Overview

Who this guidance is for

This guidance is for trustees of defined contribution (DC) occupational pension schemes. It sets out the key steps you will need to take to wind up your scheme.

Who this guidance is not for

This guidance does not apply to defined benefit (DB) pension schemes or hybrid schemes (which provide both DC and DB benefits, eg GMPs). If you are a trustee of a DB or hybrid scheme, read our guidance on winding up.

This guidance also does not apply to work-based personal pensions or cash balance arrangements.

If you want to wind up a master trust pension scheme, you will need to comply with the requirements of the authorisation regime and so will need to read our guidance on triggering events.

Published: March 2019

Updated: September 2021

Important

This guide is illustrative and you should consider carefully how it applies in relation to your own particular scheme. It does not replace the need for professional advice about individual schemes – however, you may wish to read through this guidance first, in order to identify the areas where you can carry out the steps yourself, and work out where you may need additional help from a professional adviser. Read more about advisers and service providers.

Winding up at a glance

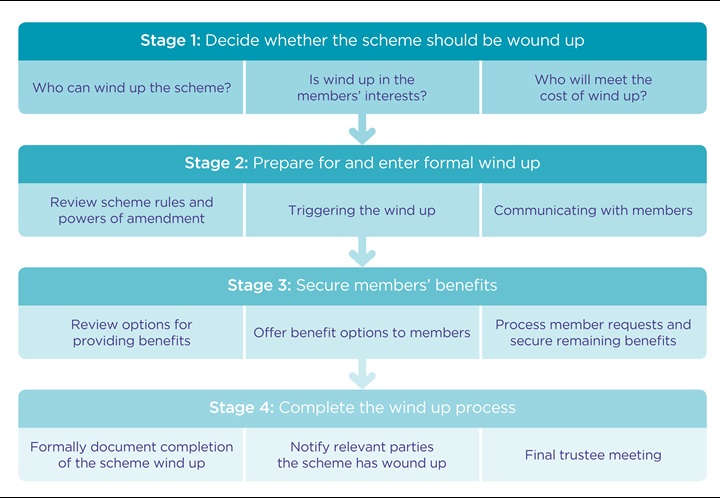

Wind up of a pension scheme can be divided into four stages. These are shown in the diagram below, along with some of the key considerations and activities for each stage. The remainder of this guidance will take you through each stage, with more detailed information about the actions that you may wish to consider taking at each stage of the process.

Schemes will normally move through the stages in this order, although there may be times when it is necessary or more practical to undertake activities in a different order. This is not normally a problem – but the activities in stages 1 to 3 all need to be completed before you can move to stage 4.

Decide whether the scheme should be wound up (stage 1)

The first stage of a wind-up is likely to be the decision whether or not to wind-up. This section of the guidance discusses when to consider this question, and actions to take when faced with such a decision.

Who can trigger the winding up of a DC pension scheme?

The options for triggering the winding up of a scheme will be set out in the scheme rules. Every pension scheme has its own set of scheme rules, so there isn’t a single answer to this question.

The scheme rules are agreed when the pension scheme is first established and may be amended from time to time. They will set out how the scheme is to be administered, and what benefits will be provided.

The power to trigger wind up of the scheme under the scheme rules will usually rest with the trustee or employer. However, it’s also possible that some events may automatically trigger wind up of the scheme, for example if the employer becomes insolvent or stops paying contributions. When this happens you will need to refer to your scheme rules to find out if the scheme has automatically gone into wind up, or if you need to make a decision to wind up the scheme or to continue to run it as a closed scheme. A closed scheme is a scheme that is closed to new members. Depending on the scheme rules, it may or may not be able to continue to accept further contributions. The trustees’ role and duties continue for a closed scheme, until such time as it has been wound up.

If your scheme has automatically triggered wind up, the rest of this section will not be relevant to you. You can proceed to the next section of this guidance.

