Automatic re-enrolment: Putting workers back into pension scheme membership

Automatic enrolment detailed guidance for employers no. 11

Accompanying resources

Information to workers

Summary of information requirements in a quick-reference table format

The different types of worker

Diagram of the different categories of worker and the criteria for each category

Employer duties and safeguards

At-a-glance summary of the duties and safeguards

Please note: This guidance is linked to

Appendix A: The cyclical re-enrolment process (full-page figure (opens in new tab))

How to save this page as a PDF

On this page

About this guidance

This guidance is aimed at professional advisers and employers with in-house pensions professionals. Trustees, managers and pension scheme providers should also familiarise themselves with the automatic re-enrolment process.

It contains information on the law surrounding automatic re-enrolment. There are two types of automatic re-enrolment – cyclical and immediate. Paragraphs 6 to 35 describe the process an employer must follow when carrying out cyclical re-enrolment broadly every three years. Paragraphs 36 to 49 describe the process an employer must follow when carrying out immediate re-enrolment when a jobholder’s active membership of a qualifying scheme ceases not on their own account.

Employers reading this guidance should have already read the following guidance in this series:

- Detailed guidance no. 1 – Employer duties and defining the workforce

- Detailed guidance no. 3 – Assessing the workforce

- Detailed guidance no. 5 – Automatic enrolment

In addition, it will be helpful for employers to be familiar with the content in Detailed guidance no. 4 – Pension schemes.

‘Month’ means ‘calendar month’ throughout this guidance.

We recognise that many employers will already have pension provision for their workers, and that this will often match or exceed the minimum requirements contained in the duties. In these cases, such employers may just need to check that the minimum requirements are covered in their existing processes.

It will be helpful to employers to be familiar with the different categories of workers. These are explained in detail in Detailed guidance no. 1 – Employer duties and defining the workforce or a quick reminder is available in the Key terms.

This guidance forms part of the detailed guidance for employers (published June 2021).

Changes from last version

- minor editorial changes have been made to this version to include references to duties start date for employers who have become employers since 1 October 2017 and who are in their first re-enrolment cycle

- references about the transitional period for schemes with defined benefits have been updated, since this has ended

- references to the exemption for a worker who met the definition of a ‘qualifying person’ in the cross border pension requirements have been removed

Paragraph numbers have changed as a result of these amendments.

Introduction

1. An underlying principle of the new duties is that an employer must put their jobholders back into pension saving. They must do this on a periodic basis or where the break in membership was not on the jobholder’s own account. Just as with automatic enrolment it is the employer’s responsibility to make arrangements to establish active membership of the pension scheme again. The process of automatically putting workers back into pension saving is known as ‘automatic re-enrolment’.

2. There are two types of automatic re-enrolment – cyclical and immediate. With cyclical automatic re-enrolment an employer must put their eligible jobholders who are no longer in pension saving (because they chose to opt out or cease membership) back into an automatic enrolment scheme on a three-yearly cycle. With immediate automatic re-enrolment an employer must put a jobholder (whose active membership of a qualifying scheme has ceased even though it was not their choice) back into an automatic enrolment scheme immediately when certain conditions are met.

3. Whether it is cyclical or immediate, the process of automatic re-enrolment is the same as automatic enrolment. The process is described in Detailed guidance no. 5 – Automatic enrolment. Once enrolled, the jobholder becomes an active member of an automatic enrolment scheme and has the right to opt out.

4. Outside the enrolment duties, some employers may choose to annually re-enrol workers back into the pension scheme if they have ceased membership in the year. This guidance covers the statutory automatic re-enrolment required as part of the employer duties. Employers may continue to use their existing practices for more frequent re-enrolment but any re-enrolment outside of the duties is on a voluntary basis (employers often use contractual agreements with their staff, for example the contracts of employment, to obtain this consent. We describe this as contractual enrolment). Such employers will still be required to follow the statutory cyclical automatic re-enrolment every three years. Where this coincides with re-enrolment under the scheme rules they will need to adapt their process to match the statutory requirements if they wish to combine the re-enrolment under the scheme rules with statutory automatic re-enrolment.

