Overview for trust-based DC schemes on the value for money framework: response to consultation, further consultation and discussion

Introduction

Feedback is invited from trustees and their administrators and advisers on the value for money framework: response to consultation, further consultation and discussion paper. This is a joint publication produced by us and the Financial Conduct Authority (FCA). It sets out proposals for how a value for money (VFM) framework may be designed to work across defined contribution (DC) trust and contract-based schemes.

While the consultation is hosted on the FCA’s website, the proposals also apply to certain types of occupational trust-based schemes that provide DC benefits, along with proposals for certain exceptions (see Scope and thresholds chapter).

You can find out how to respond to the proposals, by 8 March 2026, in the joint publication.

Purpose of this document

The purpose of this document is to provide an overview of the proposed framework and specific aspects of the joint publication. It will be particularly useful for those who have not engaged with VFM framework so far.

This document is not intended to replace the detail of the joint publication, and you should refer to the main document for further information and the questions to provide feedback on. We provide links to appropriate sections throughout.

Essential background

The government has set out its intentions for value for money (VFM) in DC schemes in the Pension Schemes Bill 2025. This includes new requirements for the majority of schemes providing DC benefits (referred to as trust-based DC schemes in this document). While it makes its way through the legislative process, we have been working with the Department for Work and Pensions (DWP) and the FCA on proposals for a framework which sets out how trustees and providers will need to consider the value that their arrangements provide, and the actions they will need to take if they are not providing value.

The consultation details proposals for how a VFM framework may be designed to work across DC trust and contract-based schemes. It builds on details from past consultations regarding the approach to VFM and the framework, most recently in FCA’s 2024 consultation (CP24/16).

The VFM framework will be implemented for trust-based schemes by DWP through legislation under the Pension Schemes Bill 2025 which is currently before Parliament. The consultation therefore invites input from trust-based schemes because it will be particularly valuable and timely in developing those regulations.

Overview of VFM

The new VFM framework intends to enable the assessment and comparison of holistic value delivered by DC workplace pension arrangements. This move is intended to ensure that industry stakeholders can understand not just the cost of a scheme, but the level of returns and the quality of service delivered to savers.

Greater transparency around key metrics is intended to drive better long-term value for savers, supporting and challenging those acting on their behalf. Consideration of these metrics will help trustees ensure that:

- savers’ money is appropriately invested

- savers pay reasonable costs and charges

- savers receive quality of services

Trustees and providers are expected to use the metrics proposed in the framework to obtain a view of the value they provide, compared against the averaged value of the commercial market. They will then need to produce a VFM assessment, to be made publicly available, and take the appropriate actions if their members are not receiving value. This can include making improvements, or transferring their members, depending on the outcome of the assessment.

Anticipated timeline

Following Royal Assent of the Pension Schemes Bill 2025, the next steps will include a consultation on the regulations, which is anticipated during 2026, depending on Parliamentary timetabling.

Under the government’s timetable, the intention is that schemes will first be required to submit their VFM metrics in early 2028, with assessments later that year, and thereafter annually. This means that trustees need to be in a position to report on metrics based on the January to December 2027 period.

Scope and thresholds

The initial focus of the proposed framework is on default arrangements. This is where savers are automatically enrolled without an active choice. The intention is to ensure that savers receive comparatively good value in such arrangements, even if they are more likely to be disengaged.

Where the term 'arrangement' is used, this is intended to mean the default arrangement which a saver is entered into following automatic enrolment or the quasi-default arrangement. It also describes an investment arrangement within a scheme which is used for the investment of pension contributions. The government intend to define this for trust-based schemes in regulations, but it is important that trustees are aware of these proposals.

Overview of scope proposals

It is proposed that the VFM framework will apply to the following where they have been operating for at least one calendar year (1 January to 31 December):

- The majority of default arrangements. Most workplace pension savers use the default arrangement of the scheme chosen by their employer for the purposes of automatic enrolment (AE). A default arrangement is one where contributions are invested without the employee having made an active choice.