When to consider winding up your scheme

Along with the scheme's sponsoring employer, you should consider taking professional advice about the best option for your scheme members before deciding to wind up the scheme. When making this decision, questions to ask yourself include:

- Whether there are good reasons for winding it up – for example, the employer might want to merge it into another pension scheme, or replace it with a more cost-effective arrangement.

- Whether the scheme meets the standards set out in our code of practice and other relevant guidance. If it doesn't, is it capable of meeting the standards in a timely and cost-effective way?

- Whether there are alternative arrangements available that would better meet the needs of employees or scheme members. For example, if you believe that your scheme is not delivering good value for its members but you can't make the changes needed to address this because the scheme isn't large enough for you to negotiate competitive charges, then you might want to work with the sponsoring employer to identify whether members could benefit from being transferred to another pension scheme. However, this will depend whether there are alternatives available that can provide a better service with a more competitive charging framework.

In some cases, for example where a scheme is not providing good outcomes for members, wind up may be in their best interests. There will, however, be some occasions where trustees think it will be best to run the scheme as a closed scheme – or decide, along with the employer, to maintain the scheme as an open scheme for some or all employees. An example might be where the scheme offers valuable guaranteed benefits – such as guaranteed annuity rates – that can't easily be duplicated in a new scheme or transferred into an individual buy out policy.

Value for members in smaller schemes

For scheme years ending after 31 December 2021, if your scheme has an asset value of less than £100 million and has been operating for at least three years you must carry out a more detailed value for members assessment. This involves self-assessing the quality of your scheme’s administration and governance with reference to seven key metrics and comparing your scheme’s costs and charges and net returns against three larger schemes. Read the statutory guidance on value for members assessments on GOV.UK for more information.

You must tell us the result of this assessment in your annual scheme return.

If you have concluded that the scheme is not offering value you must also tell us whether you propose to transfer the money purchase benefits of your scheme to another scheme and whether or not you propose to wind up the scheme.

If you do not propose to wind up the scheme, you must tell us the reasons for not doing so and what improvements you propose to make to the scheme to ensure that it does provide good value for members. You will be expected to seriously consider transferring members to an alternative, better value scheme unless there is a valid reason for not doing so.

If your scheme has guaranteed annuity rates, is invested in with profits or has a defined benefit underpin, the statutory guidance on value for members assessments on GOV.UK has helpful information on how to value such schemes.

Actions to consider when deciding whether to wind up

Key activities you will need to undertake at this stage, assuming your scheme rules give you some discretion over whether or not a wind up takes place, are:

Review the scheme rules on triggering wind up

Find out how wind up is formally triggered, who has the power to trigger wind up and whether there is any power to continue to run the scheme as a closed scheme.

Consider who will meet the costs of winding up

Find out whether the employer has any obligation (under the scheme rules or otherwise) or willingness to pay these costs. For example, if the employer pays ongoing costs, but wind up costs would be deducted from members’ funds, you might decide it’s in members’ best interests to continue the scheme as a closed scheme (if they have that option). Costs of winding up can vary significantly depending on the size of your scheme and the nature of benefits provided. You should try to identify all costs before triggering formal wind up, but any agreement with the employer to pay the cost should account for the fact that costs may change as the wind up progresses.

Check that member data is accurate and up to date

Poor data can affect the cost and time required to wind up a scheme. You may therefore want to address any issues with data before winding up is formally triggered. You will want to check the following for each of your members:

- That you have accurate and up to date personal data, such as address, date of birth and national insurance number. If you have lost contact with any members, you will need to make all reasonable attempts to contact them. Read information on tracing members.

- That all member and employer contributions have been paid and invested, so that members' fund values can be accurately determined.

- That you have checked and reconciled all benefit data, so can accurately determine their benefits. This includes checking details of additional voluntary contributions and any unusual entitlements, such as a protected pension age (allowing retirement before age 55) or a protected tax free lump sum (of more than 25%).

Consider if there are any reasons why wind-up might not be in members' interests

For example, are there any valuable benefits / guarantees offered by the scheme that would not be easy to secure / reproduce in a different arrangement? If so you might want to explore the available options carefully with your provider and advisers before making a decision.

