DB to DC transfers and conversions

On this page

- About this guidance

- Introduction

- Transfers out of DB schemes

- Types of benefit and the advice requirement: 'flexible' and 'safeguarded' benefits

- Statutory transfers: categories of benefit

- The role of the trustee

- Transfer requests

- Transfers under the scheme rules

- Conversions within the same scheme

- The requirement to take appropriate independent advice

- Exemption from the requirement to obtain appropriate independent advice

- Trustee obligations regarding the advice

- Who must pay for the advice?

- Setting transfer value assumptions

- Impact of transfer values on scheme funding

- Checks regarding the receiving scheme

- Communications

- Applying to us for more time to complete a transfer request

- Our role

- PASA guidance

- Appendix: statutory process

Overview

Assists defined benefit (DB) pension scheme trustees and managers of private and funded public service schemes to manage transfer requests and their impact.

Issued: April 2015

Last updated: 18 August 2020

See all updates to this guidance

18 August 2020

New paragraph 39 added, replacing old version.

7 May 2020

Minor updates to reorder paragraphs 63 to 65 and to clarify when the CETV form needs to be submitted.

28 January 2020

Minor updates to reorder paragraphs 63 to 96, provide information on when the CETV form needs to be submitted, and insert a link to the form.

22 January 2020

Additional minor updates to paragraphs 39 and 43 related to changes to the FCA’s Financial Register.

20 December 2019

Minor updates to paragraphs 37, 38 and 43 related to changes to the FCA’s Financial Register.

11 November 2019

Updates to paragraphs 37, 38, 39 and footnote 24 to reflect changes to the FCA's Financial Register.

April 2015

First published.

About this guidance

1. This guidance is aimed primarily at addressing statutory transfers of DB benefits made in accordance with Part 4ZA of the Pension Schemes Act 1993. However, it also applies to transfers made under a scheme’s rules (and partial transfers where the scheme rules permit this), as well as to conversions of benefits within the same scheme.

2. It addresses the following areas:

- Overview of the new requirements regarding transfers out of DB schemes

- The role and obligations of trustees

- The requirement to take appropriate independent advice

- Setting transfer value assumptions

- The impact of transfer values on scheme funding

- Checks regarding the receiving scheme

- Communications

- Applying to us for more time to complete a transfer

Introduction

3. The greater flexibility now offered to members of defined contribution (DC) schemes to access their pension savings has the potential to increase the number of members of private and funded public sector defined benefit (DB) schemes requesting a transfer of their benefits.

4. We have prepared this guidance to assist DB pension scheme trustees and managers of private and funded public service schemes[1] to manage transfer requests and their impact. It draws together a number of important considerations for trustees and complements our existing guidance relevant to transfers. A high level summary of the main requirements introduced by the Pension Schemes Act 2015 (the ‘2015 Act’) is provided, along with our expectations in relation to these.

Footnotes for this section

- [1] All of this guidance applies to funded public sector pension schemes except where specifically stated otherwise.

Transfers out of DB schemes

5. The 2015 Act makes a number of changes to the transfer rights of members, including introducing certain new concepts and definitions, which we explain below.

Types of benefit and the advice requirement: 'flexible' and 'safeguarded' benefits

6. A transfer or conversion of ‘safeguarded benefits’[2] to acquire ‘flexible benefits’[3] is subject to the requirement that the member must obtain appropriate independent advice. This requirement applies to transfers made under the legislation and the scheme rules. The exception to this is that, where the member’s cash equivalent transfer value (before any reduction) of his or her safeguarded benefits in the scheme is £30,000 or less, the member is not required to obtain advice for the purposes of making a transfer (the ‘£30,000 exemption’).

7. Benefits are now described as either ‘flexible’ or ‘safeguarded’:

Flexible benefits

- Money purchase benefits

- Cash balance benefits

- The ‘third type’ of benefits

- money purchase benefits

- cash balance benefits

8. There is a ‘third type’[4] of benefits, where categorisation may be less obvious. This ‘third type’ could fall within the definition of both flexible benefits and safeguarded benefits. Where there is doubt about the status of benefits and how to treat them, trustees should treat this ‘third type’ of benefits as safeguarded benefits unless there is a good reason to treat them differently. Where trustees are unsure whether benefits within their scheme are clearly either flexible benefits or safeguarded benefits, we recommend that they take specialist legal advice to determine if they fall within this ‘third type’.

Footnotes for this section

- [2] Section 48(8) of the 2015 Act.

- [3] Section 74 of the 2015 Act.

- [4] These are benefits, other than money purchase or cash balance benefits, calculated by reference to an amount available for the provision of benefits to or in respect of the member (whether the amount so available is calculated by reference to payments made by the member or any other person in respect of the member or any other factor).

i. Money purchase benefits

ii. Flexible benefits that are not money purchase benefits (ie cash balance benefits or the ‘third type’)

iii. Benefits that are not flexible benefits (eg DB benefits)

10. In relation to benefits that are not flexible benefits, members must have:

- ceased accrual and

- made an application to transfer those benefits (following receipt of the statement of entitlement)

- one year or more before their scheme’s normal pension age to retain the statutory right to transfer those benefits[6]. For any category of benefits, the right to a statutory transfer value applies up to the date of crystallisation.

