A review of defined benefit (DB) pension schemes with valuation dates between September 2019 and September 2020 (Tranche 15).

Published: 30 June 2020

Introduction

This analysis of the expected positions of DB pension schemes with valuation dates between 22 September 2019 and 21 September 2020 (Tranche 15) gives further context to our 2020 Annual Funding Statement (AFS) but does not supersede it. The analysis is necessarily technical in nature and so is primarily aimed at a more technical audience than the main 2020 AFS.

In modelling the impacts of market conditions on schemes, we have made a number of approximations based on the high-level and limited data we hold, which means we cannot take account of all scheme-specific characteristics. The position of individual schemes will vary depending on a number of individual factors, not considered here.

For the purpose of this analysis, other than a 0.1%pa reduction to reflect de-risking of schemes’ investment strategies, we have assumed that liabilities are calculated using discount rates which have the same margin over gilt yields that they had at a scheme’s last valuation date. Trustees may decide to choose different assumptions for their Tranche 15 valuations.

The strength of the employer covenant is a key consideration for trustees and employers when setting their funding strategies. In previous years’ analysis, we have shown trends in potential employer affordability. This analysis was based on historic, publicly available information on profit, shareholder funds and dividend payments. Given the significant and uneven impact of the COVID-19 crisis on scheme employers, for many schemes recent trends in employer affordability based on historic data are likely to be of little use in assessing employer affordability today. Consequently, we have excluded trends in employer affordability from this year’s analysis. We have also excluded data showing segmentation of Tranche 15 schemes into the AFS categories (A-E) as this data is also based on historic assessments of employer covenant.

This material and the work involved in preparing it are within the scope of and comply with the Financial Reporting Council’s Technical Actuarial Standard 100. For the purpose of this standard, the users of this material are considered to be the regulated community for UK occupational DB pension schemes.

Summary

Market conditions and impacts on scheme funding levels

Our analysis shows that most major asset classes invested in by UK pension funds achieved substantially positive returns over the three years to 31 December 2019. However, following the onset of the COVID-19 crisis, most major asset classes apart from government bonds fell in value. Over the three years to 31 March 2020, returns on government bonds remained substantially positive while returns on other asset classes were lower and, in some cases, negative.

For example, over the period from December 2016 to December 2019, the FTSE All World (excluding UK) returned +22% in sterling terms whereas the return over the period March 2017 to March 2020 was -12% (ie a fall in value). The return on FTSE British Government fixed over 15 years index was +16% over the three years to December 2019 and +26% over the three years to March 2020 (see table 1).

Nominal gilt yields were lower at all maturities at 31 December 2019 and 31 March 2020 than they were three years earlier. Real yields were lower at 31 December 2019 and 31 March 2020 than they were three years earlier at short and medium durations but higher at longer durations (see figures 1 and 2).

For the purpose of this analysis, and in line with last year’s analysis, to reflect de-risking due to schemes maturing we have assumed the out-performance assumption used in the discount rate relative to gilt yields has reduced by 0.1% over the period from the scheme’s valuation date. Other than this, we have assumed that liabilities are calculated using discount rates which have the same margin over gilt yields that they had at a scheme’s last valuation date. Coupled with the decrease in gilt yields this means the technical provisions (TPs) are likely to have grown over the three years to 31 December 2019 and 31 March 2020, respectively.

Overall, our modelling also suggests that schemes undertaking valuations at 31 December 2019 will have shown improved funding levels and deficits from those reported three years previously and the current recovery plan (RP) would be on track to remove the deficit by the end date. Schemes undertaking valuations at 31 March 2020 will have worsened funding levels and deficits compared to those reported three years previously (see figures 5a and 5b). Given the daily volatility, we have considered the position for schemes undertaking valuations at 5 April 2020 and have found it similar to schemes undertaking valuations at 31 March 2020.

The AFS was published on 30 April 2020. By that time, equity markets had risen around 10% since 31 March 2020. Gilt and bond prices had risen by around 5% over the same period. Overall, funding levels increased slightly compared to 31 March 2020.

However, the position for individual schemes will vary greatly compared with our aggregate estimates. This variation will depend on scheme-specific inter-valuation experience, valuation dates, funding assumptions and investment strategies. For example, funding levels of schemes with high levels of interest rate hedging and low exposure to equity markets will not have fallen as sharply over the period 31 December 2019 to 31 March 2020 as funding levels of schemes with low levels of hedging and high exposure to equity markets. Some schemes will have seen a small or no fall in funding level over this period, whereas others will have seen a significant fall. This variation in funding level is demonstrated in figures 6a and 6b.