Another example might be if there are any penalties for early investment surrender, such as a loss of terminal final bonus. You will want to review the current investment surrender terms at an early stage to check for any such issues, and consider how they might best be managed.

You might also consider engaging with your members, where possible, in order to get a better view of their retirement objectives, as this could help you to reach a decision on whether wind-up would be in their interests.

Identify trustee policies in trustees' names

If the scheme winds up, any insurance policies you have bought to provide pensioner benefits and which are in the name of the trustee will need to be reassigned to the members. This takes time and may have a cost – you may wish to seek legal advice about how this can be done.

If wind up will be triggered automatically, or (after considering the above issues) you conclude that winding up a scheme is in the members’ best interests, you can start preparing for formal wind up.

Prepare for and enter formal wind up of the scheme (stage 2)

Once the decision has been taken to wind-up, the second stage of a wind-up process is preparing to formally trigger wind up under the scheme rules.

This section of our guidance focuses on the actions you may want to consider before taking this step, for example drawing up a project plan, and reviewing key areas of your scheme rules. It also addresses the actions you will need to take to formally trigger wind up of the scheme, and the information you must provide to your members once wind up has been triggered.

Planning to wind up your scheme

Before triggering wind up, it’s important that you prepare and agree a project plan with the key parties involved in the process, such as the sponsoring employer, and any external administrators or advisers. The project plan should set out anticipated steps, timings and costs. It should also consider what actions you will be able to handle using in-house facilities, and the extent to which you will need professional advice or assistance, and the cost implications.

If the scheme is large or complicated you may also want to consider approaching a professional project manager to help you with planning and implementing the wind up.

The legal requirements specific to the wind up process only start once a wind up has been formally triggered. However, once a wind up starts you will not be able to make changes to the scheme unless the scheme rules specifically allow this. You may therefore want to take legal advice about whether any scheme rule amendments are necessary before the wind up starts – for example, to allow amendments during the wind up.

Actions to consider when reviewing the scheme rules

After preparing your project plan, you will need to review your trust deed and rules. Key issues that you will need to consider (and may wish to discuss with a legal adviser) are:

Review the winding up rule in the trust deed and rules

Check how a wind up can be triggered. For example, it may be necessary for the principal employer to give a formal, written notice triggering wind up to each of the trustees.

Check whether the power of amendment can be exercised after wind-up has been triggered

If the power of amendment can’t be exercised after the trigger of the wind up you may wish to amend the scheme rules to change this. It’s not uncommon for the rules to need amending after wind up has been triggered, to facilitate the wind up process.

Check whether any other rules will cease to apply on wind up

Make sure you can still exercise other key powers once wind up has been triggered.

Check what will happen to benefits / benefit accrual on wind-up

Find out how benefits will be affected by the wind-up (eg if contributions will automatically cease, or death in service benefits cease to be payable).

Check whether trustee exoneration or indemnity protections will remain in place after wind up is completed

If existing trustee protections will fall away, trustees will want to consider whether any additional protections will be needed once wind up is completed. However, if a power to purchase indemnity insurance is not explicitly mentioned in the scheme rules, you should seek legal advice before paying any insurance premiums from scheme assets. You may also wish to take legal advice on how best to ensure you are fully discharged from your responsibilities to members (whether by statute or otherwise) on wind up.

Consider extending the scheme's accounting year

A scheme accounting year can be extended to up to 18 months when it goes into wind up. Trustees might want to consider this if – assuming deadlines are managed properly under their project plan – it would mean that that only one set of accounts would need to be prepared to complete wind up.

Check the terms of office for member-nominated trustees / non-affiliated trustees

If member-nominated trustees (MNTs) or non-affiliated trustees are coming to the end of their term, you may wish to consider amending the rules to allow them to remain in place until the wind up is completed. However, in the case of non-affiliated trustees, this will only be possible if they will not exceed the maximum term permitted by legislation.

