Asset-backed contributions

On this page

- Executive summary

- About this guidance

- What is an ABC?

- The regulator's expectations of trustees

- The regulator's approach to ABCs

Guidance

This guidance is based on the regulator’s recent experience in relation to asset-backed contributions and sets out our expectations of trustees when considering such arrangements.

Issued: November 2013

This guidance expands on the statement published in November 2010 entitled employer-related investments.

Executive summary

An asset-backed contribution arrangement (‘ABC‘) is a contractual arrangement between trustees and one or more entities within the sponsoring employer’s group. ABCs involve regular payments to the scheme for the duration of the arrangement. The payment stream derives from an underlying asset.

The regulator recognises that innovative funding mechanisms such as ABCs may help employers meet their obligations to schemes and can, in certain circumstances, improve a scheme’s security by providing access to valuable assets which were previously out of reach.

In ABC arrangements the scheme usually remains reliant on the sponsoring employer (or wider group) and so can face increased risks if the ABC provides funding over a longer period than would be the case under a normal recovery plan. Trustees should take care that they do not place excessive reliance on the underlying asset.

Given the risks in this area, trustees should examine any proposed ABC arrangement critically and carefully. They should consider whether there are any less risky alternatives to support the scheme, such as an appropriate recovery plan, or an appropriate recovery plan coupled with contingent assets to provide additional security.

If trustees choose to enter into an ABC, they should take care that any capitalisation of the payment stream does not give a distorted view of the scheme’s funding position and its overall risk profile. When making decisions on issues involving funding, strategy or risk, trustees should ‘unpack’ the ABC arrangement and clearly identify the extent to which the value attributed to the ABC in the scheme’s accounts is reliant on payments being made in the future, and assess the likelihood that those payments will be made in relevant scenarios.

Where appropriate, when considering ABCs the regulator will also seek to ‘unpack’ the arrangement in order to understand the real risks that the scheme is exposed to.

About this guidance

1. This guidance has been produced for trustees and managers of all occupational pension schemes with a defined benefit element. We expect it also to be of value to sponsoring employers of such schemes and advisers to both trustees and employers.

2. It explains what ABC arrangements are, the risks involved with them and sets out practice that we expect trustees to follow when considering a proposal to enter an asset-backed contribution arrangement, and in understanding risks to the scheme.

3. The guidance is divided into four sections as follows:

- What is an ABC?

- Risks in relation to ABCs.

- The regulator’s expectations of trustees.

- The regulator’s approach to ABCs.

What is an ABC?

4. An ABC is basically a contractual funding arrangement under which an income stream is provided to a scheme, usually via a special purpose vehicle. That income stream is usually given a net present value by the trustees and is treated as an asset, thereby reducing or eliminating the scheme’s deficit.

5. The income stream does not generally form part of the ‘schedule of contributions’[1] due from the sponsoring employer(s)[2] to the scheme – instead, the payments under the ABC are a contractual (and non-statutory) payment stream.

6. The arrangements are described as ‘asset-backed’ because an asset owned by the sponsoring employer (or the wider group) will be transferred to a special purpose vehicle, in which both group companies and the scheme will have specified interests (which may include the ability for trustees to ‘step in’ to realise the value of the underlying asset, up to the value of their claim). Income from the underlying asset will typically fund the promised payments.