5. Paragraphs 6 to 35 describe the timings and process for assessing cyclical automatic re-enrolment. Paragraphs 36 to 49 describe the events that trigger immediate automatic re-enrolment. Whether automatic re-enrolment is at the cyclical automatic re-enrolment date or the immediate automatic re-enrolment date the process of automatically re-enrolling the eligible jobholder is the same. This is described at paragraphs 50 to 60.

Cyclical automatic re-enrolment

6. Cyclical automatic re-enrolment occurs approximately every three years after an employer’s staging date or duties start date2. Essentially cyclical re-enrolment is a repeat of the process the employer carried out on their staging date or duties start date (or deferral date if they used postponement to postpone all their workers when their duties started).

7. However there are some key differences between automatic re-enrolment and automatic enrolment:

- while both automatic re-enrolment and automatic enrolment apply to eligible jobholders, automatic re-enrolment will only apply to eligible jobholders who have already had an automatic enrolment date with that employer. Automatic enrolment dates are explained in Detailed guidance no. 3b – Having completed the assessment

- postponement cannot be used with automatic re-enrolment. If the eligible jobholder criteria are met by a worker on the automatic re-enrolment date1, automatic re-enrolment must take place with effect from that date.

8. Crucially, the employer does not have to assess all their workers to identify if any meet the eligible jobholder criteria. Instead they must assess only the workers who have opted out or voluntarily ceased active membership of a qualifying scheme. The assessment of worker categories carried out on the cyclical automatic re-enrolment date is separate to the employer’s usual assessment process, which they run each pay reference period to identify whether automatic enrolment or any information requirements are triggered.

9. There are a number of steps an employer must take to prepare for cyclical automatic re-enrolment. As it is broadly a repeat of what the employer did when their duties started, some of the steps in getting ready for automatic re-enrolment are the same as those taken when getting ready for automatic enrolment.

- The first step is to choose the cyclical automatic enrolment date. The employer should then work back from this date to understand when they should take the actions outlined below to prepare for this date

- Engage early with their pension provider to ensure the pension scheme for automatic re-enrolment is ready to process a number of new joiners in a short period of time

- Assess the impact on their business processes and software supporting the administration of the employer duties

- Get ready to manage opt-outs as the eligible jobholder has a one-month period after automatic re-enrolment during which they may choose to opt out.

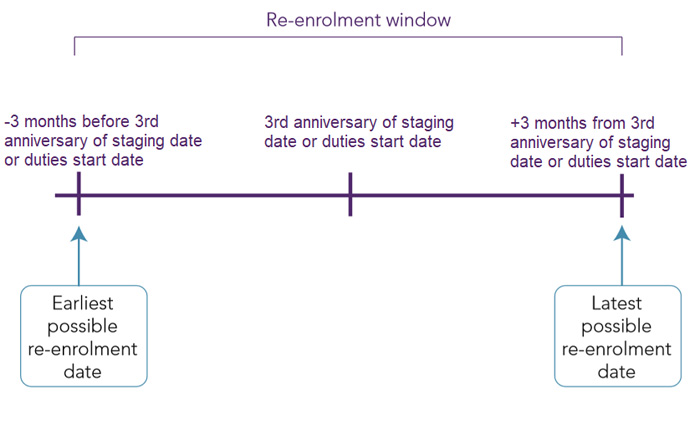

Choosing the cyclical automatic re-enrolment date

10. The first step for an employer is to know their cyclical automatic re-enrolment date. The employer may choose this date from any date that falls within a six-month window, starting three months before the third anniversary of their original staging date or duties start date and ending three months from that anniversary.

11. Employers should note that ‘months’ means calendar months. Some examples of re-enrolment windows are below.

Examples of re-enrolment windows

Employer A has a staging date2 of 1 April 2013. Their first reenrolment window is 1 January 2016 to 30 June 2016.

Employer B has a staging date of 1 October 2015. Their first re-enrolment window is 1 July 2018 to 31 December 2018.

Employer C has a duties start date of 9 February 2019. Their first re-enrolment window is 9 November 2021 to 8 May April 2022.