Implications for recovery plans (RPs) and affordability

Our analysis shows that the COVID-19 crisis will have had a substantial and varied impact on funding levels. Funding levels for many schemes will be substantially lower at 31 March 2020 (and 5 April 2020) than they were at 31 December 2019.

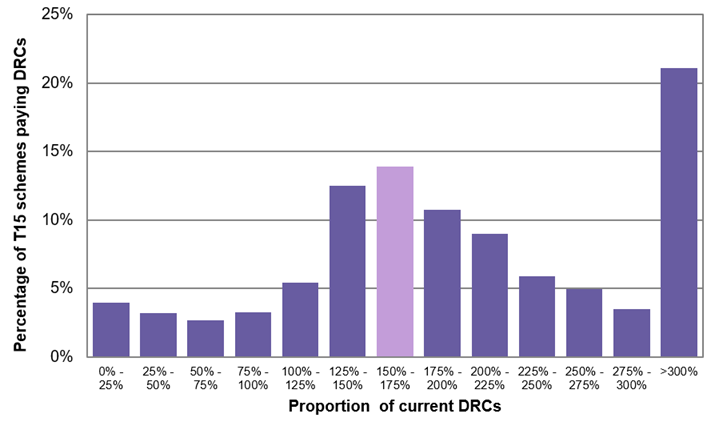

Our modelling shows that if Tranche 15 schemes all had 31 March 2020 valuation dates and were to retain their RP end dates, or for those schemes nearing the end of their RP make a modest increase in the RP length (to bring the length to three years), the median required increase in deficit repair contributions (DRCs) would be around 50% to 75% (see figure 7). Fewer than 15% of schemes would be able to retain their DRCs at the same level or less, while around 20% would need to increase DRCs to more than three times their current level. Some of this latter group of schemes would need to increase DRCs by a much more than this.

In practice, due to the COVID-19 crisis, DRCs may be limited by employer affordability, especially in the short term.

Market indicators

Scheme funding is sensitive to the impact of the changes in market conditions on schemes’ assets and the valuation of their liabilities.

Common valuation dates

End of December and end of March are the most common valuation dates for schemes in this tranche. Hence, we have concentrated on these dates in this analysis.

5 and 6 April are also quite common valuation dates. We have not presented analysis at these dates. However, market conditions at 5 and 6 April 2020 were similar to those at 31 March 2020.

Bond yields

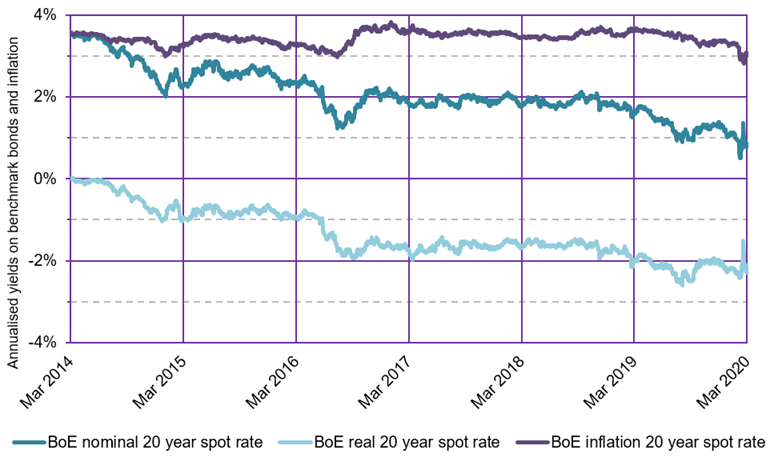

Figure 1 shows the Bank of England estimates of nominal and real gilt yields and implied inflation as measured by the Retail Prices Index (RPI) at a 20-year duration at each date from March 2014 to 31 March 2020.

Figure 1: Benchmark yields

Sources: Bank of England (BoE), Thomson Reuters

There has been a significant fall in gilt yields since March 2014. Long-term real gilt yields fell into negative territory in 2014 and have remained negative ever since. Nominal yields have fallen in the same fashion. Both long-term real and nominal yields suffered volatility in March 2020.

Long-term market implied inflation has remained mainly in the range 3%pa – 4%pa over the six-year period, falling slightly below 3%pa during March 2020.