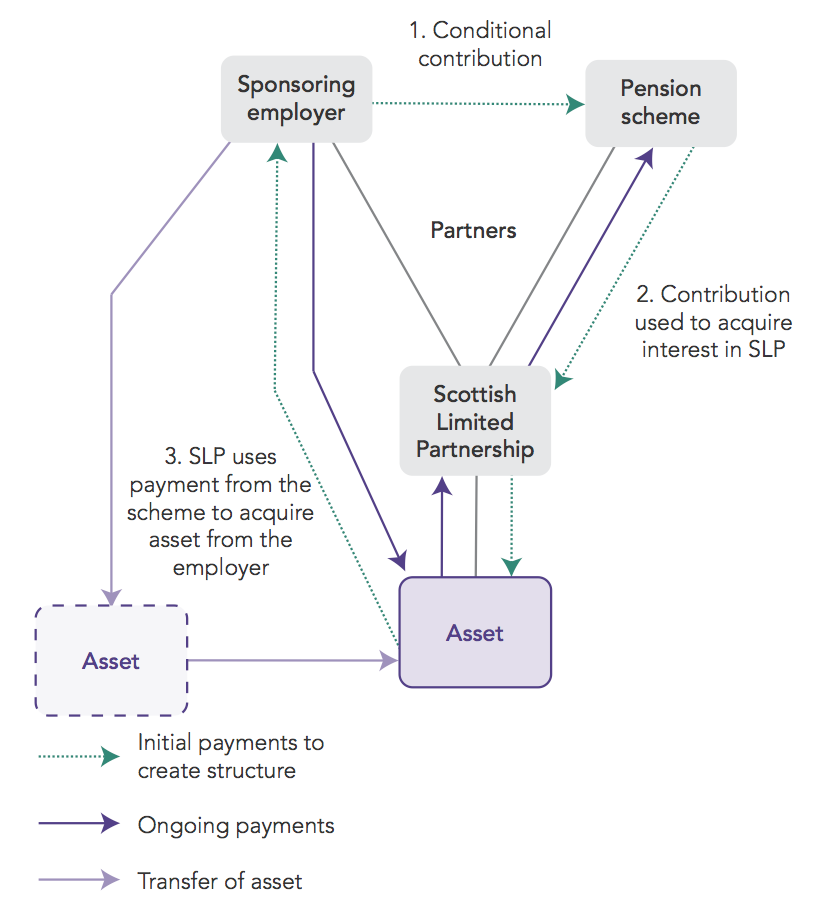

7. The details of these arrangements vary but the following diagram provides an illustrative example.

8. As shown in the diagram, a typical ABC involves the following stages:

Establishment

The sponsoring employer (or another group company) establishes new entities to facilitate the ABC: typically this involves the creation of a Scottish limited partnership (‘SLP‘) (though additional entities may also be involved).

1. The sponsoring employer makes a contribution to the scheme. This contribution is normally only made if the trustees have already agreed to acquire the interest in the SLP. This contribution will normally be returned to the sponsoring employer as part of the final stage of the establishment process.

2. The conditional contribution is used by the trustees to acquire a partnership interest in the SLP. The nature of this interest (eg the income rights and/or control it gives to the trustees) depends on the particular terms of the agreement[3].

3. The SLP uses the funds received from the scheme to acquire an asset from a group company, often the sponsoring employer itself. The type of asset transferred is dependent on the assets which the sponsoring employer/wider group has available. Examples of assets used to date range from real estate to intellectual property, business stock or loan notes. The payment made from the SLP to the sponsor for the purchase of the asset will generally mean that there is no net cash flow on the establishment of the ABC. The other partners of the SLP will normally be group entities (which may include the sponsoring employer).

Ongoing operation

- The sponsoring employer (or another group company) makes payments to the SLP in return for the use of the asset. The nature of the payments will depend on the type of asset held in the ABC – for example, where the asset in question is land, the sponsoring employer may pay rent to use the land, or where the asset is intellectual property (such as a brand), the sponsoring employer may pay a royalty or license fee.

- The income received by the SLP is paid to the scheme (and may be shared with other partners of the SLP), in accordance with the terms of the relevant agreement.

- This arrangement continues for the particular duration set out in the agreements. Some ABCs involve a large lump sum payment at the end of the term (to the extent that the scheme has a deficit at that stage).

- If due payments are not made under the ABC arrangement, the trustees may be entitled to exercise rights over the underlying asset. Alternatively there may be provisions in the relevant agreements requiring the scheme to seek satisfaction of the outstanding amounts directly from the sponsoring employer instead. These contractual rights may not take effect immediately on non-payment.

Footnotes for this section

- [1] Under section 227 of the Pensions Act 2004.