11. Where members have more than one category of benefit in the scheme they will have a statutory right to transfer out either:

a. all of their benefits or

b. all of their benefits in relation to one or more of the three benefit categories described above

12. Where a member has more than one category of benefits in the same scheme, they will have separate transfer rights for each and it will not be possible to require the member to transfer all benefits at once[7]. This will override any inconsistent provisions in the scheme’s governing documentation if they are exercising their statutory right[8].

Example

Aisha and Ben are members of the same scheme, which has a normal pension age of 65. They are both deferred members and their benefits have therefore not yet crystallised.

Aisha, who is aged 63, ceased accruing benefits two years previously. She was accruing DB benefits with a cash equivalent of more than £30,000 and was also making additional voluntary contributions to accrue money purchase benefits in the scheme (‘DC AVCs’). Aisha requests to transfer her DB benefits to a personal pension scheme.

Aisha’s DB benefits are safeguarded benefits for advice purposes (the £30,000 exemption does not apply in Aisha’s case). As she will be credited with money purchase benefits following the transfer, she will need to obtain appropriate independent advice.

For transfer purposes, Aisha’s DB benefits (category (iii) above) fall into a different category of benefits from her DC AVCs (category (i) above). She ceased accruing her DB benefits at age 61 (more than one year before her normal pension age). She will also be requesting a transfer more than one year before normal pension age. She therefore has a statutory right to transfer her DB benefits alone, as it is a separate category of benefits from her DC AVCs.

Ben is age 64 and two months and has very recently ceased accruing benefits. He was accruing DB benefits with a cash equivalent of more than £30,000 and also DC AVCs. Ben requests to transfer both his DB benefits and his DC AVCs to a personal pension scheme.

Ben’s DB benefits are safeguarded benefits for advice purposes (the £30,000 exemption does not apply in Ben’s case). As he will be credited with money purchase benefits following the transfer, he will need to obtain appropriate independent advice for the transfer of these benefits. His DC AVCs are, however, not safeguarded benefits and so the advice requirement doesn’t apply to them.

For transfer purposes, Ben’s DB benefits (category (iii) above) fall into a different category of benefits from his DC AVCs (category (i) above). He ceased accruing DB benefits at age 64 and two months (less than one year before his normal pension age). Unlike Aisha, Ben therefore has no statutory right to transfer his DB benefits. He does, however, have a statutory right to transfer his DC AVCs, as it is a separate category of benefits from his DB benefits.

Footnotes for this section

- [5] Section 93(6) of the Pension Schemes Act 1993.

- [6] Sections 93(4)(b) and 95(1A)(b) of the Pension Schemes Act 1993.

- [7] In general, the statutory right to transfer only applies when a member transfers the whole of each category of benefits – it is not generally possible to transfer only part of a category under the legislation. An exception is that, where a member has contracted-out rights (see footnote 11) and is transferring to a non-contracted-out occupational pension scheme or a personal pension scheme and those schemes are not willing to accept a transfer relating to the contracted-out rights, he can transfer only the relevant part of a category of benefits – in this case he would have a statutory right to transfer only the excess over the guaranteed minimum pension or the pension in respect of pensionable service before 6 April 1997 (see section 96(2)-(3) of the Pension Schemes Act 1993).

- [8] Section 129 of the Pension Schemes Act 1993.

The role of the trustee

13. Trustees should ensure they have processes in place to implement transfer requests in a timely manner. They should maintain accurate and complete records of all requests received and the transfers that have been made. This should also enable trustees to apply to us for an extension to make the transfer if needed.

14. It is not the trustees’ role to second-guess the member’s individual circumstances and choice to transfer their safeguarded benefits. It is also not their role to prevent a member from making decisions which the trustees might consider to be inappropriate. In addition, the advice is likely to be confidential to the member. As a result, trustees should not request a copy of the advice the member has received or make enquiries about the substance of the advice. Their role is to check that the appropriate advice has been obtained by verifying that the adviser’s confirmation meets the legislative requirements.

15. Trustees can support members in a number of ways to ensure they have the information they need to make a fully informed decision, including on how to find a Financial Conduct Authority (FCA) authorised adviser. Trustees can do this by making members aware of the FCA's consumer pages.

16. Similarly, the member’s adviser is likely to seek information from the scheme relevant to a potential transfer. The adviser might routinely request to be provided with information ordinarily available to a member such as the scheme booklet, summary funding statement or benefits statement. Advisers might also request further information about the benefit structure or funding level of the scheme.