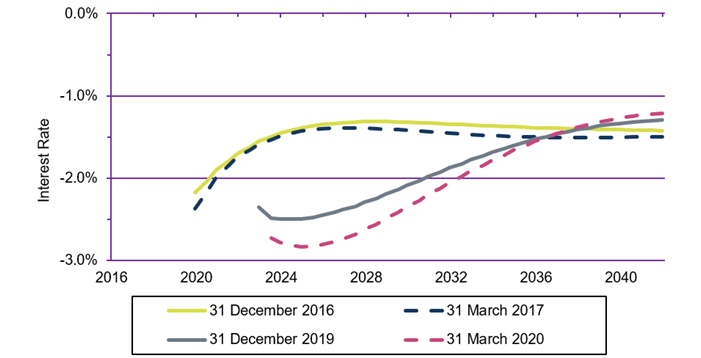

Figure 2 shows the real forward interest rates as estimated by the Bank of England as at the end of December 2016, March 2017, December 2019 and March 2020

Figure 2: UK instantaneous real forward gilt curves

Source: BoE

This chart shows that over the periods December 2016 to December 2019 and March 2017 to March 2020 the implied real forward interest rate curve has changed shape. There has been a significant fall in real interest rates in the short and medium parts of the curve and a rise in real interest rates at the long end of the curve.

All other things being equal and using our best judgement about the net effect of changes in the real yield curve, we expect that if trustees use a discount rate to calculate liabilities that has the same margin above gilt yields at the previous valuation, schemes will have a higher reported value for their liabilities than they were expecting.

Asset returns

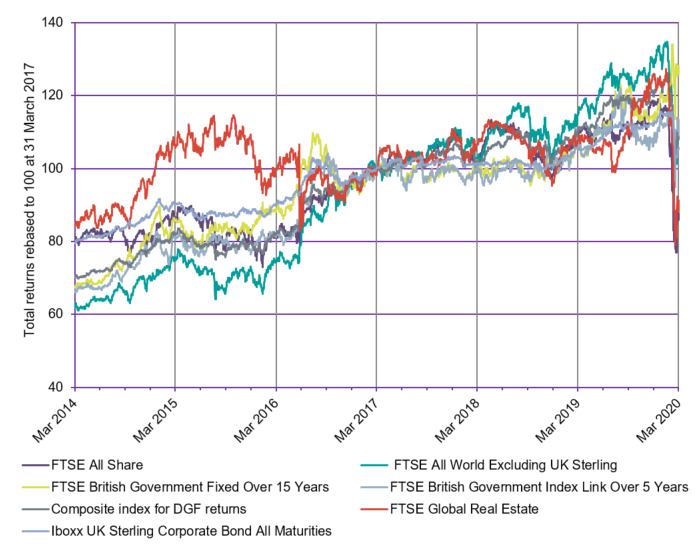

Figure 3a shows total returns for a range of asset class indices since 2014. The returns have been re-based to 100 at 31 March 2017, so the chart shows the relative change from that point. Figure 3b shows the same data for January to March 2020, to show the volatility during that period.

The charts show the same output as previous years except the Hedge Fund index. In our experience, we see many funds allocating Diversified Growth Funds (DGFs) to the Hedge Fund category, so we have created a composite index to approximate the returns achieved by DGFs. This index is 60% of the FTSE All World United Kingdom Sterling Index, 20% of the Iboxx United Kingdom Sterling Corporate All Maturities Total Return Index and 20% FTSE British Government Fixed All Stocks Total Return Index.

Figure 3a: Asset returns

Source: Thomson Reuters

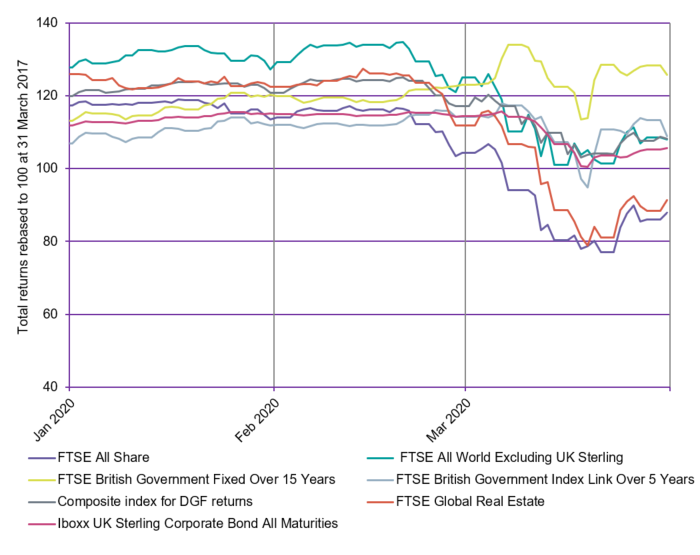

Figure 3b shows the same index as figure 3a above but focuses on the period from 1 January to 31 March 2020.