- [2] References to ‘sponsoring employers’ in this guidance mean a scheme’s statutory employer. Our statement identifying your statutory employer published in July 2011 provides further details.

- [3] The interests in the SLP will also be subject to applicable legislation.

Risks in relation to ABCs

9. It is important that trustees consider the risks involved in ABC arrangements as part of their assessment of any proposal, obtaining advice and considering available alternatives as appropriate.

10. The key risks that should be considered in relation to ABCs include:

- inflexible schedule of payments, delaying full funding

- weak underlying assets or limited legal claims on those assets

- masking the scheme’s overall risk profile

- weakened covenant

- illegality of the structure

- costs and complexity.

11. Some of these risks are explained further below.

Risk: Inflexible schedule of payments delaying full funding

12. Where ABCs involve long payment periods, the scheme may receive lower annual payments than under an appropriate recovery plan, and remains reliant on the ABC continuing to function for a long period until the scheme becomes fully funded[4]. An extended payment period increases the risk that the scheme will be underfunded if the ABC (or sponsoring employer or wider group) fails in the short to medium term and this risk might not be mitigated by the presence of the asset in the ABC.

13. When negotiating recovery plans, trustees and sponsoring employers should address this risk by eliminating any funding shortfall as quickly as the employer can reasonably afford. Employer growth and business plans will be a key aspect of these discussions. The regulator expects parties to follow these same principles when entering into ABCs. However, ABCs sometimes fetter trustees’ discretion in relation to funding matters, especially where the capitalised income stream from the ABC eliminates the deficit on a technical provisions basis, leaving the trustee unable to agree higher payments under a recovery plan even where they are affordable and appropriate.

14. A key flexibility in the Part 3 regime is that recovery plans must be regularly reviewed (at least every three years) and payments are tailored to a sponsoring employer’s circumstances. This means that where a sponsoring employer’s position improves, trustees can request an accelerated rate of contribution. In contrast, ABCs generally lock trustees in to a fixed payment stream over a set period, which cannot normally be accelerated however much a sponsoring employer’s position improves. In some instances, the payment stream under an ABC can end early where the scheme reaches pre-agreed certain funding targets.

15. Schemes also remain exposed to any downturn in the sponsoring employer’s fortunes even if an ABC is entered into. In most cases, the ability of the ABC to make payments to the scheme is dependent on the sponsoring employer (or wider group) making payments into the ABC (for example, rent to use a property held in the ABC). If the ABC was to fail and the scheme needed to rely on the underlying asset, its value may be intrinsically linked to the employer’s health as described below.

16. The risk to the scheme can be exacerbated where ABCs involve a payment stream which is back-end loaded and particularly where a final ‘bullet’ payment at the end of the fixed term accounts for a significant proportion of the capitalised value of the payments. Not only does the scheme rely on the arrangement continuing for a long period of time, the back-end loading also means that trustees must rely on the underlying asset in the ABC maintaining a substantial proportion of its value in the long-term. The inter-relation between the asset and the sponsoring employer in many cases will mean that the scheme is also reliant on the group continuing to be able to pay for the use of the underlying asset.

Risk: Weak underlying assets or limited legal claims on those assets

17. The underlying assets in ABCs vary from arrangement to arrangement. It is the underlying asset that supports the promised payments under the ABC, so it is important that trustees properly evaluate the extent to which the asset can underwrite these obligations. Risks can be created if too much reliance is placed on the asset by trustees.

18. It is important to note that trustees do not own the underlying asset. Instead, trustees own an interest in a special purpose vehicle (typically an SLP) which gives them an entitlement to a specified payment stream. Depending upon the particular agreement, trustees may only have access to the underlying asset where the SLP fails to make the due payments or where the sponsoring employer becomes insolvent.

19. The level of reliance which can be placed on the interest in the ABC depends on the value of the underlying asset itself and the extent to which the trustees have legal claims to the asset.