17. As an integral part of scheme management, it will be important for trustees to monitor and understand demand from members for transfers and the subsequent impact those transfers could have on scheme funding, including the effect of a transfer of those members with a large transfer value relative to the scheme.

18. Trustees must notify us of transfers of more than £1.5m or, if lower, 5% of scheme assets[9].

19. It will also be important to monitor the potential impact on investments, particularly regarding the balance of asset classes held by the scheme and the liquidity required to pay large numbers of individual transfers or in respect of members with a large transfer value relative to the scheme.

Footnotes for this section

- [9] Regulation 2(1)(c) of The Pensions Regulator (Notifiable Events) Regulations 2005, unless the exemption in Direction 1 of the Directions Issued by The Pensions Regulator under Section 69(1) of the Pensions Act 2004 applies.

Transfer requests

20. Members with safeguarded benefits have a statutory right to request a statement of entitlement once in every 12 month period. Schemes may allow more frequent requests. Where a member requests a transfer there are a number of steps in the process that must be followed. Members may separately request information about whether they are entitled to transfer credits under the scheme and a statement of the amount. This information must be given within two months of the request[10].

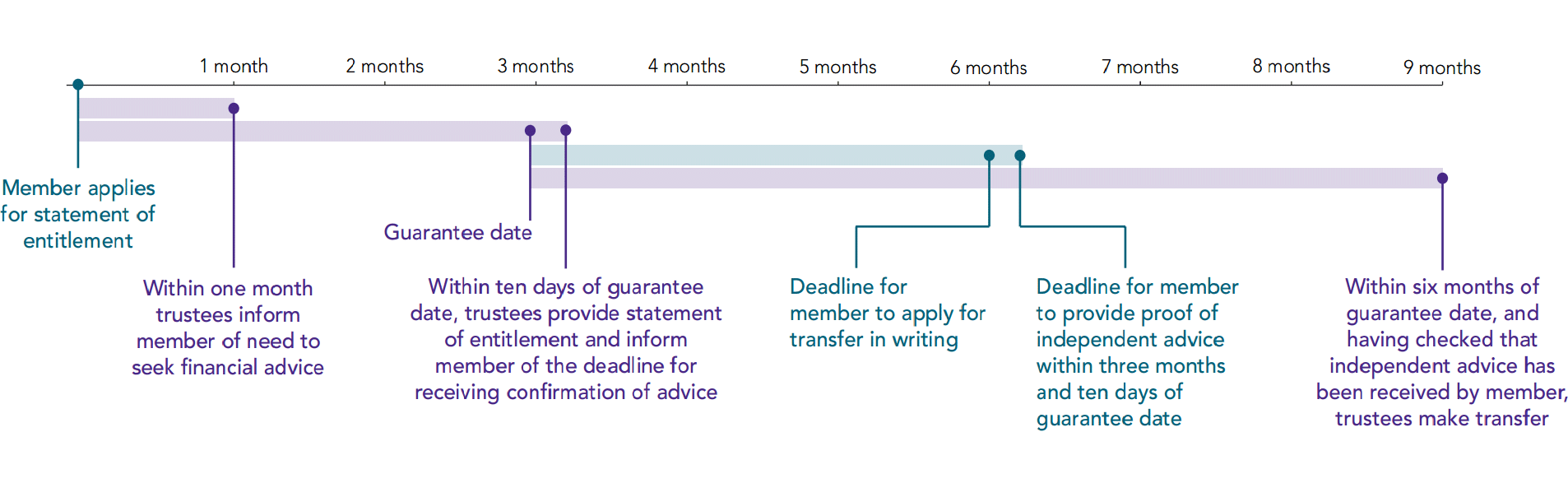

21. A timeline in the appendix sets out the main steps for a statutory transfer where the £30,000 exemption does not apply. The accompanying table sets out further detail of the information that trustees have to provide about the requirement to obtain appropriate independent advice (or, alternatively, the information to be provided where the member’s benefits fall within the £30,000 exemption).

22. Where a member’s safeguarded benefits contain contracted-out rights[11] the trustees should also make sure that they comply with the requirements of the Contracting-out (Transfer and Transfer Payment) Regulations 1996 (the ‘contracting-out regulations’). This includes obtaining additional written acknowledgements from the member regarding their contracted-out rights before they complete the transfer.

Footnotes for this section

- [10] Regulation 14 of the Occupational and Personal Pension Schemes (Disclosure of Information) Regulations 2013.

- [11] Guaranteed minimum pensions or ‘section 9(2B) rights’ (see Occupational Pension Schemes (Contracting out) Regulations 1996 (SI 1996/1172)).

Transfers under the scheme rules

23. Many scheme rules might permit transfers where a member does not have a right under Part 4ZA of the Pension Schemes Act 1993. The circumstances in which transfers under the rules are permitted will depend on each scheme’s trust deed and rules. Trustees may also wish to consider the option of offering partial transfers of either safeguarded or flexible benefits if this is permitted under a scheme’s rules. This could range from a pre-determined, set ratio or leaving the choice open for members to select a proportion of benefits to transfer. For example, if members have accrued benefits in two separate DB sections of an unsegregated scheme, this would count as one category of benefits under the legislation; in this case, members might wish to transfer the benefits from one DB section but not the other.