If a scheme is already in wind up, or a wind up is automatically triggered for any reason (for example, once the employer stops paying contributions) you may not have time to plan for all of the above activities. You will still be able to wind up the scheme – but it’s likely to be more complicated and you may need to take legal advice.

Formal trigger of wind up

When you have completed the steps above (and assuming wind up has not been triggered automatically) the next stage is to formally trigger the wind up. You will need to make sure that you comply with any formal requirements set out in the trust deed and rules.

On formal trigger of wind up, you will need to let us know that the scheme status has changed to 'winding up'. You can do this online using Exchange.

Once wind up is triggered, the process should be completed efficiently, and we would anticipate that in most cases the key activities can be completed well within two years. However, if your scheme is not wound up within two years you will need to to submit a report to us on the progress of the wind up, and provide further reports on an annual basis.

You can use the Section 72A wind up report template:

You must also keep written records of any decision to wind up the scheme (or postpone wind up), and of any decisions about the timing of any steps being taken for the purposes of the wind up.

Communicating with members

Once the wind up has been formally triggered, you must notify all members and beneficiaries that the scheme is winding up. This notification must be issued within one month of formally starting the wind up and contain the following information:

- A statement that the scheme is being wound up and the reasons for the wind up.

- Whether death in service benefits will continue to be payable for active members.

- A summary of the action that has been and is being taken to establish the scheme's liabilities and recover any assets, estimated timeframes and an indication of whether benefits are likely to be reduced.

- If the official receiver or an insolvency practitioner has been appointed to the employer, a statement that at least one of the trustees of the scheme is required to be an independent person.

Asset recovery and the reduction of accrued rights are unlikely to be issues for DC schemes in most cases, but you may want to consider taking legal advice if you think your scheme may have problems with either area.

It is important that you communicate with your members throughout the wind up process. As a minimum, you must give members the information in point 3 above every 12 months while the scheme is winding up. If the wind up is not completed within two years, copies of the reports made to us must also be provided to members on request.

Securing members benefits (stage 3)

After the wind up has formally been triggered, the next focus is on securing members benefits. This can be done in a number of different ways, and you may wish to offer your members different options.

This section of our guidance focuses on three main strands of work that you or your administrators will need to complete before you can move on to the final stage and complete the scheme wind up:

- Making sure the scheme is in a position to secure members benefits.

- Considering the options available.

- Securing members’ benefits.

Strands 1 and 2 are likely to be undertaken simultaneously, at least in part.

Making sure your scheme is in a position to secure members’ benefits

This strand of work is mainly about making sure that scheme data is up to date, that no employer contributions are owed and that the provisions and benefits of the existing scheme are understood. You may already have undertaken some of these activities as part of Stage 1. These activities will mainly be undertaken by the scheme's administrators although the trustees retain overall responsibility. However, it will be for the trustees to review the scheme rules to determine whether any changes are needed, for example to enable or facilitate their offering certain options to members.

Actions to consider when making sure your scheme can secure members' benefits

Review whether the scheme rules permit the trustees to offer members all available options for securing benefits / securing benefits without consent

Consider which options for securing benefits will be offered to members. If the scheme rules restrict the available options (eg they do not permit a transfer to a new scheme without consent), you may wish consider whether it would be helpful (or possible) to amend the scheme rules to change this.

Trace all 'missing' members using DWP or tracing agency as necessary

There are a number of different ways in which you or your administrators could try to trace members. These could include:

- checking public registers for former employees

- using the DWP tracing service (chargeable)

- contacting employers who have historically participated in the scheme, and are still in business, to ask them to pass on information to any members they now employ

- contacting alumni networks to ask them to pass on information or post it on their website

- asking members who can be traced to help find other members

- using social media to advertise for or track down former members

If, after all reasonable tracing routes are exhausted, you still don't have a last known address for some of the members, this isn't necessarily a barrier to the scheme winding up. However, you may want to consider taking legal advice on this issue.