Value of the underlying asset

20. With regards to value, trustees must consider both the present value of the underlying asset (which can be problematic where there is no existing market for those assets, or where the assets are intangible) and the value of that asset on insolvency of the sponsoring employer/group. It is important that trustees do not rely solely on an audit valuation when making this assessment. Trustees should be able to clearly identify the asset which is to be transferred to the ABC and determine whether the generation of income by the ABC can be achieved by that asset alone or whether it is dependent on other assets which have not been transferred to the ABC.

21. The value on insolvency is relevant because the SLP’s ability to make the promised payments to the scheme will often be tied to the fortunes of the sponsoring employer/group. It will often be the group which funds the SLP (via the monies it pays to use the assets), and therefore the scheme will be reliant on the survival of the group to enable the promised payments to be made. Alternatively, the sponsoring employer/group may be the only conceivable purchaser of the asset from the ABC.

22. The circumstances in which the SLP is unable to make the due payments (and where the trustees will need to rely on the underlying asset) could well coincide with a failure of the sponsoring employer/group. Trustees therefore need to consider what value the asset might have where the present user of the asset (eg in the case of real estate, the lessee of the property) or the potential acquirer of the asset is insolvent.

23. The value of the underlying asset may be affected by the speed of realisation, particularly in an insolvency situation (where trustees are most likely to need to rely on the asset). Trustees should therefore consider whether the complexity of their interest (routed through one or more intermediate entities and possibly subject to notice periods before outstanding payments can be pursued) could affect the ability to access the value of the asset quickly.

24. Trustees should not confuse the value of the underlying asset with the value of their interest in the ABC. Their interest is generally limited to the remaining payments due under the ABC arrangement which may be substantially lower than the value of the asset. Such over-collateralisation may improve the likelihood of residual payments being made by the ABC on insolvency.

Legal claims to the underlying asset

25. With regards to the extent of the trustees’ legal claim to the asset, where trustees do not have ‘step in’ rights, they would rely on a number of interests being enforced (ie their interest in the SLP, and the SLP’s interest in the underlying asset, or claims directly against the sponsoring employer who may also have to first pursue its own interests in the SLP) to enable value to be extracted from the asset for the benefit of the scheme. They may not be entitled to enforce these directly, and may have to rely on another party (for example, the general partner of the SLP) to enforce the obligations.

26. ABCs are frequently described as being a ‘bond like’ investment. It is important that trustees recognise that ABCs are not necessarily as strong as bonds and that the valuation of the payment stream should be appropriately discounted (including appropriate discount rates to reflect the risk of non-receipt of distant payments). Unlike corporate bonds, the ability to sell and trade these interests is limited under the ABC arrangement. Schemes would not typically invest in a large number of corporate bonds issued by the sponsoring employer or its group (not least due to the restrictions on employer-related investment set out below).

Risk: Masking the scheme's overall risk profile

27. In most of the ABCs seen by the regulator, the future payment stream is capitalised and treated as an asset on ‘day one’. By treating the future payments due under the ABC as an asset, the scheme appears to experience an immediate improvement to its funding level[5]. However the scheme remains reliant on the sponsoring employer and/or the ABC being able to make future payments in order for the scheme to reach this target.

Risk: Weakened covenant

28. In some circumstances, the transfer of an asset to an ABC can provide additional security to a scheme. However, in other cases the establishment of the ABC could damage the employer covenant which supports the scheme.

29. The trustees may already have access to the asset proposed to be transferred to the ABC. This may be because it is owned by the sponsoring employer itself or (for example) due to another entity having provided the trustees with security over the asset. In that situation, trustees’ access to the value of that asset may be reduced if it is transferred to an ABC. This will depend on a variety of factors, including the provisions in the ABC documentation which allow for recovery by the scheme against the underlying asset (eg whether the trustee has ‘step in’ rights) and the number of creditors who might compete with the scheme if the asset remained owned by the sponsoring employer.

30. The covenant could also be damaged through the ongoing operation of the ABC. If the ABC requires payments from the sponsoring employer for the use of the underlying asset, there is the potential for covenant value to pass to other participants in the ABC structure (who may not have any obligations towards the scheme).

