Published: 27 July 2021

Data coverage

The data contained in this statistical release were submitted by schemes to The Pensions Regulator (TPR) in triennial valuation summaries, their associated recovery plans (RPs), and annual scheme returns.

The data set builds on previous releases and includes Tranche 14 valuations and associated RPs received up to 31 January 2021. It also includes data on schemes in surplus for all tranches.

Tranche 14 is the second tranche of the fifth cycle of the Scheme Funding Regime. The majority of Cycle Four plans (Tranches 10, 11 and 12) and Cycle Three plans (Tranches 7, 8 and 9) are fourth and third valuations respectively under the scheme funding regime. However, Tranches 3, 6, 9 and 12 (1, 4, 7 and 10, etc) do not constitute a perfect cohort. There are a few reasons why this may be the case, including the following:

- some schemes have had their most recent valuation less than three years since their previous valuation

- where a scheme’s assets were less than its technical provisions (TPs) in the previous cycle (ie Tranche 11) but exceeded its TPs for its valuation under the current cycle (ie Tranche 14)

- where a scheme has wound up or is in the process of winding up

- where a scheme has transferred to the Pension Protection Fund (PPF)

Base data varies slightly in different sections as a result of data coverage, validation, and cleaning.

The data count all memberships in schemes with a promise to a pension. As some individuals may have a number of pension entitlements spread over a number of schemes, they may be included more than once in the total memberships under consideration.

The summaries on mortality assumptions are based on current male pensioners aged 65 only, unless otherwise stated.

Methodology

Weighted averages are weighted by TPs. Where ‘average’ is used in the report, it refers to the mean.

Owing to the scheme-specific nature of the data, individual data points cannot be presented in some instances. As such, data distributions start and end at the 5th and 95th percentiles respectively, and in some instances group ranges have been broadened to include figures comprising fewer than 10 observations.

Figure totals may reflect rounding.

Maturity is measured as the ratio of pensioner TPs to total TPs.

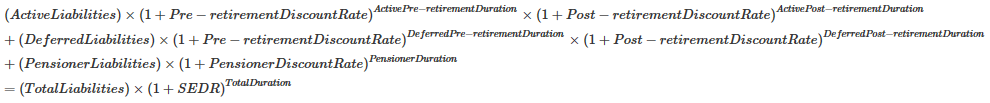

The discount rate assumption is reported in one of two formats:

- a single investment return

- different investment returns for pre-retirement and post-retirement benefits

For the purposes of comparison, in instances where different rates have been reported, a single effective discount rate (SEDR) is calculated. This is based on the single rate or, where a different rates approach has been adopted, constructed from both the pre- and post-retirement rates. This is calculated using the following equation of value:

The duration parameters used in the above formula are estimated on a scheme by scheme basis, using data provided to us in the annual scheme return and valuation returns. Using the above formula the SEDR has been calculated for all schemes (tranches 1-7: schemes in deficit only, tranches 8-14: all schemes), and as such historical positions will differ to earlier publications.

Average annual deficit repair contributions (DRCs) summarised in Table 3.4 are calculated as the average of DRCs over the first four years of the RP.

The outperformance of the SEDR is calculated using different 20-year gilts (nominal and real) to previous editions. As a result, the levels of outperformance assumed will differ to those shown in previous reports. The differences may be inconsistent across tranches because the relationship between the Bank of England 20-year nominal government spot rate and FTSE index 20 year conventional gilt (used previously) varies at different dates.

Covenant Groups (1-4) are assigned at the point of initial RP reviews to facilitate prioritisation. These grades may vary to the view taken during case-level intervention, where a wider range of information is taken into account. They are defined as:

- Covenant Group 1: Strong

- Covenant Group 2: Tending to strong

- Covenant Group 3: Tending to weak

- Covenant Group 4: Weak

Covenant assessments are not usually undertaken for schemes in surplus.

‘Return-seeking assets’ as a proportion of total assets held comprise the sum of:

- 100% of a scheme’s allocation to equities

- 75% of property

- 100% of commodities

- 60% of Insurance policies

- 80% of hedge funds

- 25% of corporate bonds

- 100% of assets held in the ‘other’ category

The PPF stressed asset ratio used in this report refers to: the ratio of the stressed value of assets to the (unstressed) market value of assets. For the purposes of this report the stressed value of assets is calculated for all schemes using the standard approach, but where the results of a bespoke stress have been submitted these have been instead used. The methodology for the standard stress test is consistent with the methodology published in the relevant levy year.

Employer Industry Classification and Geographical Area as used in the Life Expectancy section have been derived using:

- the SIC code, and

- the Registered Trading Address post code of the largest sponsoring employer by number of DB members to each scheme

Schemes in the data set

Table 1.1: Number of valuations analysed by cycle and tranche (schemes in surplus and deficit, all tranches)

| Cycle | Tranche | Valuation Period | Number of RPs analysed | Number of surplus valuations analysed |

|---|---|---|---|---|

| 1 | 1 | 22 September 2005 to 21 September 2006 | 2,127 | 435 |

| 1 | 2 | 22 September 2006 to 21 September 2007 | 1,888 | 463 |

| 1 | 3 | 22 September 2007 to 21 September 2008 | 1,840 | 422 |

| 2 | 4 | 22 September 2008 to 21 September 2009 | 2,048 | 156 |

| 2 | 5 | 22 September 2009 to 21 September 2010 | 1,937 | 252 |

| 2 | 6 | 22 September 2010 to 21 September 2011 | 1,652 | 445 |

| 3 | 7 | 22 September 2011 to 21 September 2012 | 1,770 | 221 |

| 3 | 8 | 22 September 2012 to 21 September 2013 | 1,726 | 271 |

| 3 | 9 | 22 September 2013 to 21 September 2014 | 1,530 | 482 |

| 4 | 10 | 22 September 2014 to 21 September 2015 | 1,403 | 432 |

| 4 | 11 | 22 September 2015 to 21 September 2016 | 1,462 | 358 |

| 4 | 12 | 22 September 2016 to 21 September 2017 | 1,481 | 460 |

| 5 | 13 | 22 September 2017 to 21 September 2018 | 1,112 | 658 |

| 5 | 14 | 22 September 2018 to 21 September 2019 | 1,144 | 519 |

Table 1.1: Number of valuations analysed by cycle and tranche

This data set comprises schemes that have submitted recovery plans (that is, schemes in deficit on the TPs funding basis as at their valuation date) as well as schemes in surplus. By 31 January 2021, TPR had received 1,144 RPs and 519 valuations in respect of schemes reporting a surplus.

74.8% of schemes with Tranche 14 valuations, reported valuations in respect of Tranche 11, Tranche 8, Tranche 5 and Tranche 2.

Table 1.2a: Concentration by scheme characteristics (schemes in surplus and deficit)

| Tranche (percentage of schemes) | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

| Size by number of members | ||||||||||||||

| Fewer than 100 members | 33.2 | 34.0 | 34.1 | 32.0 | 34.6 | 36.5 | 34.4 | 35.0 | 35.1 | 34.5 | 36.1 | 36.0 | 34.7 | 36.2 |

| 100 to fewer than 500 members | 34.0 | 36.1 | 34.1 | 33.0 | 34.7 | 34.7 | 32.8 | 34.7 | 34.8 | 31.7 | 33.8 | 35.3 | 31.2 | 34.6 |

| 500 to fewer than 1,000 members | 11.1 | 10.3 | 12.0 | 11.9 | 10.9 | 9.9 | 11.1 | 10.5 | 10.1 | 11.7 | 10.3 | 9.5 | 12.4 | 9.4 |

| 1,000 to fewer than 5,000 members | 14.5 | 12.6 | 13.7 | 15.0 | 12.8 | 13.2 | 14.0 | 12.7 | 13.8 | 14.1 | 12.9 | 13.4 | 14.2 | 12.9 |

| 5,000 members or more | 7.1 | 6.9 | 6.2 | 8.2 | 7.0 | 5.6 | 7.8 | 7.1 | 6.0 | 8.0 | 6.9 | 5.8 | 7.5 | 6.9 |

| Size by TPs | ||||||||||||||

| Less than £5m | 31.1 | 31.8 | 28.4 | 27.4 | 27.8 | 26.0 | 23.5 | 23.6 | 21.3 | 21.7 | 21.4 | 18.8 | 20.3 | 18.3 |

| £5m to less than £20m | 28.7 | 31.1 | 29.8 | 28.2 | 29.8 | 29.2 | 24.8 | 26.9 | 29.0 | 23.1 | 26.0 | 26.0 | 21.3 | 25.3 |

| £20m to less than £100m | 24.9 | 23.0 | 26.4 | 25.6 | 25.2 | 26.5 | 28.6 | 27.9 | 28.5 | 28.2 | 28.1 | 29.9 | 29.4 | 29.5 |

| £100m to less than £300m | 7.7 | 7.1 | 8.7 | 9.9 | 8.6 | 10.9 | 12.4 | 10.4 | 12.2 | 14.3 | 11.7 | 13.5 | 14.8 | 12.8 |

| £300m or greater | 7.7 | 7.0 | 6.7 | 8.9 | 8.6 | 7.3 | 10.7 | 11.3 | 9.1 | 12.6 | 12.7 | 11.7 | 14.1 | 14.0 |

| Maturity (ratio of pensioner TPs to total TPs) | ||||||||||||||

| Less than 25% | 47.2 | 46.4 | 40.5 | 38.2 | 36.5 | 30.5 | 30.2 | 29.0 | 25.1 | 26.9 | 24.2 | 21.9 | 21.7 | 19.4 |

| 25% to less than 50% | 36.6 | 37.7 | 42.1 | 40.1 | 42.3 | 45.7 | 42.1 | 44.3 | 44.3 | 42.4 | 44.1 | 45.1 | 42.7 | 42.2 |

| 50% to less than 75% | 14.4 | 13.7 | 15.3 | 18.9 | 18.6 | 20.7 | 24.1 | 23.7 | 26.7 | 26.7 | 27.0 | 28.0 | 30.3 | 32.6 |

| 75% or greater | 1.8 | 2.2 | 2.1 | 2.7 | 2.7 | 3.2 | 3.6 | 3.0 | 3.9 | 4.0 | 4.7 | 5.0 | 5.4 | 5.8 |

| Presence of active members | ||||||||||||||

| TPs reported for active members | 78.1 | 73.7 | 71.5 | 67.8 | 63.5 | 61.0 | 55.8 | 51.5 | 52.7 | 45.7 | 43.5 | 42.7 | 37.1 | 34.7 |

| TPs not reported for active members | 21.9 | 26.3 | 28.5 | 32.2 | 36.5 | 39.0 | 44.2 | 48.5 | 47.3 | 54.3 | 56.5 | 57.3 | 62.9 | 65.3 |

| Covenant (schemes in deficit only) | ||||||||||||||

| Covenant group 1 (Strong) | 21.8 | 18.0 | 16.7 | 11.4 | 11.4 | 11.5 | 14.3 | 17.7 | ||||||

| Covenant group 2 (Tending to Strong) | 37.4 | 33.1 | 38.2 | 46.8 | 47.8 | 45.7 | 43.2 | 41.8 | ||||||

| Covenant group 3 (Tending to Weak) | 22.2 | 25.0 | 21.8 | 28.1 | 27.3 | 28.7 | 27.8 | 25.8 | ||||||

| Covenant group 4 (Weak) | 18.7 | 23.9 | 23.3 | 13.6 | 13.4 | 14.2 | 14.7 | 14.8 | ||||||

| RP length (schemes in deficit only) | ||||||||||||||

| Fewer than 5 years | 25.5 | 29.2 | 25.1 | 18.3 | 26.0 | 32.7 | 28.3 | 29.1 | 34.4 | 38.9 | 34.1 | 39.6 | 47.3 | 50.0 |

| 5 to fewer than 7.5 years | 14.4 | 17.6 | 15.1 | 14.9 | 19.0 | 19.6 | 21.1 | 18.1 | 19.4 | 20.5 | 19.4 | 19.7 | 21.4 | 22.9 |

| 7.5 to fewer than 10 years | 41.5 | 39.3 | 38.0 | 32.1 | 28.9 | 23.0 | 20.4 | 23.0 | 19.0 | 15.1 | 21.3 | 19.7 | 15.4 | 12.6 |

| 10 years or more | 18.6 | 13.9 | 21.9 | 34.7 | 26.2 | 24.7 | 30.1 | 29.8 | 27.2 | 25.6 | 25.3 | 21.0 | 15.9 | 14.4 |

| Return seeking assets | ||||||||||||||

| Less than 20% | 3.2 | 4.6 | 4.5 | 5.2 | 6.5 | 5.3 | 6.9 | 7.3 | 5.5 | 8.4 | 14.5 | 13.6 | 18.3 | 20.7 |

| 20% to less than 40% | 5.2 | 5.9 | 6.6 | 11.2 | 9.7 | 12.8 | 14.2 | 12.2 | 12.1 | 16.8 | 21.6 | 23.7 | 27.1 | 29.6 |

| 40% to less than 60% | 18.7 | 18.4 | 25.3 | 30.3 | 28.5 | 31.3 | 37.4 | 33.9 | 35.7 | 36.6 | 37.1 | 38.4 | 36.1 | 32.8 |

| 60% to less than 80% | 50.3 | 48.5 | 45.7 | 43.4 | 42.9 | 40.5 | 35.3 | 38.6 | 39.1 | 31.8 | 22.3 | 20.9 | 16.5 | 14.6 |

| 80% or greater | 22.6 | 22.6 | 17.9 | 9.9 | 12.4 | 10.1 | 6.2 | 8.1 | 7.6 | 6.3 | 4.5 | 3.5 | 2.1 | 2.3 |

| Presence of contingent assets | ||||||||||||||

| No contingent asset | 84.6 | 79.7 | 82.0 | 78.9 | 80.7 | 83.3 | 81.8 | 81.1 | 82.8 | 82.1 | 83.9 | |||

| At least one contingent asset | 15.4 | 20.3 | 18.0 | 21.1 | 19.3 | 16.7 | 18.2 | 18.9 | 17.2 | 17.9 | 16.1 | |||

| Funding level (TPs) | ||||||||||||||

| Less than 70% | 18.3 | 12.5 | 14.1 | 42.8 | 19.8 | 11.7 | 22.4 | 20.7 | 9.8 | 11.1 | 13.0 | 12.3 | 8.5 | 10.4 |

| 70% to less than 80% | 21.3 | 18.6 | 21.1 | 26.3 | 24.5 | 17.8 | 25.2 | 23.2 | 14.6 | 15.5 | 17.0 | 14.9 | 11.8 | 11.6 |

| 80% to less than 90% | 26.4 | 26.5 | 25.1 | 15.6 | 27.6 | 25.5 | 26.5 | 24.4 | 24.2 | 24.9 | 26.5 | 23.2 | 17.2 | 20.5 |