- ‘Quasi-default’ arrangements. These are arrangements within pre-AE (‘legacy’) workplace pension schemes that are akin to AE default arrangements. The term legacy is used in a broad sense to refer to workplace schemes which are not qualifying schemes for AE. This is an arrangement which:

- may be open or closed to new savers

- is used by at least 80% of employees and ex-employees (active and deferred members), of at least 1 employer

- A default or quasi-default arrangement will be in scope of the VFM rules where it meets at least one of three tests:

- at least 1,000 members; or

- fewer than 1,000 members but is the sole default or quasi-default arrangement provided by a scheme; or

- fewer than 1,000 members and is not the sole default or quasi-default arrangement provided by a scheme but is the largest

- Executive pension plans (EPPs) will be excluded as they are typically tailored to the needs of senior executives. Similarly, small self-administered schemes (SSAS) will be excluded from the VFM framework.

These proposals would mean that all master trusts and the majority of single employer DC schemes that are not an EPP or SSAS are in scope, regardless of size. However, this is yet to be finalised through the regulations from the Pension Schemes Bill 2025 and we welcome feedback on your views of the appropriate scope for trust-based schemes.

We are proposing that trustees will not need to produce a VFM assessment if they have decided to wind up the entire scheme and have sent appropriate notification to us. Additionally, we propose that trustees will not need to produce a VFM assessment if they have decided to transfer members out of a default arrangement but not wind up the scheme, so long as they have provided us with evidence that an agreement has been made with an alternative provider.

For further information about these proposals, and the associated questions on which views are being sought in relation to scope and thresholds, see chapter 2 of the joint publication.

Overview of VFM metrics

Trustees will be required to collect a range of data-points, to be able to holistically compare performance and determine if their scheme is providing value. The document contains proposals for how the framework will consider and incorporate these metrics, and how trustees should consider approaching them. These data-points include investment metrics, costs and charges information, as well as quality of service data, to consider in terms of the overall value provided to savers.

Investment metrics

Investment performance is a key driver of outcomes for DC savers, and it is important that trustees monitor and assess the value being delivered by their investment strategy.

The proposals for the framework include options on how to approach backward-looking metrics, that is past investment performance and associated volatility, and introduce proposals regarding forward-looking metrics.

To ensure that value is being considered throughout the duration of time that a saver is in an arrangement, the proposal is that these metrics are disclosed for the investment portfolio at different stages leading to a saver’s target retirement date, to reflect growth, any de-risking and what is achieved at retirement.

Backward-looking metrics (BLM)

The proposals are that past investment performance is disclosed at three levels, based on periods of one year, three years and five years where available and, 10 years where reasonably practicable to obtain:

- gross investment performance (net only of transaction costs)

- investment performance net of all costs and charges

Only for the one year time period, disclosure of investment performance net of investment charges (but gross of service costs) is also proposed.

Feedback is being sought on the proposal for multi-employer arrangements with variable charges. We acknowledge that costs and charges will vary in these types of arrangements, so have proposed the disclosure of the maximum and minimum value in the range and the median for the net performance metrics.

The publication sets out in detail the proposed calculation methodology for performance figures over multi-year periods, proposing arithmetic averaging of annual performances as a means to ensure the calculation approach is consistent across different investment approaches (such as static allocation, lifestyling and target date funds).

Risk metrics are an important consideration of the overall investment approach, and the publication considers proposals of how these can be calculated and disclosed. This includes the disclosure of the range of annual returns, being the difference between the highest and the lowest. It also includes the average annualised standard deviation (ASD), calculated by averaging the variances experienced in each calendar year, as well as the maximum ASD experienced in a given calendar year over that period.

In situations where an arrangement is transferred to another within the same scheme, there will still be requirements to disclose past performance and risk metrics over time so as not to disguise any poor performance, referred to as 'chain linking'. However, there are proposals for some exceptions to this.

For legacy arrangements, it is proposed that trustees should disclose all applicable metrics, but they can draw attention to certain prescribed features, such as guaranteed investment returns, when determining the VFM rating.

Further details and illustrations of the methodologies can be found in chapter 3 of the joint publication.

