Annual Funding Statement analysis 2025

Scheme funding analysis of the defined benefit (DB) pension schemes universe as at 31 December 2024.

Published: 29 April 2025

On this page

Introduction

The scheme funding analysis sets out the results and analysis of our modelling of the occupational defined benefit (DB) universe as at 31 December 2024 based on a technical provisions (Part 3) funding basis.

We calculated these figures by adjusting schemes' latest actuarial valuations to the same date. We used scheme data provided to The Pensions Regulator (TPR) through the scheme return or submit a recovery plan, combined with relevant financial market information and actuarial assumptions.

Our calculations use broad assumptions and approximations combined with general actuarial methods and techniques. This is due to the high level and limited data that we hold. We cannot take account of all scheme-specific characteristics, and the actual position of individual schemes will vary. A scheme's individual funding position will depend on a number of factors not covered in our data or methodology. In particular, actual investment returns, levels of hedging applied over the inter-valuation period and asset sales for any collateral payments on leveraged LDI strategies will be scheme-specific and likely to differ from those assumed by our modelling.

The figures in this report are based on revisions to our internal model, so that the results presented here will enable consistent comparisons with other external organisations that also publish occupational DB asset and liability values. As such, we have recalculated previous years' figures using this revised method so these figures cannot be directly compared to figures we published before.

This material and the work to prepare it comply with the Financial Reporting Council's Technical Actuarial Standard 100. For this standard, the users of this material are the trustees of the DB schemes we regulate, the employers that fund those schemes, and their actuarial advisers. We assume these users are familiar with occupational DB scheme funding terminology.

Summary

We have seen significant changes in scheme asset strategies over the last 20 years, such that, the majority of scheme assets are now invested in bonds, including leveraged LDI investment strategies. As such often the most important factor that changes the value of scheme assets and liabilities is the movement in gilt yields. We have observed a significant increase in gilt yields (with the associated significant fall in gilt asset values) over the three-year period from 31 December 2021 to 31 December 2024 – especially during September 2022, when there were large, short-term movements.

These movements in gilt yields have caused a significant fall in the value of scheme liabilities and asset values over the three-year period, with the value of liabilities reducing by a greater level than the assets. This is why we have seen significant improvement in overall aggregate funding levels. The position for individual schemes will vary greatly compared with our aggregate estimates and depend on scheme-specific inter-valuation experience and schemes' investment strategies. Schemes that were relatively unhedged in respect of interest rate and inflation risks will have experienced more significant improvements in funding levels compared to well-hedged schemes, as liabilities fell substantially more than assets.

The results of the DB universe funding position as at the 31 December 2024 on a technical provisions (TPs) basis are shown in tables 1 and 2:

Table 1: Funding position on a technical provisions basis

Sources: TPR (scheme data), London Stock Exchange Group (LSEG), Bank of England (BoE)

| Funding position on a technical provisions basis | 31 December 20211 | 31 December 2024 |

|---|---|---|

| Assets (£billions) | 1,827 | 1,153 |

| Technical provisions (£billions) | 1,734 | 941 |

| Surplus/(Deficit) (£billions) | 93 | 212 |

| Funding level | 105% | 123% |

| % of schemes in surplus | 53% | 85% |

| % of schemes in deficit | 47% | 15% |

| Number of schemes2 | 4,927 | 4,818 |

Footnotes for Table 1

- 1 Figures for 31 December 2021 have been estimated using the data on our system as at 30 September 2023.

- 2 Where a scheme is sectionalised or segregated, each section is treated as if it were a separate scheme for the purposes of this report.

Table 2: Scheme distribution on a technical provisions basis as at 31 December 2024

Sources: TPR (scheme data), LSEG, BoE

| Funding level | Number of schemes | Total assets (£billions) | Total TP liabilities (£billions) | Surplus/ deficit (£billions) |

|---|---|---|---|---|

| Under 80% | 146 | 11 | 19 | -8 |

| 80% to 100% | 598 | 141 | 150 | -10 |

| 100% to 120% | 1,562 | 371 | 337 | 34 |

| Over 120% | 2,512 | 631 | 435 | 196 |

| Total | 4,818 | 1,153 | 941 | 212 |

We expect that the aggregate funding position as at the 31 March 2025 (and 5 April 2025) to be broadly similar to that as at the end of December 2024, although with slightly lower liabilities and asset values.

