Identifying persons for the fit and proper assessment

This guidance is for trustees of collective defined contribution (CDC) schemes and should be read alongside our CDC code of practice, which sets out our expectations for identifying roles subject to the fit and proper assessment. The Pension Schemes Act 2021 Section 11(2) sets out the full list of persons to be assessed for fitness and propriety.

You will need to identify all persons who carry out those roles as part of your authorisation application. We will assess whether each person is fit and proper to act in their role in relation to the CDC scheme.

This guidance will help you identify those carrying out the roles we must assess, which are:

- the person who establishes the CDC scheme

- trustees

- persons who can appoint or remove trustees

- persons who can amend the trust deed

These are important roles that are responsible for correctly setting up the scheme and ensuring members’ interests are protected. The roles should be clearly identifiable in the trust deed. The ‘person’ in one or more of these roles may be a company and not an individual.

Below, we outline the types of person we will assess for fitness and propriety, and the details to provide to us.

Types of persons to be included

A ‘person’ can include:

- an individual

- a ‘legal person’ such as a corporate entity, or a partnership with separate legal personality

You may need to take legal advice on whether the ‘person’ to be assessed is an individual or a ‘legal person’ such as a company.

Individuals: You should provide details of any individual who is appointed to carry out any of the roles subject to the fit and proper assessment.

Corporate entities: You should provide details of any corporate entity identified as being a person subject to the fit and proper assessment.

You should also provide details of all relevant individual directors (including executive and non-executive directors) or other individuals who perform a core function of that role in relation to the CDC scheme on behalf of the corporate entity.

Corporate directors: Where a director of a company is itself a corporate entity, you should provide details of any relevant individual carrying out a core function of the role for the CDC scheme.

Partnerships with separate legal personality: You should provide details of the partnership and all relevant individual partners where they perform a core function of the role for the CDC scheme, along with other individuals performing core functions on behalf of the partnership in respect of the relevant role.

Identifying the establisher of the CDC scheme

Any person (normally the employer – either an individual person or a corporate entity), who establishes a CDC scheme must be identified for assessment of fitness and propriety as part of the authorisation application. The scheme establisher is the person who entered into a trust deed with the objective of running a CDC scheme and they will be identifiable from the trust deed.

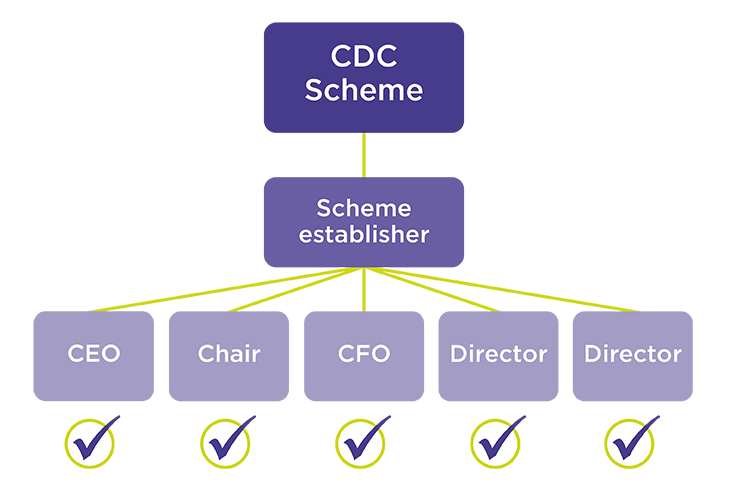

If the scheme establisher is a corporate entity, we would need to assess the fitness and propriety of all persons in the entity who made the decision to establish the CDC scheme and enter into the trust deed. They may also have been the decision-maker in providing the initial funding for the CDC scheme to be set up. This may include anyone in roles such as Chief Executive, Chairman, Chief Operating Officer, Chief Financial Officer and members of the board of directors. This can be seen in Diagram 1 below.

In seeking authorisation for your scheme, you must identify all those persons in such roles to us so we can assess their fitness and propriety.

Diagram 1: Who to assess in relation to the scheme establisher

Identifying the trustees

Trustee boards can be structured in a number of different ways. They may include:

- individuals – including member nominated trustees

- corporate trustees with trustee directors (who may be individuals or corporate entities)

- professional trustees (who may be individuals or corporate entities)

- a combination of these

However the trustee board is structured, you need to identify for assessment all individuals who carry out trustee functions, whether they are appointed as individuals, or acting through a corporate trustee as a trustee director. You should also include the details of the corporate entity itself.