Forward-looking metrics (FLM)

The joint publication proposes to allow for forward-looking metrics, to better reflect investment strategy ambitions and to allow comparisons of expected outcomes for savers as well as not disincentivising innovation. Part of these proposals include that schemes can use their own methodology and assumptions to develop the expected returns and volatilities for each arrangement, in accordance with their investment strategy. The FLM should be calculated based on the arrangement's strategic asset allocation (SAA) and must reflect the assumptions used in determining, or in later monitoring the ongoing suitability of the SAA. This allows for ongoing updates to the set of assumptions, provided they are made with a consistent methodology.

As part of the proposal, there are suggested guardrails to mitigate gaming risks, for example if the FLM is inflated or unrealistic. The proposals include a requirement to compare against a comparator-group average (see 'assessment process' chapter), comparing against backward-looking metrics when these are available, as well as a requirement for firms and trustees to obtain suitable external advice.

For further information on the proposals for forward-looking metrics, as well as the questions we are seeking feedback on, see chapter 4 of the joint publication.

Asset allocation disclosures

To obtain a better understanding of past investment performance across portfolios, the proposal is for trustees to disclose their asset allocation. The expectation is that trustees will also consider their asset allocation in the context of their potential future performance and the potential drivers behind it.

Further information can be found in chapter 5 of the joint publication.

Costs and charges

Costs and charges are a necessary part of scheme management, but the objective of VFM is that these are proportionate and supportive of what the scheme is aiming to achieve and the value delivered. This means moving away from a focus purely on costs to an understanding of how this is contributing to, or hindering, overall value.

The proposal is for trustees to disclose their total costs and charges (that is, investment charges and service costs) data over one year, three years and five years where available, and 10 years where it is reasonably practicable to obtain. For the one-year reporting period, it is proposed to require the split between service costs and investment charges as well as the total costs and charges figure. It is also proposed that from the second year, the change in the split out costs and charges from the previous year be shown, to demonstrate the trend in costs and charges over time.

Similarly to the investment performance metrics, there are proposals for multi-employer arrangements to disclose the maximum, minimum and median costs and charges where these vary. This should be disclosed for both the total costs and the service costs (and investment costs if they also vary) to allow for comparison. There is also a requirement for multi-employer arrangements to provide more granular costs related information, broken down into cohorts reflecting various asset and membership sizes. These are explained further and illustrated in a cohort table provided in the joint publication.

It is proposed that the total amount of costs incurred by both members and employers should be disclosed (for example where an employer subsidises costs) in order to provide a true picture of overall value. There is also guidance on how to account for costs under mutual profit sharing and with profits arrangements as well as combination charging structures (for example a mix of annual management charges expressed as a percentage of the fund and a flat fee).

Trustees providing vertically integrated arrangements (where administration and service costs are not accounted for separately) will be required to estimate the split between their investment costs and service charges.

For further information on the proposals around costs and charges, see chapter 6 of the joint publication.

Quality of service

The value a saver receives can be impacted by the quality of service provided, for example where delays have led to a reduction in realised outcomes. However, it is acknowledged that this can be a difficult metric to objectively measure if based purely on perceptions of service.

For this reason, the proposals around quality of service disclosures are currently based on areas that trustees should already be considering in relation to good scheme governance, as well as being quantifiable metrics. This includes areas such as accurate record keeping and data remediation, promptness and accuracy of core financial transactions and complaints data.

With the wider changes to the pensions landscape, it is anticipated that this will also result in changes to how savers engage with their pensions. It is acknowledged that this aspect of the framework will need to evolve along with the changes to the landscape and we welcome any feedback in this area, including the intention to develop a standardised member satisfaction survey.

For further information, see chapter 7 of the joint publication.

Assessment process (including disclosures)

The key objective of VFM is that savers are in an arrangement that is providing value, and in order to achieve that outcome trustees will need to complete an assessment process. Trustees will need to disclose their metrics to enable comparisons, as well as disclosing the assessment report so that there is full transparency.

It is proposed that a centralised data solution is established for trustees to use to submit the VFM metrics explained in earlier sections. The data solution would collate the metrics relating to the commercial comparator group arrangements using information provided by the trustee, and returning the averaged data for trustees to use in their assessment. The joint publication sets out the scope of these proposals and we welcome feedback.