Market indicators

Market summary

Over the period 31 December 2021 to 31 December 2024, we saw significant changes in market conditions. In late 2022, gilt yields surged sharply due to market reactions to the 'mini-budget' of September 2022. These remained elevated throughout 2023 and 2024, reflecting persistent inflationary pressures and expectations of continued monetary tightening by the BoE. The large rise in gilt yields corresponds to a significant fall in the price of gilts over the same period.

UK index-linked gilts underwent similar changes, reflecting economic conditions and investor sentiment. Real yields on index-linked gilts had been negative since 2014, primarily due to strong demand from pension funds seeking to hedge inflation risk. However, real yields have risen significantly due to increased government borrowing and shifting investor demand, with positive yields observed from September 2022 onwards. Similarly, the large rise in real yields corresponds to a significant fall in the price of index-linked gilts over the same period.

Longer duration bonds performed worse than shorter duration bonds due to the higher yields compounding over a longer period of time.

Credit markets outperformed the equivalent government bond indices over the three-year period to 31 December 2024. Credit spreads initially widened in 2022 as rising interest rates led to increased borrowing costs and greater default risks. However, as inflationary pressures began to moderate and economic growth stabilised, credit spreads started to tighten.

Equity markets have generated positive returns over the three-year period to 31 December 2024. Equity performance has been dominated by the US market and in particular, the technology sector, which has been driven by enthusiasm surrounding artificial intelligence and its applications.

Bond yields

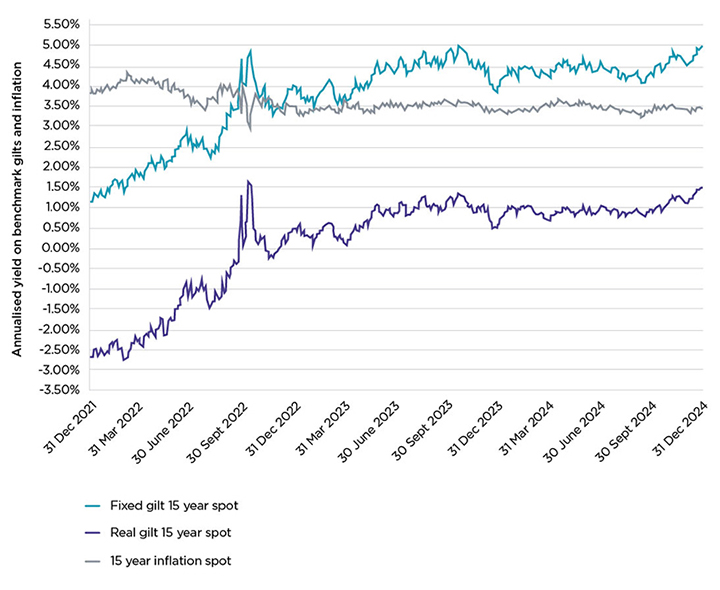

Figure 1 shows the BoE estimates of nominal and real gilt yields and implied inflation as measured by the RPI at a 20-year duration at each date from 31 December 2021 to 31 December 2024.

Figure 2 shows the real forward interest rates as estimated by the BoE as at the end of December 2021 and December 2024.

Figure 1: Benchmark yields

Sources: BoE, LSEG

Long-dated fixed interest and index-linked gilts saw steady increases in yields over the first half of the three-year period and then remained fairly stable thereafter, with nominal yields fluctuating between 4.0% to 5.0% and real yields between 0.5% to 1.5%. Long-term market-implied inflation has remained mainly in the range 3%pa to 4%pa over the three-year period, remaining fairly constant at around 3.5%pa through-out both 2023 and 2024.