Risk: Illegality of the structure

31. In our November 2010 Statement we highlighted the risk that ABCs could be classed as ‘employer-related investment’ (‘ERI’) for the purposes of section 40 of the Pensions Act 1995, and that investment in such arrangements could breach the statutory restrictions on ERI.

32. If a court found that an ABC breached these restrictions, the entire agreement could be found to be void for illegality. If this was to occur, the consequences could be that, depending on how the documents are drafted, the trustees could be required to return all the payments received under the ABC, and the scheme could be left without the agreed future income stream or adequate ongoing contributions.

33. Although many advisers have described ABCs as a ‘loophole’ in the ERI regime, this issue remains untested by the courts.

Footnotes for this section

- [4] Where the scheme has sufficient assets to cover its technical provisions – see section 222 of the Pensions Act 2004.

- [5] Explained further in paragraphs 45 to 48.

The regulator's expectations of trustees

34. Trustees must ensure that they properly understand the risks and benefits of any proposed ABC arrangement by undertaking a robust evaluation of the ABC.

35. In order to evaluate a proposal, trustees will generally need to obtain extensive legal, actuarial, asset valuation and covenant advice (see the ‘Advice’ section on pages 14 and 15). Before entering into an ABC, trustees will also need to take investment advice and consider whether the decision to make the investment needs to be delegated to a fund manager[6]. Trustees must consider how the various pieces of advice interact in order to fully understand the risks and benefits of the proposal.

36. Trustees should decide whether any advantages to the scheme of entering into the ABC could be obtained through another arrangement which does not carry the restrictions which accompany ABCs – in some cases, an appropriate recovery plan alone may be a better option for the scheme than an ABC. Trustees should consider all options which they believe to be feasible, including any which the sponsoring employer has not considered or proposed, and it may be necessary for trustees to additionally obtain advice in relation to these alternatives.

37. The particular matters to be considered will vary according to the particular circumstances of the scheme and the proposed ABC. However we would expect trustees to at least consider the following:

- Trustees should assess the period and amount of payments by which the scheme’s deficit (ignoring any immediate capitalisation of payments) will be met under the proposed ABC. They should compare this to the period and amount of payments under a standard recovery plan which might be available.

- Where the ABC involves a longer (or more back-end loaded) payment period than would be available under an appropriate recovery plan, trustees should consider whether the potential value of and access to the underlying asset justifies such a payment plan. As part of this analysis, trustees should assess whether the rights of other parties to the SLP (normally the sponsoring employer or other group entities) compete with or limit the scheme’s interest.

- Trustees should consider whether the ABC provides access to any assets which are not currently owned by the sponsoring employers (or otherwise available to the scheme) and therefore do not already form part of the covenant on which the scheme can rely. Trustees should also consider whether these assets could be provided to the scheme by way of a contingent asset arrangement, such as security over the asset.

- Trustees should take account of any claims, assets or other interests which would be given up on entry into the ABC.

- Trustees need to consider whether entering into an ABC fetters their ability to negotiate increased deficit repair contributions in future, for example when a sponsoring employer’s increased profitability enables it to make additional contributions to the scheme.

- Trustees need to consider whether an ABC could restrict their ability to carry out de-risking exercises such as buy-ins, buyouts and longevity swaps.

38. In comparing available alternatives, trustees should ensure that they consider the costs of establishing, maintaining and monitoring the ABC structure. These costs are not limited to the trustees’ costs of obtaining advice, but include the costs to the sponsoring employer and the ongoing costs of running the complex structure for the entirety of the payment term.

39. Trustees should act in accordance with the principles set out in the regulator’s code of practice on funding. Trustees should also recognise the importance, to the scheme, of the sponsoring employer’s ability to invest to maintain or grow their business (and improve the covenant being offered to the scheme) when assessing the reasonable affordability of contributions (whether under the ABC or an alternative).

40. Given the significant impact ABCs can have in relation to the long term funding of a scheme, trustees should be aware of the potential for conflicts of interest to arise in relation to both the trustee body and their advisers. Trustees should consider the regulator’s guidance on conflicts[7] and take appropriate steps to mitigate any conflicts which are identified.

