Review of climate-related disclosures by occupational pension schemes 2024

From 1 October 2021, new regulations came into effect for trustees of certain schemes aimed at improving the governance and reporting of climate-related risks and opportunities.

These regulations require trustees of some schemes to identify, assess, and manage climate-related risks and opportunities and report on what they have done. Here, we set out observations and feedback to industry based on our review of a selection of reports from the second year that climate reporting duties have applied.

On this page

- About this review

- What we found

- Governance

- Strategy

- Scenario analysis

- Risk management

- Metrics

- Targets

- Continuous improvement

- Appendix – what we did

About this review

Climate reporting is required under the Occupational Pension Schemes (Climate Change Governance and Reporting) Regulations 2021 (the Climate and Governance Regulations). The requirements were developed from the recommendations of the Taskforce on Climate-Related Financial Disclosures (TCFD). We remind trustees that they must have regard to the Department for Work and Pensions (DWP)'s statutory guidance when complying with the Climate and Governance Regulations and believe that careful consideration of our review findings will assist trustees, advisers and in-house teams when preparing their climate reports.

Climate reporting should be the output of the strategic decisions that trustees are making. Alongside ensuring trustees properly consider the impact of climate change on their own scheme, one of the purposes of climate reports is to drive improvements across the pensions industry through transparency and sharing good practice.

Climate change poses risks and offers opportunities to all pension schemes. Trustees of schemes not subject to the Climate and Governance Regulations, may also benefit from our findings which will help them improve their management of climate-related risks and opportunities.

As part of our review, we considered:

- quality and consistency of reporting against the Climate and Governance Regulations and DWP's statutory guidance

- whether trustees had considered the issues we raised in our 2023 statement on climate-related disclosures

- how well trustees understood the range of climate-related risks and opportunities for their scheme, and explained the results of their analysis

- how trustees intend to address the risks and opportunities they have identified, proportionate to the scheme's circumstances and other risk exposures

To contextualise the findings of our review, we engaged a small number of industry groups and trustee advisers. This provided insight into the way reports were prepared, and the issues encountered. We have used this engagement to validate our observations on what trustees did well, and improvements we would like to see.

Time and resource

Not all schemes are exposed to climate change risk to the same extent. Trustees should reach their own assessment of this, based on advice. However, as a general rule, we would expect climate-related risk to be:

- more material for defined contribution (DC) schemes and open or immature defined benefit (DB) schemes

- less material for DB schemes that are very well funded or invested in assets that closely match their liabilities

The time and resource devoted to monitoring and managing climate change risk should be proportionate to the materiality of the risk. Where climate change poses a less material risk, not all of the points outlined in this statement may be relevant or proportionate, so we do not necessarily expect all schemes to address every ‘good practice’ point in this statement. Conversely, where climate risk is more material, more of the points in this statement are likely to be relevant.

What we found

Here we set out our overarching observations of the reports we reviewed and identify future considerations trustees should take into account when preparing their reports.

Context

We found it helpful when scheme information was included near the beginning of reports, such as scheme size, structure of DB sections, DC popular default funds and funding level. This helped put the rest of the report in context for the reader.

Materiality

Where reports referred to specific investment mandates, it was helpful to explain their size in relation to the total scheme assets. This helped the reader to understand the materiality of the issue.

Generic wording

Many reports included generic wording such as 'the trustee regularly…', 'we expect our advisers to do…'. This gave us less confidence in the governance and risk management processes being carried out. The quality of reports could be improved by including specifics on policies in place, steps taken to manage risks and information received from advisers.

Developments between reports

We noted that some trustees reporting for the second time reused parts of their previous report. This is a sensible way of producing the report efficiently, provided the legal requirements continue to be met. For instance, large parts of the governance and risk management sections may not need to change year on year. If trustees take this approach, we expect them to supplement these elements with a summary of developments and activities during the reporting year.

Length

The quality of reports did not necessarily correlate with their length. Better reports were more concise and efficient in how they addressed disclosure requirements, with some excellent reports towards the shorter to mid-range in length. Reports varied in length, up to 94 pages, with an average of 38 pages.

Member summaries

Some reports had excellent plain English summaries aimed at members. This format allows the remainder of the report to be written with a more informed/technical reader in mind, which may aid brevity.