24. Where trustees consider it appropriate to include such options we would generally expect consistency of approach with the statutory process as a means of enhancing member understanding. Trustees should consider carefully non-statutory options offered by the scheme and may need to take advice on the implications (including whether there are any overriding statutory requirements, for example in relation to contracted-out rights). If such options are made available it will be important to understand demands on the scheme’s liquidity and investment strategy, the employer appetite and the administrative practicality of doing so.

25. The requirement for a member to obtain appropriate independent advice applies to transfers to obtain flexible benefits under the scheme rules in the same way as it applies to statutory transfers[12].

Footnotes for this section

- [12] Section 48(1)(b) of the 2015 Act.

Conversions within the same scheme

26. Some members might wish to convert their safeguarded benefits into flexible benefits within the scheme (or exercise a right to take an internal transfer). The most common example is a conversion of DB benefits to DC benefits within the same scheme. There is no statutory obligation for schemes to permit this and the exact method of conversion or internal transfer will depend on the scheme’s trust deed and rules. In addition, where members are converting to DC benefits within a scheme, there is no obligation to provide the new decumulation options permitted after 6 April 2015. It is up to trustees and employers to determine which options to offer and to amend their rules accordingly.

27.The statutory transfer provisions[13] would not apply in these circumstances. The conversion of safeguarded benefits is likely to constitute a ‘protected modification’ under section 67A of the Pensions Act 1995 and the member’s informed consent[14] to the conversion would be required in these circumstances. Trustees should seek legal advice about the steps required for their scheme.

28. The requirement for a member to obtain appropriate independent advice applies to conversions or internal transfers to obtain money purchase benefits (or other types of flexible benefit) within a scheme in the same way as it applies to transfers between schemes[15].

Footnotes for this section

- [13] Part 4ZA of the Pension Schemes Act 1993.

- [14] In accordance with section 67B of the Pensions Act 1995.

- [15] Section 48(1)(a) of the 2015 Act.

The requirement to take appropriate independent advice

29. Where legislative requirements are met, a member has a statutory right to transfer one or more categories of their benefits to another scheme and, in general, trustees cannot prevent a member from transferring in these circumstances.

30. We believe it is likely to be in the best financial interests of the majority of members to remain in their DB scheme. A DB scheme promises a pre-determined level of benefits that is underwritten by an employer. It is also unlikely that the application of best estimate assumptions used to calculate the transfer value would provide benefits of equal value to those given up.

31. However, accessing their pension flexibly may be better suited to the financial interests of certain members in their particular circumstances. Individual members may also place a higher premium on accessing their benefits in a different way as compared to the regular income for life provided by their DB schemes.

32. To protect members against the risks associated with a transfer the 2015 Act has introduced a requirement that trustees check that a member has obtained the appropriate independent advice before transferring the member’s safeguarded benefits to a DC scheme (or a DC section of the same scheme).

33. In respect of all requests for a transfer of safeguarded benefits to acquire flexible benefits received on or after 6 April 2015[16], trustees must, unless the exemption described in the paragraph below applies, check that the member has taken appropriate independent advice from an authorised independent adviser on the merits of the transfer.

Footnotes for this section

- [16] The requirement to obtain financial advice falls on a member who has applied for the statement of entitlement post 5 April 2015. For conversions under scheme rules, the member and the trustee are to have agreed to the conversion post 5 April 2015.

Exemption from the requirement to obtain appropriate independent advice

34. Where the member’s cash equivalent value of safeguarded benefits in the scheme is £30,000 or less[17] (ie the £30,000 exemption applies), the member is not required to obtain advice for the purposes of making a transfer. The value of the member’s safeguarded benefits is tested against the £30,000 threshold before any reduction is applied[18].

35. For a transfer of safeguarded benefits less than £30,000 the member must be reminded about the information on transfers available from The Pensions Regulator, MoneyHelper and the FCA to assist them. Trustees must also recommend that, although there is no obligation to take independent financial advice, the member nevertheless take advice before deciding whether to transfer[19].

Footnotes for this section

- [17] See regulation 5 of the Pension Schemes Act 2015 (Transitional Provisions and Appropriate Independent Advice) Regulations 2015.

- [18] ie ignoring regulation 7D of and schedule 1A to the Occupational Pension Schemes (Transfer Values) Regulations 1996. See regulation 5 of the Pension Schemes Act 2015 (Transitional Provisions and Appropriate Independent Advice) Regulations 2015.

- [19] Paragraph 3 of Schedule 1 to the Occupational Pension Schemes (Transfer Values) Regulations 1996.