Figure 3b: Asset returns – January to March 2020

Source: Thomson Reuters

Table 1 shows the total returns in UK Sterling for various asset indices over the periods December 2016 to December 2019 and March 2017 to March 2020.

Table 1: Total returns in UK Sterling from different asset classes over the three years to 31 December 2019 and 31 March 2020

| Index name (Asset class) | Total returns over the period 31 December 2016 to 31 December 2019 |

Total returns over the period 31 March 2017 to 31 March 2020 |

|---|---|---|

| FTSE All Share (UK equities) |

22.0% | -12.2% |

| FTSE All World Excluding UK Sterling (Overseas equities) |

35.4% | 8.0% |

| Iboxx UK Sterling Corporate Bond All Maturities (Corporate Bonds) |

14.0% | 5.6% |

| FTSE British Government Fixed Over 15 Years (Fixed interest gilts) |

16.1% | 25.8% |

| FTSE British Government Index Link Over 5 Years (Index linked gilts) |

9.1% | 9.0% |

| Composite DGF index | 25.4% | 8.1% |

| FTSE Global Real Estate (Property) |

28.0% | -8.7% |

Over the three years to December 2019, most asset classes saw positive returns, with equity and property returns being significantly positive.

Following the COVID-19 crisis, returns on all asset classes apart from government bonds fell back significantly (much more so than any positive returns in first quarter of 2017). So, returns over the three years to March 2020 were low or negative for most asset classes but were significantly positive for government fixed-interest bonds.

By the time the AFS was published on 30 April 2020, equity markets had risen around 10% since 31 March 2020. Gilt and bond prices had risen by around 5% over the same period.

DB schemes

Funding position of DB schemes in aggregate

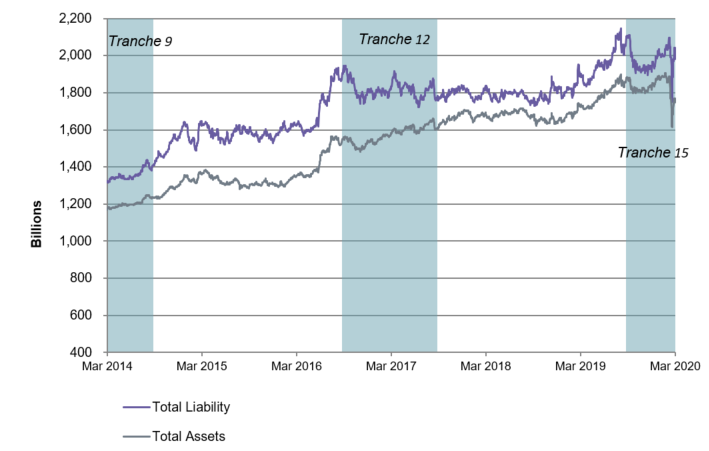

Figure 4 shows estimates of assets and liabilities (technical provisions) for all schemes in our regulated DB universe. This is an aggregate analysis based on highly summarised data.

Figure 4: Estimated assets and liability positions of DB pension schemes

Sources: TPR, Thomson Reuters (financial markets data)

Overall, the changes in market conditions and schemes’ funding plans mean that deficits on a TPs basis for the DB universe are expected to be smaller at December 2019 than at December 2016. Deficits at March and April 2020 are expected to be higher those three years earlier.

Potential impact on scheme deficits in more detail

The analysis above showed how funding levels have changed for all schemes in the DB universe. This may not be representative of the tranche of schemes undertaking valuations now. Figures 5a and 5b illustrate the key drivers in the change in deficit for all Tranche 15 schemes at the two most common valuation dates – 31 December and 31 March.

We have assumed that the discount rates that are used to calculate the liabilities of each scheme have changed since the previous scheme valuations broadly in line with two factors:

a) the movement in real and nominal gilt yields over the period, and

b) the movement in investment portfolios from growth seeking to matching assets

We have seen evidence to support a small reduction in the expected returns in excess of gilt yields as a result of schemes investing in more matching assets. This has resulted in a small item in figures 5a and 5b called ‘change in relative expected outperformance’.

In previous years’ analysis, we also considered how discount rates may have changed as a result of changes in expected returns on return-seeking assets since the previous scheme valuations. Given the uncertainty provoked by the COVID-19 crisis, it is difficult to assess how expected returns on return-seeking assets may have been affected. There will be divergent views. To provide a benchmark for illustrative purposes, we have undertaken this year’s analysis assuming schemes do not change their expected returns. So, apart from the change to reflect de-risking, we have used liability discount rates at the same margin above gilt yields as at each scheme’s previous valuation date. In practice, schemes may use different approaches to setting discount rates and may also have different views now on prudent expected returns from the same portfolio than they had at the previous valuation.