Advice

A wide range of advice should be obtained by trustees so that they understand the risks and benefits provided by the ABC.

The particular advice to be considered will vary according to the particular circumstances of the scheme and the proposed ABC, however we would expect trustees to at least consider the following legal, asset valuation, actuarial and covenant advice.

Legal advice, including:

- The risks in relation to the ABC arrangement being caught by the ERI restrictions set out in section 40 of the Pensions Act 1995.

- Whatever advice is given above, given the impact of ERI risks, advice on the adequacy of any proposed underpin to protect the scheme if the ABC proves to be void for illegality.

- The payments due under the ABC, including:

- the extent to which the sponsoring employer or wider group is funding the SLP (enabling it to make payments to the scheme)

- the trustees’ entitlement to distributions by the SLP

- the circumstances in which trustees can access the value of the underlying asset, their ability to control any sale of the asset to realise the value and any other party’s entitlement to any share of the value of the asset, including on insolvency of the sponsoring employer or wider group.

- The impact of entering into the ABC arrangement on their rights and duties under Part 3 of the Pensions Act 2004, including whether the ABC fetters the trustees’ discretion to seek increases to the rate of funding.

- The other matters set out in Appendix C (legal considerations when considering arrangements to increase scheme security including contingent assets) of our monitoring employer support guidance[8].

Advice on asset valuation, in addition to any audit valuation including:

- The valuation of the underlying asset. That advice must include consideration of the value that can be expected to be realised in the event of an insolvency of the sponsoring employer or wider group, taking into account any relevant interrelation between the asset and the group (both in terms of the use of the asset and the potential pool of buyers).

- The net present value to be attributed to the payment stream, taking account of the term of the payment stream, back-end loading, growth assumptions in the payment stream, illiquidity, the impact of triggers which might suspend payments, the risk of default and any uncertainty around the valuation of the underlying asset in insolvency (including any legal advice as to claims on the asset in insolvency).

Covenant advice, including:

- What level of cash contributions are reasonably affordable by the sponsoring employer.

- What contingent assets the sponsoring employer might be able to provide.

- Whether the establishment of the ABC (including the transfer of assets from the sponsoring employer or another group company to the special purpose vehicle) weakens the sponsor’s covenant.

- The practicality of exercising any ‘step in’ rights or powers of sale in relation to the underlying asset in the event of insolvency.

- Investment advice is also needed before trustees enter into an ABC and any fund manager with delegated authority may need to make the investment decision. Trustees may also need to take advice on whether any consequential changes to the remainder of the scheme’s investment portfolio would be necessary.

- Actuarial advice is also required to enable the trustees to understand how the proposed ABC interacts and integrates with the overall longer term funding plan. In addition advice is required as to how the proposed ABC compares to any alternative funding plans that may be under consideration.

Underpin

41. In line with the principles of good governance and risk management, the regulator expects ABC arrangements to include an ‘underpin’ to protect the scheme’s position, for example in the event that the courts find that ABCs are void for illegality or where there is a change in the law.

42. The underpin should be robust and certain, and ensure that a scheme is not made worse off due to an ABC being found to be void. The underpin should cover both:

- any repayment to the scheme of monies previously received under the ABC but returned, and

- future payments (reflecting the fact that the scheme would lose the income stream and any security from the ABC).

43. The underpin should be in a separate agreement so that any illegality of the ABC structure does not make the underpin itself void. One approach would be an agreement under which the sponsoring employer agrees, until such time as a recovery plan can be agreed, to provide an income stream equal to the future payments which would otherwise have been due under the ABC (or in the early years of operation of an ABC the employer could agree to make the payments that would have been required under an alternative appropriate recovery plan), and for the employer to immediately contribute to the scheme an amount equal to the monies which the scheme has had to return as a consequence of the illegality. An ‘agreement to agree’ an alternative funding plan is not adequate.

44. Where trustees have entered into an ABC which does not contain an adequate underpin, we would expect trustees and employers to rectify this situation as soon as practicably possible.