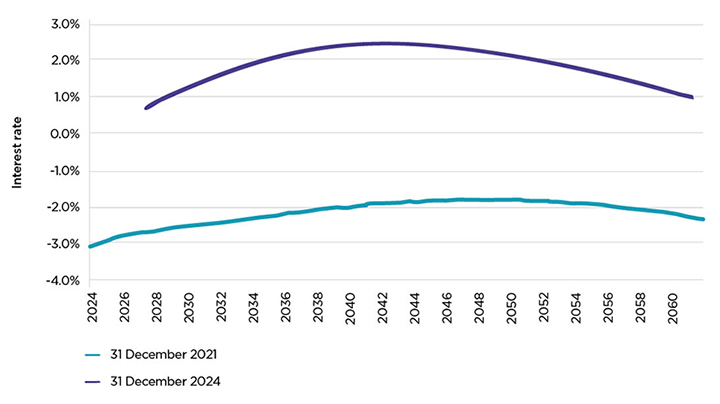

Figure 2: UK instantaneous real forward gilt curves

Source: BoE

The shape of the curve is broadly similar at the two dates, however, over the period 31 December 2021 to 31 December 2024 there was a significant increase in real interest rates along the whole curve.

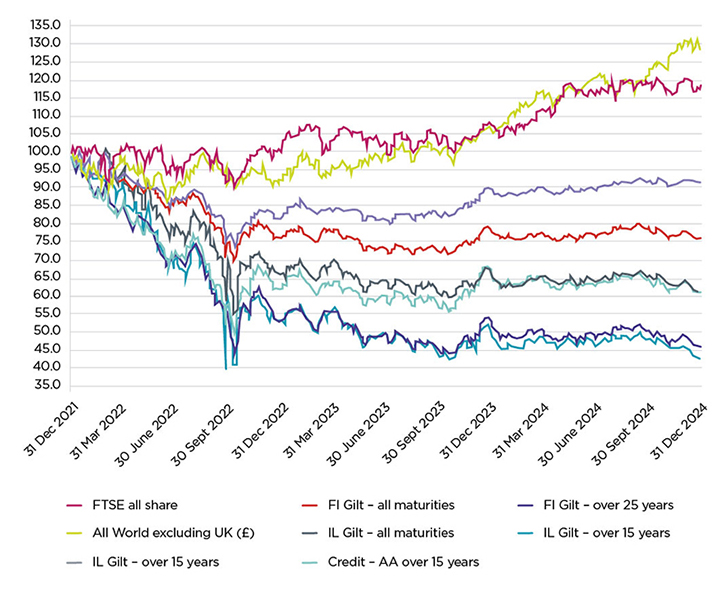

Asset returns

Figure 3 and Table 3 both show the total investment return for a range of asset class indices since the end of 2021 up to the end of 2024. The investment returns in figure 3 have been re-based to 100 at 31 December 2021, therefore the chart shows the relative change from that point.

Figure 3: Asset returns

Source: LSEG

The graph corresponds with the market summary, whereby gilts (and corporate bonds) have seen negative returns over the three-year period, with specific volatility observed during September 2022. Long-dated gilts observed the greatest fall in value, with losses of over 50% over the three-year period, whilst medium dated bonds also observed a fall in value over the period with losses between 25% (nominal gilts) to 40% (index-linked gilts). Corporate bonds observed a similar pattern to that of gilts, albeit losses were lower. Conversely, equities observed positive returns over the three-year period, with returns of between 20% to 30%.

The actual returns for the different asset indices (as shown in the previous graph) are set out in table 3.