| 90% to less than 100% | 18.4 | 23.0 | 21.2 | 8.4 | 16.7 | 23.8 | 14.9 | 18.1 | 27.5 | 25.0 | 23.9 | 25.9 | 25.3 | 26.2 |

| 100% or greater | 15.6 | 19.3 | 18.5 | 6.8 | 11.5 | 21.2 | 11.1 | 13.5 | 24.0 | 23.5 | 19.7 | 23.7 | 37.2 | 31.3 |

| PPF Standard stressed/Unstressed asset ratio | ||||||||||||||

| Less than 90% | 22.3 | 26.4 | 23.8 | 19.5 | 17.3 | 8.2 | 6.8 | 5.5 | ||||||

| 90% to less than 95% | 36.6 | 35.3 | 36.9 | 29.1 | 27.6 | 20.5 | 15.1 | 14.4 | ||||||

| 95% to less than 100% | 24.1 | 22.1 | 23.0 | 26.3 | 25.7 | 29.3 | 26.1 | 21.2 | ||||||

| 100% to less than 105% | 11.2 | 9.8 | 8.6 | 13.4 | 16.2 | 21.9 | 23.2 | 23.7 | ||||||

| 105% or greater | 5.9 | 6.4 | 7.7 | 11.6 | 13.2 | 20.1 | 28.7 | 35.2 | ||||||

| PPF Combined stressed/Unstressed asset ratio | ||||||||||||||

| Less than 90% | 22.1 | 26.0 | 23.6 | 19.0 | 17.3 | 8.2 | 6.7 | 5.5 | ||||||

| 90% to less than 95% | 35.7 | 33.8 | 34.8 | 27.6 | 26.0 | 19.2 | 14.5 | 13.9 | ||||||

| 95% to less than 100% | 23.3 | 21.1 | 22.4 | 24.0 | 22.0 | 26.3 | 22.2 | 19.4 | ||||||

| 100% to less than 105% | 11.7 | 11.2 | 10.6 | 14.7 | 15.9 | 21.0 | 22.1 | 21.8 | ||||||

| 105% or greater | 7.2 | 7.9 | 8.6 | 14.7 | 18.9 | 25.2 | 34.4 | 39.4 | ||||||

Table 1.2a: Concentration by scheme characteristics

Table 1.2b: Distribution of members and liabilities across covenant groups (schemes in deficit only)

| Covenant Groups (schemes in deficit only) | Tranches 12, 13 and 14 | |||||

|---|---|---|---|---|---|---|

| Members (%) | Assets for Part 3 (TPs) valuation (%) | Technical provisions (%) | Buyout liabilities (%) | s179 liabilities (%) | ||

| Covenant group 1 (Strong) | 15.5 | 18.0 | 17.8 | 17.2 | 17.1 | |

| Covenant group 2 (Tending to Strong) | 53.1 | 56.6 | 55.8 | 56.9 | 56.9 | |

| Covenant group 3 (Tending to Weak) | 22.1 | 20.1 | 20.9 | 20.5 | 20.5 | |

| Covenant group 4 (Weak) | 9.4 | 5.3 | 5.6 | 5.4 | 5.5 | |

Table 1.2b: Distribution of members and liabilities across covenant groups

Coverage = approximately 93.3 % of schemes in deficit for Tranches 12, 13 and 14 combined.

Covenant Groups (1-4) are assigned at the point of initial RP reviews to facilitate prioritisation. These grades may vary to the view taken during case-level intervention, where a wider range of information is taken into account. They are defined as: Covenant Group 1 - strong; 2 - tending to strong; 3 - tending to weak; 4 - weak. Covenant assessments are not usually undertaken for schemes in surplus.

Table 1.2c: Distribution of schemes and memberships across TPs funding levels (schemes in surplus and deficit, Tranches 12, 13 and 14)

| Funding level (TPs) | Schemes (%) | Members (%) |

|---|---|---|

| Less than 50% | 1.5 | 0.2 |

| 50% to less than 60% | 2.4 | 0.6 |

| 60% to less than 70% | 6.6 | 2.0 |

| 70% to less than 80% | 12.8 | 5.8 |

| 80% to less than 90% | 20.4 | 28.2 |

| 90% to less than 100% | 25.8 | 33.9 |

| 100% to less than 110% | 20.5 | 23.2 |

| 110% to less than 120% | 6.0 | 5.3 |

| 120% or greater | 4.0 | 0.8 |

Table 1.2c: Distribution of schemes and memberships across TPs funding levels

Table 1.2d: Concentration of memberships by scheme characteristics (schemes in surplus and deficit)

| Tranche (percentage of memberships) | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

| Size by number of members | ||||||||||||||

| Fewer than 100 members | 0.6 | 0.8 | 0.8 | 0.5 | 0.8 | 0.8 | 0.7 | 0.9 | 0.8 | 0.7 | 0.9 | 0.8 | 0.6 | 1.0 |

| 100 to fewer than 500 members | 3.5 | 4.6 | 4.4 | 3.0 | 4.6 | 4.4 | 3.7 | 4.7 | 4.1 | 3.7 | 4.7 | 4.0 | 3.3 | 5.3 |

| 500 to fewer than 1,000 members | 3.5 | 3.8 | 4.5 | 3.3 | 4.2 | 3.7 | 3.8 | 4.2 | 3.5 | 4.0 | 4.1 | 3.2 | 3.8 | 4.1 |

| 1,000 to fewer than 5,000 members | 14.0 | 15.0 | 16.9 | 12.3 | 16.0 | 16.2 | 13.9 | 16.6 | 15.6 | 14.8 | 17.0 | 14.3 | 13.9 | 18.6 |

| 5,000 members or more | 78.3 | 75.8 | 73.4 | 80.8 | 74.4 | 74.9 | 78.0 | 73.7 | 76.0 | 76.7 | 73.3 | 77.7 | 78.5 | 71.1 |

| Size by TPs | ||||||||||||||

| Less than £5m | 1.2 | 3.1 | 1.3 | 0.9 | 0.9 | 0.6 | 0.5 | 0.6 | 0.4 | 0.4 | 0.4 | 0.3 | 0.5 | 0.4 |

| £5m to less than £20m | 3.4 | 4.4 | 3.4 | 2.5 | 3.0 | 2.3 | 1.9 | 2.6 | 2.0 | 1.4 | 1.8 | 1.5 | 1.0 | 1.6 |

| £20m to less than £100m | 11.0 | 11.6 | 10.3 | 7.3 | 9.2 | 7.9 | 6.7 | 7.6 | 6.7 | 6.0 | 6.3 | 4.9 | 4.8 | 6.2 |

| £100m to less than £300m | 10.8 | 10.2 | 15.4 | 10.1 | 11.0 | 12.8 | 9.6 | 9.2 | 10.4 | 9.3 | 9.7 | 8.3 | 7.5 | 9.1 |

| £300m or greater | 73.7 | 70.7 | 69.5 | 79.2 | 76.0 | 76.3 | 81.4 | 79.9 | 80.4 | 82.9 | 81.7 | 85.0 | 86.2 | 82.7 |

| Maturity (ratio of pensioner TPs to total TPs) | ||||||||||||||

| Less than 25% | 14.8 | 14.9 | 20.2 | 16.4 | 9.3 | 5.9 | 6.2 | 8.4 | 13.6 | 19.7 | 7.9 | 5.0 | 15.5 | 8.3 |

| 25% to less than 50% | 46.2 | 51.4 | 49.6 | 44.5 | 49.4 | 59.2 | 47.1 | 49.7 | 52.2 | 47.7 | 52.4 | 65.4 | 51.5 | 52.6 |

| 50% to less than 75% | 37.8 | 31.6 | 27.5 | 37.8 | 39.5 | 32.9 | 43.8 | 40.0 | 32.3 | 31.9 | 37.0 | 27.8 | 31.6 | 35.0 |

| 75% or greater | 1.3 | 2.1 | 2.7 | 1.3 | 1.8 | 2.1 | 3.0 | 1.9 | 1.9 | 0.7 | 2.7 | 1.7 | 1.4 | 4.2 |

| Presence of active members | ||||||||||||||

| TPs reported for active members | 97.5 | 95.1 | 93.9 | 90.8 | 89.8 | 88.2 | 79.7 | 74.7 | 82.7 | 68.5 | 66.6 | 70.9 | 62.1 | 52.8 |

| TPs not reported for active members | 2.5 | 4.9 | 6.1 | 9.2 | 10.2 | 11.8 | 20.3 | 25.3 | 17.3 | 31.5 | 33.4 | 29.1 | 37.9 | 47.2 |

| Covenant (schemes in deficit only) | ||||||||||||||

| Covenant group 1 (Strong) | 36.9 | 23.9 | 36.8 | 14.9 | 19.9 | 18.7 | 9.5 | 19.6 | ||||||

| Covenant group 2 (Tending to Strong) | 33.0 | 41.4 | 40.9 | 42.3 | 45.1 | 51.9 | 59.1 | 46.2 | ||||||

| Covenant group 3 (Tending to Weak) | 18.9 | 20.0 | 15.8 | 24.1 | 29.6 | 24.1 | 16.7 | 26.8 | ||||||

| Covenant group 4 (Weak) | 11.2 | 14.7 | 6.4 | 18.7 | 5.4 | 5.3 | 14.8 | 7.3 | ||||||

| RP length (schemes in deficit only) | ||||||||||||||

| Fewer than 5 years | 17.0 | 32.8 | 25.7 | 7.1 | 15.2 | 16.6 | 13.6 | 23.3 | 17.5 | 19.7 | 18.4 | 19.7 | 32.0 | 45.6 |

| 5 to fewer than 7.5 years | 13.9 | 18.6 | 18.1 | 9.0 | 17.1 | 21.4 | 30.9 | 12.9 | 17.6 | 22.2 | 22.8 | 20.3 | 17.1 | 29.2 |

| 7.5 to fewer than 10 years | 43.7 | 38.1 | 31.7 | 28.5 | 39.9 | 29.8 | 23.8 | 34.2 | 24.9 | 30.8 | 25.7 | 32.4 | 40.3 | 15.5 |

| 10 years or more | 25.5 | 10.5 | 24.4 | 55.4 | 27.8 | 32.3 | 31.7 | 29.6 | 40.0 | 27.3 | 33.1 | 27.7 | 10.6 | 9.6 |

| Return seeking assets | ||||||||||||||

| Less than 20% | 0.6 | 1.4 | 3.1 | 2.1 | 3.0 | 3.1 | 9.2 | 6.1 | 3.6 | 8.5 | 13.1 | 14.8 | 21.8 | 27.8 |

| 20% to less than 40% | 5.5 | 11.9 | 7.3 | 21.3 | 15.9 | 14.7 | 25.3 | 26.3 | 14.1 | 24.3 | 39.0 | 35.0 | 38.3 | 37.8 |

| 40% to less than 60% | 22.7 | 24.6 | 24.2 | 39.3 | 40.6 | 39.5 | 40.3 | 35.5 | 41.0 | 41.1 | 32.7 | 31.6 | 23.5 | 24.3 |

| 60% to less than 80% | 58.8 | 45.6 | 50.5 | 30.9 | 35.0 | 38.4 | 21.9 | 28.8 | 40.0 | 21.0 | 14.7 | 18.4 | 15.8 | 9.6 |

| 80% or greater | 12.3 | 16.6 | 15.0 | 6.4 | 5.6 | 4.3 | 3.3 | 3.3 | 1.3 | 5.0 | 0.6 | 0.3 | 0.6 | 0.5 |

| Presence of contingent assets | ||||||||||||||

| No contingent asset | 63.5 | 56.2 | 50.7 | 64.2 | 61.7 | 65.1 | 68.5 | 64.1 | 61.6 | 79.1 | 66.4 | |||

| At least one contingent asset | 36.5 | 43.8 | 49.3 | 35.8 | 38.3 | 34.9 | 31.5 | 35.9 | 38.4 | 20.9 | 33.6 | |||

| Funding level (TPs) | ||||||||||||||

| Less than 70% | 5.5 | 3.6 | 4.9 | 31.7 | 8.2 | 3.1 | 10.1 | 7.5 | 2.9 | 4.3 | 4.8 | 2.7 | 2.2 | 3.9 |

| 70% to less than 80% | 13.1 | 8.7 | 18.6 | 33.8 | 23.9 | 17.7 | 20.1 | 21.1 | 15.7 | 12.1 | 9.8 | 5.6 | 6.7 | 4.9 |

| 80% to less than 90% | 34.4 | 23.5 | 23.0 | 14.9 | 39.0 | 29.1 | 28.0 | 37.3 | 44.3 | 21.2 | 36.1 | 52.6 | 12.3 | 15.2 |

| 90% to less than 100% | 31.3 | 42.4 | 26.9 | 15.9 | 21.8 | 39.0 | 32.3 | 27.3 | 22.8 | 40.6 | 32.9 | 18.1 | 46.2 | 39.2 |

| 100% or greater | 15.6 | 21.7 | 26.6 | 3.7 | 7.1 | 11.1 | 9.6 | 6.8 | 14.3 | 21.8 | 16.4 | 21.0 | 32.6 | 36.9 |

| PPF Standard stressed/Unstressed asset ratio | ||||||||||||||

| Less than 90% | 12.4 | 13.8 | 15.1 | 9.3 | 3.7 | 1.4 | 1.4 | 0.8 | ||||||

| 90% to less than 95% | 26.2 | 26.3 | 31.5 | 19.5 | 19.1 | 20.3 | 15.2 | 5.3 | ||||||

| 95% to less than 100% | 40.0 | 38.1 | 33.5 | 36.6 | 28.5 | 32.9 | 21.0 | 13.7 | ||||||

| 100% to less than 105% | 12.4 | 12.3 | 10.2 | 10.2 | 30.3 | 20.8 | 30.5 | 26.7 | ||||||

| 105% or greater | 9.0 | 9.6 | 9.8 | 24.4 | 18.3 | 24.7 | 31.8 | 53.6 | ||||||

| PPF Combined stressed/Unstressed asset ratio | ||||||||||||||

| Less than 90% | 8.2 | 8.4 | 15.8 | 5.7 | 5.5 | 3.0 | 1.3 | 3.2 | ||||||

| 90% to less than 95% | 20.5 | 22.8 | 28.1 | 14.9 | 14.9 | 17.4 | 14.8 | 4.8 | ||||||

| 95% to less than 100% | 31.7 | 21.2 | 23.7 | 30.1 | 17.1 | 14.3 | 12.6 | 5.6 | ||||||

| 100% to less than 105% | 17.0 | 28.6 | 18.3 | 15.5 | 18.4 | 17.9 | 23.3 | 21.9 | ||||||

| 105% or greater | 22.5 | 19.0 | 14.1 | 33.8 | 44.0 | 47.5 | 48.0 | 64.5 | ||||||