12. The first day of the six-month window is the earliest possible reenrolment date that the employer can choose. The last day of the six-month window is the latest possible re-enrolment date that the employer can choose.

13. The employer can choose any date within the re-enrolment window as their automatic re-enrolment date. Unlike the automatic enrolment date, the cyclical automatic re-enrolment date is an employer level date. So an employer cannot apply different dates to different workers or groups of workers. For example, an employer cannot use one re-enrolment date for monthly paid salaried workers and a different re-enrolment date for weekly paid workers – the same date applies to all the workers included in the assessment.

14. The automatic re-enrolment date is also:

- the date from which active membership of a pension scheme must start for those eligible jobholders who are being automatically re-enrolled

- the start date of the joining window (the six-week period during which automatic re-enrolment must be completed)

- the start date for the calculation of contributions due to the pension scheme for those eligible jobholders who are being automatically re-enrolled.

15. As it is such a key date, there are certain considerations an employer may wish to consider when choosing their cyclical automatic re-enrolment date:

- an employer may wish to align the cyclical automatic re-enrolment date with other key dates in their business calendar. For example the start of the corporate year, their existing arrangements for re-enrolment under the scheme rules or, for those employers operating a flexible benefits system, the date workers choose their options

- an employer may have seasonal peaks they wish to avoid, as automatic re-enrolment may result in an influx of new pension scheme members along with the associated communication activities

- postponement is not available for an employer to use at automatic re-enrolment. If an employer does not wish to have part period pension contributions calculations then they may wish to consider choosing an automatic re-enrolment date that is the first day of a pay reference period.

The pension scheme for cyclical automatic re-enrolment

16. The pension scheme to be used for automatic re-enrolment must meet the criteria to be an automatic enrolment scheme. More information on these criteria can be found in Detailed guidance no. 4 – Pension schemes. It is likely that such a pension scheme will already be in place as the employer will be using it to fulfil their automatic enrolment duty.

17. The employer and the trustees or managers of the pension scheme must follow the same process for establishing active membership under automatic re-enrolment as required under automatic enrolment, so there is unlikely to be any need for changes to the joining process. However, the employer should engage early with their pension provider to ensure that the trustees and managers are ready to process a large number of new joiners in a short period of time.

Assessing the impact on business processes

18. An employer will have existing business processes and software supporting the administration of the employer duties. It is likely that this will involve an employer’s HR, pensions administration and payroll functionality as a minimum, and may include third parties such as the provider of the pension scheme.

19. The re-enrolment assessment is a standalone assessment, so the employer should review whether any changes to their software and processes are required. This is particularly true of the payroll functionality. Postponement cannot be used at re-enrolment, so unless the employer has chosen a cyclical automatic re-enrolment date which coincides with the first day of a pay reference period, part period pension contribution calculations will be required unless the scheme rules provide otherwise.

20. Making changes to software and processes can take time, so employers should plan ahead. They should work with any third-party suppliers (for example payroll software providers) and the pension provider or administrator to ensure any necessary changes are made in good time.

Getting ready to manage opt-outs

21. An eligible jobholder has a one-month period after automatic re-enrolment during which they may choose to opt out. This is the same as for automatic enrolment and so an employer can utilise their existing opt-out and refund processes.

The re-enrolment assessment

22. The re-enrolment assessment is an assessment of a group of the employer’s workers to identify whether any meet the criteria to be an eligible jobholder. The assessment date is the cyclical automatic re-enrolment date.

23. The process of the assessment is the same as for automatic enrolment, which the employer is running as part of their usual monitoring processes each pay reference period (as described in Detailed guidance no. 3 – Assessing the workforce).

24. The employer must make the assessment based on the worker’s circumstances on the assessment date. The employer may be able to carry out the assessment ahead of time, if they are confident the circumstances will not change.

25. Similarly, it may be possible to make the assessment after the assessment date and look back to what the criteria was on the assessment date. However, an employer should be aware that if they choose to do it this way, they will reduce the amount of time available to them to complete automatic re-enrolment as this must be completed within six weeks of the cyclical automatic reenrolment date.