Action plans

Where trustees have used the reporting process to identify additional work that needs to be carried out, they should set a plan for this, monitor progress and update on progress in their next report.

Examples of action trustees have taken

The reports we read showed a range of actions trustees have taken to address climate risks and opportunities identified through their climate reporting, for example:

- updating DC default lifestyle strategies to include sustainable funds

- increasing allocation to low carbon tracker funds, and/or to companies with ‘high levels of green revenue’

- exploring climate opportunities such as forestry, green bonds and/or committing funds to private market renewables

- articulating stewardship priorities on climate change mitigation, climate change adaptation and avoiding biodiversity loss

- encouraging fund managers to engage with top carbon dioxide emitters

- working with investment managers to obtain emissions data from additional asset classes such as property, infrastructure and hedge funds

Section-specific findings

Below, we set out our feedback on each section of the reports. For each of the reporting areas, we set out:

Good practice we observed

This includes aspects which may not be legally required, but which we considered made the report more useful for readers and/or improved our understanding of the trustees’ approach to climate-related risk. Trustees wishing to develop their practices should consider these ideas.

Issues we observed

This includes aspects we considered indicative of weaker climate-related risk management, or elements that made reports more difficult to understand.

Ways to improve future reports

The main points we’d like trustees to consider when preparing their next report.

Governance

This was generally a stronger section in reports. Some schemes used this section to highlight trustee policies on environmental, social, and governance (ESG) and climate change, or membership of industry bodies.

Good practice we observed

- Summarising the trustee training on climate change undertaken during the period covered by the report, including the specific topics covered. This gave us confidence the trustees are maintaining up-to-date knowledge and understanding.

- Establishing explicit climate-related investment beliefs or a climate change policy to provide a structured framework for decision making.

- Clear descriptions of the roles and responsibilities of the trustees’ sub-committees, in-house teams and advisers. One example presented this information in an appendix together with other points that don’t change year on year (such as frequency of monitoring and a list of regular annual activities). This format enables a shorter section in main body of report focussed on key policies and developments during the reporting period.

Issues we observed

- Generic statements like the trustees 'regularly' discuss climate change or 'regularly' assess each service provider. The lack of any examples to support those statements gave us less confidence on the quality of the governance in these areas.

- A number of reports did not include how the trustees assess the competence of those assisting with or advising on climate-related risks and opportunities. More commonly, this assessment was completed for the trustees’ investment advisers but not for other advisers (such as covenant or actuarial).

Ways to improve future reports

- Ensure the mandatory disclosure requirements are met, such as assessment of competency of advisers on climate-related matters.

- Set clear climate and sustainability-related objectives for your investment consultant (see our guidance on setting objectives).

- Consider setting climate and sustainability-related objectives for your other scheme advisers, relevant to their role.

- Demonstrate that the trustee has strong oversight of climate change governance even where activities are delegated.

Strategy

We observed encouraging signs of careful consideration of climate-related risks and opportunities and how this informed schemes’ investment and funding strategies. Reports used a range of approaches to disclosing the risks and opportunities that were identified.

Good practice we observed

- Identifying material climate-related risks and opportunities specific to different asset classes or sectors.

- Identifying climate-related risks affecting the liabilities or funding for DB schemes, for example market shocks that could delay the scheme reaching its long-term funding objective.

- Identifying specific climate-related risks and opportunities for the sponsor (for example, increased cost of raw materials or challenges with product lines) and explaining the potential covenant impact.

Issues we observed

- A few reports had gaps in their assessment of risks as they were based on ratings provided by the asset managers which were not available across all asset classes or time horizons. As these manager ratings were reported without comment or conclusions, it was not clear whether the trustees had formed their own view of the relevant risks.

- Several hybrid schemes used the same time horizons for their DB and DC sections. In the absence of scheme and membership context, it wasn't always clear if the same time horizons were appropriate.

- Covenant was omitted entirely for a number of DB schemes or only covered by a very high-level concluding comment or a link to the sponsor’s own assessment, without any explanation of the trustees’ own considerations or views.

Ways to improve future reports

- Trustees should form and set out their own views on material climate-related risks and opportunities that affect the scheme even when relying on input from others. This assessment should be sufficiently broad, such as including funding and covenant where appropriate.