Table 1.2d: Concentration of memberships by scheme characteristics

Funding and other security arrangements

Table 2.1a: Key average funding ratios (schemes in surplus and deficit)

| Unweighted average (%) - Tranche | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | ||

| Ratio of assets to: | |||||||||||||||

| Technical provisions | 79.8 | 82.3 | 81.3 | 71.3 | 79.0 | 82.3 | 78.4 | 82.2 | 89.4 | 88.6 | 87.0 | 88.8 | 93.5 | 91.4 | |

| s.179 liabilities | 83.9 | 93.5 | 90.1 | 76.1 | 92.7 | 93.9 | 80.4 | 84.2 | 95.7 | 89.4 | 86.9 | 90.0 | 97.3 | 97.3 | |

| Buyout liabilities | 53.4 | 58.0 | 60.4 | 51.4 | 57.7 | 58.7 | 55.5 | 58.3 | 63.8 | 61.0 | 60.3 | 61.2 | 68.7 | 69.7 | |

| Ratio of TPs to: | |||||||||||||||

| s.179 liabilities | 105.0 | 113.5 | 110.7 | 101.5 | 112.3 | 109.7 | 99.9 | 98.6 | 102.5 | 96.9 | 95.8 | 96.9 | 100.0 | 103.0 | |

| Buyout liabilities | 66.9 | 70.3 | 74.5 | 71.9 | 72.9 | 71.3 | 70.7 | 70.9 | 71.5 | 68.9 | 69.2 | 68.8 | 73.5 | 75.7 | |

Table 2.1a: Key average funding ratios

Table 2.1b: Key weighted average funding ratios (schemes in surplus and deficit)

| Weighted average (%) - Tranche | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | ||

| Ratio of assets to: | |||||||||||||||

| Technical provisions | 85.8 | 88.8 | 83.9 | 74.4 | 83.1 | 86.7 | 84.1 | 84.8 | 89.2 | 90.9 | 89.0 | 90.5 | 96.4 | 96.0 | |

| s.179 liabilities | 92.7 | 105.2 | 96.3 | 79.7 | 100.6 | 97.8 | 89.1 | 90.9 | 95.3 | 94.8 | 93.7 | 94.3 | 102.6 | 105.3 | |

| Buyout liabilities | 60.8 | 66.7 | 66.8 | 55.2 | 62.1 | 62.7 | 60.6 | 60.6 | 64.1 | 64.1 | 62.4 | 64.5 | 71.8 | 75.5 | |

| Ratio of TPs to: | |||||||||||||||

| s.179 liabilities | 108.2 | 118.6 | 114.8 | 105.8 | 121.8 | 114.4 | 109.4 | 111.4 | 109.9 | 106.4 | 106.8 | 105.4 | 106.9 | 111.2 | |

| Buyout liabilities | 70.8 | 75.0 | 79.9 | 74.1 | 74.4 | 72.2 | 72.1 | 71.2 | 71.8 | 70.3 | 70.0 | 71.1 | 74.1 | 78.3 | |

Table 2.1b: Key weighted average funding ratios

Weighted by TPs.

Table 2.2: Distribution of key funding ratios on various bases (schemes in surplus and deficit)

| Tranche | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

| Ratio of assets to TPs: | ||||||||||||||

| 95th percentile | 97.3 | 98.0 | 97.5 | 93.2 | 96.3 | 98.1 | 97.7 | 107.0 | 113.9 | 112.7 | 111.1 | 113.3 | 118.8 | 114.7 |

| Upper quartile | 89.0 | 91.1 | 90.4 | 80.2 | 88.0 | 91.3 | 87.6 | 92.5 | 99.0 | 98.4 | 97.1 | 99.2 | 103.7 | 101.6 |

| Median | 81.3 | 84.1 | 82.6 | 71.3 | 80.1 | 84.2 | 79.3 | 82.2 | 90.1 | 89.3 | 87.3 | 89.6 | 95.1 | 92.6 |

| Lower quartile | 71.8 | 75.5 | 74.2 | 62.2 | 71.4 | 75.5 | 70.1 | 72.2 | 80.1 | 79.0 | 77.7 | 78.6 | 82.9 | 82.0 |

| 5th percentile | 57.5 | 61.4 | 60.3 | 50.6 | 57.6 | 61.1 | 55.2 | 56.0 | 62.5 | 62.7 | 60.1 | 60.3 | 65.1 | 63.5 |

| Ratio of assets to s.179 liabilities: | ||||||||||||||

| 95th percentile | 121.5 | 132.9 | 127.0 | 115.0 | 130.2 | 131.9 | 119.7 | 126.4 | 141.5 | 133.6 | 130.3 | 137.5 | 143.9 | 142.8 |

| Upper quartile | 94.5 | 106.0 | 101.4 | 88.1 | 104.6 | 105.4 | 92.4 | 97.6 | 110.0 | 102.9 | 100.6 | 104.8 | 113.2 | 113.2 |

| Median | 81.3 | 90.8 | 88.4 | 72.1 | 90.9 | 91.6 | 77.3 | 81.0 | 93.6 | 86.3 | 84.1 | 87.3 | 95.1 | 94.9 |

| Lower quartile | 70.3 | 78.7 | 75.4 | 60.7 | 77.8 | 79.2 | 64.5 | 67.3 | 78.0 | 71.9 | 69.8 | 71.1 | 78.5 | 79.2 |

| 5th percentile | 55.4 | 63.4 | 60.6 | 48.5 | 63.0 | 63.7 | 51.7 | 53.8 | 58.6 | 56.8 | 54.8 | 54.6 | 58.7 | 59.1 |

| Ratio of assets to buyout liabilities: | ||||||||||||||

| 95th percentile | 74.1 | 78.0 | 84.0 | 75.7 | 79.6 | 78.4 | 79.2 | 88.1 | 91.6 | 88.9 | 89.4 | 93.1 | 99.7 | 101.2 |

| Upper quartile | 60.6 | 66.0 | 68.8 | 59.3 | 65.5 | 66.2 | 63.3 | 66.3 | 73.2 | 70.0 | 69.2 | 71.6 | 80.7 | 81.2 |

| Median | 52.3 | 57.3 | 59.0 | 49.8 | 57.1 | 58.7 | 54.0 | 56.0 | 62.4 | 59.4 | 58.1 | 59.4 | 67.1 | 68.1 |

| Lower quartile | 45.2 | 50.0 | 50.8 | 42.4 | 48.4 | 50.7 | 45.8 | 48.0 | 52.5 | 49.8 | 48.4 | 48.6 | 55.7 | 56.5 |

| 5th percentile | 35.5 | 39.1 | 40.4 | 32.5 | 38.7 | 39.3 | 35.7 | 36.5 | 40.7 | 37.8 | 37.6 | 36.0 | 41.2 | 41.6 |

| Ratio of TPs to s.179 liabilities: | ||||||||||||||

| 95th percentile | 154.3 | 160.0 | 154.1 | 146.9 | 154.9 | 152.6 | 151.2 | 151.3 | 146.8 | 138.2 | 139.3 | 140.4 | 140.8 | 144.2 |

| Upper quartile | 115.9 | 126.0 | 123.1 | 113.9 | 126.9 | 123.1 | 112.3 | 111.0 | 116.9 | 108.9 | 108.5 | 111.4 | 113.5 | 116.1 |

| Median | 101.4 | 110.2 | 108.4 | 99.3 | 110.8 | 107.9 | 97.3 | 95.7 | 101.8 | 95.9 | 94.2 | 95.7 | 99.6 | 102.0 |

| Lower quartile | 89.0 | 97.5 | 95.6 | 85.4 | 96.5 | 94.8 | 83.9 | 82.3 | 86.6 | 82.3 | 81.7 | 81.2 | 85.8 | 89.7 |

| 5th percentile | 72.7 | 79.3 | 77.5 | 67.4 | 76.4 | 74.4 | 61.8 | 60.9 | 63.8 | 59.1 | 58.2 | 56.5 | 61.0 | 65.8 |

| Ratio of TPs to buyout liabilities: | ||||||||||||||

| 95th percentile | 87.2 | 89.8 | 97.4 | 94.2 | 94.8 | 90.4 | 91.4 | 93.6 | 91.9 | 90.4 | 91.8 | 91.6 | 94.2 | 96.3 |

| Upper quartile | 73.5 | 77.6 | 83.3 | 79.5 | 80.2 | 78.2 | 78.0 | 78.2 | 78.7 | 75.6 | 76.7 | 77.3 | 81.1 | 83.4 |

| Median | 66.1 | 69.9 | 73.5 | 71.8 | 71.9 | 71.1 | 70.0 | 69.7 | 71.8 | 68.1 | 68.2 | 68.7 | 73.3 | 75.5 |

| Lower quartile | 59.1 | 62.6 | 65.0 | 63.3 | 65.0 | 63.6 | 62.5 | 62.9 | 64.0 | 61.4 | 60.8 | 60.0 | 65.3 | 67.5 |

| 5th percentile | 49.2 | 52.5 | 54.1 | 51.6 | 54.8 | 52.8 | 52.2 | 53.4 | 52.0 | 50.3 | 50.4 | 46.8 | 53.7 | 56.1 |

Table 2.2: Distribution of key funding ratios on various bases

Table 2.3a: Average [Unweighted] ratio of assets to TPs by scheme characteristics (schemes in surplus and deficit)

| Unweighted average (%) - Tranche | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

| Size by number of members | ||||||||||||||

| Fewer than 100 members | 85.3 | 86.5 | 85.9 | 76.8 | 82.4 | 88.5 | 82.1 | 82.7 | 90.1 | 90.5 | 89.5 | 89.7 | 95.2 | 92.6 |

| 100 to fewer than 500 members | 82.3 | 86.5 | 85.9 | 72.0 | 81.6 | 87.2 | 79.5 | 81.6 | 89.0 | 87.2 | 85.2 | 88.0 | 91.5 | 90.0 |

| 500 to fewer than 1,000 members | 81.6 | 88.5 | 85.7 | 70.4 | 82.2 | 87.8 | 80.0 | 81.9 | 88.1 | 89.0 | 85.9 | 87.1 | 92.6 | 90.6 |

| 1,000 to fewer than 5,000 members | 84.9 | 88.0 | 86.8 | 73.6 | 83.0 | 88.6 | 81.0 | 82.4 | 89.6 | 88.9 | 86.8 | 89.1 | 94.1 | 92.4 |

| 5,000 members or more | 89.0 | 91.7 | 90.1 | 76.3 | 84.1 | 90.1 | 81.8 | 85.3 | 91.4 | 88.7 | 88.5 | 92.7 | 94.8 | 95.5 |

| Size by TPs | ||||||||||||||

| Less than £5m | 86.1 | 86.8 | 86.6 | 77.8 | 83.5 | 90.1 | 83.9 | 84.4 | 91.6 | 90.5 | 92.1 | 91.0 | 94.9 | 94.4 |

| £5m to less than £20m | 82.1 | 86.4 | 84.9 | 72.3 | 81.2 | 86.3 | 80.2 | 80.7 | 87.6 | 88.8 | 86.0 | 87.5 | 94.1 | 89.7 |

| £20m to less than £100m | 82.4 | 87.7 | 86.0 | 71.4 | 82.1 | 88.2 | 79.3 | 81.1 | 89.8 | 88.4 | 84.6 | 88.4 | 91.8 | 90.4 |

| £100m to less than £300m | 84.7 | 88.1 | 89.1 | 73.2 | 83.8 | 88.8 | 79.8 | 83.4 | 89.5 | 87.9 | 86.9 | 88.9 | 93.1 | 91.0 |

| £300m or greater | 89.1 | 91.2 | 88.4 | 75.5 | 82.8 | 88.1 | 81.8 | 84.5 | 90.5 | 89.0 | 87.9 | 90.4 | 94.8 | 95.0 |

| Maturity (ratio of pensioner TPs to total TPs) | ||||||||||||||

| Less than 25% | 82.6 | 85.2 | 84.1 | 74.5 | 81.7 | 88.1 | 82.4 | 83.1 | 90.2 | 90.1 | 87.8 | 86.5 | 93.1 | 90.7 |

| 25% to less than 50% | 83.5 | 87.6 | 86.1 | 71.6 | 81.5 | 87.4 | 78.7 | 80.8 | 88.4 | 87.1 | 85.6 | 88.0 | 91.7 | 90.7 |

| 50% to less than 75% | 88.2 | 90.7 | 89.4 | 75.6 | 83.8 | 88.0 | 81.5 | 82.5 | 89.8 | 89.2 | 87.2 | 90.0 | 94.6 | 91.3 |

| 75% or greater | 92.6 | 94.6 | 96.4 | 81.5 | 89.6 | 94.1 | 88.3 | 90.6 | 92.4 | 95.7 | 96.2 | 98.6 | 99.7 | 100.2 |

| Presence of active members | ||||||||||||||

| TPs reported for active members | 85.0 | 88.5 | 87.9 | 74.7 | 84.2 | 90.8 | 83.3 | 85.6 | 92.4 | 91.4 | 89.5 | 91.5 | 95.7 | 94.5 |

| TPs not reported for active members | 81.1 | 83.7 | 82.1 | 72.4 | 79.2 | 83.9 | 77.9 | 78.8 | 86.2 | 86.9 | 85.4 | 87.0 | 92.3 | 90.2 |

| Covenant (schemes in deficit only) | ||||||||||||||

| Covenant group 1 (Strong) | 81.1 | 81.6 | 88.4 | 87.7 | 85.1 | 87.0 | 94.0 | 97.1 | ||||||

| Covenant group 2 (Tending to Strong) | 78.6 | 79.3 | 84.7 | 83.6 | 83.1 | 86.3 | 90.2 | 93.1 | ||||||

| Covenant group 3 (Tending to Weak) | 76.1 | 78.5 | 82.5 | 81.9 | 80.3 | 82.9 | 87.4 | 88.5 | ||||||

| Covenant group 4 (Weak) | 74.5 | 75.1 | 78.6 | 78.1 | 76.8 | 77.1 | 84.0 | 86.9 | ||||||

| RP length (schemes in deficit only) | ||||||||||||||

| Fewer than 5 years | 84.9 | 86.4 | 87.3 | 78.3 | 84.4 | 88.4 | 86.2 | 87.1 | 90.6 | 89.6 | 89.3 | 89.7 | 89.8 | 90.2 |

| 5 to fewer than 7.5 years | 78.7 | 82.5 | 81.8 | 73.1 | 80.9 | 82.8 | 79.6 | 79.1 | 84.6 | 84.1 | 83.5 | 82.5 | 83.5 | 82.7 |

| 7.5 to fewer than 10 years | 78.4 | 80.0 | 79.6 | 71.0 | 78.0 | 80.2 | 76.0 | 77.8 | 80.5 | 80.1 | 79.6 | 79.2 | 78.7 | 78.8 |

| 10 years or more | 76.0 | 76.7 | 74.6 | 66.5 | 73.2 | 76.0 | 69.7 | 70.4 | 76.6 | 74.3 | 72.4 | 72.6 | 72.8 | 69.9 |