26. Unlike at the date their duties started, the employer does not have to include all their workers in the assessment. An employer can exclude the following workers from the re-enrolment assessment:

- any worker who is an active member of a qualifying scheme that they provide on the cyclical automatic re-enrolment date

- any worker aged 21 or under on that date

- any worker who is at state pension age (SPA) or over on that date

- any worker who has not yet had an automatic enrolment date3 on the date they are identifying the workers to be included in the assessment. This will be any worker:

- who has been a non-eligible jobholder or an entitled worker since the start of employment or the duties start date and has never met the criteria to be an eligible jobholder, or

- who, when they have met the criteria, the employer used postponement and on the deferral date the criteria to be an eligible jobholder were not met, or

- who was an active member of a qualifying scheme at the employer’s duties start date but has never met the criteria to be an eligible jobholder either whilst an active member or after they ceased active membership

- is subject to postponement on that date.

- any worker who had the transitional period for schemes with defined benefits4 applied to them where the transitional period has ended and they have not met the eligible jobholder criteria in the period since the end of the transitional period (or deferral date if postponement was used at the end of the transitional period)5

27. Having identified the workers to be included in the re-enrolment assessment, the employer must assess these workers to identify if any meet the criteria to be an eligible jobholder on the cyclical automatic re-enrolment date.

Having completed the assessment

28. The worker is an eligible jobholder if, at the end of this assessment, the employer has identified that:

- the worker is aged at least between 22 but under state pension age

- they are working or ordinarily work in the UK under their contract6

- qualifying earnings are payable in the relevant pay reference period, that are above the earnings trigger for automatic enrolment.

29. If this assessment of the worker identifies that they are an eligible jobholder, the employer must automatically re-enrol them unless the worker meets the conditions in the paragraph below. Postponement cannot be used at re-enrolment. The process of automatic re-enrolment is described in paragraphs 50 to 60.

30. An employer may choose whether to automatically re-enrol any eligible jobholder who:

- opted out or ceased active membership of a qualifying scheme (or a scheme that would have been a qualifying scheme) at their own request within the 12 months before the automatic re-enrolment date

- was paid a winding up lump sum7 within the 12 months before the automatic re-enrolment date whilst in employment with the employer and then during the 12-month period that started on the date the winding up lump sum payment was made:

- ceased employment and

- was subsequently re-employed by the same employer

- has given in their notice to end their employment (resignation or retirement) or been given notice of dismissal by the employer

- has Primary, Enhanced, Fixed or Individual protection8 from tax charges on their pension savings

- holds the office of director with the employer9

- is a partner in a Limited Liability Partnership which is the employer, and is not treated for income tax purposes as falling within HMRC’s ‘salaried member’ rules

31. More information on the exceptions from the automatic re-enrolment duty and other employer duties can be found in Detailed guidance no. 1 – Employer duties and defining the workforce.

32. If an employer chooses to automatically re-enrol an eligible jobholder they are required to follow the automatic enrolment process (see paragraph 50 below).

33. If an employer chooses not to automatically re-enrol an eligible jobholder, the employer has no further duties until the next cyclical automatic re-enrolment, unless:

- the worker gives the employer an opt-in or joining notice, or

- the information about the right of a jobholder to opt in and the right of an entitled worker to join has not yet been given. More information about the information requirements can be found in Detailed guidance no. 10 – Information to workers

34. Similarly, for those workers who do not meet the eligible jobholder criteria, the employer has no further duties until the next cyclical automatic re-enrolment, unless the worker gives the employer an opt-in or joining notice or the information about the right of a jobholder to opt in and the right of an entitled worker to join has not yet been given.

35. The employer must also re-declare their compliance with The Pensions Regulator (TPR) to tell us how they have complied with their automatic reenrolment duty.

Immediate automatic re-enrolment

36. Immediate re-enrolment is triggered by the occurrence of specific events, in the main where a jobholder’s active membership of a qualifying scheme has ceased because of an action by a third party, ie not on the jobholder’s own account.

37. When these events occur the employer must put the jobholder back into an automatic enrolment scheme with effect from the automatic re-enrolment date. However, this automatic re-enrolment date is not the cyclical re-enrolment date. It is a date specific to the jobholder and to the type of event that has occurred.