Trustee obligations regarding the advice

36. Requiring members to obtain appropriate independent advice does not make trustees responsible for checking what advice was given, what recommendation was made or to confirm whether the member is following that recommendation.

37. The trustees are required to check that appropriate independent advice has been received by the member before they carry out the transfer or conversion[20]. The member will have received written confirmation from their adviser which they will be able to provide to the trustees[21]. This written confirmation includes:

- That the advice has been provided which is specific to the type of transaction proposed by the member.

- That the adviser has the required authorisations under the relevant legislation to provide advice on the transfer of safeguarded benefits.

- The reference number of the company or business in which the adviser works.

- The name of the member that was given the advice and the scheme in which they hold safeguarded benefits to which the advice applies[22].

38. Trustees should retain a copy of this written confirmation.

39. When the trustees have received the confirmation that appropriate independent advice has been received, and before the transfer is made, they must check that the adviser has the correct permission to carry on the regulated activity[23]. This can be done by verifying details on the Financial Services Register maintained by the FCA. During 2020 the FCA updated the register with a simpler, clearer design, in line with changes being made due to the replacement of the Approved Persons Regime with the Senior Managers and Certification Regime (SM&CR). The register can be used as follows[24]:

- there should be a search bar at the bottom or top of the screen

- enter the firm reference number for the adviser firm. Although it is possible to search using other criteria (eg firm name), as the firm reference number is unique to a firm we recommend using this as the search criteria where possible. The register will clearly indicate if the firm is not authorised.

- to establish the adviser firm’s permission, click on the entry for the firm and scroll down to ‘Activities and Services’ (alternatively, there is a shortcut link to this under ‘What can this firm do in the UK?’ in the Contents list on the left-hand side of the page. One or more activities should appear for which the firm has permission. The firm must have permission for the activity ‘Advising on pension transfers and pension opt-outs’.

- within this activity, there is a heading called ‘Limitation’. A check should be made that there is not the limitation ‘Except under Article 53E’.

Under the Senior Managers and Certification Regime, only senior managers and selected other roles will now need to be approved and a directory of certified and assessed persons will be added to the Register later in 2020. Other individuals, for example those carrying out customer-facing roles, will be subject to a certification regime carried out by their firm and most will not appear on the FCA register in the future.

Trustees should continue to check the Register for firm details. They can then contact firms to confirm that the relevant individual works for that firm or check an appropriate third-party directory.

40. If advice is received from an adviser whose firm is not on the FCA register, then the trustees must not transfer the member’s benefits.

41. It will be important for the trustees to keep a record of who conducted the check, when this was conducted and evidence that the adviser’s firm or company was on the Financial Services Register before the transfer of benefits was made. For example, where electronic records are kept it would be sensible to retain a screen shot of the register showing the company or business permissions and the date it was checked. Trustees, with their administrators, have discretion to establish a process appropriate to their scheme.

42. Trustees should also be alert to the risk of fraudulent communications submitted to the scheme confirming appropriate independent advice has been provided when this has not been the case. Trustees should be alerted if, for example, they receive a large number of written transfer confirmations from the same firm of advisers within a short space of time or where trustees have reason to suspect the authenticity of the written confirmation from the adviser. Where trustees are suspicious, they should contact the firm purporting to have given the written confirmation directly to check that firm has submitted the written confirmation. For this purpose, trustees can use the contact details for the firm in the ‘basic details’ section of the financial services firm search on the FCA Register. Where there are concerns about the adviser, these should be reported to the FCA.

43. The member should be contacted as soon as possible in the event of a problem corroborating information on the Financial Services Register and informed that the transfer will not proceed until the member has provided the correct information.

44. Trustees should keep a record of the checks undertaken and retain them for at least six years although we recommend that they are retained for a longer period.

Footnotes for this section

- [20] Section 48 of the 2015 Act.

- [21] Regulation 7 of the Pension Schemes Act 2015 (Transitional Provisions and Appropriate Independent Advice) Regulations 2015.

- [22] Regulation 7 of the Pension Schemes Act 2015 (Transitional Provisions and Appropriate Independent Advice) Regulations 2015.

- [23] Regulation 11 the Pension Schemes Act 2015 (Transitional Provisions and Appropriate Independent Advice) Regulations 2015.

- [24] FCA's Financial Services Register

Who must pay for the advice?

45. Members will be expected to meet the cost of the advice, except where the transfer is employer-instigated. Employers[25] are required to pay for appropriate independent advice where they, or the trustees or other third party on their behalf, write to two or more members and set out the option to transfer in terms that encourage, persuade or induce a request to transfer[26].

46. Routine communications from trustees that simply explain to members their options, including the possibility of transferring or converting benefits, should not trigger the requirement for the employer to pay for advice. Such communication might include information to certain categories of member, such as those receiving pre-retirement material that includes a transfer value, or where the trustees routinely include transfer values as part of an annual benefit statement. However, trustees should avoid placing a particular emphasis on one particular option or options and we expect material to be fair, clear, unbiased and straightforward.