| Return seeking assets | ||||||||||||||

| Less than 20% | 86.2 | 87.6 | 88.8 | 91.3 | 86.6 | 96.6 | 92.9 | 93.2 | 97.9 | 98.5 | 95.1 | 96.0 | 99.7 | 99.4 |

| 20% to less than 40% | 86.9 | 86.0 | 89.5 | 79.6 | 86.2 | 90.4 | 86.0 | 87.7 | 92.9 | 92.3 | 88.6 | 89.5 | 94.6 | 91.4 |

| 40% to less than 60% | 84.9 | 86.8 | 86.0 | 73.5 | 82.9 | 87.1 | 80.1 | 82.5 | 88.9 | 86.8 | 84.4 | 86.9 | 90.9 | 88.3 |

| 60% to less than 80% | 83.6 | 87.5 | 85.0 | 71.6 | 81.4 | 87.5 | 78.8 | 79.2 | 88.4 | 86.6 | 85.2 | 87.7 | 91.2 | 88.5 |

| 80% or greater | 83.8 | 88.0 | 88.7 | 70.5 | 80.4 | 87.8 | 73.1 | 79.5 | 87.2 | 89.4 | 89.2 | 88.4 | 91.4 | 93.8 |

| Presence of contingent assets | ||||||||||||||

| No contingent asset | 74.6 | 83.1 | 89.1 | 81.8 | 83.1 | 90.3 | 89.7 | 88.2 | 89.9 | 94.9 | 92.9 | |||

| At least one contingent asset | 70.6 | 79.7 | 83.9 | 77.8 | 79.5 | 85.7 | 85.5 | 83.1 | 84.4 | 87.4 | 85.0 | |||

| Funding level (TPs) | ||||||||||||||

| Less than 70% | 61.0 | 61.0 | 61.5 | 59.9 | 61.5 | 61.0 | 60.7 | 59.7 | 59.2 | 61.1 | 59.4 | 59.6 | 59.5 | 60.9 |

| 70% to less than 80% | 75.2 | 75.4 | 75.5 | 74.7 | 75.3 | 75.5 | 75.2 | 75.4 | 75.5 | 75.4 | 75.5 | 75.8 | 75.5 | 75.8 |

| 80% to less than 90% | 84.9 | 85.1 | 85.1 | 84.4 | 85.0 | 85.2 | 84.8 | 85.1 | 85.2 | 85.4 | 85.1 | 85.4 | 85.3 | 85.6 |

| 90% to less than 100% | 94.6 | 94.4 | 94.5 | 94.3 | 94.3 | 94.5 | 94.0 | 94.4 | 94.7 | 94.6 | 94.7 | 94.8 | 95.1 | 95.0 |

| 100% or greater | 111.5 | 110.9 | 110.3 | 111.5 | 110.7 | 110.5 | 109.6 | 109.3 | 109.4 | 109.2 | 110.1 | 109.9 | 109.9 | 109.1 |

| PPF Standard stressed/Unstressed asset ratio | ||||||||||||||

| Less than 90% | 76.4 | 79.1 | 88.0 | 87.9 | 86.9 | 87.3 | 95.3 | 91.6 | ||||||

| 90% to less than 95% | 79.9 | 80.6 | 88.0 | 86.2 | 85.1 | 87.5 | 91.5 | 89.3 | ||||||

| 95% to less than 100% | 81.2 | 83.3 | 89.8 | 87.2 | 85.1 | 87.2 | 90.6 | 88.8 | ||||||

| 100% to less than 105% | 85.4 | 87.9 | 92.7 | 91.5 | 90.2 | 90.0 | 92.2 | 90.2 | ||||||

| 105% or greater | 93.8 | 94.4 | 97.1 | 97.4 | 91.9 | 92.1 | 97.9 | 95.2 | ||||||

| PPF Combined stressed/Unstressed asset ratio | ||||||||||||||

| Less than 90% | 76.4 | 79.1 | 88.1 | 88.0 | 86.9 | 87.5 | 95.3 | 91.6 | ||||||

| 90% to less than 95% | 79.8 | 80.6 | 88.3 | 86.4 | 85.3 | 87.4 | 91.5 | 89.7 | ||||||

| 95% to less than 100% | 81.0 | 82.9 | 89.6 | 86.5 | 84.6 | 87.3 | 91.4 | 88.7 | ||||||

| 100% to less than 105% | 85.1 | 86.9 | 90.7 | 90.9 | 89.6 | 89.7 | 91.3 | 89.8 | ||||||

| 105% or greater | 92.5 | 93.2 | 96.7 | 96.2 | 90.9 | 91.3 | 96.8 | 94.8 | ||||||

Table 2.3a: Average [Unweighted] ratio of assets to TPs by scheme characteristics

Table 2.3b: Average [Weighted] ratio of assets to TPs by scheme characteristics (schemes in surplus and deficit)

| Weighted average (%) - Tranche | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

| Size by number of members | ||||||||||||||

| Fewer than 100 members | 83.8 | 85.0 | 85.4 | 75.1 | 81.5 | 81.2 | 87.7 | 81.0 | 89.9 | 92.4 | 87.2 | 87.1 | 93.1 | 92.0 |

| 100 to fewer than 500 members | 82.7 | 86.4 | 85.8 | 71.7 | 82.4 | 87.0 | 79.0 | 82.3 | 89.4 | 87.7 | 85.6 | 88.4 | 92.9 | 91.5 |

| 500 to fewer than 1,000 members | 81.0 | 88.2 | 86.2 | 70.7 | 81.1 | 87.5 | 79.3 | 81.8 | 88.1 | 89.1 | 85.9 | 87.0 | 92.3 | 91.4 |

| 1,000 to fewer than 5,000 members | 84.9 | 87.4 | 87.1 | 73.2 | 81.8 | 88.3 | 80.7 | 83.4 | 90.0 | 88.5 | 87.7 | 90.3 | 94.5 | 94.0 |

| 5,000 members or more | 92.2 | 94.8 | 91.6 | 77.5 | 85.0 | 88.8 | 85.8 | 85.6 | 89.0 | 91.7 | 89.8 | 90.7 | 97.1 | 97.6 |

| Size by TPs | ||||||||||||||

| Less than £5m | 84.5 | 85.8 | 85.5 | 75.6 | 81.9 | 87.5 | 82.0 | 82.0 | 89.9 | 89.1 | 90.0 | 89.0 | 93.8 | 92.3 |

| £5m to less than £20m | 81.8 | 86.5 | 84.8 | 72.1 | 81.2 | 86.2 | 80.2 | 80.3 | 87.8 | 88.1 | 85.4 | 87.2 | 93.4 | 88.8 |

| £20m to less than £100m | 82.6 | 87.7 | 85.8 | 71.3 | 82.1 | 87.9 | 79.5 | 80.9 | 89.9 | 88.7 | 84.6 | 88.6 | 92.2 | 90.6 |

| £100m to less than £300m | 85.1 | 87.8 | 89.4 | 73.4 | 83.7 | 88.6 | 79.9 | 83.6 | 89.4 | 87.8 | 87.4 | 88.9 | 93.2 | 91.4 |

| £300m or greater | 91.9 | 94.5 | 91.1 | 77.3 | 84.5 | 88.1 | 85.5 | 85.3 | 89.1 | 91.5 | 89.4 | 90.6 | 96.8 | 97.1 |

| Maturity (ratio of pensioner TPs to total TPs) | ||||||||||||||

| Less than 25% | 82.0 | 87.6 | 89.6 | 72.8 | 82.9 | 90.0 | 82.6 | 85.5 | 87.9 | 95.9 | 88.4 | 93.2 | 96.6 | 90.8 |

| 25% to less than 50% | 86.3 | 93.1 | 91.7 | 73.2 | 83.8 | 87.2 | 83.9 | 83.4 | 88.8 | 89.7 | 87.5 | 89.1 | 93.7 | 95.9 |

| 50% to less than 75% | 95.4 | 94.1 | 88.4 | 79.8 | 84.2 | 89.4 | 84.8 | 85.7 | 90.0 | 91.2 | 90.4 | 92.1 | 99.2 | 96.7 |

| 75% or greater | 99.5 | 99.4 | 87.3 | 85.4 | 89.5 | 86.5 | 91.5 | 94.9 | 87.4 | 99.7 | 91.4 | 93.6 | 106.2 | 99.2 |

| Presence of active members | ||||||||||||||

| TPs reported for active members | 90.5 | 93.3 | 90.6 | 76.6 | 84.5 | 88.6 | 85.2 | 85.5 | 89.7 | 91.6 | 89.8 | 91.0 | 96.5 | 97.9 |

| TPs not reported for active members | 86.6 | 84.2 | 82.2 | 74.7 | 80.2 | 82.7 | 81.9 | 82.3 | 85.6 | 89.3 | 86.7 | 87.7 | 96.2 | 93.6 |

| Covenant (schemes in deficit only) | ||||||||||||||

| Covenant group 1 (Strong) | 89.1 | 86.7 | 86.1 | 89.6 | 89.3 | 90.4 | 95.8 | 98.0 | ||||||

| Covenant group 2 (Tending to Strong) | 81.6 | 83.0 | 87.3 | 88.6 | 86.4 | 88.9 | 96.9 | 96.7 | ||||||

| Covenant group 3 (Tending to Weak) | 77.2 | 82.1 | 88.2 | 84.1 | 84.6 | 85.7 | 90.0 | 94.7 | ||||||

| Covenant group 4 (Weak) | 78.2 | 79.9 | 81.7 | 78.8 | 83.4 | 82.3 | 90.0 | 90.6 | ||||||

| RP length (schemes in deficit only) | ||||||||||||||

| Fewer than 5 years | 89.0 | 93.6 | 90.4 | 79.5 | 88.7 | 90.8 | 90.1 | 91.4 | 93.1 | 92.5 | 92.9 | 92.3 | 94.2 | 95.2 |

| 5 to fewer than 7.5 years | 83.2 | 88.7 | 83.6 | 78.9 | 84.0 | 86.3 | 86.3 | 86.0 | 86.8 | 90.2 | 88.6 | 87.3 | 86.8 | 88.7 |

| 7.5 to fewer than 10 years | 86.3 | 85.2 | 84.8 | 75.3 | 82.2 | 89.0 | 84.8 | 81.7 | 82.2 | 87.2 | 84.9 | 82.6 | 90.1 | 86.6 |

| 10 years or more | 83.8 | 81.9 | 77.1 | 72.3 | 81.1 | 82.1 | 75.6 | 79.5 | 85.5 | 80.2 | 82.7 | 83.8 | 87.8 | 77.8 |

| Return seeking assets | ||||||||||||||

| Less than 20% | 84.9 | 97.0 | 92.0 | 85.0 | 93.8 | 90.0 | 92.3 | 94.1 | 97.9 | 101.4 | 95.1 | 99.6 | 101.3 | 101.3 |

| 20% to less than 40% | 96.5 | 90.8 | 94.8 | 82.6 | 87.1 | 92.6 | 86.8 | 87.1 | 89.8 | 91.3 | 90.9 | 87.8 | 97.0 | 95.4 |

| 40% to less than 60% | 91.4 | 92.2 | 92.6 | 74.8 | 84.5 | 87.5 | 83.9 | 83.7 | 88.3 | 88.4 | 85.7 | 87.9 | 93.5 | 92.9 |

| 60% to less than 80% | 87.9 | 94.5 | 85.0 | 73.9 | 83.0 | 88.7 | 78.6 | 81.9 | 89.0 | 87.1 | 85.6 | 89.9 | 93.9 | 90.2 |

| 80% or greater | 97.3 | 91.1 | 98.9 | 91.8 | 77.6 | 94.2 | 87.5 | 72.1 | 89.8 | 111.8 | 86.0 | 88.3 | 91.3 | 86.0 |

| Presence of contingent assets | ||||||||||||||

| No contingent asset | 78.0 | 85.6 | 89.3 | 85.4 | 85.1 | 90.7 | 91.2 | 89.1 | 92.2 | 97.5 | 97.8 | |||

| At least one contingent asset | 74.3 | 82.4 | 87.0 | 83.5 | 84.3 | 85.6 | 90.5 | 88.7 | 87.2 | 92.7 | 92.6 | |||

| Funding level (TPs) | ||||||||||||||

| Less than 70% | 64.1 | 65.9 | 65.0 | 64.5 | 64.9 | 62.4 | 63.6 | 63.2 | 63.8 | 60.7 | 61.2 | 62.8 | 62.6 | 62.5 |

| 70% to less than 80% | 76.3 | 76.1 | 76.3 | 75.6 | 76.0 | 77.3 | 75.5 | 75.7 | 75.4 | 75.2 | 75.9 | 75.7 | 75.6 | 76.5 |

| 80% to less than 90% | 85.5 | 85.2 | 85.1 | 84.9 | 85.2 | 85.2 | 85.2 | 84.7 | 86.1 | 85.2 | 85.3 | 84.8 | 86.7 | 86.0 |

| 90% to less than 100% | 93.7 | 94.9 | 94.0 | 93.3 | 94.5 | 93.0 | 94.3 | 93.5 | 93.9 | 94.6 | 94.3 | 95.1 | 95.5 | 95.6 |

| 100% or greater | 109.0 | 105.3 | 103.7 | 104.9 | 104.3 | 105.1 | 101.7 | 104.2 | 105.6 | 105.9 | 103.8 | 106.7 | 106.7 | 106.6 |

| PPF Standard stressed/Unstressed asset ratio | ||||||||||||||

| Less than 90% | 81.7 | 79.3 | 85.4 | 94.3 | 83.3 | 99.8 | 96.0 | 87.8 | ||||||

| 90% to less than 95% | 81.7 | 83.3 | 89.8 | 84.5 | 85.9 | 89.2 | 93.8 | 90.2 | ||||||

| 95% to less than 100% | 84.7 | 84.6 | 87.4 | 91.0 | 87.7 | 87.2 | 93.3 | 91.8 | ||||||

| 100% to less than 105% | 85.9 | 88.5 | 93.0 | 91.5 | 88.8 | 88.4 | 97.4 | 95.6 | ||||||

| 105% or greater | 92.4 | 90.4 | 91.7 | 94.5 | 93.3 | 95.1 | 99.4 | 97.8 | ||||||

| PPF Combined stressed/Unstressed asset ratio | ||||||||||||||

| Less than 90% | 82.8 | 77.2 | 89.1 | 89.5 | 87.7 | 104.2 | 96.0 | 100.0 | ||||||

| 90% to less than 95% | 79.6 | 83.1 | 88.8 | 85.4 | 87.1 | 88.1 | 93.8 | 89.7 | ||||||

| 95% to less than 100% | 82.6 | 82.9 | 88.3 | 90.3 | 86.1 | 92.7 | 93.0 | 88.4 | ||||||

| 100% to less than 105% | 85.7 | 84.9 | 89.4 | 89.9 | 87.8 | 84.6 | 97.9 | 95.1 | ||||||

| 105% or greater | 91.7 | 92.0 | 90.4 | 95.2 | 91.1 | 92.3 | 97.7 | 97.2 | ||||||

Table 2.3b: Average [Weighted] ratio of assets to TPs by scheme characteristics

Weighted by TPs.