38. The table below shows these re-enrolment events.

Table 1

Immediate re-enrolment events and automatic re-enrolment dates

| Event | Conditions | Example | Automatic re-enrolment date | |

|---|---|---|---|---|

| A | The employer has caused (either by an act or omission) active membership of a qualifying scheme to cease and it was not at the request of the jobholder. | Worker is a jobholder when active membership ceased. Jobholder did not request employer to take action or omission on their behalf. | For example by amending the eligibility criteria in the scheme rules. |

Jobholder’s automatic re-enrolment date is the day after active membership of a qualifying scheme ceased. Note: Automatic re-enrolment must take place if the jobholder criteria are met, ie their earnings are above the lower level of qualifying earnings and they are aged between 16 and 74. |

| B | The employer has caused (either by an act or omission) the scheme of which the jobholder is an active member to cease to be a qualifying scheme for that jobholder and it was not at the request of the jobholder. | Worker is a jobholder when the scheme ceased to be a qualifying scheme in respect of that jobholder. Jobholder did not request employer to take action or omission on their behalf. | For example by reducing contributions in a DC scheme to a lower tier in the pension scheme rules which is below the minimum contribution entitlement. |

Jobholder’s automatic re-enrolment date is the day after the scheme ceased to be a qualifying scheme for that jobholder. Note: Automatic re-enrolment must take place if the jobholder criteria are met, ie their earnings are above the lower level of qualifying earnings and they are aged between 16 and 74. |

| C | The trustees or managers of a pension scheme or another third party have caused the jobholder’s active membership of a qualifying scheme to cease. | Worker is a jobholder when active membership ceased. Jobholder did not request employer to take action or omission on their behalf. | For example, the trustees of an occupational DC scheme have adopted an adjustment measure to comply with the charge cap regulations. The measure will entail that no further contributions will be accepted into the scheme in respect of the jobholder from the adjustment date. |

Jobholder’s automatic re-enrolment date is the day after active membership of a qualifying scheme ceased. Note: Automatic re-enrolment must take place if the jobholder criteria are met, ie their earnings are above the lower level of qualifying earnings and they are aged between 16 and 74. |

| D | A jobholder’s active membership of a qualifying scheme ceased after automatic enrolment because the jobholder ceased to be working or ordinarily working in the UK. | Worker is a jobholder aged at least 22 and up to state pension age when active membership ceased. | For example the rules of the scheme do not allow membership if the member is no longer working or ordinarily working in the UK. | The automatic re-enrolment date is the first date that the jobholder criteria are next met ie their earnings are above the lower level of qualifying earnings and they are aged between 16 and 74. |

| E | A jobholder’s active membership of a qualifying scheme ceased after automatic enrolment because the jobholder who was automatically enrolled ceased to have qualifying earnings in the relevant pay reference period. | Worker is a jobholder aged at least 22 and up to state pension age when active membership ceased. | For example the rules of the scheme did not allow active membership to continue when earnings fell below the lower level of qualifying earnings in a pay reference period. | The automatic re-enrolment date is the first date that the jobholder criteria are next met ie their earnings are above the lower level of qualifying earnings and they are aged between 16 and 74. |

| F | The employer and the worker have agreed that the notice to end employment (resignation, retirement or dismissal) is withdrawn. | Worker is a jobholder on the date they and the employer agree the notice is withdrawn. | The automatic re-enrolment date is the date of the agreement to withdraw the notice, if the eligible jobholder criteria are met on this date. If not, the automatic re-enrolment date is the first date that the eligible jobholder criteria are next met. |

39. Where active membership of a qualifying scheme ceases or the scheme ceases to be a qualifying scheme for a jobholder and it was not on the jobholder’s own account or because they asked the employer or third party to take the action, the employer will have to assess the worker to see what category they were on the date it ceased. This is to determine which of the six scenarios A-F applies.

40. If none apply then the employer need take no further action (assuming all the information requirements have been met) until the next cyclical automatic re-enrolment or if they are given an opt-in or joining notice.