Table 3: Total returns in UK Sterling from different asset classes over the three years to 31 December 2024

| Index name (asset class) | Total returns over the period 31 December 2021 to 31 December 2024 |

|---|---|

| FTSE British Government Fixed All maturities (fixed interest gilts) | -24% |

| FTSE British Government Fixed over 25 years (fixed interest gilts) | -53% |

| FTSE British Government Index Link All maturities (index-linked gilts) | -39% |

| FTSE British Government Index Link over 15 years (index-linked gilts) | -57% |

| Iboxx UK Sterling Corporate Bond All Maturities (corporate bonds) | -9% |

| Iboxx UK Sterling Corporate Bond over 15 years (corporate bonds) | -39% |

| FTSE All World Excluding UK Sterling (overseas equities) | 28% |

| FTSE All Share (UK equities) | 19% |

DB schemes

Funding position of DB schemes in aggregate

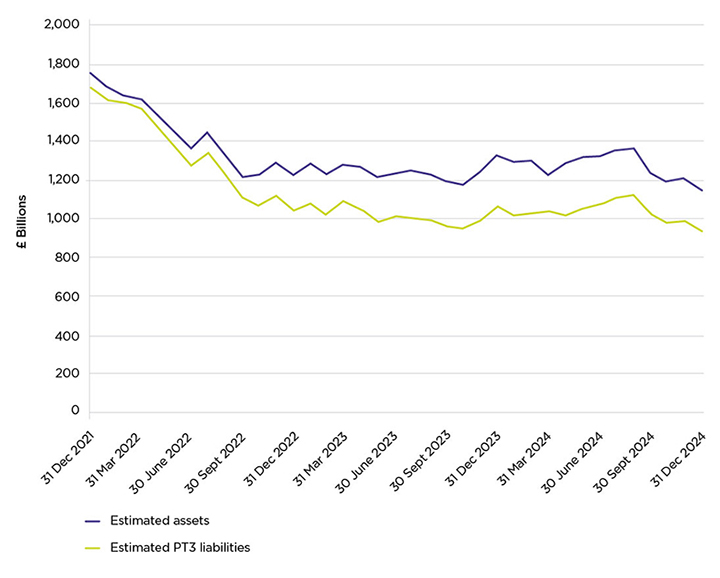

Figure 4 shows our estimates of aggregate assets and liabilities (technical provisions) for all schemes in our regulated DB universe over the three-year period ending 31 December 2024.

Figure 4: Estimated assets and liability positions of DB pension schemes

Sources: TPR (scheme data), BoE, LSEG

The graph shows how both asset values and liability values fell steadily over the first half of the period 31 December 2021 to 30 September 2023, with liabilities decreasing around 45% compared to a fall in asset values by around 35%. By contrast over the period 30 September 2023 to 31 December 2024, aggregate asset and liability values remained broadly stable, with asset values around £1,200 billion and liabilities around £1,000 billion, such that the overall surplus at the end of December 2024 was around £200 billion.

Figure 5 estimates the key factors that have caused the change in the aggregate surplus over the three-year period.

Figure 5: Estimated impact of change in surplus over the period December 2021 to December 2024

Sources: TPR, LSEG, Office for National Statistics (ONS)

The graph shows that the change in the value of the surplus is principally influenced by two key factors: the fall in the value of liabilities (circa £800 billion) and the fall in asset values (circa £650 billion), with the former outweighing the latter, such that as at the end of December 2024 we observe an overall higher value of surplus (circa £200 billion).

Variation of impact on scheme funding – all schemes

The analysis above will not be representative of the impact of market conditions on individual schemes. Different schemes will have had different experiences, in particular depending on their individual investment strategies and funding plans. Schemes that were relatively unhedged in respect of interest rate and inflation risks will have experienced more significant improvements in funding levels compared to well-hedged schemes, as liabilities fell more significantly than assets.