- For DC arrangements in particular, the time horizons considered should be sufficiently long to reflect the period members’ savings will be invested to and through retirement.

- Trustees of all DB schemes should include their considerations around climate-related risks to the covenant – we expand on this below.

Climate-related covenant risks

The DWP’s statutory guidance includes a mandatory requirement for trustees of DB schemes to consider the impact of climate-relate risks and opportunities on the sponsoring employer’s covenant.

To meet this requirement, trustees’ consideration of covenant should be proportionate and reflect the extent and expected time horizon of the scheme’s covenant reliance, as well as the sponsor’s exposure to climate-related risks. We expect covenant considerations to be greater for schemes that are more reliant on the covenant for cash contributions or to underpin investment risk, and for schemes with sponsors exposed to carbon intensive activities.

Working collaboratively with sponsors and using sponsor information is likely to benefit trustees in their own considerations. Whilst maintaining sponsor confidentiality where required, trustees should clearly explain their approach in their reports and provide context to support their conclusions.

While we acknowledge that some well-funded schemes have minimal covenant reliance, as a minimum, this should be adequately explained in the report.

Recent coverage of scenarios used by pension schemes

Recent commentary has challenged the scenario analysis modelling of climate change typically used by pension schemes, for example in reports by the Institute and Faculty of Actuaries and Carbon Tracker. These reports argue that:

- many scenario models used in financial services significantly understate climate risk

- the key model limitations, judgements and assumptions are not well understood.

These themes were reflected in our findings. 29 of the 30 reports reviewed included a 'hot house world' scenario (one that assumes no transition, temperature rises well over two degrees Celsius and severe physical impacts). The results showed a very wide range of severity of financial impact for this scenario. This ranged from over 30% reduction in pot size at retirement (DC scheme) and over 40% reduction in projected funding level (DB scheme) through to very modest impacts. Four reports for DB schemes showed a positive impact under this scenario (because the liabilities fell more than the assets).

While a range of results could be appropriate, it is important that trustees understand what is included (and not included) in their modelling. For example, the scenarios produced by the Network for Greening the Financial System (NGFS) do not allow for all physical risks, nor for tipping points.

There are a number of ongoing industry initiatives in relation to improvement of climate scenario analysis. Trustees may wish to ask their advisers about:

- the latest developments in the market and whether these mean it is appropriate to re-run scenario analysis

- whether standard scenarios should be tailored, for example to model roughly the impact of climate tipping points

- whether a qualitative analysis based on clear narratives could be more suitable for capturing tail risks than a quantitative analysis

In addition to a 'hot house' scenario, the majority of reports reviewed included two transition scenarios where temperature rises are limited to two degrees Celsius, normally with one representing a more disorderly or delayed transition. Around a quarter of the reports sampled considered four scenarios, which included 'base case' and 'climate emergency' as the fourth scenario. No reports in our sample considered more than four scenarios and only one considered two scenarios.

Good practice we observed

Including commentary to explain the limitations of the scenario analysis and how this affected the trustees’ conclusions from the analysis.

For DC schemes or sections – assessing impact on different member cohorts – such as 40, 20 and five years before retirement. Conversely, assessing cohorts with ages too close together was less helpful.

Considering climate scenario analysis as part of investment decisions – in one example assessing the impact of moving 15% of the scheme’s global equity portfolio to an alternative sustainable fund.

Issues we observed

Some quantitative scenario analysis covered a shorter time period than the relevant time horizons identified by the trustees. This meant the analysis could not be used to draw conclusions over all relevant time horizons. Short time horizons also led to some analyses showing a favourable impact under the 'hot house' scenario.

Analysis for DB schemes often identified a reduction in liabilities in a 'hot house world' scenario due to lower life expectancy. While we welcome consideration of liabilities, there is a risk that varying life expectancy in isolation gives an incomplete picture. To improve their analysis, trustees should consider the key assumptions, such as investment returns and inflation, in the round.

Covenant considerations were omitted for some DB schemes or the covenant impacts under scenarios were not explained to support trustee comments on the resilience of the funding strategy.

Ways to improve future reports

While quantitative analysis is still developing in the market, trustees could consider a qualitative analysis based on clear narratives as an alternative. A qualitative analysis may also be more appropriate for schemes in certain circumstances (for example, well-funded DB schemes).