47. Where the employer has requested that trustees include the transfer value and/or information about transferring when communicating with members, trustees should consider the employer’s reason for this request and, if appropriate, take advice as to whether they could be deemed to be encouraging, persuading or inducing members to transfer on behalf of the employer. If trustees receive advice that they would be encouraging, persuading or inducing members on the employer’s behalf, they should discuss this with the employer before sending out the communication (given the likely cost implications for the employer). In these circumstances, it would also be good practice for the communication that the trustees send out to include information about the employer’s arrangements for paying for the advice.

48. Where an employer is required to pay for the independent advice, members might ask the trustees if they have a free choice of adviser. Where the employer must pay, it may choose:

- to both arrange for appropriate independent advice to be provided and to pay for it (in this case, if the member decides to seek advice from a separate adviser, the employer has no obligation to pay for the separate advice) or

- not to arrange for the advice to be provided, but to pay for the advice the member obtains (in this case, the member is free to decide which authorised independent adviser to use and there is no cap on the cost of the advice)

Footnotes for this section

- [25] ‘Employer’ includes current and former principal and participating employers under the scheme rules (whether or not that employer has ever employed any members) and any parent or subsidiary in the same corporate group as the employer. Corporate trustees which are subsidiaries of the employer do not, however, count as employers in this context.

- [26] Regulation 12 The Pension Schemes Act 2015 (Transitional Provisions and Appropriate Independent Advice) Regulations 2015.

Setting transfer value assumptions

49. The statutory basis and approach to be used in the calculation of cash equivalent transfer values is unchanged. Broadly, the requirement is to establish a process for establishing a transfer value based on assumptions that are no weaker than at the ‘best estimate’ level. Details of these requirements are contained in the legislation and this is supplemented by our transfer values guidance[27].

50. The threshold at which members are required to obtain appropriate independent advice should not influence decision-making processes when setting transfer value bases for the scheme. Transfer bases can be changed at any time, informed by funding position and experience. A balance will be needed between the frequency of reviews and practicality of applying different transfer bases. Trustees should therefore discuss with their advisers options to respond to material changes (either positive or negative) to the scheme’s overall position and any consequential impact on the management of the scheme, for example the need for changes to investment strategy.

Footnotes for this section

Impact of transfer values on scheme funding

51. Trustees should consider the impact on their DB scheme’s funding that the number and size of transfer requests could have. Scheme funding and transfer value assumptions are related and, as such, decisions on each should not be taken in isolation. Consistent with Code of practice 3: Funding defined benefits[28], trustees should be considering the risks presented by transfers to the likelihood of members receiving their benefits in full.

52. Trustees are expected to adopt a proportionate and integrated approach to the overall management of scheme funding risks, taking into account their view of the strength of the employer’s covenant. They should consider whether there could be a material risk to their funding assumptions as a result of their approach to transfers. An integrated approach to management of these risks[29] will inform whether further action is needed by the trustees. For example, it may be necessary to understand how current and future age profiles, likely member demand and size of transfers could impact on expected investment returns, liquidity and views on the strength of the employer’s covenant.

53. Trustees should identify any potential for different classes of transferring members disproportionately affecting scheme funding. Care with transfer bases will be especially important for smaller schemes where the departure of a few members with very large transfer values relative to the total scheme assets could have disproportionate impact on the funding of the scheme.

54. In some situations reducing transfer values for underfunding[30] may be appropriate[31]. In all cases trustees should balance their responsibilities to transferring members with those remaining in the scheme. Achieving such balance will not be a precise science and trustees should obtain advice from their actuary. Our transfer value guidance[32] sets out the considerations needed to reach a balanced view. Decisions to reduce transfer values should be kept under review to ensure the level of reduction remains appropriate. The position may change, for example, if a significant number of reduced transfer values are paid out of the scheme.

Footnotes for this section

- [28] Funding defined benefits code.

- [29] See paragraphs 36–56 at the above link.

- [30] Trustees may request that their actuary prepares an insufficiency report – trustees may commission this where, on the date of the report (which must be after the effective date of the last actuarial valuation), the scheme’s assets were insufficient to cover its liabilities.

- [31] For funded public service pension schemes, reductions to transfer values must be applied in accordance with the Funded Public Service Pension Schemes (Reduction of Cash Equivalents) Regulations 2015.

- [32] Transfer values guidance.

Checks regarding the receiving scheme

55. We expect trustees to check the receiving scheme to ensure that it is able and willing to accept the transfer[33] and it is a legitimate arrangement.

56. Where trustees have reason to believe that the receiving scheme is not a legitimate arrangement, they should consider carefully whether the transfer should be made. Our scams information sets out what trustees can do where they suspect a scam and who to contact[34]. A code of good practice on combating pension scams has also been published setting out industry standard due diligence to follow and assist those involved in the administration of transfers[35].

Footnotes for this section

- [33] Section 95(2) Pension Schemes Act 1993.