In addition to consideration of financial assumptions, our analysis assumes that the mortality base table assumptions used by the scheme actuary at the last valuation remain unchanged. However, future improvements are updated to use the latest Continuous Mortality Investigation (CMI) projections with no change to long-term rates of improvement. (While this is appropriate for the purposes of the simplistic analysis of schemes in general, what will be appropriate for individual schemes will depend on their specific circumstances. Note, at the time the analysis was performed we used CMI 2018 projections.) For the purpose of this analysis, we have not attempted to quantify the potential impact of COVID-19 on schemes’ mortality experience or assumptions.

The method used to estimate the movement in the deficits over the three-year periods presented below is necessarily simplistic. We expect scheme actuaries to have access to more detailed scheme data, which will allow a more in-depth reconciliation to take place. The method and simplifications we have made in these reconciliations are contained in the ‘methods, principal assumptions and limitations’ appendix.

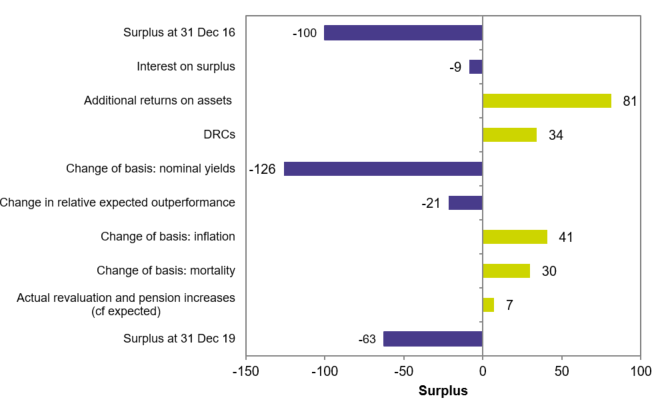

In figures 5a and 5b, the starting deficit for all schemes has been notionally set to 100 to allow for easy comparison of the change over the period. The size of the bars shown on the chart illustrates the relative impact of each of those items on the deficit over the period.

Figure 5a: Estimated impact of market conditions on deficits of all Tranche 15 schemes – December 2016 to December 2019

Sources: TPR, Thomson Reuters

We estimate that the aggregate deficit of Tranche 15 schemes as at 31 December 2019 would have reduced from three years ago. This is because deficit contributions, better than expected asset returns, a reduction in expected inflation and updated assumptions for future mortality improvements have more than offset the increase in liabilities due to changes in nominal yields and the reduction in relative expected outperformance.

However, it is expected that deficits have increased since 31 December 2019. This post-valuation experience can be reflected in schemes’ funding plans.

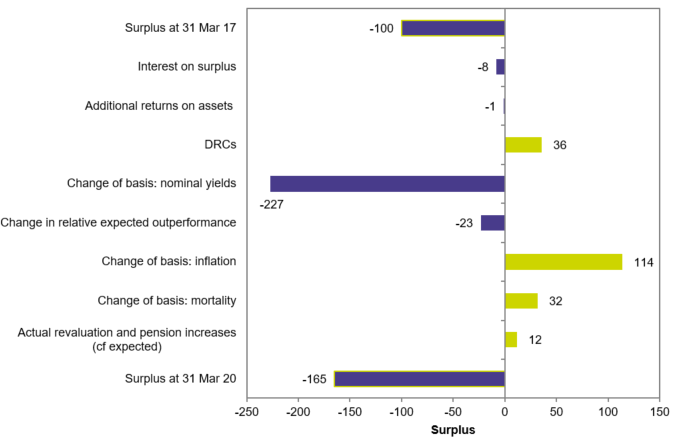

Figure 5b: Estimated impact of market conditions on deficits of all Tranche 15 schemes – March 2017 to March 2020

Sources: TPR, Thomson Reuters

We estimate that the aggregate deficit of Tranche 15 schemes as at 31 March 2020 would have increased significantly from three years ago. This is mainly due to financial market movements over the three months to 31 March 2020 - asset returns in most asset classes had fallen and real interest rates had also fallen further across much of the yield curve.

By the time the 2020 AFS was published on 30 April 2020, funding levels will have increased slightly compared to the position at 31 March 2020.

Variation of impact on scheme deficits – all schemes

The analysis above will not be representative of the impact of market conditions on individual schemes. Different schemes will have had different experiences depending on their individual investment strategies and funding plans.