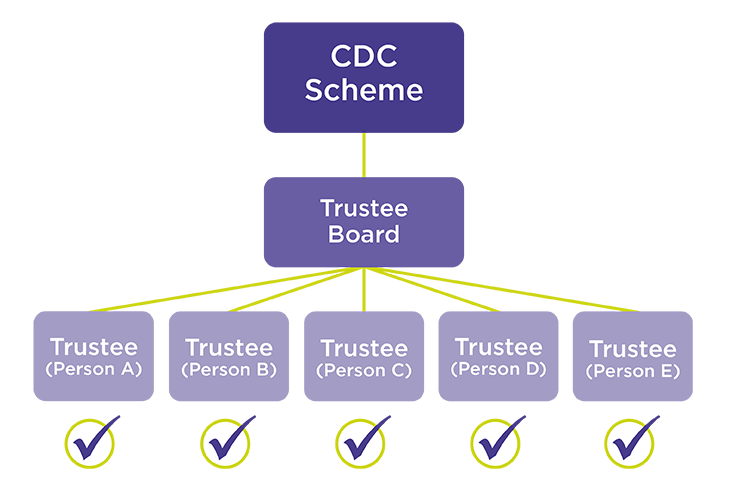

Individual trustees in a trustee board

In a board of individual trustees all the trustees must be identified for the fit and proper assessment.

For example, in Diagram 2 below, persons A, B, C, D, and E (all members of the trustee board) must all be assessed.

Diagram 2: Assessing individual trustees in a trustee board

Corporate trustee boards

Where there is a corporate trustee in place, the directors will perform the functions of the trustee. We will expect all the directors of the trustee to be identified for assessment, unless they do not perform core functions and make decisions in relation to the CDC scheme (for example where the corporate entity is a professional trustee with a number of appointments).

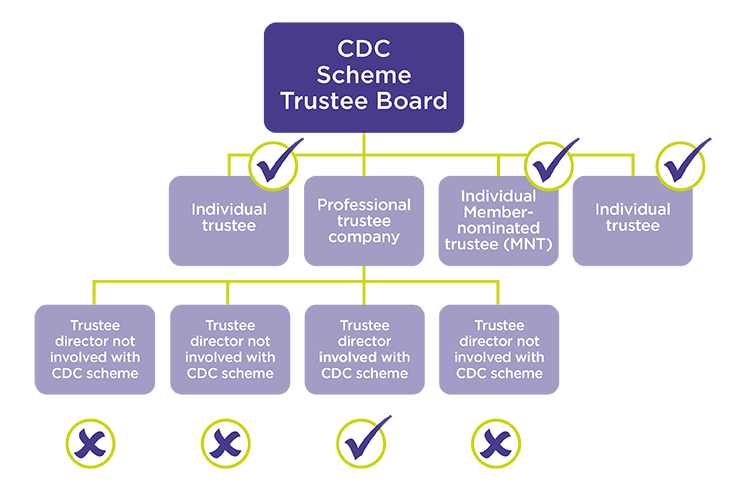

Diagram 3 below illustrates how we will assess persons acting in trustee roles within the structure of a corporate professional trustee. A tick indicates persons to be assessed.

Diagram 3: Assessing persons acting in trustee roles in a corporate professional trustee structure

Professional trustees

In Diagram 3, the CDC scheme has a number of individual trustees, and a professional trustee which is a corporate entity. The professional trustee company has a number of directors performing trustee functions (trustee directors). However, only one of these is assigned to and performs trustee functions in respect of the CDC scheme on behalf of the professional trustee. Only that person would be assessed in this instance.

The other trustee directors of the professional trustee company do not perform any trustee functions in respect of the CDC scheme (although they may do for other schemes). They would not need to be assessed.

If all the trustee directors of a professional trustee company perform trustee functions in relation to the CDC scheme, then all the trustee directors would need to be assessed.

Again, the important thing for the trustees to be aware of is that anyone who performs a role relevant to the scheme involving any trustee duties needs to be identified to us to be assessed for their fitness and propriety.

Where a professional trustee company provides a designated alternate to undertake the role of trustee for the CDC scheme (for example when an individual is sick or on holiday and a substitute takes their place at a board meeting representing the corporate entity), the person who would be able to act as the designated alternate would also need to be assessed for fitness and propriety.

Persons who can appoint or remove trustees

The scheme’s trust deed and any associated documentation should set out who has the power to appoint and remove trustees. We need to assess all persons, whether corporate entities or individuals who alone or collectively have the power to appoint or remove trustees, or to require that specific persons be appointed or removed as trustees. An individual who participates in an election, or expresses a preference, will not need to be assessed.

If the power lies solely with some or all of the trustee board, they will already have been identified and so no further individuals will need to be assessed.

Where a corporate entity such as the employer has the power to appoint trustees, all the individuals responsible for the decision need to be assessed. If it is a board that makes the decision, then all the members of that board will need to be assessed.

If the process involves another body, for example a union, then those in decision-making positions need to be identified and assessed. This would not include those who simply participate in an election involving the wider union membership.

Persons who can amend the trust deed

As with the appointment of trustees, the scheme’s trust deed and any associated documentation should provide clarity on who has the power to amend the trust deed. Any person in such a position, whether in that capacity as an individual or as a corporate entity, must be assessed for fitness and propriety.

We expect the principles set out in the above sections to be followed here.