Under the proposals, trustees will be required to submit their metrics to the centralised database by the end of March each year and publish their assessment report by the end of October each year. Options are proposed as to when the metrics should be made public. This could be at the time they are submitted or later, alongside the contextualised assessment report. Trustees’ views are welcomed on this, and further information can be found in chapter 10 of the joint publication.

Three-step process

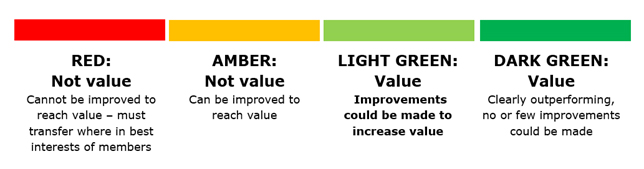

It is proposed that this assessment process is conducted through a three-step process leading to a determination of value against one of four ratings (red, amber, light green, dark green). This is called the RAGG rating. This will involve a comparison against a commercial market comparator group which will consist of in-scope contract and trust-based arrangements which meet the following criteria:

- open to new employers

- firm/scheme designed multi-employer arrangements (for example no bespoke arrangements or single employer trusts)

Step 1

This first step considers the assessment of investment performance, which incorporates backward and forward-looking metrics and consideration of investment charges. Options have been proposed for how this should be approached holistically, including weightings and guardrails. Full details of the proposals can be found in chapter 8 of the joint publication.

For each year to retirement cohort, the proposals include a comparison and assessment of BLMs (including investment performance, risk and charges) and FLMs. This could be either through the proposed option 1 or option 2. A provisional value/not value rating should be assigned for each cohort, and then to the arrangement overall.

Step 2

The second step considers service metrics, which has aimed to be kept as streamlined as possible to avoid unnecessary burden, while maintaining a complete and robust picture of services and costs.

The proposals in the second step consider the value delivered from services through a comparison and assessment of service metrics and costs. While service metrics may be used to lower a provisional 'value' finding to 'not value' if service metrics are poor, they cannot be used to improve a provisional finding of 'not value' to 'value'.

Step 3

In the third step, it is proposed trustees can rationalise certain aspects of their arrangement, taking into account features and characteristics, such as member demographics and safeguarded benefits. These features, along with other more general features such as the size of scheme and number of savers will have been provided for each in scope arrangement alongside the metrics in a ‘features table’.

Trustees will need to carefully consider whether these features are credible enough factors to justify a move from not value to a value rating, which will need to be explained. Trustees may also contextualise their metrics at this point, for example to explain external market impacts, but this may not be used to change the value or not value rating.

Each of the assessment steps is set out in detail in the joint publication.

RAGG rating

These are the RAGG ratings:

The proposal is for trustees to attribute a RAGG rating for each of their in-scope arrangements. This is to align with the categories in legislation, which it is proposed will be as follows:

- Dark green: The arrangement is clearly outperforming those in the comparator group and there are minimal areas where improvements could be made but we still expect trustees to focus on continuous improvement. We expect few arrangements would reach this standard.

- Light green: The arrangement is delivering value, but there are areas that could/should be improved. We would expect this would be a more common value rating than dark green.

- Amber: The arrangement is not value but IGCs or trustees must believe improvements are possible within three years to make the arrangement value for money. Despite this, the provider or trustees may still decide at a future point that a bulk transfer is the best course of action for members.

- Red: The arrangement is not value and a bulk transfer should follow where this is in the best interests of members. A transfer may not always be possible (ie would not be in best interests). In those cases, the provider and trustees must still take action to improve value where possible.

Feedback is welcome on the proposals for the assessment process overall, you can find the full details in chapter 8 of the joint publication.

Actions for arrangements not delivering value

The proposal is that if an arrangement is rated a red or amber, trustees must take action as their savers are not receiving value. This will include notifying us (within five business days of publishing the assessment) and any employer who is contributing to the arrangement (within a month), closing to new business (if a multi-employer arrangement) submitting action or improvement plans and, if red rated, transferring savers to value arrangements where this is in savers’ best interests.

We welcome feedback on these proposals, more information can be found in chapter 9 of the joint publication.

Next steps

We welcome your responses on any aspect of the joint publication by 8 March 2026.

You can provide feedback by emailing vfmconsultationpaper@fca.org.uk and VFMFramework@tpr.gov.uk – please send to both addresses.