calls in a collateral management policy. This requires trustees to understand the liquidity of their pension scheme assets.

Figure 3: The average liquidity breakdown of pension schemes assets grouped by LDI mandate asset size

Figure 3 shows the average liquidity as defined by trading frequency available to pension schemes with similar sized LDI mandates.

Pre-agreed asset sale plan

Many pension schemes now specify which assets can be sold for raising cash in pre-agreed instructions. This might be a single fund, a pre-specified portfolio of assets or a waterfall of funds.

A waterfall of funds is where cash calls are directed to one fund until it is exhausted, followed by a second fund, third fund and so on.

Trustees should be aware of the concentration risks associated with the assets earmarked for sale during stress events. By diversifying collateral assets, schemes can reduce the possibility of high selling pressures in specific markets or funds and mitigate systemic vulnerabilities.

Rigid cash call structures can lead to asset disposals without due consideration of market pricing. More flexible liquidity frameworks to meet cash calls could therefore be of value in stressed market conditions though this needs to be considered against the need to raise cash in a timely manner.

Table 2: The usage of pre-agreed asset sale plans by pension schemes with either a pooled or segregated LDI mandate.

|

2025: Total (%) |

2024: Total (%) |

|

|---|---|---|

|

Yes |

2,054 (85%) |

2,072 (80%) |

|

No |

375 (15%) |

528 (20%) |

Table 2 shows that the majority of pension schemes with either a pooled or segregated LDI mandate have a pre-agreed asset sale plan.

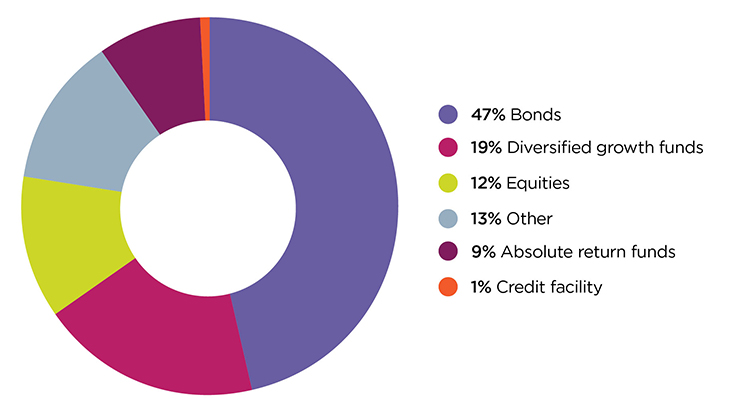

Figure 4: Assets most likely to be used first to fund any cash calls

Figure 4 shows that Bonds and Diversified Growth Funds are the assets most likely to be used to fund any cash calls.

Governance

Pension schemes operate different investment governance models. Some trustees only delegate day-to-day investment decisions to an investment manager, while others delegate a range of investment powers to a fiduciary manager.

We ask trustees to understand how the investment governance model affects the operation of their LDI strategy.

Trustees may be supported in respect of LDI investments by investment advisers, investment or fiduciary managers and LDI managers. Trustees should be clear on each party’s respective role and responsibilities.

One approach is to give LDI managers discretion to redeem assets from a given mandate for example a Buy and Maintain Credit Fund, or a Diversified Growth Fund, once its collateral levels fall below a certain threshold.

Trustees recognise that pension schemes will often have other demands on liquidity, such as benefit payments and capital calls for private market investments. In this instance, it may be appropriate to delegate responsibility to fiduciary managers or internal managers that have oversight of a pension scheme’s overall cashflow requirements.

Table 3: Proportion of schemes that give LDI managers discretion to redeem assets from a given asset class

|

2025: Total (%) |

|

|---|---|

|

Yes |

1,799 (74%) |

|

No |

630 (26%) |

Table 3 shows that 1,799 pension schemes give LDI managers discretion to redeem assets from a relevant asset class.

Table 4: Proportion of pension schemes that delegate authority to a third party

|

2025: Total (%) |

|

|---|---|

|

All assets |

1,114 (46%) |

|

Some assets |

1,094 (45%) |

|

No assets |

221 (9%) |

Table 4 shows that 2,208 of 2,429 pension schemes with an LDI mandate delegate authority to a third party such as a fiduciary manager, internal manager or a third party for some or all of the assets.

Signatories

We expect trustees to ensure that they have sufficient signatories ready to sign instructions during times of market stress.

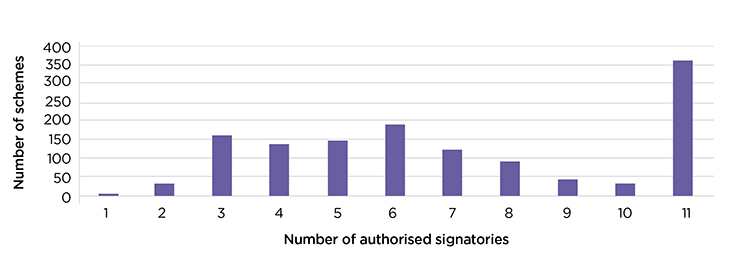

Figure 5: The number of schemes by number of authorised signatories (single and multiple signatory lists)

Figure 5 shows that of the 1,315 schemes that do not fully delegate to a third party, 331 schemes had four or less signatories.