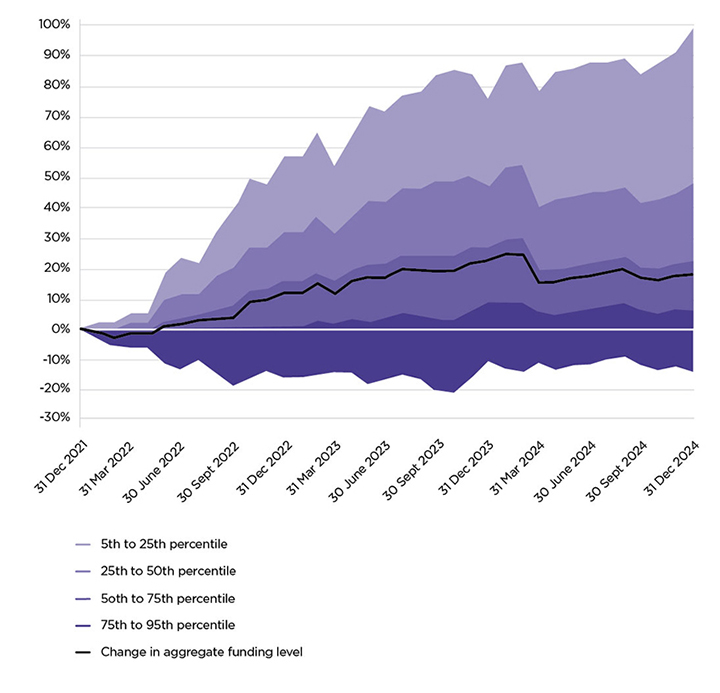

We have illustrated this variation in Figure 6, which estimates how the funding level of each scheme has changed over the three-year period to 31 December 2024. These illustrations show changes in funding level and not the funding levels themselves.

Figure 6: Variation of impact on funding level of all schemes – December 2021 to December 2024

Sources: TPR, BoE, LSEG

The graph shows a very wide range of changes in funding levels ranging between a 100% improvement to a -15% deterioration, with the median improvement being just under 20% over the three- year period. Overall, we expect that around 85% of schemes would have observed an improvement in their funding level over the three-year period.

Of those that have seen an improvement, we estimate that over a quarter of schemes will have seen an improvement of over 50% in their funding level over this three-year period. These were schemes with lower levels of interest rate and inflation protection, that saw large falls in the value of the liabilities that were not matched by falls in asset values.

For the minority of schemes (circa 15%) that are estimated to have seen a reduction in their funding level over the period, these were schemes that had very high levels of interest rate and inflation protection, relative to their technical provisions. Our expectation is that these schemes instead wanted to protect either their low dependency or buyout funding positions. For the majority of these schemes, whilst their funding level on a technical provisions basis was expected to fall they nonetheless remained in surplus on a technical provisions basis over the three-year period.

The overall improvement in funding on a technical provisions basis was also observed for alternative funding bases, with material improvements in funding positions over the last three years on a low dependency basis and buyout basis, as set out in table 4.

Table 4: Funding position on a low dependency and buyout basis

Sources: TPR (scheme data), LSEG, BoE

| 31 December 2024 | 31 December 2024 | |

|---|---|---|

| Funding Basis | Low dependency | Buyout |

| Assets (£Bns) | 1,153 | 1,153 |

| Liabilities (£Bns) | 1,021 | 1,127 |

| Surplus/(Deficit) | 133 | 26 |

| Funding Level | 113% | 102% |

| % of schemes in surplus | 76% | 54% |

| % of schemes in deficit | 24% | 46% |

| Number of schemes3 | 4,818 | 4,818 |

Footnote for Table 4

- 3 Where a scheme is sectionalised or segregated, each section is treated as if it were a separate scheme for the purposes of this report.

Our estimates show that as at the end of December 2024, we estimate that over 75% of the DB universe was in surplus on a low dependency basis and over 50% of schemes in surplus on a buyout basis, with an aggregate surplus of circa £135 billion and £25 billion respectively.

We note there are a range of potential approaches and assumptions that can be applied when determining a low dependency funding basis, dependent on a range of factors, including investment strategy, level of prudence applied and the size of the scheme. For our analysis of the DB universe on a low dependency basis, we have applied a uniform approach, and have assumed that low dependency liabilities are calculated using a discount rate of gilts plus 50 basis points, with no allowance for any inflation risk premium. In practice, we expect that we will observe a range of approaches to determining low dependency, which we will monitor and consider changes to our modelling approach over time.