Where trustees choose to carry out a quantitative analysis, they should have a sufficient understanding of the assumptions and limitations.

For all types of analysis, trustees should allow time to interpret the results of their analysis, and comment on their conclusions in the report.

Risk management

This tended to be a shorter, narrative section, reflecting the requirements under this pillar. Most trustees adapted their existing risk management framework to encompass climate change risk.

Good practice we observed

- Clear explanations of how climate-related risks and opportunities are screened and reported on a quarterly, bi-annual, or annual basis and considered at trustee Board meetings.

- Demonstration of risk management activities including, for example, details of:

- stewardship activities such as engagements with investee companies that took place during the year

- risk register entries, how often they are assessed and who is responsible for them

- trustee discussions on a particular climate-related risk that took place during the year

- Consideration of research and public statements by investment groups as an indication of sentiment on the extent climate risk is being priced in the market.

- For DB schemes, details of how climate-related risk to the employer covenant is assessed and managed.

Issues we observed

- Some reports included generic wording such as saying “climate risks are identified” without explaining how.

- Some reports did not include any information on how, if at all, the trustees used stewardship to help manage climate-related risk. DWP's statutory guidance sets out that trustees should explain whether they have used stewardship as a risk management tool and, if not, why they didn't. It is sufficient to include a high-level summary in this report and refer readers to other published documents for more detail where appropriate.

Ways to improve future reports

- Include enough detail, such as setting out the investment reports the trustees receive, to demonstrate the trustees have a robust and proportionate climate risk management framework in place.

- Consider the use of stewardship as a risk management tool, and disclose the extent to which you have done so.

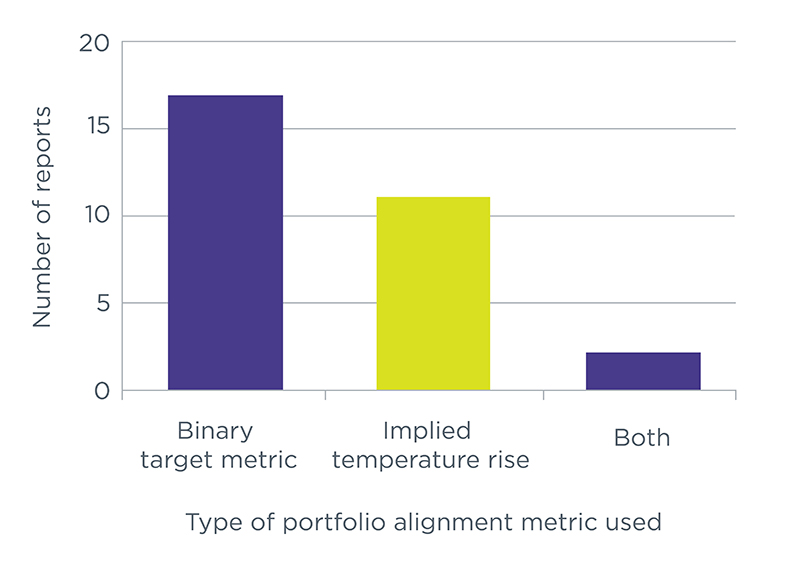

Portfolio alignment metric

This was the first year it was mandatory to calculate and disclose a 'portfolio alignment metric', which is a measure of how the scheme’s investments are aligned with the Paris Agreement. These metrics are 'forward looking' so can be a better measure of transition risk than 'backwards looking' emissions metrics.

Binary target metrics typically used the Science Based Targets initiative (SBTi). Implied temperature rise (ITR) reported values tended to be between two degrees Celsius to three degrees. ITR above 3 degrees Celsius was reported for a few individual funds – it may be appropriate for trustees to apply more scrutiny to investments materially out of line with the Paris Agreement.

Data coverage was typically lowest compared with the other disclosed metrics. Given the potential value of this metric, improving data coverage could be an area of trustee focus for next year.

Figure 1: bar graph showing portfolio metrics used in our sample

Good practice we observed

- Narratives to explain how the trustees had interpreted the results of metrics and any actions they had taken.