Proper assessment of the scheme's risk profile

45. The regulator encourages trustees to take an integrated approach to managing risks, focussing on an understanding of covenant, investment and funding. ABCs can distort the understanding of these elements by making it appear as if the scheme has more assets than are currently available and is therefore less reliant on the sponsor than is actually the case.

46. The assessment of covenant, investment and funding can influence the way in which trustees approach a number of matters in the normal operation of a scheme. These include the exercise of investment powers, decisions about whether transfer values should be reduced and the attitude to the departure of sponsoring employers.

47. When making such decisions, in order to fully understand the scheme’s risk profile, trustees should ‘unpack’ the ABC arrangement by disregarding the net present value attributed to the ABC in the scheme’s accounts, and instead recognising the ABC as a funding stream. This ‘unpacking’ process will enable trustees to clearly identify the extent to which the scheme’s future funding flow depends on payments being made from the ABC, the period over which those payments will be made and whether they are back-end loaded. Trustees should carefully consider whether any reliance should be placed on those future payments.

48. In considering the covenant, trustees should ensure that they do not ‘double count’ any assets transferred to the ABC vehicle.

Reporting

49. If trustees decide to enter into an ABC, the regulator expects them to explain the decision to members in the next available communication. The communication should be clear about funding implications (for example, explaining that whilst the acquisition of the interest might be characterised as a large ‘up front’ contribution, the scheme will actually receive smaller payments over a long period), the extent to which the scheme remains reliant on the sponsor/group and why this arrangement benefits the scheme.

50. Trustees must also report any investment in an ABC to the regulator. The annual scheme return requires trustees to provide brief details of any ABC and we are likely to ask trustees for further details where we receive such notification. Trustees should be prepared to respond to queries regarding the ABC including details of the payment stream and the nature of the underlying asset. Trustees can also notify us at the time at which ABC proposals are made.

51. Where trustees are required to lodge valuation summaries as part of the regular Part 3 valuation process, reference should be made to any ABC which is in place.

Footnotes for this section

- [6] Where trustees are not authorised or exempt to make relevant investment decisions under the Financial Services and Markets Act 2000 or have otherwise decided to delegate such decisions in accordance with section 34(2) Pensions Act 1995.

- [7] Conflicts of interest module of our code of practice.

- [8] Assessing and monitoring the employer covenant.

- [9] This ‘unpacking’ process should not affect the accounting treatment of the ABC for the purpose of producing the scheme’s accounts.

The regulator's approach to ABCs

52. The regulator does not ‘approve’ ABC arrangements and does not provide advice on individual arrangements. However where appropriate we will challenge trustees’ decisions to enter into ABCs. We will also take account of the impact of ABCs on schemes’ funding positions when considering the exercise of our functions.

53. In keeping with our general approach, we will operate in a risk-based and proportionate manner and will consider the effect of ABCs on a case-by-case basis.

54. If we have concerns about an ABC we may consider our full range of powers as appropriate[10].

Funding

55. When considering an actuarial valuation, the regulator will evaluate the nature of the scheme’s interest in the ABC and assess the proportion of the scheme’s assets made up of the net present value attributed to the payment stream.

56. Where we consider that the valuation of the payment stream is material the regulator will ‘unpack’ the effect of the ABC. In other words, when considering the valuation and the scheme’s funding plans, we will look behind the net present value attributed to the ABC and consider the aggregate funding stream provided under any recovery plan and the ABC.

57. If the payment period under the ABC is longer (or more back-end loaded) than an appropriate recovery plan then we will ask trustees to explain how they have concluded the value of and access to the underlying asset justifies the extended period for the scheme to become fully funded.

58. Trustees should be able to clearly demonstrate to the regulator why they have agreed to the ABC. Trustees should be able to show, after proper consideration of other options, how they have reached the conclusion that entering into an ABC is in the best interests of beneficiaries.

Footnotes for this section

- [10] Further information about powers in relation to potential ERI breaches is contained in our November 2010 statement employer related investments.