Fast track

This is the first valuation tranche to undertake a valuation under the new funding and investment regulations and revised DB funding code of practice. Recently, we also published the final Fast Track details in November 2024, which apply for all schemes undertaking a valuation for Tranche 24/25.

Our analysis indicates that if all the schemes in the DB universe were to undertake a valuation as at 31 December 2024, circa 80% of schemes would potentially be able to meet all the Fast Track parameters, without the need to make any change to the level of their deficit repair contributions. For some of these schemes, this might require a change in the existing funding approach, but this could be done at no additional current cost to the employer.

For further information, see the Fast Track submissions tests and conditions.

Changes in financial conditions over the period 31 December 2024 to 31 March 2025

As at the 31 March 2025 (and 5 April 2025), financial markets were broadly similar to that of 31 December 2024, albeit with slightly higher nominal and index-linked gilt yields. Given the movement in financial markets over the three-month period we expect that the funding position of the DB universe was broadly unchanged, albeit that the overall value of technical provisions and assets were slightly lower at the end of March 2025. The expected position as at 5 April remained broadly similar.

Methods, principal assumptions and limitations

Scheme data

We have used the scheme funding data on our system as at 30 September 2024 to produce our summary of estimates as at 31 December 2024. This data comes from the 2024 annual scheme return and recovery plan submissions received by that date. For historic figures in this analysis, we estimated them using scheme funding data held on our systems as at 31 March 2024 and 30 September 2023, where applicable.

The raw data and model outputs have been subject to actuarial data checks which look to highlight key outliers and are adjusted as necessary.

We have also used external data sources, including:

- financial market indices data obtained from LSEG

- ONS for values of annual benefit outgo and contributions in respect of future accrual

It’s important to note the following.

- The underlying data is historical. Schemes have up to 15 months to complete a valuation and need to only undertake a valuation every three years. Therefore, the liability and asset values held are generally between one year and four years’ out of date.

- The data is a high-level summary of the results of the valuation, ie. we do not have individual member data or detailed benefit structure information that schemes have access to.

- The asset breakdown is based on the last audited accounts over the scheme return year. Schemes have up to seven months from the year end to complete their audited accounts. Therefore, the asset breakdown is generally around two years out of date.

- When referring to 'schemes' in this report, this is in fact referring to individual segregated sections of assets and liabilities. For example, the data for this modelling includes 4,818 sections as at September 2024. This report describes these as 'schemes' for simplicity, in line with common use. It should be noted that some of these 'schemes' are sub-sections of a single scheme, so the number of schemes (if defined as separate trusts) is less than this.

Modelling methodology

The figures in this report are based on our modelling of the DB universe. This estimates the aggregate assets and liabilities up to 31 December 2024 by rolling forward from schemes' latest actuarial valuations, based on scheme data and relevant financial market information. Given the purpose of the model, there is no explicit additional prudence applied (on top of the prudence allowed for in the TPs for each scheme at the previous valuation), rather the aim is for the results to be our best-estimate of an up to date position of the DB universe as a whole in the absence of any other available data.

Given the high level and limited data that we hold, our calculations use broad assumptions and approximations combined with general actuarial methods and techniques. We cannot take account of all scheme-specific characteristics and the actual position of individual schemes will vary, depending on a number of individual factors not covered in our data or methodology. The broad assumptions we apply are based on judgement. We are aware there are alternative assumptions/approaches that could be adopted. These might be equally valid and would lead to slightly different results. We continue to review our approach and the assumptions underlying our model on an ongoing basis.

The key assumptions, which are judgement based, underlying our model include the following.

- Technical provisions are estimated assuming each scheme uses a gilts + type approach.