- [34] Avoid and report pension scams

- [35] www.combatingpensionscams.org.uk

Communications

57. Members may be unaware of whether they have safeguarded or flexible benefits (or both) in their scheme and the associated requirement to take advice when transferring safeguarded benefits[36]. Pre-retirement material should be reviewed and updated to explain the new pension flexibilities, and the member obligations associated with the transfer of safeguarded benefits.

58. If the scheme also provides flexible benefits, then additional information should be provided. Our guide to communicating and reporting[37] includes good practice guidelines regarding communicating with members about their retirement choices.

59. Where a statement of entitlement is given to a member as a result of a transfer request, the member must be provided with information including a statement to explain whether the member’s transfer value has been reduced and, if so:

- the amount by which it has been reduced

- the reasons for the reduction

- an estimate of any date by which it may be possible to provide an unreduced transfer value and

- a statement of the member’s rights to obtain further estimates[38]

60. It is important for the member to be made aware of the time limits applicable to making a transfer application so that, for example, they do not find they have lost their statutory transfer right as they have less than a year until their normal pension age or their pension coming into payment because of delay.

61. Further guidance is also available in respect of transfer exercises initiated by an employer where an employer may be seeking to actively reduce the risks or costs associated with the DB scheme by offering members the option to transfer. Our published statement outlines factors trustees should consider when they are aware the employer has made this type of proposal[39], including information that may need to be provided to members about these proposals. We support the current industry code of practice[40] on incentive exercises for pensions.

62. Trustees are also encouraged to ensure that members receive clear information about the risk of pension scams. The statement of entitlement provides an additional opportunity to make members aware of what to watch out for. For example, trustees may wish to send their members a copy of our pension scams booklet[41] at the same time as they issue the statement of entitlement.

Footnotes for this section

- [36] Trustees must provide members with a summary of their options once they stop accruing benefits if they are under the scheme’s normal pension age. This includes transfer options. (See Regulation 27A Occupational Pension Schemes (Preservation of Benefit) Regulations 1991 (SI 1991/167).

- [37] Communicating and reporting.

- [38] Paragraph 1(e) of Schedule 1 to the Occupational Pension Schemes (Transfer Values) Regulations 1996.

- [39] Incentive exercises regulatory guidance.

- [40] Incentive exercises industry code of practice (PDF, 574kb, 30 pages).

- [41] www.pension-scams.com.

Applying to us for more time to complete a transfer request

63. We are not able to waive a trustee’s legal duty to carry out a transfer within the statutory deadline and expect that the majority of transfer requests will be completed well within the statutory deadline. As these are maximum timescales, trustees should not delay unnecessarily where the transfer can be completed more quickly.

64. Where trustees have carried out a check to determine whether the member has obtained appropriate independent advice but the check could not confirm this, or the trustees have been unable to perform the check due to factors outside their control (for example where a member has not provided the trustees with the adviser’s confirmation that advice has been taken), then the trustees are not required to make the transfer and there is no need to apply to us for additional time[42]. Where, following a failed check, trustees subsequently receive the relevant confirmation that appropriate independent advice has been received, they have discretion to continue with the transfer.

65. In light of the new requirements regarding transfers and appropriate independent advice, we recognise that there are many obligations on trustees and the deadlines can be tight for trustees in certain circumstances. If trustees are worried about meeting the statutory deadlines they can submit a request to us to extend the six month payment period during which they must make payment of a transfer[43]. However, there are limited circumstances in which we may grant an extension of this time period. Any application for an extension must be made within this six month period: we will be unable to grant an extension if an application is made out of time. However, in order to provide us with sufficient time to consider it, an application should be submitted well ahead of this deadline, preferably at least six weeks before it. The application should indicate the additional time required to effect the transfer and the reasons why the transfer cannot be completed on time.

Download the cash equivalent transfer value (CETV) extension application form (PDF, 182kb, 7 pages)

Circumstances requiring a time extension

66. The circumstances where a time extension may be granted are:

- if the scheme is being wound up or about to be wound up

- the interests of members generally would be prejudiced by the transfer

- the member has not taken all steps they need to take for the trustees to carry out the transfer

- the trustees have not been provided with the information they reasonably require to carry out the transfer

- there is a dispute between the scheme and member over the transfer value or the scheme is ceasing to be contracted out

67. Any application should identify one or more of these grounds as the basis for the request for a time extension and include supporting evidence. For example, the trustees may wish to demonstrate the need for more time in order to preserve asset values before they are liquidated or, as part of due diligence, they may be awaiting confirmation from HMRC that the receiving scheme is registered with them.

68. In the event an application is made, trustees should continue to progress a member’s request. If the transfer is successfully completed whilst the extension application is being dealt with by us, this may remove the need for us to proceed with it.