Table 2.4: Average ratio of TPs to buyout liabilities by scheme characteristics (schemes in surplus and deficit)

| Unweighted average (%) - Tranche | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

| Size by number of members | ||||||||||||||

| Fewer than 100 members | 69.8 | 72.8 | 75.7 | 75.0 | 75.7 | 75.7 | 73.3 | 74.8 | 74.3 | 70.5 | 71.6 | 71.6 | 74.2 | 76.4 |

| 100 to fewer than 500 members | 66.0 | 69.3 | 72.3 | 70.9 | 72.3 | 70.4 | 69.2 | 68.7 | 70.8 | 67.6 | 67.8 | 67.5 | 72.2 | 74.5 |

| 500 to fewer than 1,000 members | 66.6 | 69.4 | 73.3 | 71.4 | 71.6 | 69.8 | 69.2 | 68.8 | 69.5 | 68.4 | 69.1 | 66.0 | 74.4 | 76.1 |

| 1,000 to fewer than 5,000 members | 66.3 | 71.2 | 76.3 | 72.0 | 72.7 | 70.1 | 70.9 | 70.5 | 69.7 | 69.5 | 68.7 | 68.5 | 74.0 | 76.5 |

| 5,000 members or more | 69.8 | 73.6 | 80.1 | 73.9 | 75.2 | 72.6 | 72.4 | 71.9 | 71.5 | 71.4 | 69.6 | 71.8 | 76.4 | 78.5 |

| Size by TPs | ||||||||||||||

| Less than £5m | 68.9 | 71.6 | 74.2 | 73.9 | 75.3 | 75.5 | 72.6 | 75.0 | 73.6 | 69.4 | 71.7 | 71.1 | 72.1 | 76.5 |

| £5m to less than £20m | 66.2 | 70.0 | 73.2 | 71.7 | 72.7 | 71.9 | 70.6 | 69.9 | 71.7 | 68.9 | 68.0 | 68.8 | 73.9 | 74.0 |

| £20m to less than £100m | 67.1 | 70.1 | 74.3 | 71.6 | 73.1 | 70.4 | 69.7 | 69.8 | 70.5 | 67.9 | 69.0 | 67.9 | 72.7 | 75.6 |

| £100m to less than £300m | 66.6 | 72.4 | 76.4 | 73.1 | 73.0 | 70.6 | 71.7 | 71.1 | 70.9 | 70.7 | 70.0 | 68.4 | 74.8 | 77.0 |

| £300m or greater | 71.5 | 74.3 | 80.9 | 75.2 | 75.3 | 73.6 | 73.2 | 71.2 | 72.5 | 71.3 | 70.1 | 71.4 | 76.7 | 78.0 |

| Maturity (ratio of pensioner TPs to total TPs) | ||||||||||||||

| Less than 25% | 64.6 | 68.3 | 71.5 | 69.6 | 71.3 | 70.5 | 67.9 | 69.6 | 69.8 | 65.7 | 66.8 | 65.4 | 68.3 | 71.9 |

| 25% to less than 50% | 67.4 | 70.9 | 74.2 | 71.8 | 72.8 | 70.5 | 69.1 | 69.1 | 69.3 | 67.2 | 67.0 | 66.7 | 71.3 | 73.5 |

| 50% to less than 75% | 75.1 | 77.3 | 81.1 | 78.2 | 78.5 | 76.8 | 75.9 | 75.2 | 75.4 | 73.8 | 72.9 | 73.7 | 78.3 | 78.8 |

| 75% or greater | 84.4 | 87.7 | 91.1 | 87.7 | 86.2 | 86.2 | 89.0 | 87.9 | 85.3 | 85.5 | 86.6 | 82.2 | 87.5 | 88.2 |

| Presence of active members | ||||||||||||||

| TPs reported for active members | 66.8 | 70.4 | 74.7 | 71.9 | 73.3 | 71.2 | 70.3 | 70.5 | 70.1 | 68.4 | 68.2 | 66.7 | 71.8 | 73.5 |

| TPs not reported for active members | 70.8 | 72.9 | 74.6 | 74.6 | 74.6 | 74.3 | 72.2 | 72.1 | 73.5 | 70.1 | 70.5 | 71.1 | 74.9 | 77.1 |

| Covenant (schemes in deficit only) | ||||||||||||||

| Covenant group 1 (Strong) | 70.1 | 71.0 | 70.3 | 70.5 | 69.0 | 69.2 | 74.3 | 77.5 | ||||||

| Covenant group 2 (Tending to Strong) | 70.1 | 69.5 | 70.8 | 68.5 | 69.4 | 67.4 | 73.0 | 76.4 | ||||||

| Covenant group 3 (Tending to Weak) | 69.4 | 69.8 | 70.8 | 67.2 | 67.6 | 67.4 | 71.4 | 74.4 | ||||||

| Covenant group 4 (Weak) | 69.6 | 71.5 | 72.3 | 67.7 | 68.9 | 68.7 | 74.1 | 74.9 | ||||||

| RP length (schemes in deficit only) | ||||||||||||||

| Fewer than 5 years | 69.1 | 71.6 | 75.3 | 73.3 | 75.0 | 72.6 | 72.6 | 73.3 | 73.3 | 70.3 | 70.6 | 70.4 | 73.0 | 74.8 |

| 5 to fewer than 7.5 years | 68.6 | 70.8 | 75.0 | 74.2 | 74.2 | 72.2 | 70.8 | 70.4 | 72.3 | 68.4 | 67.3 | 67.9 | 71.3 | 73.7 |

| 7.5 to fewer than 10 years | 66.3 | 70.1 | 74.7 | 72.2 | 71.5 | 71.6 | 69.4 | 68.4 | 69.6 | 66.9 | 68.2 | 65.5 | 69.6 | 73.5 |

| 10 years or more | 66.3 | 70.6 | 73.4 | 70.4 | 71.8 | 69.3 | 69.2 | 68.9 | 68.5 | 66.4 | 67.8 | 64.8 | 70.0 | 70.8 |

| Return seeking assets | ||||||||||||||

| Less than 20% | 80.3 | 81.4 | 83.1 | 86.8 | 84.5 | 86.5 | 85.3 | 85.9 | 83.6 | 79.9 | 78.6 | 81.2 | 83.3 | 84.8 |

| 20% to less than 40% | 76.9 | 78.0 | 81.9 | 78.5 | 81.0 | 78.9 | 76.2 | 75.7 | 77.7 | 74.3 | 72.5 | 71.7 | 75.3 | 76.8 |

| 40% to less than 60% | 69.8 | 72.9 | 77.0 | 72.7 | 74.7 | 72.9 | 71.5 | 71.3 | 72.1 | 68.6 | 67.5 | 67.3 | 70.7 | 72.4 |

| 60% to less than 80% | 66.5 | 70.0 | 73.2 | 70.6 | 71.2 | 69.0 | 66.9 | 68.2 | 68.1 | 65.4 | 65.3 | 63.0 | 68.1 | 70.6 |

| 80% or greater | 64.3 | 67.8 | 70.1 | 68.9 | 69.4 | 69.1 | 67.6 | 67.1 | 69.8 | 65.0 | 65.8 | 64.0 | 67.6 | 70.6 |

| Presence of contingent assets | ||||||||||||||

| No contingent asset | 73.1 | 73.9 | 72.6 | 71.4 | 71.3 | 71.7 | 69.4 | 69.5 | 69.1 | 73.9 | 75.8 | |||

| At least one contingent asset | 71.2 | 73.4 | 71.7 | 70.8 | 71.2 | 72.3 | 69.1 | 69.7 | 69.6 | 72.9 | 76.0 | |||

| Funding level (TPs) | ||||||||||||||

| Less than 70% | 70.3 | 74.9 | 78.8 | 72.3 | 75.1 | 73.4 | 71.6 | 72.7 | 75.0 | 69.7 | 71.3 | 68.5 | 72.2 | 73.4 |

| 70% to less than 80% | 66.6 | 70.3 | 74.0 | 71.7 | 71.9 | 71.7 | 70.2 | 68.9 | 71.2 | 67.6 | 65.9 | 67.0 | 69.7 | 72.5 |

| 80% to less than 90% | 66.5 | 69.4 | 74.0 | 71.8 | 72.4 | 71.7 | 70.2 | 69.6 | 70.0 | 68.0 | 68.0 | 66.8 | 71.5 | 72.6 |

| 90% to less than 100% | 66.5 | 70.3 | 73.3 | 74.1 | 74.3 | 70.2 | 71.4 | 71.0 | 71.1 | 68.9 | 70.5 | 68.6 | 72.6 | 75.5 |

| 100% or greater | 69.6 | 72.3 | 74.3 | 80.4 | 78.3 | 75.9 | 75.2 | 76.7 | 73.3 | 72.0 | 72.5 | 73.8 | 77.1 | 80.5 |

| PPF Standard stressed/Unstressed asset ratio | ||||||||||||||

| Less than 90% | 67.2 | 68.1 | 69.4 | 65.0 | 65.7 | 64.4 | 70.1 | 70.6 | ||||||

| 90% to less than 95% | 68.6 | 69.4 | 68.7 | 66.8 | 66.8 | 65.2 | 68.1 | 71.5 | ||||||

| 95% to less than 100% | 73.3 | 71.8 | 74.1 | 69.3 | 68.4 | 66.7 | 71.0 | 72.3 | ||||||

| 100% to less than 105% | 75.6 | 76.5 | 76.7 | 73.9 | 72.8 | 70.3 | 74.8 | 75.1 | ||||||

| 105% or greater | 86.0 | 85.6 | 80.9 | 77.1 | 78.8 | 77.4 | 79.3 | 81.2 | ||||||

| PPF Combined stressed/Unstressed asset ratio | ||||||||||||||

| Less than 90% | 67.2 | 68.2 | 69.2 | 64.9 | 65.8 | 64.2 | 70.1 | 70.8 | ||||||

| 90% to less than 95% | 68.7 | 69.5 | 68.7 | 66.9 | 66.9 | 65.1 | 68.3 | 71.7 | ||||||

| 95% to less than 100% | 73.1 | 71.8 | 73.8 | 69.6 | 68.3 | 66.5 | 71.1 | 72.2 | ||||||

| 100% to less than 105% | 75.5 | 74.9 | 75.8 | 73.3 | 72.1 | 70.1 | 74.5 | 75.0 | ||||||

| 105% or greater | 83.2 | 83.3 | 80.2 | 74.9 | 76.0 | 75.8 | 78.0 | 80.4 | ||||||

Table 2.4: Average ratio of TPs to buyout liabilities by scheme characteristics

Table 2.5: Use of contingent assets (schemes in surplus and deficit, Tranche 14 only)

| Number of schemes (holding at least one) | Percentage of schemes (holding at least one) | |

|---|---|---|

| All contingent assets | ||

| PPF-recognised contingent asset | 98 | 5.9 |

| Contingent asset reported in support of funding (non-PPF-recognised) | 174 | 10.5 |

| All contingent assets | 267 | 16.1 |

| PPF recognised | ||

| Type A | 77 | 4.6 |

| Type B and C | 23 | 1.4 |

| Non-PPF recognised (schemes in deficit only) | ||

| Parental guarantee | 116 | 7.0 |

| Escrow, cash or charge over other asset (including property), or other (eg letter of credit) | 76 | 4.6 |

Table 2.5: Use of contingent assets

16.1 % of Tranche 14 schemes hold at least one contingent asset.

PPF-recognised contingent assets fall into three categories:

- Type A: guarantees provided by the parent/group companies to fund the scheme, most commonly guarantees to cover a pre-arranged percentage of liabilities.

- Type B: includes security over cash, UK real estate and securities

- Type C: includes letters of credit and bank guarantees

There are some cases in which a contingent asset that is reported in the recovery plan has not been formally recognised by the PPF in support of the scheme’s levy calculation. These contingent assets may, for example, take the form of security over property, escrow accounts or parental/group guarantees, and are referred to here as non-PPF-recognised.

Table 2.6: Use of contingent assets by scheme characteristics (schemes in surplus and deficit, Tranche 14 only)

| Percentage of schemes (%) | ||||

|---|---|---|---|---|

| PPF-recognised | Non-PPF-recognised | All contingent assets | ||

| Size by number of members | ||||

| Fewer than 100 members | 3.2 | 3.3 | 6.5 | |

| 100 to fewer than 500 members | 5.6 | 8.7 | 14.1 | |

| 500 to fewer than 1,000 members | 7.1 | 21.2 | 27.6 | |

| 1,000 to fewer than 5,000 members | 10.3 | 20.6 | 30.4 | |

| 5,000 members or more | 12.2 | 23.5 | 33.9 | |

| Size by TPs | ||||

| Less than £5m | 1.6 | 1.6 | 3.3 | |

| £5m to less than £20m | 5.2 | 5.5 | 10.7 | |

| £20m to less than £100m | 4.7 | 9.0 | 13.4 | |

| £100m to less than £300m | 10.8 | 23.0 | 33.3 | |

| £300m or greater | 10.7 | 22.7 | 32.2 | |

| Maturity (ratio of pensioner TPs to total TPs) | ||||

| Less than 25% | 2.8 | 6.9 | 9.5 | |

| 25% to less than 50% | 6.5 | 11.0 | 17.2 | |

| 50% to less than 75% | 7.3 | 12.7 | 19.7 | |

| 75% or greater | 3.2 | 8.4 | 11.6 | |

| Presence of active members | ||||

| TPs reported for active members | 5.2 | 11.6 | 16.8 | |

| TPs not reported for active members | 6.3 | 9.9 | 15.7 | |

| Covenant (schemes in deficit only) | ||||

| Covenant group 1 (Strong) | 3.8 | 5.8 | 9.3 | |

| Covenant group 2 (Tending to Strong) | 5.1 | 9.3 | 14.1 | |

| Covenant group 3 (Tending to Weak) | 6.6 | 16.2 | 22.4 | |

| Covenant group 4 (Weak) | 9.5 | 9.5 | 18.9 | |

| RP length (schemes in deficit only) | ||||

| Fewer than 5 years | 6.8 | 11.2 | 17.3 | |

| 5 to fewer than 7.5 years | 7.3 | 16.8 | 24.0 | |

| 7.5 to fewer than 10 years | 9.0 | 22.9 | 31.2 | |

| 10 years or more | 5.5 | 20.0 | 25.5 | |

| Return seeking assets | ||||

| Less than 20% | 6.1 | 7.8 | 13.7 | |

| 20% to less than 40% | 4.3 | 14.7 | 18.5 | |

| 40% to less than 60% | 6.8 | 10.1 | 16.7 | |

| 60% to less than 80% | 7.0 | 7.0 | 13.6 | |

| 80% or greater | 5.1 | 7.7 | 12.8 | |

| Presence of contingent assets | ||||

| No contingent asset | 0.0 | 0.0 | 0.0 | |

| At least one contingent asset | 36.7 | 65.2 | 100.0 | |

| Funding level (TPs) | ||||

| Less than 70% | 8.1 | 16.2 | 23.7 | |

| 70% to less than 80% | 8.8 | 16.1 | 24.9 | |

| 80% to less than 90% | 5.3 | 12.9 | 18.2 | |

| 90% to less than 100% | 6.9 | 16.4 | 22.4 | |

| 100% or greater | 3.7 | 0.0 | 3.7 | |

| PPF Standard stressed/Unstressed asset ratio | ||||

| Less than 90% | 4.4 | 6.6 | 11.0 | |

| 90% to less than 95% | 7.6 | 6.7 | 14.3 | |

| 95% to less than 100% | 5.7 | 7.1 | 12.5 | |

| 100% to less than 105% | 5.6 | 15.0 | 20.4 | |

| 105% or greater | 5.8 | 11.7 | 17.0 | |

| PPF Combined stressed/Unstressed asset ratio | ||||

| Less than 90% | 5.5 | 6.6 | 12.1 | |

| 90% to less than 95% | 7.4 | 6.9 | 14.3 | |

| 95% to less than 100% | 5.9 | 6.9 | 12.5 | |

| 100% to less than 105% | 4.4 | 15.0 | 19.4 | |

| 105% or greater | 6.3 | 11.7 | 17.3 | |

Table 2.6: Use of contingent assets by scheme characteristics

Table 2.7: Schemes’ use of contingent assets (schemes in surplus and deficit, Tranches 4-14)