- Making use of data providers and estimates to fill gaps in reported data. One report disclosed full Scope 1, 2 and 3 emissions for 84% of total scheme assets, another for around 96% of its growth assets.

Issues we observed

- One report stated data from certain managers/asset classes was not available. However, we saw similar data available in other reports, suggesting the data could have been obtained for a proportionate effort.

- Presentation of large amounts of data. In some cases, this made it difficult for the reader to interpret the results.

- Reports frequently omitted information on steps being taken to address material data gaps or took a passive approach of relying on general industry-wide data improvements.

Ways to improve future reports

- Continue to extend coverage of emissions data focussing on the areas most exposed to climate-related risks. Trustees should consider obtaining estimates to fill in gaps.

- Consider presenting results at a more summarised or aggregated level to aid reader understanding. While we appreciate that asset class and manager-level data will be more useful for trustee decision making, this more granular level could be reported separately in an appendix.

- Review the results of the metrics and interrogate outlier results. Comment on the trustees’ conclusions in your report.

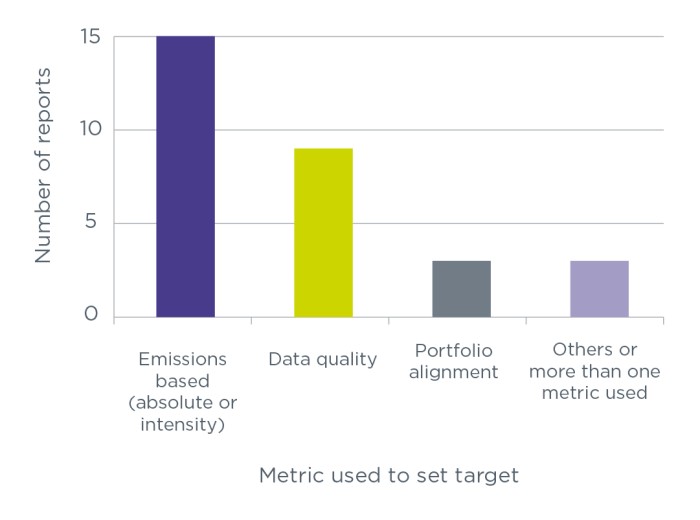

Targets

The most common type of target was to reduce carbon emissions associated with the scheme’s assets, as shown below.

Figure 2: bar graph showing metrics used to set targets

We noted a few reports showed targets were close to or had already been achieved. Trustees in this position should consider updating their target and could consider new approaches like using the portfolio alignment metric.

Good practice we observed

Well-reasoned explanations of why the target was chosen. One report noted consideration of the sponsor’s and fiduciary manager’s own targets. Another explained how the target was expected to help manage climate-related risks.

Issues we observed

Several reports lacked information on the steps the trustees were taking to achieve their target.

Ways to improve future reports

Targets should be used to manage climate related risks or take advantage of opportunities. They should be linked to actions trustees can take.

Net zero targets

- 19 out of the 30 reports in our sample, had some form of net zero goal. All of these referred to 2050 or before 2050 as the target date.

- Of these, 13 were presented as a formal target set by the trustees, and six were limited to an ambition or aspiration.

While there is no requirement for trustees to set a net zero target, we believe such targets can be consistent with sensible risk management, by helping position investment portfolios to be resilient to potential economy-wide changes from a climate transition.

Where net targets were in place, they normally included an interim target (for example, to reduce carbon intensity 50% by 2030) but otherwise tended to have limited supporting detail.

The Transition Plan Taskforce (TPT) recently published its framework for complete and credible transition plans, which could be a useful reference for trustees wishing to develop their net zero goals.

Continuous improvement

Trustees, advisers and those preparing climate change reports must ensure any gaps in required disclosures are addressed in future reports. We expect our wider review findings and comments to be taken into account so that reports are high quality and user-friendly.

Appendix – what we did

This statement draws on our review of 30 published climate-related reports relating to scheme year-ends between 1 October 2022 and 30 September 2023. This is about 10% of the total number of reports for that period. We selected a representative sample of reports which included:

- 13 DB schemes

- 13 Hybrid schemes (with DB and DC sections)

- three single-employer DC schemes

- one DC master trust

For five of the reports, this was the scheme’s second report published under the Climate and Governance Regulations. The remainder were reporting for the first time.