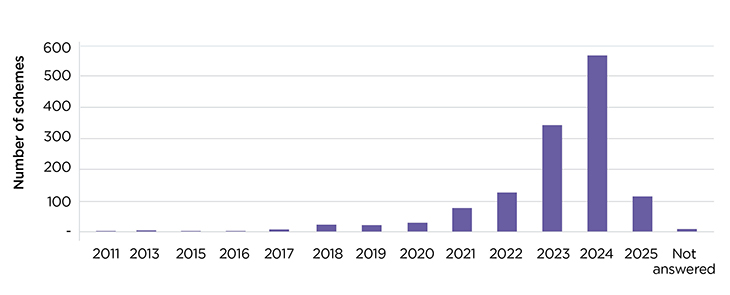

Figure 6: Calendar year in which Authorised Signatory List (ASL) last reviewed

Figure 6 shows that of the 1,315 schemes that do not fully delegate to a third party, 285 schemes had not reviewed their Authorised Signatory List since 31 December 2021. Eight schemes did not answer.

How well trustees are meeting the guidelines

Compliance to interest rate buffers

Trustees are complying with explicit collateral guidelines. This means that LDI mandates use less leverage and can withstand greater volatility before capital replenishment is required.

Following the gilt market volatility of 2022, LDI funds have increased the interest rate buffers they hold to withstand fluctuations in long-term interest rates. This follows various guidance issued for LDI funds. LDI managers have maintained higher buffer thresholds, reducing leverage and improved collateral management. In general, this means that LDI funds are now less leveraged than they have been with a direct pool of assets able to support meeting margin calls for interest rate fluctuations. Interest rate volatility has returned at various moments in 2025 and the experience has been that LDI related operations have been normal.

Compliance to recapitalisation processes

In line with our guidance, trustees, advisors, and LDI managers have strengthened recapitalisation processes by establishing clearer and faster recapitalisation frameworks. Defined processes ensure that pension schemes can quickly restore liquidity levels when buffers are depleted. Many schemes now operate with pre-agreed cash call arrangements, allowing them to inject liquidity into their LDI strategies swiftly, therefore reducing systemic risk.

Focus on liquidity by trustees, LDI managers and fiduciary managers

To meet collateral calls promptly, LDI and fiduciary managers are placing greater emphasis on liquidity management. This means ensuring enough liquid assets are available by regularly monitoring asset liquidity, conducting stress tests, and running scenario analyses to avoid having to sell assets under pressure.

Where trustees can continue to improve

While there will be a cohort of schemes that have significant reserves within their LDI mandate enabling them to ride out any foreseeable increase in gilt yields, we believe there are a number of areas which deserve greater focus by trustees in the future including diversification of collateral assets and resilience testing.

Diversification of collateral assets

Trustees need to be more aware of the concentration risks associated with the assets earmarked for sale during stress events. There is a risk that pension schemes attempt to sell similar types of assets at the same time which results in valuations for collateral assets falling and also the inability to find buyers. Trustees can mitigate this risk in two ways:

- Trustees can consider diversifying collateral assets. This could reduce liquidity bottlenecks in specific markets and diversify sources of cash to replenish LDI assets.

- Highly rigid cash call structures can lead to asset disposals without regard to the value of the underlying asset. Trustees, their advisors and fund managers could look to develop flexibility in the liquidity frameworks which allows for a dynamic approach to meeting cash calls where prevailing market conditions may mean that a change of approach is desirable.

Resilience testing

We ask trustees to test the resilience of their LDI investments and processes from time to time. This could be alongside wider investment strategy testing or when there are significant changes to the funding level or investment position, or in market conditions.

An investment adviser or LDI manager can design the tests, but trustees should be confident that they are sufficiently robust and provide the information trustees need to understand the risks. The outcome should be recorded and any areas of concern addressed.

One such test would be how quickly transactions need to be made, and how well the operational processes and those of your advisers/providers would be able to meet this. This would include the time taken to receive information, make a decision to instruct, and taking into account the trading frequency and settlement of assets.

To further strengthen resilience, schemes should develop and test processes to restore depleted buffers within five days.

We encourage trustees to:

- Carry out periodic stress tests to evaluate LDI strategy robustness and the ability to replenish interest rate buffers within five days.

- Be more aware of the concentration risks associated with assets earmarked for sale during stress events.

- Consider whether a diversified pool of collateral assets is desirable and if a more flexible approach to generating cash may be more prudent in extreme scenarios.