41. If A, B or C apply then the employer must assess the worker the day after active membership of the qualifying scheme ceased and if appropriate on day one of the following pay reference periods. The first day after active membership of the qualifying scheme ceased that the worker meets the jobholder criteria is the worker’s immediate automatic re-enrolment date.

42. If D applies, then the employer must assess the worker after they return to be working or ordinarily working in the UK on that date and if appropriate on day one of the following pay reference periods. The first day after their return to working or ordinarily working in the UK that the worker meets the jobholder criteria is the worker’s immediate automatic re-enrolment date.

43. If E applies, the employer must assess the earnings of the worker each pay reference period to identify the first day that the jobholder criteria are met. This will be the immediate automatic re-enrolment date.

44. If F applies, the employer must assess the worker on the date they agree with the worker that the notice is withdrawn, and if appropriate, on day one of the following pay reference periods. The first day on or after the date they agree with the worker that the notice is withdrawn that the worker meets the eligible jobholder criteria is the worker’s immediate automatic reenrolment date.

45. Employers should note that this is the only instance of immediate re-enrolment where the condition for re-enrolment is that the worker meets the eligible jobholder criteria. In all other cases of immediate re-enrolment, the employer must automatically re-enrol a worker who is a jobholder (ie eligible or non-eligible).

46. Regardless of which event triggered immediate automatic reenrolment, the employer must automatically re-enrol the jobholder (or eligible jobholder in the case of F) with effect from the applicable immediate automatic re-enrolment date, unless they:

- were paid a winding up lump sum within the 12 months before the automatic re-enrolment date whilst in employment with the employer and then during the 12-month period that started on the date the winding up lump sum payment was made:

- ceased employment and

- was subsequently re-employed by the same employer

- have given in their notice to end their employment (resignation or retirement) or been given notice of dismissal by the employer

- have Primary, Enhanced, Fixed or Individual protection from tax charges on their pension savings10

- holds the office of director with the employer11

- is a partner in a Limited Liability Partnership which is the employer, and is not treated for income tax purposes as falling within HMRC’s ‘salaried member’ rules, or

- opted out or ceased active membership of a qualifying scheme (or a scheme that would have been a qualifying scheme) at their own request within the 12 months before the automatic re-enrolment date (relevant in the case of F only)

47. If any of the conditions in the bullets above are met, the employer can choose whether to apply the immediate automatic reenrolment duty or not. If an employer chooses to automatically re-enrol an eligible jobholder they are required to follow the automatic re-enrolment process below.

48. If an employer chooses not to automatically re-enrol an eligible jobholder, the employer has no further duties until the next cyclical automatic re-enrolment, unless:

- the worker gives the employer an opt-in or joining notice, or

- the information about the right of a jobholder to opt in and the right of an entitled worker to join has not yet been given.

49. Whether the employer is obliged to automatically re-enrol or has chosen to do so the process is the same as described below.

The automatic re-enrolment process

50. If the employer is automatically re-enrolling the eligible jobholder, whether it be as a result of cyclical or immediate automatic re-enrolment, they must make arrangements so that the eligible jobholder becomes an active member of an automatic enrolment scheme with effect from their automatic re-enrolment date.

51. The employer must follow the same steps set out in law as for automatic enrolment, so that the jobholder becomes an active member with effect from their automatic re-enrolment date.

52. The process of automatic enrolment is described in Detailed guidance no. 5 – Automatic enrolment. When reading this guidance and applying it to automatic re-enrolment, the following terms apply:

- for ‘automatic enrolment’ read ‘automatic re-enrolment’,

- for ‘automatically enrolled’ read ‘automatically re-enrolled’ and

- for ‘automatic enrolment date’ read ‘automatic re-enrolment date’

53. In addition, when reading Detailed guidance no. 5 – Automatic enrolment and applying it to immediate automatic re-enrolment, references to ‘eligible jobholder’ should be taken to refer include ‘jobholders’ depending upon which event has triggered the immediate automatic re-enrolment.