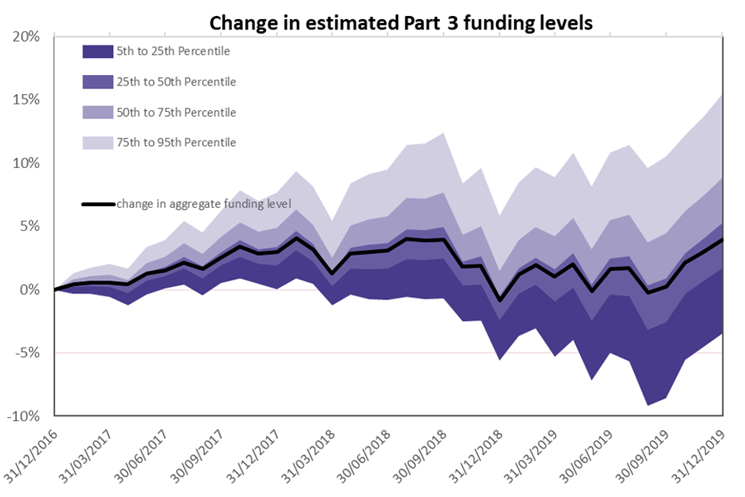

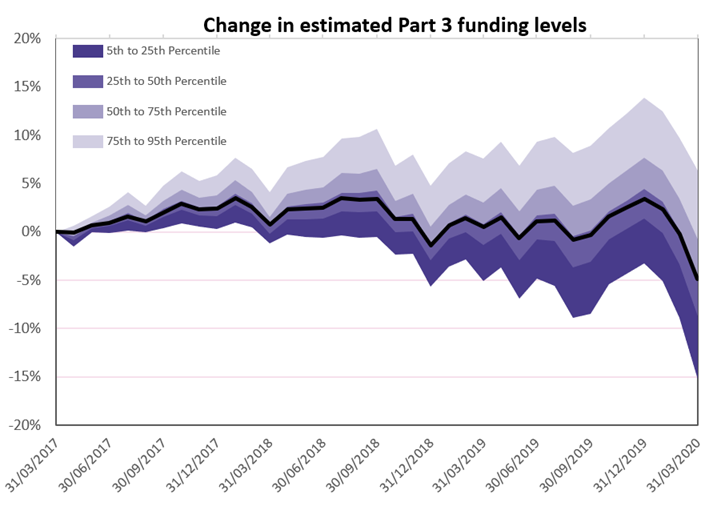

We have illustrated this variation in figures 6a and 6b. These illustrations estimate how the funding level of each scheme has changed over the three-year period to 31 December 2019 (figure 6a) and to 31 March 2020 (figure 6b). Note that these illustrations show changes in funding level and not the funding levels themselves.

Figure 6a: Variation of impact of market conditions on deficits of all schemes – December 2016 to December 2019

Sources: TPR, Thomson Reuters (financial markets data)

Over the three-year period to 31 December 2019, the average funding level (the black line in figure 6a) increased slightly, as has already been illustrated in the earlier analysis (for example figures 4 and 5a). However, the experience of individual schemes varied significantly. Five percent of schemes saw estimated funding levels fall by more than 3%, whereas 5% of schemes saw estimated funding levels rise by more than 15% over the three-year period.

Figure 6b: Variation of impact of market conditions on deficits of all schemes – March 2017 to March 2020

Sources: TPR, Thomson Reuters (financial markets data)

Over the three-year period to 31 March 2020, the average funding level (the black line in figure 6b) fell, as has already been illustrated in the earlier analysis (for example figures 4 and 5b). However, the experience of individual schemes has varied significantly. Five percent of schemes saw funding levels fall by more than 15%, whereas 5% of schemes saw funding levels rise by more than 5% over the three-year period.

The most significant factors in driving the variation of experience between schemes are the extent to which schemes hedge interest rates and the extent to which schemes are invested in growth asset classes (eg equity and property). Interest rate hedging was positive for schemes over the three-period to 31 December 2019 and the three-year period to 31 March 2020. Investment in equities and property was positive for schemes over the three-year period to 31 December 2019 but negative for schemes over the three-year period to 31 March 2020.

For the purpose of this analysis, to estimate the level of hedging we use PV01 and IE01 data, provided along with a scheme’s asset data. If these aren’t available, we make an assumption based on the scheme’s asset portfolio as to the extent of interest rate and inflation hedging.