| Tranche (Percentage of Schemes | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 4 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | ||

| All contingent assets | |||||||||||

| Schemes with at least one PPF-recognised contingent asset | 8.0 | 14.1 | 11.9 | 11.9 | 12.6 | 10.5 | 10.1 | 9.4 | 8.0 | 8.8 | 5.9 |

| Schemes with at least one contingent asset reported in support of funding (non-PPF-recognised) | 7.7 | 6.9 | 6.6 | 10.8 | 7.6 | 7.2 | 8.4 | 9.9 | 9.6 | 9.4 | 10.5 |

| Schemes with at least one contingent asset | 15.4 | 20.3 | 18.0 | 21.1 | 19.3 | 16.7 | 18.2 | 18.9 | 17.2 | 17.9 | 16.1 |

| PPF recognised | |||||||||||

| Type A | 6.6 | 12.7 | 10.6 | 10.2 | 10.9 | 9.1 | 8.3 | 7.9 | 6.5 | 6.8 | 4.6 |

| Type B and C | 1.5 | 1.7 | 1.4 | 1.8 | 2.0 | 1.5 | 2.0 | 1.8 | 1.7 | 2.1 | 1.4 |

| Non-PPF recognised (schemes in deficit only) | |||||||||||

| Parental guarantee | 4.2 | 4.2 | 3.6 | 5.1 | 4.2 | 4.4 | 5.3 | 6.2 | 5.8 | 5.9 | 7.0 |

| Escrow, cash or charge over other asset (including property), or other (eg letter of credit) | 3.8 | 2.8 | 3.1 | 5.9 | 3.6 | 3.3 | 3.7 | 4.4 | 4.8 | 4.2 | 4.6 |

Table 2.7: Schemes’ use of contingent assets

Recovery plans and contributions

Table 3.1: Distribution of recovery plan lengths (schemes in deficit only)

| RP length (years) - Tranche | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | ||

| 95th percentile | 15.0 | 15.0 | 17.0 | 19.8 | 17.3 | 15.8 | 17.9 | 17.4 | 18.7 | 16.8 | 16.4 | 15.8 | 14.8 | 14.5 | |

| Upper quartile | 10.0 | 10.0 | 10.0 | 12.0 | 10.0 | 10.0 | 11.0 | 10.8 | 10.2 | 10.0 | 10.0 | 9.6 | 8.7 | 7.9 | |

| Median | 8.8 | 8.0 | 8.8 | 9.3 | 8.2 | 7.1 | 7.7 | 8.0 | 7.0 | 6.4 | 7.0 | 6.3 | 5.2 | 5.0 | |

| Lower quartile | 5.0 | 5.0 | 5.0 | 6.6 | 5.0 | 4.2 | 4.8 | 4.8 | 4.0 | 3.8 | 3.8 | 3.8 | 3.0 | 2.9 | |

| 5th percentile | 1.1 | 1.0 | 1.5 | 2.0 | 1.3 | 0.8 | 1.0 | 0.7 | 0.6 | 0.8 | 0.3 | 0.5 | 0.1 | 0.5 | |

Table 3.1: Distribution of recovery plan lengths

Table 3.2: Distribution of recovery plan lengths (for schemes in deficit submitting valuations in respect of both Tranches 11 and 14)

| RP length (years) - Tranche | ||

|---|---|---|

| 11 | 14 | |

| 95th percentile | 16.9 | 14.7 |

| Upper quartile | 11.0 | 8.0 |

| Median | 8.1 | 5.2 |

| Lower quartile | 5.2 | 3.0 |

| 5th percentile | 1.7 | 0.7 |

Table 3.2: Distribution of recovery plan lengths

Table 3.3: Average recovery plan length by scheme characteristics (schemes in deficit only)

| RP length (years) - Tranche | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | ||

| All schemes | 8.0 | 7.6 | 8.5 | 9.5 | 8.4 | 7.6 | 8.3 | 8.3 | 7.8 | 7.3 | 7.5 | 7.1 | 6.1 | 5.9 | |

| Size by number of members | |||||||||||||||

| Fewer than 100 members | 7.9 | 7.7 | 8.1 | 8.5 | 8.0 | 7.3 | 8.0 | 7.9 | 7.5 | 6.6 | 6.8 | 6.9 | 5.4 | 5.5 | |

| 100 to fewer than 500 members | 8.1 | 7.8 | 8.9 | 10.0 | 8.5 | 7.7 | 8.6 | 8.2 | 8.2 | 7.7 | 7.8 | 7.5 | 6.6 | 6.4 | |

| 500 to fewer than 1,000 members | 8.1 | 7.4 | 8.3 | 9.7 | 8.1 | 7.8 | 7.8 | 8.6 | 7.4 | 6.5 | 7.5 | 7.2 | 6.6 | 6.0 | |

| 1,000 to fewer than 5,000 members | 8.0 | 7.1 | 8.8 | 9.8 | 8.9 | 8.0 | 8.4 | 9.0 | 7.9 | 7.9 | 8.1 | 6.9 | 5.9 | 5.9 | |

| 5,000 members or more | 7.8 | 7.0 | 8.0 | 10.5 | 8.9 | 7.9 | 9.1 | 8.4 | 8.0 | 8.6 | 8.5 | 6.9 | 6.9 | 5.5 | |

| Size by TPs | |||||||||||||||

| Less than £5m | 7.8 | 7.5 | 8.4 | 8.3 | 7.9 | 7.4 | 8.0 | 8.0 | 7.7 | 6.6 | 6.1 | 7.1 | 5.4 | 4.9 | |

| £5m to less than £20m | 8.3 | 8.0 | 8.9 | 10.0 | 8.6 | 7.9 | 8.8 | 8.3 | 8.3 | 7.6 | 7.8 | 7.6 | 6.4 | 6.1 | |

| £20m to less than £100m | 8.1 | 7.3 | 8.3 | 9.8 | 8.3 | 7.5 | 8.1 | 8.2 | 7.5 | 7.2 | 7.9 | 7.0 | 6.2 | 6.4 | |

| £100m to less than £300m | 7.5 | 6.8 | 8.3 | 9.7 | 8.5 | 7.8 | 8.0 | 8.6 | 7.5 | 7.1 | 7.5 | 6.9 | 6.4 | 6.0 | |

| £300m or greater | 7.8 | 7.1 | 8.4 | 10.6 | 9.0 | 7.9 | 9.0 | 8.7 | 7.9 | 8.4 | 7.9 | 6.8 | 6.4 | 5.5 | |

| Maturity (ratio of pensioner TPs to total TPs) | |||||||||||||||

| Less than 25% | 7.8 | 7.4 | 8.2 | 8.4 | 7.6 | 7.2 | 7.8 | 7.7 | 7.0 | 6.6 | 6.3 | 6.8 | 5.5 | 4.7 | |

| 25% to less than 50% | 8.2 | 7.7 | 8.7 | 10.4 | 8.7 | 7.7 | 8.8 | 8.5 | 8.1 | 7.8 | 7.9 | 7.5 | 6.6 | 6.2 | |

| 50% to less than 75% | 8.4 | 7.9 | 8.7 | 9.9 | 8.9 | 8.1 | 8.4 | 8.6 | 8.1 | 7.4 | 8.0 | 6.9 | 5.8 | 6.3 | |

| 75% or greater | 6.9 | 6.8 | 7.7 | 9.1 | 8.1 | 7.9 | 6.4 | 6.9 | 6.7 | 6.4 | 6.3 | 6.3 | 6.1 | 5.2 | |

| Presence of active members | |||||||||||||||

| TPs reported for active members | 7.9 | 7.3 | 8.1 | 9.4 | 8.0 | 7.2 | 7.9 | 7.9 | 7.9 | 7.0 | 7.2 | 6.9 | 5.7 | 5.6 | |

| TPs not reported for active members | 8.4 | 8.3 | 9.4 | 9.8 | 8.9 | 8.2 | 8.9 | 8.7 | 7.8 | 7.5 | 7.8 | 7.3 | 6.4 | 6.0 | |

| Covenant (schemes in deficit only) | |||||||||||||||

| Covenant group 1 (Strong) | 6.3 | 6.6 | 6.0 | 5.4 | 5.3 | 5.3 | 4.7 | 4.2 | |||||||

| Covenant group 2 (Tending to Strong) | 7.9 | 7.5 | 7.2 | 6.6 | 6.9 | 6.4 | 5.2 | 5.0 | |||||||

| Covenant group 3 (Tending to Weak) | 9.1 | 8.8 | 8.8 | 8.2 | 8.3 | 7.7 | 7.0 | 6.6 | |||||||

| Covenant group 4 (Weak) | 10.4 | 9.9 | 9.4 | 9.5 | 9.9 | 10.0 | 8.6 | 8.7 | |||||||

| RP length (schemes in deficit only) | |||||||||||||||

| Fewer than 5 years | 3.1 | 2.8 | 3.2 | 2.7 | 3.0 | 2.8 | 2.8 | 2.7 | 2.7 | 2.9 | 2.5 | 2.8 | 2.6 | 2.7 | |

| 5 to fewer than 7.5 years | 6.2 | 6.3 | 6.3 | 6.5 | 6.3 | 6.3 | 6.3 | 6.3 | 6.2 | 6.3 | 6.2 | 6.2 | 6.2 | 6.2 | |

| 7.5 to fewer than 10 years | 9.3 | 9.2 | 9.2 | 9.2 | 9.1 | 8.9 | 9.0 | 9.0 | 8.8 | 8.8 | 8.9 | 8.8 | 8.8 | 8.7 | |

| 10 years or more | 13.2 | 14.4 | 14.9 | 14.8 | 14.3 | 14.0 | 14.5 | 14.4 | 14.7 | 14.1 | 14.1 | 14.5 | 14.1 | 14.0 | |

| Return seeking assets | |||||||||||||||

| Less than 20% | 6.8 | 7.4 | 7.9 | 7.2 | 6.5 | 7.0 | 5.7 | 5.2 | 6.4 | 5.3 | 5.9 | 5.2 | 5.0 | 4.4 | |

| 20% to less than 40% | 6.8 | 7.7 | 7.8 | 9.2 | 7.2 | 6.9 | 6.7 | 7.3 | 6.3 | 6.2 | 6.7 | 6.5 | 5.6 | 5.6 | |

| 40% to less than 60% | 8.0 | 7.4 | 8.2 | 9.4 | 7.7 | 7.4 | 8.5 | 8.3 | 7.6 | 7.6 | 7.9 | 7.4 | 6.6 | 6.3 | |

| 60% to less than 80% | 8.2 | 7.7 | 8.7 | 9.9 | 9.0 | 8.1 | 8.8 | 8.9 | 8.4 | 7.7 | 8.1 | 8.0 | 6.6 | 6.8 | |

| 80% or greater | 8.3 | 7.4 | 9.1 | 9.3 | 9.2 | 8.1 | 10.8 | 8.6 | 8.6 | 8.4 | 8.4 | 8.3 | 6.0 | 7.0 | |

| Presence of contingent assets | |||||||||||||||

| No contingent asset | 9.4 | 8.2 | 7.4 | 8.3 | 8.1 | 7.8 | 7.3 | 7.4 | 7.0 | 5.9 | 5.7 | ||||

| At least one contingent asset | 10.4 | 8.9 | 8.5 | 8.6 | 8.8 | 8.0 | 7.4 | 8.0 | 7.5 | 6.7 | 6.6 | ||||

| Funding level (TPs) | |||||||||||||||

| Less than 70% | 9.5 | 9.3 | 11.3 | 11.0 | 10.6 | 11.7 | 12.2 | 11.8 | 13.2 | 12.2 | 12.2 | 12.0 | 10.6 | 10.6 | |

| 70% to less than 80% | 8.5 | 8.5 | 9.5 | 9.2 | 9.3 | 9.1 | 9.0 | 9.3 | 9.9 | 9.3 | 9.3 | 8.4 | 9.0 | 8.0 | |

| 80% to less than 90% | 7.8 | 7.7 | 8.1 | 8.1 | 7.3 | 7.0 | 6.6 | 7.2 | 7.8 | 6.9 | 7.2 | 7.0 | 5.7 | 5.6 | |

| 90% to less than 100% | 6.2 | 5.7 | 5.9 | 5.7 | 5.8 | 5.2 | 4.4 | 4.4 | 4.9 | 4.4 | 4.1 | 4.2 | 3.6 | 3.3 | |

| PPF Standard stressed/Unstressed asset ratio | |||||||||||||||

| Less than 90% | 9.1 | 8.5 | 8.7 | 7.5 | 7.9 | 8.3 | 5.7 | 6.8 | |||||||

| 90% to less than 95% | 8.9 | 8.9 | 8.0 | 8.1 | 8.0 | 7.6 | 6.3 | 6.4 | |||||||

| 95% to less than 100% | 8.0 | 8.4 | 7.7 | 7.1 | 7.6 | 7.3 | 6.8 | 6.2 | |||||||

| 100% to less than 105% | 6.8 | 6.7 | 6.2 | 6.1 | 7.1 | 6.9 | 6.3 | 5.7 | |||||||