69. Approval of applications is one of our reserved regulatory functions exercised by the Determinations Panel.

Download the cash equivalent transfer value (CETV) extension application form (PDF, 69kb, 5 pages)

Footnotes for this section

- [42] Regulation 13(a) Occupational Pension Schemes (Transfer Values) Regulations 1996 (SI 1996/1847).

- [43] Section 99(2A) of the Pension Schemes Act 1993.

Our role

70. Trustees are expected to identify and address key risks in administration and, as a risk based regulator, we are focussed on education and enablement to help trustees comply with their legal requirements.

71. Where transferring, trustees can provide evidence of concerns, for example where member funds may be at risk of a pension scam, then this would be a factor we would consider when deciding whether to take action in respect of non-payment of a transfer value.

72. In the event of poor scheme governance and non-compliance with legal requirements, we may consider further engagement with the trustees to understand how they intend to make improvements and whether it would be appropriate to consider the use of our powers.

PASA guidance

73. The Pensions Administration Standards Association (PASA) has published guidance and templates on DB transfers to DC schemes. We encourage trustees and administrators to read and engage with this. It aims to support members in making better choices. The guidance aims to strike a balance between members’ protection and their legal right to take their pension in a different shape or form.

Appendix: statutory process

Timeline for statutory transfers over £30,000

Members have a right to apply for a statement of entitlement once in every 12 month period. Schemes may allow more frequent requests.

This timeline sets out the maximum period available. We expect the majority of transfer requests will be completed well within the statutory deadline.

Information requirements

| Deadline | Information requirements regarding appropriate independent advice |

|---|---|

|

Within one month of a written request for:

|

If the £30,000 exemption does not apply (ie cash equivalent more than £30,000): members must be informed that, before the trustees will be able to carry out the transfer, the trustees will be required to check that the member has taken appropriate independent advice unless their safeguarded benefits fall within the £30,000 exemption. Members must also be informed that the authorised independent adviser’s confirmation that appropriate independent advice has been obtained by the member must be in the required form and be provided to the trustees within three months of the date on which the statement of entitlement was provided to the member. This information does not need to be provided if it has already been given before the time the member makes an application for the statement of entitlement (as the member had previously requested information about how to apply) or if the statement of entitlement is to be sent out within one month of the date of the application. If the £30,000 exemption does apply: members must be informed that there is no requirement for the trustees to check that the member has received appropriate independent advice before they carry out the transfer |

| Guarantee date must be within three months of the date of the member’s application for a statement of entitlement |

In all cases: a member may apply for a statement of entitlement in respect of all benefits, or in respect of one or more categories of benefits. The statement of entitlement should include a formal quotation of the member’s cash equivalent transfer value for each category of benefits at the guarantee date for which the member has applied. Various types of information about the transfer value are required to be sent with the statement of entitlement, including stating whether a reduction has been applied to the initial cash equivalent of each of the member’s categories of benefits (see regulation 11 of the Occupational Pension Schemes (Transfer Values) Regulations 1996). |

| Statement of entitlement must be provided to the member within 10 days of the guarantee date (excluding weekends, Christmas Day, New Year’s Day and Good Friday) |

If the £30,000 exemption does not apply: at the same time as providing the statement of entitlement, members must be informed that the trustees will be required to check that the member has obtained appropriate independent advice. The member will therefore need to be provided with the same information previously provided to the member when the member initially requested a statement of entitlement (see first box above). The trustees must also inform the member of the date by which they must receive confirmation that the member has received appropriate independent advice – this will be the date three months after the member receives the statement of entitlement. If the £30,000 exemption does apply: members must be informed that there is no requirement for the trustees to check that the member has received appropriate independent advice before they carry out the transfer. |

| Member application to transfer must be submitted within three months of the guarantee date | In all cases: the member’s application must confirm they wish to proceed with the transfer and indicate the scheme to which they wish to transfer their benefits. |

| The authorised independent adviser’s confirmation that the member has received appropriate independent advice must be submitted within three months from the day on which the statement of entitlement was provided to the member |

If the £30,000 exemption does not apply: the authorised independent adviser’s written confirmation that appropriate independent advice was provided to the member must confirm that advice has been provided about the transfer, that he has the required permission under the relevant legislation to provide this advice, the adviser firm’s FCA-authorised reference number, and the member’s name and the scheme from which the transfer is to be made. Trustees have discretion to honour a transfer in the event member confirmation is received after the three month period, for example, if there has been a delay in obtaining appropriate independent advice. |

| Transfer of benefits must be carried out within six months of the guarantee date | If the £30,000 exemption does not apply: before making the transfer, the trustees must check the authorised independent adviser’s firm’s reference number against the FCA’s Financial Services Register to confirm that the member has received appropriate independent advice from an authorised independent adviser. If the £30,000 exemption does apply: no check regarding appropriate independent advice is required. In all cases: the receiving pension scheme has to be willing to accept the transfer and the trustees of the transferring scheme should satisfy themselves that the receiving pension scheme is a legitimate arrangement to which they can make a transfer. |