Employer trends

As well as the impact of market conditions on a scheme, changes in the strength of the employer covenant are a key consideration for trustees and employers when considering funding plans and integrated risk management (IRM).

In previous years’ analysis, we have shown trends in potential employer affordability, which were based on historic publicly available information. Given the significant and uneven impact of the COVID-19 crisis on scheme employers, recent historic trends in employer affordability are of limited use in assessing employer affordability today. Consequently, we have excluded trends in employer affordability from this year’s analysis.

Implications for scheme funding

The analysis in this report shows that many schemes are likely to have larger deficits than those revealed at their previous valuation date. This is particularly true of schemes with valuation dates in March and April 2020. Many schemes with earlier valuation dates will also have suffered poor post-valuation experience.

Trustees would generally have expected their funding position to have improved over three years since their previous valuation, in accordance with their RP. However, given market movements over the period, it is likely that many schemes’ RPs will not be on track.

In addition, the COVID-19 crisis may have impacted the extent to which employers can afford to make DRC payments. For some employers, affordability will have significantly reduced, at least in the short term.

Therefore, we expect some trustees will need to make changes to their RP to reflect changes in their scheme’s funding level and changes in extent to which employers can afford to make DRC payments.

Potential impact on DRCs – scheme funding levels

Figure 7 below illustrates the potential impact on DRCs for Tranche 15 valuations assuming a 31 March 2020 valuation date. The impact is expressed as a percentage of the level of current DRCs (ie what was agreed in Tranche 12 valuations). We have assumed, for the purpose of illustration and to remove the distorting impact of short remaining periods, that each scheme aims to eliminate the deficit over three years or the remaining term of the RP agreed at the last valuation, whichever is longer.

Figure 7: Modelled Tranche 15 DRCs as a proportion of current DRCs – based on same RP end date as last valuation, or three years if longer

On these assumptions, fewer than 15% of schemes would be able to retain their DRCs at the same level or reduce them. Forty percent of schemes would need to increase to DRCs by between 0 and 100%. Around 20% would need to increase DRCs to more than three times their current levels. Some of this latter group of schemes would need to increase DRCs by a much higher factor than three.

Further examination of the schemes in the last category showed that many of them currently have shorter RPs than the average. In these cases, a relatively small increase in the RP length would lead to a much lower increase in the level of DRCs required.

This analysis does not take into account whether the current level of DRCs remain affordable nor does it consider what level of contributions is affordable.

Potential impact on DRCs - employer affordability

A key factor for trustees and employers when agreeing an appropriate RP is the affordability position of the employer, recognising that what is affordable may be affected by the employer’s plans for sustainable growth. The COVID-19 crisis may have impacted the extent to which individual employers can afford to make DRC payments. For some employers, affordability will have been significantly reduced and will be the limiting factor for DRCs, at least in the short term.

Methods, principal assumptions and limitations

Scheme data

We rely solely on the information supplied to us via scheme returns, which may not be completely up-to-date or contain the level of detail that would be available to scheme actuaries when advising trustees. This inevitably leads to many more simplifications and approximations in the methods we use to estimate aggregate and individual funding positions, compared with the more robust calculations carried out for formal valuation and RP reporting by scheme trustees.

Many of these assumptions or simplifications have been driven by data limitations. For example, we have used index tracking of major asset classes, made no allowance for detailed changes in asset strategy since the previous valuation, and made only a broad allowance for the effect of hedging instruments to mitigate interest rate or inflation risk.

Additionally, we have made assumptions about scheme liabilities in aggregate that may not accurately reflect the underlying liabilities of individual schemes.

The baseline for estimating the current deficit of each scheme is based on the results reported to us following its last valuation, adjusted approximately for contributions paid and movements in assets and liabilities in line with appropriate indices. Our analysis relies upon point-in-time valuations of schemes’ assets and liabilities.

We have assumed that the discount rates that are used to calculate the liabilities of each scheme have changed since the previous scheme valuations broadly in line with two factors:

a) the movement in real and nominal gilt yields over the period, and

b) the movement in investment portfolios from growth seeking to matching assets

The overall resulting discount rates have, on average, slightly lower margins over gilt yields compared to those assumed by the scheme actuaries at the previous valuation and the nominal (and real) discount rates are lower. We have assumed that future expected returns in excess of gilt yields for each asset class have remained unchanged for the purpose of estimating liabilities. In practice, schemes may use different approaches to setting discount rates and may also have different views on prudent expected returns from the same portfolio.

The analysis assumes that the mortality base table assumptions used by the scheme actuary at the last valuation remain unchanged, but that future improvements are updated to use the 2018 version of the CMI projections with no change to long-term rates of improvement.