Audit member data and reconcile individual accounts

Make sure the member data you hold is accurate. You should also make specific checks to ensure:

- all employer and employee contributions have been collected and allocated correctly

- all refunds of contributions due have been paid

- any additional voluntary contributions and insured benefits held in the plan have been identified

Publish a section 27 notice to establish claims from unknown / missing beneficiaries

If you place a notice in The London Gazette (a government records website) and make other efforts to notify unknown members, including by advertising in at least one newspaper relevant for your membership, you can gain statutory protection from claims to trust property from unknown beneficiaries. This does not protect you against members you are aware of but simply cannot locate (although, as stated earlier, this isn't necessarily a barrier to scheme wind up).

Considering the options available

As part of the process of winding up the scheme, you will need to present members with options to secure their benefits. There are many different ways of doing this and you should consider taking professional advice on the best range of options to offer.

When you present the available options to members, you should encourage them to consider carefully which option will be best for their particular circumstances. You may wish to refer them to MoneyHelper or suggest that they seek independent financial advice.

Some of the more common options to secure member benefits are as follows:

Buy-out policies

A common method for securing benefits for deferred members (who are no longer making contributions and have not yet taken their retirement benefits) is some kind of buy-out policy. A DC buy-out policy is usually a contract with an insurer in the member's own name, under which the insurer will invest the member's pension savings until they are ready to access them.

There are a number of providers that offer buy-out policies and you will need to review the terms and investment options carefully, with a view to ensuring that the policy you choose provides equivalent or better outcomes for members than your existing scheme. Most trustees will want to consider getting professional investment advice about the buy-out policy.

Transfer to a new arrangement

If, for example, the principal employer is continuing to operate and the reason the scheme is being wound up is that it provides poor value for members, it may be appropriate to transfer active members to a new pension arrangement which can continue to receive contributions. New arrangements could include group personal pension plans, master trusts or an existing scheme associated with the principal employer.

On 6 April 2018 amendments were made to regulations1 to simplify the conditions that apply to bulk transfers of DC benefits without guarantees to a new occupational pension arrangement2.

These changes enable you to transfer DC benefits without guarantees in bulk, without member consent, when any of the conditions listed below are met:

- The transfer is made to a master trust authorised by us.

- The principal employers of both the transferring and receiving schemes are within the same group, and the transferring members are current or former employees of employers in that group (ie where the need to transfer has arisen from a corporate restructure).

- You have taken written advice from an appropriate adviser independent of the receiving scheme.

These changes may significantly simplify winding up of many DC schemes. Read further information on bulk transfers without consent on GOV.UK.

Other options

- Retirement: depending on the scheme rules, members over minimum pension age (usually aged 55) may be able to choose to take their benefits.

- Uncrystallised funds pension lump sum: members over minimum pension age may choose to take all their fund as a cash payment, which would be subject to tax.

- Winding up lump sum: members with fund values of £18,000 or less could be given the option to take a cash payment.

- Short service refund: members with less than 30 days' accrual could be given the option to have their contributions refunded.

- Transfer with consent: members could also choose to transfer their benefits to a new pension arrangement of their choice.

Actions to consider when choosing a buy-out provider or new pension scheme

Scope the selection exercise

Set out the scope and purpose of the selection exercise, including the trustees' selection criteria.

Identify available buy-out options/alternative pension arrangements

Liaise with potential insurers or scheme providers and review variety of buy-out policy options/new arrangements that are available.

Appoint a professional investment adviser to provide a report on the options and make a recommendation, and consider that report

It is usual for trustees to take investment advice on a suitable buy-out policy. You may also wish to take advice on the suitability of any new pension arrangement where you are proposing to transfer members' benefits. However, although a professional investment adviser will recommend a course of action, you have the final responsibility for the decision.

It is important to consider the recommendation carefully in light of your knowledge of the scheme membership and not simply 'rubber stamp' the recommendation. You need to be comfortable that the decision you are making is in the best financial interests of your membership so should challenge or question the recommendation if you have any concerns.