54. There are two exceptions to this, where the employer may choose to use a modified process for automatic re- enrolment. These are:

- if the eligible jobholder being automatically re-enrolled (cyclical or immediate) is already a member of a personal pension scheme with that employer and the employer wants to use that scheme to fulfil their re-enrolment duty, or

- if the eligible jobholder is being automatically re-enrolled as a result of active membership of the qualifying scheme ceasing, either because they ceased to be working or ordinarily working in the UK or they ceased to have qualifying earnings in the relevant pay reference period (immediate re-enrolment). In this case re-enrolment under the modified process can be into a personal pension scheme or an occupational pension scheme.

Modified automatic re-enrolment process

55. Under the modified process, before the end of what is known as the ‘joining window’ (the six week period from the automatic re-enrolment date) the employer must make arrangements to achieve active membership for the eligible jobholder, effective from their automatic re-enrolment date by making arrangements with the provider of a personal pension scheme or the trustees or managers of an occupational scheme, so that:

- the scheme is an automatic enrolment scheme, and

- the eligible jobholder is an active member of that scheme

56. In the case of a personal pension scheme, as part of ensuring that the scheme is an automatic enrolment scheme, there will need to be agreements in place that meet the minimum requirements part of the qualifying criteria for pension schemes. There may not be any need to put new agreements in place, just to reactivate the existing agreements or the parts of the agreements that will relate to the minimum contribution entitlement. This will depend on:

- what agreements were in place between the pension scheme provider, the jobholder and the employer when the jobholder was first an active member

- the pension scheme provider’s processes for administering the policy

57. However, if reactivating previous agreements or parts of these agreements, the jobholder cannot be required to give consent or provide any information as this would mean the scheme does not meet the automatic enrolment criteria.

58. The qualifying earnings thresholds are reviewed every year and may change. This may result in an increase in the minimum contribution entitlement. If the automatic re-enrolment date falls after an increase in qualifying earnings, then the minimum contribution rates at the time of reenrolment may be different from those under the scheme rules or governing documentation, (agreements under a personal pension scheme), that applied when active membership of the qualifying scheme was created.

59. Where those previous scheme rules or governing documentation required contributions of only the minimum amount and this has increased, then unless the original documents gave the provider or the employer the ability to change contribution rates without consent, the provider will not be able to reactivate these agreements or parts of these agreements. Unless they can be reactivated at the level of the minimum contribution entitlement that applies at the automatic re-enrolment date, (without requiring consent), the pension scheme cannot be made an automatic enrolment scheme. In this case the employer and the provider cannot therefore practically use the modified automatic re-enrolment process.

60. The employer must follow the full automatic enrolment process described in Detailed guidance no. 5 – Automatic enrolment where:

- they want to use a different personal pension scheme than the one of which the jobholder is a member

- they want to use a personal pension scheme for automatic enrolment and the jobholder is not a member of a personal pension scheme

- the eligible jobholder was previously automatically enrolled or enrolled and opted out during the opt-out period (this is because the effect of opt-out is that the worker is treated as never having been a member)

- they are unable to use the modified process.

After automatic re-enrolment

61. Once automatic re-enrolment (cyclical or immediate) has been completed, an employer will have ongoing responsibilities either:

- with the pension scheme, as the jobholder remains a member of the scheme, such as paying contributions, or

- to manage the opt-out process, if the jobholder chooses to opt out of the pension scheme, and

- to keep records.

62. Once cyclical automatic re-enrolment has been completed, an employer must re-declare their compliance with TPR to tell us how they have discharged their re-enrolment duty. They must continue with their usual monitoring process each pay reference period and their ongoing responsibilities for those workers who are active members of a qualifying scheme that they provide. At the next cyclical automatic re-enrolment date they must repeat the reenrolment assessment.

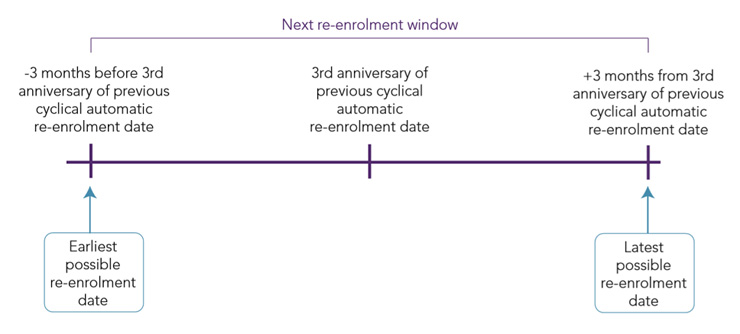

63. The next cyclical automatic re-enrolment date is a date of the employer’s choice; from a six-month window starting three months before the third anniversary of the employer’s last cyclical automatic re-enrolment date and ending three months from that anniversary.