For the purposes of our aggregate analysis, to estimate the level of hedging, we use PV01 and IE01 data provided along with the scheme’s asset data. If these aren’t available, we make an assumption based on the scheme’s asset portfolio as to the extent of interest rate and inflation hedging.

When estimating the impacts on RPs, we have used the simplifying assumption that all Tranche 15 schemes have their next actuarial valuation as at 31 March 2020.

The assumptions we have made may be a significant source of difference when compared with formal valuation results at the individual scheme level. In particular, for individual schemes, the results will be highly dependent on the following:

- The exact date of valuation.

- The scheme’s asset strategy, including any changes made during the inter-valuation period.

- The extent of hedging against interest rates and inflation.

- Any changes to its mortality and longevity assumptions to reflect new information and emerging experience.

- The scheme’s assessment of the appropriate discount rate to measure its liabilities.

For example, if trustees choose to use discount rates that are higher than we have assumed, then the estimated liabilities and deficits are likely to be lower than those modelled in this analysis, and vice versa.

Employer and contribution data

We rely solely on the information supplied to us via scheme returns to identify our employer population, which may not be up-to-date or contain the level of detail that would be available to covenant advisers when advising their clients. This inevitably leads to many more simplifications and approximations in the methods we use to estimate aggregate and individual covenant support.

The information on DRCs we collect covers DRCs expected in each year of the associated RP, with additional information as to the date the RP began and ends. DRCs are assumed to be paid continuously: 1/365th of DRCs in year one of the RP are assumed to be paid on every day of the year.

Employer covenant

The strength of the employer covenant is an important element in scheme funding and a key part of IRM. We use a number of metrics relating to employers to determine the covenant risk. However, we recognise that this is a highly complex area and that a one-size-fits-all approach to looking at the employer covenant would miss the many complexities and nuances of individual employers. For these reasons, we combine the use of metrics with professional judgement when assessing covenant.

Assessing the covenant is about understanding the extent to which the employer can support the scheme, now and in the future, including the risks to this support being available when it is needed. The focus should be on the ability of the employer to make cash contributions to the scheme to achieve and maintain full funding over an appropriate period, including addressing downside risks.

COVID-19 has resulted in considerable uncertainty over some employers' covenant strength and their affordability to address deficits in schemes. However, the impact will be varied across the landscape and we anticipate some businesses will recover more quickly than others.

Glossary

Deficit repair contributions (DRCs)

These are contributions made by employers to the scheme in order to address any deficit in the value of the assets compared to the technical provisions (TPs), typically in line with the Schedule of Contributions and the recovery plan (RP). For the purpose of this analysis, we have assumed current contributions to be those in year 4 of the RP agreed at the Tranche 12 valuation, except for RPs which were shorter than four years where we have assumed that the contributions paid in the last full year of the plan have continued. Throughout this analysis we have used deficit repair contributions (DRCs) in the context of the value the scheme receives without making any allowance for any tax benefit the sponsoring employer may receive.

IRM

Integrated risk management (IRM) is a risk management approach that can help to identify, manage and monitor the factors that affect the prospects of meeting scheme's funding objectives. It involves examining how employer covenant, investment and funding risks relate to and are affected by each other. It also considers what to do if risks materialise.

Recovery plan (RP)

Under Part 3 of the Pensions Act 2004, where there is a funding shortfall at the effective date of the actuarial valuation, the trustees must prepare a plan to achieve full funding in relation to the TPs. The plan to address this shortfall is known as a recovery plan.

RP length

The RP length is the time that it is assumed it will take for a scheme to eliminate any shortfall at the effective date of the actuarial valuation, so that by the end of the RP it will be fully funded in relation to the TPs.

Technical provisions (TPs)

The funding measure used for the purposes of Part 3 valuations. The TPs are a calculation undertaken by the actuary of the assets needed at any particular time to make provision for benefits already accrued under the scheme, using assumptions prudently chosen by the trustees, and are required for the scheme to meet the statutory funding objective. These include pensions in payment (including those payable to survivors of former members) and benefits accrued by other members and beneficiaries, which will become payable in the future.

Tranches

‘Tranche’ refers to the set of schemes that are required to carry out a funding valuation within a particular time period. Schemes whose valuation dates fall between 22 September 2019 and 21 September 2020 (both dates inclusive) are in Tranche 15. Because scheme-specific funding valuations are generally required every three years, these schemes (with a few exceptions) had their last formal valuation in Tranche 12 (valuation dates between 22 September 2016 and 21 September 2017).