Select buy-out policy provider / new arrangement

When selecting a policy or new arrangement, you will need to consider all relevant issues, including the overall suitability of the policy or arrangement, any default options, and member borne charges and transaction costs.

Other issues to consider specifically in relation to buy-out policies include:

- financial strength of insurer, and whether the policy will be covered by the Financial Services Compensation Scheme

- can members transfer out of the policy before they retire

- are the funds contained within the policy sufficiently matched to current funds

Communication to members

In some cases you may prefer to communicate with members yourself, rather than the insurer or provider of the new pension arrangement doing this on your behalf.

Footnotes for this section

- Amendments were made to regulation 12 of the Occupational Pension Schemes (Preservation of Benefit) Regulations 1991. This guidance does not cover the rules (under regulation 12(1) of those regulations) which applied to bulk transfers of money purchase benefits without consent prior to these amendments coming into force; however, it will remain possible to effect a bulk transfer of money purchase benefits under these rules until 30 September 2019.

- The new legislation applies to rights to money purchase benefits where the assets held for the purposes of providing those benefits do not include any guarantee or promise in relation to the amount of benefits to be provided, or the amount available for the provision of benefits.

Securing members' benefits

Once you are comfortable that members' benefits have been identified and can be fully provided, you need to let the members know about their options and then arrange for the benefits to actually be secured. Typically this will mean offering members the choice of any cash options, such as a winding-up lump sum, and advising them that if they do not respond, their benefits will be secured by way of a 'default option' – usually a transfer to a new pension arrangement (without consent) or a buy-out policy.

Actions to consider when securing members’ benefits

Issue member option forms

Issue option forms to members, setting out all options and informing them how their benefits will be secured if no express instructions are received (eg via buy out policy). The form should alert members to any specific consequences of the default option. You may also wish to recommend that members take financial advice.

Process any member requests for alternative options

Process any member requests for options other than the default option. This might include requests to transfer out (with consent), for winding up lump sums, or for retirement options. This will normally be done by the scheme's administrators.

Provide confirmation to members

Confirm to members once personal options have been processed.

Transfer remaining scheme assets and members to the selected new arrangement

Transfer remaining scheme assets and members to the selected arrangement – this might be a new pension scheme, or a buy-out policy.

Completing the wind up process (stage 4)

Once all the benefits have been secured, you will need to complete the formalities for winding up the scheme.

Actions to consider when completing wind up

Consider options for indemnities and insurance, agree this with the employer (if appropriate) and implement the insurance

If this is not being funded by the employer, or specifically permitted by scheme rules, you should consider taking legal advice about whether it is possible to obtain indemnity cover, or take out insurance for liabilities.

Formally document completion of the wind-up

This is normally done by way of a deed of termination.

Notify TPR

Notify us the scheme has been wound up. You can update the scheme registration online through Exchange.

If there were any untraceable members you should also add a 'pensions tracing service contact' to the scheme roles, in the event that any untraced members contact the tracing service they will be directed to this contact.

Notify HMRC

Notify HMRC by submitting an Event Report.

Remove your entry from the Data Protection Register

You will need to notify the Information Commissioner that you (as trustee) have ceased to be a data controller.

Produce final accounts

A final set of accounts will need to be produced and signed off.

Close the trustee bank account

You will want to make sure all banking / investment arrangements in place for the scheme are properly closed.

Final trustee meeting

Review the actions taken to wind-up the scheme and check that you have taken all necessary steps to conclude the wind up.

Provide statutory information to members and beneficiaries

You will need to comply with statutory requirements to provide certain information to members and beneficiaries once the winding up is complete. The information that must be provided includes:

- who has or will become liable for the payment of the member's or beneficiary's benefits

- if the member or beneficiary is entitled to payment of benefits, the amount of benefit that is payable and (if it is payable periodically) any conditions for continuing to make payments or provisions which would allow the payments to be altered

The information needs to be provided to each member or beneficiary within three months of the scheme paying its liabilities to that member or beneficiary.