| 105% or greater | 5.9 | 5.1 | 6.2 | 6.5 | 5.9 | 5.9 | 5.2 | 5.4 | |||||||

| PPF Combined stressed/Unstressed asset ratio | |||||||||||||||

| Less than 90% | 9.0 | 8.5 | 8.7 | 7.5 | 8.0 | 8.4 | 5.7 | 6.8 | |||||||

| 90% to less than 95% | 8.9 | 8.9 | 8.0 | 8.1 | 8.1 | 7.6 | 6.3 | 6.3 | |||||||

| 95% to less than 100% | 8.0 | 8.3 | 7.9 | 7.3 | 7.6 | 7.3 | 6.3 | 6.2 | |||||||

| 100% to less than 105% | 6.9 | 7.2 | 6.6 | 6.4 | 7.0 | 6.7 | 6.6 | 5.9 | |||||||

| 105% or greater | 6.4 | 5.8 | 5.8 | 6.3 | 6.6 | 6.4 | 5.6 | 5.4 | |||||||

Table 3.3: Average recovery plan length by scheme characteristics

Table 3.4: Average annual contributions as a percentage of technical provisions liabilities by scheme characteristics (schemes in deficit only)

| Ratio Percent (%) - Tranche | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | ||

| All schemes | 3.1 | 2.8 | 2.7 | 2.7 | 2.2 | 2.2 | 2.2 | 2.3 | 2.1 | 2.2 | 2.3 | |

| Size by number of members | ||||||||||||

| Fewer than 100 members | 3.6 | 3.5 | 3.2 | 3.3 | 2.8 | 3.0 | 2.8 | 2.9 | 2.6 | 2.8 | 2.9 | |

| 100 to fewer than 500 members | 3.0 | 2.7 | 2.6 | 2.7 | 2.2 | 2.1 | 2.1 | 2.2 | 2.0 | 2.3 | 2.1 | |

| 500 to fewer than 1,000 members | 3.0 | 2.7 | 2.3 | 2.6 | 1.9 | 2.0 | 2.0 | 2.0 | 2.0 | 1.9 | 1.9 | |

| 1,000 to fewer than 5,000 members | 2.8 | 2.3 | 2.2 | 2.3 | 1.7 | 1.7 | 1.7 | 1.8 | 1.6 | 1.8 | 1.6 | |

| 5,000 members or more | 2.3 | 2.0 | 1.8 | 1.8 | 1.4 | 1.4 | 1.6 | 1.5 | 1.3 | 1.3 | 1.4 | |

| Size by TPs | ||||||||||||

| Less than £5m | 3.8 | 3.5 | 3.6 | 3.6 | 3.1 | 3.4 | 3.3 | 3.4 | 3.2 | 3.6 | 3.7 | |

| £5m to less than £20m | 3.0 | 2.9 | 2.6 | 2.7 | 2.4 | 2.3 | 2.2 | 2.3 | 2.0 | 2.1 | 2.3 | |

| £20m to less than £100m | 3.0 | 2.5 | 2.4 | 2.7 | 2.0 | 2.0 | 2.0 | 2.1 | 2.0 | 2.2 | 2.0 | |

| £100m to less than £300m | 2.7 | 2.4 | 2.2 | 2.4 | 1.7 | 1.8 | 2.0 | 2.0 | 1.7 | 1.6 | 1.8 | |

| £300m or greater | 2.4 | 2.1 | 2.0 | 2.0 | 1.5 | 1.6 | 1.5 | 1.7 | 1.5 | 1.5 | 1.5 | |

| Maturity (ratio of pensioner TPs to total TPs) | ||||||||||||

| Less than 25% | 3.7 | 3.5 | 3.3 | 3.4 | 2.7 | 2.9 | 2.8 | 3.3 | 3.0 | 3.3 | 3.5 | |

| 25% to less than 50% | 2.8 | 2.6 | 2.5 | 2.6 | 2.1 | 2.1 | 2.1 | 2.2 | 1.9 | 1.8 | 2.0 | |

| 50% to less than 75% | 2.6 | 2.3 | 2.2 | 2.3 | 1.9 | 2.0 | 1.9 | 1.9 | 1.8 | 2.1 | 1.9 | |

| 75% or greater | 2.4 | 2.3 | 2.4 | 2.2 | 2.4 | 2.1 | 1.8 | 1.7 | 1.9 | 2.4 | 1.7 | |

| Presence of active members | ||||||||||||

| TPs reported for active members | 3.0 | 2.7 | 2.5 | 2.7 | 2.0 | 1.9 | 2.0 | 2.2 | 1.9 | 2.2 | 2.0 | |

| TPs not reported for active members | 3.3 | 3.0 | 2.9 | 2.8 | 2.5 | 2.6 | 2.3 | 2.4 | 2.3 | 2.2 | 2.4 | |

| Covenant (schemes in deficit only) | ||||||||||||

| Covenant group 1 (Strong) | 2.9 | 2.4 | 2.1 | 2.0 | 2.3 | 2.4 | 2.0 | 2.1 | ||||

| Covenant group 2 (Tending to Strong) | 2.6 | 2.3 | 2.2 | 2.3 | 2.4 | 2.1 | 2.4 | 2.2 | ||||

| Covenant group 3 (Tending to Weak) | 2.5 | 2.1 | 2.1 | 2.1 | 2.2 | 1.8 | 2.0 | 2.1 | ||||

| Covenant group 4 (Weak) | 2.5 | 2.2 | 2.6 | 2.3 | 2.4 | 2.2 | 2.4 | 2.2 | ||||

| RP length (schemes in deficit only) | ||||||||||||

| Fewer than 5 years | 4.2 | 3.7 | 3.0 | 3.4 | 2.4 | 2.4 | 2.5 | 2.6 | 2.3 | 2.4 | 2.4 | |

| 5 to fewer than 7.5 years | 3.8 | 3.0 | 3.1 | 3.0 | 2.6 | 2.4 | 2.3 | 2.5 | 2.4 | 2.3 | 2.3 | |

| 7.5 to fewer than 10 years | 3.1 | 2.5 | 2.5 | 2.6 | 2.2 | 2.4 | 2.2 | 2.2 | 2.1 | 2.1 | 2.0 | |

| 10 years or more | 2.2 | 2.1 | 2.0 | 2.1 | 1.9 | 1.8 | 1.8 | 1.8 | 1.6 | 1.7 | 1.8 | |

| Return seeking assets | ||||||||||||

| Less than 20% | 3.6 | 4.2 | 2.4 | 3.3 | 2.9 | 2.7 | 2.6 | 2.3 | 2.9 | 3.3 | 2.8 | |

| 20% to less than 40% | 2.7 | 2.5 | 2.7 | 2.5 | 2.0 | 2.1 | 2.0 | 2.2 | 2.0 | 2.0 | 2.0 | |

| 40% to less than 60% | 3.0 | 2.8 | 2.7 | 2.7 | 2.1 | 2.2 | 2.2 | 2.3 | 2.0 | 2.1 | 2.2 | |

| 60% to less than 80% | 3.3 | 2.8 | 2.6 | 2.8 | 2.2 | 2.3 | 2.4 | 2.3 | 2.1 | 2.1 | 2.2 | |

| 80% or greater | 3.2 | 2.7 | 2.8 | 2.6 | 2.5 | 2.2 | 2.0 | 2.5 | 2.1 | 2.4 | 2.7 | |

| Presence of contingent assets | ||||||||||||

| No contingent asset | 3.1 | 2.9 | 2.7 | 2.8 | 2.3 | 2.3 | 2.3 | 2.3 | 2.2 | 2.3 | 2.4 | |

| At least one contingent asset | 2.9 | 2.7 | 2.5 | 2.5 | 2.1 | 2.0 | 2.0 | 2.2 | 1.9 | 1.9 | 1.9 | |

| Funding level (TPs) | ||||||||||||

| Less than 70% | 3.9 | 4.3 | 4.4 | 3.7 | 3.4 | 4.4 | 3.9 | 3.9 | 3.7 | 4.9 | 3.8 | |

| 70% to less than 80% | 3.0 | 3.3 | 3.3 | 3.1 | 2.5 | 2.8 | 2.7 | 2.8 | 2.8 | 2.8 | 3.0 | |

| 80% to less than 90% | 2.1 | 2.4 | 2.7 | 2.4 | 1.9 | 2.2 | 2.2 | 2.3 | 2.0 | 2.3 | 2.3 | |

| 90% to less than 100% | 1.0 | 1.1 | 1.3 | 1.3 | 0.9 | 1.1 | 1.1 | 1.1 | 1.0 | 1.0 | 1.1 | |

| PPF Standard stressed/Unstressed asset ratio | ||||||||||||

| Less than 90% | 2.9 | 2.3 | 2.3 | 2.5 | 2.4 | 2.1 | 2.1 | 2.4 | ||||

| 90% to less than 95% | 2.6 | 2.2 | 2.4 | 2.2 | 2.4 | 2.1 | 2.1 | 2.3 | ||||

| 95% to less than 100% | 2.7 | 2.1 | 2.0 | 2.2 | 2.2 | 2.0 | 2.3 | 2.3 | ||||

| 100% to less than 105% | 2.6 | 2.3 | 2.2 | 1.9 | 2.3 | 1.9 | 2.7 | 2.4 | ||||

| 105% or greater | 2.8 | 2.3 | 1.9 | 1.8 | 2.3 | 2.6 | 1.9 | 2.0 | ||||

| PPF Combined stressed/Unstressed asset ratio | ||||||||||||

| Less than 90% | 2.9 | 2.3 | 2.3 | 2.5 | 2.4 | 2.1 | 2.1 | 2.5 | ||||

| 90% to less than 95% | 2.7 | 2.3 | 2.4 | 2.3 | 2.4 | 2.1 | 2.1 | 2.4 | ||||

| 95% to less than 100% | 2.7 | 2.1 | 2.0 | 2.2 | 2.3 | 2.0 | 2.4 | 2.3 | ||||

| 100% to less than 105% | 2.6 | 2.2 | 2.1 | 1.9 | 2.3 | 1.9 | 2.7 | 2.4 | ||||

| 105% or greater | 2.7 | 2.1 | 1.9 | 1.8 | 2.0 | 2.4 | 1.9 | 2.0 | ||||

Table 3.4: Average annual contributions as a percentage of technical provisions liabilities by scheme characteristics

Discount rates

Table 4.1: Average nominal discount rate and outperformance by Tranche (Tranches 1-7: schemes in deficit only, Tranches 8-14: all schemes)

| Mean percentage (%) - Tranche | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |||

| Pre and post-retirement rates (a) | 5.018 | 5.355 | 5.633 | 5.273 | 5.248 | 5.108 | 4.186 | 3.966 | 4.337 | 3.389 | 3.237 | 2.740 | 2.596 | 2.442 | ||

| Pre-retirement rate (b) | 6.133 | 6.303 | 6.441 | 6.106 | 6.111 | 6.049 | 5.074 | 4.917 | 5.269 | 4.295 | 4.148 | 3.590 | 3.545 | 3.320 | ||

| Post-retirement rate (b) | 4.631 | 4.927 | 5.056 | 4.725 | 4.763 | 4.700 | 3.652 | 3.496 | 3.931 | 2.871 | 2.766 | 2.269 | 2.201 | 2.103 | ||

| SEDR (c) | 5.526 | 5.758 | 5.898 | 5.516 | 5.531 | 5.454 | 4.356 | 4.149 | 4.576 | 3.462 | 3.324 | 2.787 | 2.692 | 2.518 | ||

| SEDR (all schemes) (d) | 5.506 | 5.635 | 5.830 | 5.448 | 5.454 | 5.369 | 4.305 | 4.091 | 4.498 | 3.431 | 3.281 | 2.747 | 2.616 | 2.433 | ||

| SEDR outperformance over 20-year UK gilt (e) | 1.367 | 1.185 | 1.243 | 1.067 | 0.888 | 0.964 | 1.050 | 0.996 | 0.924 | 0.971 | 0.904 | 0.900 | 0.765 | 0.735 | ||

| SEDR outperformance over greater than 15 year AA UK corporate bonds (f) | 0.578 | 0.286 | -0.643 | -1.330 | -0.054 | -0.077 | -0.301 | 0.014 | 0.206 | 0.117 | -0.088 | 0.220 | 0.002 | -0.083 | ||

(a) Single rates provided

(b) Different rates provided

(c) Composite of pre- and post-retirement rates where different rates are provided

(d) Combined single and different rates

Source for (e): Thomson Reuters, Bank of England

Source for (f): Thomson Reuters, Markit Iboxx

Table 4.2: Average real discount rate and outperformance by Tranche (Tranches 1-7: schemes in deficit only, Tranches 8-14: all schemes)

| Mean percentage (%) - Tranche | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |||

| Pre and post-retirement rates (a) | 2.030 | 2.145 | 2.092 | 2.084 | 1.649 | 1.549 | 0.968 | 0.681 | 0.863 | 0.194 | 0.115 | -0.649 | -0.724 | -0.968 | ||

| Pre-retirement rate (b) | 3.115 | 3.042 | 2.851 | 2.940 | 2.495 | 2.479 | 1.885 | 1.670 | 1.813 | 1.102 | 1.022 | 0.227 | 0.188 | -0.103 | ||

| Post-retirement rate (b) | 1.656 | 1.708 | 1.512 | 1.600 | 1.192 | 1.176 | 0.507 | 0.290 | 0.518 | -0.280 | -0.321 | -1.051 | -1.110 | -1.278 | ||

| SEDR (c) | 2.327 | 2.300 | 2.096 | 2.152 | 1.700 | 1.675 | 1.005 | 0.749 | 0.950 | 0.131 | 0.079 | -0.643 | -0.725 | -0.968 | ||

| SEDR (all schemes) (d) | 2.253 | 2.253 | 2.095 | 2.134 | 1.687 | 1.645 | 0.990 | 0.732 | 0.927 | 0.151 | 0.085 | -0.678 | -0.773 | -1.036 | ||

| Real SEDR Outperformance against 20 year index linked gilts (e) | 1.061 | 0.979 | 1.134 | 1.050 | 0.833 | 0.907 | 1.013 | 0.981 | 0.900 | 0.985 | 0.994 | 1.065 | 0.874 | 0.866 | ||

(a) Single rates provided

(b) Different rates provided

(c) Composite of pre- and post-retirement rates where different rates are provided