- Low dependency liabilities are estimated for each scheme by taking the technical provisions results and assumptions reported to us following a schemes last valuation, adjusted to a basis that assumes: a discount rate broadly equivalent to the gilt curve plus 0.5% pa, a Retail Price Index inflation assumption with no adjustment for an inflation risk premium, a Consumer Price Index (CPI) inflation assumption which assumes a 0.3% pa deduction to our RPI assumption (as a broad approximation of all future pricing differentials for the difference between RPI and CPI) and a broad expense allowance of 3% of liabilities.

- Liability values are adjusted for movements in both fixed interest and index-linked gilt markets to take account of market changes when deriving discount rates and inflation between the date of the last valuation and the calculation date.

- Our estimate of technical provisions, also make a further adjustment by reducing the overall discount rate over time to allow for the impact of schemes’ maturing and de-risking along a journey plan. The impact of allowing for a more prudent overall discount rate is to increase the value of the liabilities compared to no adjustment being applied. This adjustment is applied for all schemes except in the situation where schemes at their last valuation adopted discount rates in line with a low dependency style basis. In which case, no further adjustment is applied.

- For schemes that have a mortality assumption that shows their assumed life expectancies are within the bottom quartile, our estimate of the low dependency liabilities are adjusted to assume a stronger mortality assumption equal to the 25th percentile life expectancy from our universe data.

- Our estimate of buyout liabilities are further adjusted to reflect broad changes in insurer pricing over time.

- Further broad adjustments are made to liabilities for changes in longevity expectations by adjusting the liabilities in line with changes to the core CMI model over the period since a scheme's last valuation.

- Trustees do not take any management action in regards of buying and selling assets or changes to the investment allocation over time.

- Both assets and liabilities are adjusted in line for expected benefit payments paid combined with an adjustment for future accrual, where applicable, over the period since a scheme's last valuation.

- Assets are further adjusted in line with movements in market indices plus deficit repair contributions over the period since a scheme's last valuation.

- Assets are rebalanced daily in order to retain the same investment allocation.

There are many more simplifications and approximations in the methods we use to estimate aggregate and individual funding positions compared with the more robust calculations carried out for formal valuation and recovery plan reporting by scheme actuaries for trustees. Additionally, the greater the magnitude of change in market conditions, the less reliable the simplified method and data will be in illustrating the impact of changing funding levels over time. It should be noted that this is not a TPR-specific issue, but a global actuarial issue when using the approximate roll-forward methodology to estimate assets and liabilities at alternative dates.

A key difference between the results presented in this report compared with previous reports is that an allowance has been applied to both liabilities and asset estimates for both benefit outgo and additional accrual. As this change in methodology affects liabilities and assets in a similar way, the overall funding level and overall surplus/deficit is unaffected, which has been the key focus for AFS purposes. This change has been instigated as external commentators have frequently tried to compare our liabilities with other organisation’s asset values, which is misleading. Therefore, the results in this report, primarily notional asset and liability values, are not directly comparable to previous estimates.

Additionally, results are always approximate. While we do not expect a pronounced systemic bias in the model, results may be materially inaccurate at an individual scheme level where experience differs to those of our key assumptions. This could be because of either or both of the following.

- Trustees taking positive management action to change investment strategies, which are not reflected in our current data set due to time lag issues.

- Actual asset returns are materially different to index returns or scheme experience materially differs from that assumed.

Caveats and limitations of advice

We are content that the data used in the model is appropriate to provide high-level estimates of the DB scheme universe as at 31 December 2024. As the scope of the model is to provide estimates at an aggregate level, the results should not be used to draw conclusions for individual schemes, nor provide any analysis for individual scheme funding levels. Considering the purpose of these results, we do not consider it appropriate to provide further analysis on the material risks and uncertainties. By necessity these risks will be at a scheme specific level, based on the characteristics of the funding and investment approach of each scheme. Therefore, it will require the scheme actuary or corporate actuary to provide the necessary advice.

Compliance

This note complies with Technical Actuarial Standard 100 (TAS 100) v2.0, as published by the Financial Reporting Council. TAS 100 v2.0 applies to technical actuarial work (as defined in section 4 of TAS 100 v2.0) that is completed on or after 1 July 2023.