Winding up a defined contribution scheme

Overview

Who this guidance is for

This guidance is for trustees of defined contribution (DC) occupational pension schemes. It sets out the key steps you will need to take to wind up your scheme.

Who this guidance is not for

This guidance does not apply to defined benefit (DB) pension schemes or hybrid schemes (which provide both DC and DB benefits, eg GMPs). If you are a trustee of a DB or hybrid scheme, read our guidance on winding up.

This guidance also does not apply to work-based personal pensions or cash balance arrangements.

If you want to wind up a master trust pension scheme, you will need to comply with the requirements of the authorisation regime and so will need to read our guidance on triggering events.

Published: March 2019

Updated: September 2021

See all updates to this guidance

Information added to stage 1 of the guidance about the new legal requirement for smaller DC schemes to carry out a more detailed value for members assessment.

Winding up at a glance

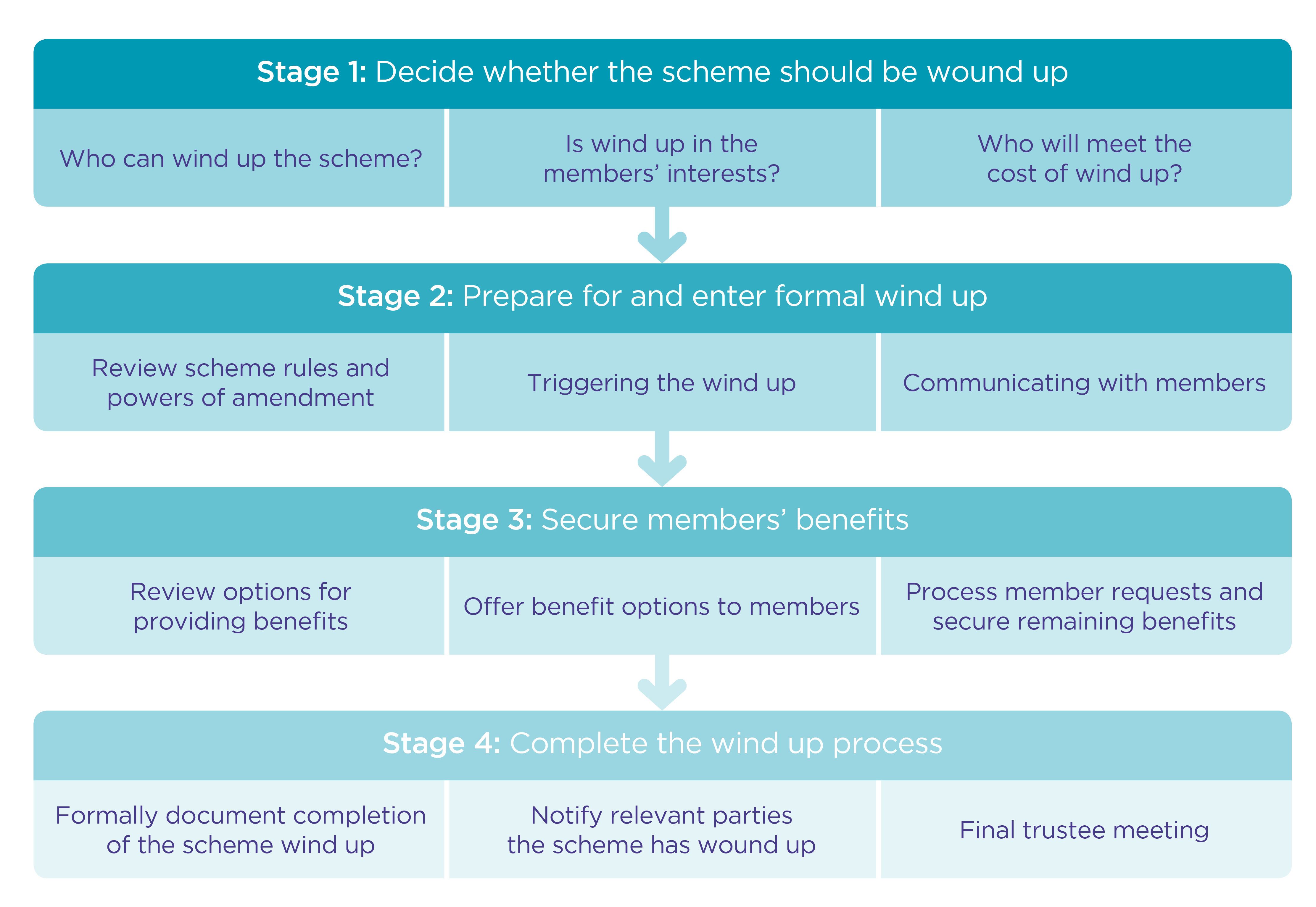

Wind up of a pension scheme can be divided into four stages. These are shown in the diagram below, along with some of the key considerations and activities for each stage. The remainder of this guidance will take you through each stage, with more detailed information about the actions that you may wish to consider taking at each stage of the process.

Schemes will normally move through the stages in this order, although there may be times when it is necessary or more practical to undertake activities in a different order. This is not normally a problem – but the activities in stages 1 to 3 all need to be completed before you can move to stage 4.