(d) Combined single and different rates

Source for (e) : Thomson Reuters, Bank of England

Table 4.3: Average nominal SEDR by scheme characteristics (Tranches 1-7: schemes in deficit only, Tranches 8-14: all schemes)

| Mean percentage (%) - Tranche | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | ||

| All schemes | 5.506 | 5.635 | 5.830 | 5.448 | 5.454 | 5.369 | 4.305 | 4.091 | 4.498 | 3.431 | 3.281 | 2.747 | 2.617 | 2.433 | |

| Size by number of members | |||||||||||||||

| Fewer than 100 members | 5.184 | 5.432 | 5.550 | 5.251 | 5.195 | 5.071 | 4.067 | 3.843 | 4.237 | 3.333 | 3.201 | 2.696 | 2.642 | 2.449 | |

| 100 to fewer than 500 members | 5.834 | 5.720 | 5.941 | 5.458 | 5.506 | 5.444 | 4.378 | 4.189 | 4.572 | 3.538 | 3.369 | 2.845 | 2.703 | 2.508 | |

| 500 to fewer than 1,000 members | 5.440 | 5.833 | 5.991 | 5.533 | 5.711 | 5.559 | 4.488 | 4.277 | 4.658 | 3.466 | 3.290 | 2.766 | 2.550 | 2.342 | |

| 1,000 to fewer than 5,000 members | 5.435 | 5.725 | 5.976 | 5.619 | 5.586 | 5.606 | 4.487 | 4.204 | 4.725 | 3.422 | 3.294 | 2.668 | 2.538 | 2.382 | |

| 5,000 members or more | 5.406 | 5.648 | 5.941 | 5.645 | 5.678 | 5.656 | 4.427 | 4.307 | 4.768 | 3.352 | 3.213 | 2.617 | 2.402 | 2.191 | |

| Size by TPs | |||||||||||||||

| Less than £5m | 5.148 | 5.419 | 5.533 | 5.216 | 5.151 | 5.020 | 3.997 | 3.755 | 4.159 | 3.284 | 3.130 | 2.640 | 2.624 | 2.384 | |

| £5m to less than £20m | 5.487 | 5.708 | 5.878 | 5.461 | 5.470 | 5.320 | 4.291 | 4.101 | 4.475 | 3.491 | 3.380 | 2.871 | 2.746 | 2.578 | |

| £20m to less than £100m | 5.441 | 5.771 | 5.956 | 5.528 | 5.615 | 5.531 | 4.425 | 4.243 | 4.624 | 3.537 | 3.359 | 2.810 | 2.670 | 2.462 | |

| £100m to less than £300m | 6.985 | 5.677 | 5.970 | 5.582 | 5.534 | 5.613 | 4.387 | 4.200 | 4.679 | 3.409 | 3.227 | 2.644 | 2.564 | 2.376 | |

| £300m or greater | 5.358 | 5.695 | 5.959 | 5.619 | 5.670 | 5.536 | 4.445 | 4.253 | 4.668 | 3.321 | 3.183 | 2.599 | 2.363 | 2.222 | |

| Maturity (ratio of pensioner TPs to total TPs) | |||||||||||||||

| Less than 25% | 5.278 | 5.493 | 5.645 | 5.297 | 5.312 | 5.133 | 4.205 | 3.992 | 4.265 | 3.388 | 3.185 | 2.698 | 2.664 | 2.441 | |

| 25% to less than 50% | 5.473 | 5.786 | 6.000 | 5.571 | 5.561 | 5.506 | 4.431 | 4.219 | 4.654 | 3.522 | 3.363 | 2.836 | 2.693 | 2.531 | |

| 50% to less than 75% | 6.413 | 5.735 | 5.865 | 5.506 | 5.516 | 5.416 | 4.270 | 4.048 | 4.510 | 3.381 | 3.314 | 2.679 | 2.531 | 2.349 | |

| 75% or greater | 4.750 | 5.292 | 5.391 | 5.050 | 4.965 | 5.033 | 3.776 | 3.444 | 4.067 | 2.992 | 2.798 | 2.557 | 2.311 | 2.180 | |

| Presence of active members | |||||||||||||||

| TPs reported for active members | 5.584 | 5.684 | 5.905 | 5.529 | 5.533 | 5.491 | 4.416 | 4.196 | 4.629 | 3.511 | 3.374 | 2.874 | 2.700 | 2.545 | |

| TPs not reported for active members | 5.229 | 5.508 | 5.661 | 5.268 | 5.321 | 5.195 | 4.166 | 3.978 | 4.357 | 3.361 | 3.212 | 2.650 | 2.566 | 2.371 | |

| Covenant (schemes in deficit only) | |||||||||||||||

| Covenant group 1 (Strong) | 4.410 | 4.128 | 4.708 | 3.371 | 3.223 | 2.741 | 2.628 | 2.459 | |||||||

| Covenant group 2 (Tending to Strong) | 4.372 | 4.194 | 4.547 | 3.446 | 3.270 | 2.824 | 2.654 | 2.427 | |||||||

| Covenant group 3 (Tending to Weak) | 4.327 | 4.146 | 4.537 | 3.470 | 3.344 | 2.769 | 2.620 | 2.436 | |||||||

| Covenant group 4 (Weak) | 4.201 | 3.957 | 4.348 | 3.406 | 3.264 | 2.678 | 2.515 | 2.416 | |||||||

| RP length (schemes in deficit only) | |||||||||||||||

| Fewer than 5 years | 5.822 | 5.581 | 5.747 | 5.352 | 5.361 | 5.335 | 4.200 | 3.982 | 4.399 | 3.368 | 3.169 | 2.657 | 2.585 | 2.423 | |

| 5 to fewer than 7.5 years | 5.319 | 5.640 | 5.874 | 5.363 | 5.422 | 5.340 | 4.308 | 4.128 | 4.492 | 3.489 | 3.337 | 2.755 | 2.677 | 2.493 | |

| 7.5 to fewer than 10 years | 5.436 | 5.644 | 5.846 | 5.497 | 5.547 | 5.340 | 4.429 | 4.215 | 4.559 | 3.523 | 3.365 | 2.839 | 2.597 | 2.441 | |

| 10 years or more | 5.405 | 5.731 | 5.874 | 5.494 | 5.481 | 5.465 | 4.328 | 4.161 | 4.664 | 3.445 | 3.361 | 2.883 | 2.719 | 2.486 | |

| Return seeking assets | |||||||||||||||

| Less than 20% | 4.793 | 5.106 | 5.214 | 4.747 | 4.805 | 4.657 | 3.550 | 3.268 | 3.722 | 2.803 | 2.691 | 2.169 | 2.121 | 1.976 | |

| 20% to less than 40% | 4.972 | 5.320 | 5.531 | 5.200 | 5.151 | 5.060 | 4.035 | 3.701 | 4.119 | 3.149 | 3.103 | 2.564 | 2.480 | 2.351 | |

| 40% to less than 60% | 5.348 | 5.638 | 5.803 | 5.421 | 5.452 | 5.344 | 4.300 | 4.122 | 4.468 | 3.446 | 3.371 | 2.793 | 2.751 | 2.603 | |

| 60% to less than 80% | 5.656 | 5.671 | 5.881 | 5.535 | 5.585 | 5.508 | 4.510 | 4.256 | 4.718 | 3.651 | 3.565 | 3.160 | 2.999 | 2.728 | |

| 80% or greater | 5.514 | 5.711 | 5.894 | 5.478 | 5.512 | 5.495 | 4.292 | 4.381 | 4.625 | 3.831 | 3.716 | 3.107 | 3.060 | 3.101 | |

| Presence of contingent assets | |||||||||||||||

| No contingent asset | 5.416 | 5.413 | 5.337 | 4.275 | 4.070 | 4.481 | 3.421 | 3.289 | 2.753 | 2.614 | 2.433 | ||||

| At least one contingent asset | 5.606 | 5.593 | 5.483 | 4.404 | 4.177 | 4.577 | 3.474 | 3.252 | 2.719 | 2.626 | 2.432 | ||||

| Funding level (TPs) | |||||||||||||||

| Less than 70% | 5.075 | 5.318 | 5.490 | 5.369 | 5.225 | 5.036 | 4.134 | 3.853 | 4.212 | 3.220 | 3.146 | 2.640 | 2.558 | 2.476 | |

| 70% to less than 80% | 5.372 | 5.620 | 5.844 | 5.542 | 5.519 | 5.312 | 4.336 | 4.200 | 4.471 | 3.434 | 3.380 | 2.778 | 2.644 | 2.478 | |

| 80% to less than 90% | 5.865 | 5.695 | 5.934 | 5.500 | 5.539 | 5.406 | 4.412 | 4.216 | 4.577 | 3.467 | 3.380 | 2.801 | 2.630 | 2.462 | |

| 90% to less than 100% | 5.549 | 5.745 | 5.928 | 5.450 | 5.495 | 5.530 | 4.323 | 4.168 | 4.598 | 3.500 | 3.212 | 2.783 | 2.640 | 2.419 | |

| 100% or greater | 3.885 | 4.431 | 3.409 | 3.235 | 2.691 | 2.599 | 2.390 | ||||||||

| PPF Standard stressed/Unstressed asset ratio | |||||||||||||||

| Less than 90% | 4.398 | 4.261 | 4.622 | 3.744 | 3.600 | 3.125 | 2.958 | 2.963 | |||||||

| 90% to less than 95% | 4.443 | 4.225 | 4.672 | 3.550 | 3.433 | 2.980 | 2.964 | 2.701 | |||||||

| 95% to less than 100% | 4.233 | 4.044 | 4.366 | 3.399 | 3.328 | 2.897 | 2.781 | 2.595 | |||||||

| 100% to less than 105% | 4.041 | 3.709 | 4.208 | 3.170 | 3.050 | 2.617 | 2.555 | 2.443 | |||||||

| 105% or greater | 3.629 | 3.300 | 4.008 | 2.995 | 2.714 | 2.279 | 2.250 | 2.133 | |||||||

| PPF Combined stressed/Unstressed asset ratio | |||||||||||||||

| Less than 90% | 4.393 | 4.258 | 4.629 | 3.748 | 3.594 | 3.148 | 2.962 | 2.949 | |||||||

| 90% to less than 95% | 4.439 | 4.228 | 4.674 | 3.546 | 3.428 | 2.991 | 2.966 | 2.691 | |||||||

| 95% to less than 100% | 4.240 | 4.024 | 4.382 | 3.401 | 3.349 | 2.903 | 2.793 | 2.608 | |||||||

| 100% to less than 105% | 4.051 | 3.822 | 4.292 | 3.215 | 3.122 | 2.644 | 2.566 | 2.450 | |||||||

| 105% or greater | 3.810 | 3.456 | 3.995 | 3.084 | 2.824 | 2.352 | 2.316 | 2.172 | |||||||

Table 4.3: Average nominal SEDR by scheme characteristics

Table 4.4: Average outperformance of the nominal SEDR over nominal 20 year UK gilts by scheme characteristics (Tranches 1-7: schemes in deficit only, Tranches 8-14: all schemes)

| Mean percentage (%) - Tranche | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | ||

| All schemes | 1.367 | 1.185 | 1.243 | 1.068 | 0.888 | 0.964 | 1.050 | 0.996 | 0.924 | 0.971 | 0.904 | 0.900 | 0.765 | 0.735 | |

| Size by number of members | |||||||||||||||

| Fewer than 100 members | 1.040 | 0.988 | 0.965 | 0.852 | 0.649 | 0.679 | 0.828 | 0.734 | 0.667 | 0.854 | 0.819 | 0.839 | 0.782 | 0.731 | |

| 100 to fewer than 500 members | 1.692 | 1.273 | 1.344 | 1.057 | 0.943 | 1.029 | 1.127 | 1.089 | 1.001 | 1.074 | 0.999 | 1.003 | 0.852 | 0.826 | |

| 500 to fewer than 1,000 members | 1.304 | 1.356 | 1.406 | 1.188 | 1.139 | 1.159 | 1.235 | 1.184 | 1.090 | 1.017 | 0.920 | 0.930 | 0.706 | 0.644 | |

| 1,000 to fewer than 5,000 members | 1.304 | 1.276 | 1.407 | 1.254 | 1.003 | 1.198 | 1.218 | 1.135 | 1.140 | 0.987 | 0.909 | 0.821 | 0.686 | 0.687 | |

| 5,000 members or more | 1.285 | 1.194 | 1.358 | 1.332 | 1.048 | 1.232 | 1.121 | 1.242 | 1.172 | 0.919 | 0.831 | 0.777 | 0.572 | 0.506 | |

| Size by TPs | |||||||||||||||

| Less than £5m | 0.995 | 0.973 | 0.935 | 0.795 | 0.616 | 0.631 | 0.749 | 0.638 | 0.592 | 0.798 | 0.735 | 0.776 | 0.761 | 0.664 | |

| £5m to less than £20m | 1.341 | 1.264 | 1.291 | 1.071 | 0.899 | 0.913 | 1.043 | 1.007 | 0.913 | 1.023 | 1.017 | 1.017 | 0.892 | 0.877 | |

| £20m to less than £100m | 1.311 | 1.307 | 1.373 | 1.155 | 1.052 | 1.119 | 1.169 | 1.148 | 1.047 | 1.077 | 0.974 | 0.976 | 0.818 | 0.766 | |

| £100m to less than £300m | 2.868 | 1.236 | 1.401 | 1.249 | 0.946 | 1.196 | 1.141 | 1.118 | 1.080 | 0.968 | 0.876 | 0.800 | 0.716 | 0.700 | |

| £300m or greater | 1.237 | 1.232 | 1.383 | 1.299 | 1.045 | 1.129 | 1.149 | 1.184 | 1.087 | 0.888 | 0.800 | 0.753 | 0.523 | 0.533 | |

| Maturity (ratio of pensioner TPs to total TPs) | |||||||||||||||

| Less than 25% | 1.131 | 1.044 | 1.061 | 0.900 | 0.753 | 0.751 | 0.959 | 0.898 | 0.695 | 0.913 | 0.781 | 0.843 | 0.804 | 0.730 | |

| 25% to less than 50% | 1.338 | 1.340 | 1.408 | 1.189 | 0.997 | 1.098 | 1.182 | 1.124 | 1.085 | 1.065 | 0.990 | 0.998 | 0.842 | 0.835 | |

| 50% to less than 75% | 2.290 | 1.267 | 1.284 | 1.155 | 0.934 | 0.990 | 0.991 | 0.958 | 0.930 | 0.927 | 0.949 | 0.830 | 0.682 | 0.658 | |

| 75% or greater | 0.625 | 0.871 | 0.823 | 0.750 | 0.376 | 0.584 | 0.546 | 0.297 | 0.462 | 0.539 | 0.448 | 0.670 | 0.466 | 0.480 | |

| Presence of active members | |||||||||||||||

| TPs reported for active members | 1.450 | 1.237 | 1.323 | 1.158 | 0.962 | 1.097 | 1.155 | 1.105 | 1.050 | 1.052 | 0.982 | 1.025 | 0.847 | 0.834 | |

| TPs not reported for active members | 1.070 | 1.050 | 1.065 | 0.868 | 0.762 | 0.773 | 0.918 | 0.879 | 0.789 | 0.900 | 0.846 | 0.805 | 0.715 | 0.681 | |