Key terms

Summary of the different categories of worker

The table below is a quick reminder of the different categories of worker. These are explained in detail in Detailed guidance no. 1 – Employer duties and defining the workforce.

| Category of worker | Description of worker |

|---|---|

| Worker | An employee or someone who has a contract to perform work or services personally, that is not undertaking the work as part of their own business. |

| Jobholder |

A worker who:

|

| Eligible jobholder |

A jobholder who:

|

| Non-eligible jobholder |

A jobholder who:

|

| Entitled worker |

A worker who:

|

Footnotes

[1] In exceptional circumstances an employer may have a re-enrolment duty in respect of a worker who has not yet had an automatic enrolment date. This can only occur where the employer is exempted from the automatic enrolment duty and up to the cyclical reenrolment date the worker has never met the eligible jobholder criteria but then is an eligible jobholder for the first time on the cyclical automatic reenrolment date.

[2] Up until 30 September 2017, employers were assigned a specific date known as the 'staging date' on which their workplace pension duties began. Since 1 October 2017, the date an employer has duties is the day they take on their first member of staff – this is their duties start date.

[3] In exceptional circumstances an employer may have a re-enrolment duty in respect of a worker who has not yet had an automatic enrolment date. This can only occur where the employer is exempted from the automatic enrolment duty and up to the cyclical re-enrolment date the worker has never met the eligible jobholder criteria but then is an eligible jobholder for the first time on the cyclical automatic re-enrolment date. These workers should not be excluded from the assessment.

[4] References throughout this guidance to ‘schemes with defined benefits’ in relation to the transitional period for these schemes includes both defined benefit pension schemes and hybrid pension schemes where a defined benefit pension is offered.

[5] Another exemption where a worker meets the definition of a ‘qualifying person' for the purposes of cross border pension requirements remains in the legislation. However, the cross border pension requirements were revoked on 31 December 2020. This means that in practice the conditions for this exemption cannot be met, as the cross border requirements no longer exist and so it cannot, in our view, apply. For more information see Detailed guidance no. 1 – Employer duties and defining the workforce.

[6] Except workers in offshore employment for whom the employer does not have to consider whether they are working or ordinarily work in the UK. A worker in offshore employment is a person who works under a worker’s contract in the territorial waters of the UK, or in connection with the exploration of the sea-bed or subsoil, or the exploitation of their natural resources, in the UK sector of the continental shelf (including the UK sector of a cross-boundary petroleum field).

[7] Under HMRC provisions the trustees of defined contribution (DC) occupational pension schemes in wind up are allowed to commute sums of under £18,000 provided certain conditions are met. The payment of this commuted sum is known as a ‘winding-up lump sum payment’).

[8] A worker who has built up pension savings above the Lifetime Allowance for HMRC purposes is protected from tax charges on those savings under HMRC’s primary, enhanced or fixed protection requirements. See paragraph 100 of Detailed guidance no. 6 – Opting in, joining and contractual enrolment for the list of the different types of protection from tax charges included in the exception from the employer duties.

[9] Paragraph 32 of Detailed guidance no. 1 – Employer duties and defining the workforce explains what it means to hold office as a director.

[10] See paragraph 103 of Detailed guidance no. 1 – Employer duties and defining the workforce for the list of the different types of protection from tax charges included in the exception from the employer duties.

[11] Paragraph 32 of Detailed guidance no. 1 – Employer duties and defining the workforce explains what it means to hold office as a director.

Related content

Automatic enrolment detailed guidance

1. Employer duties and defining the workforce

3b. Having completed the assessment

5. Automatic enrolment process

6. Opting in, joining and contractual enrolment

Now reading: 11. Automatic re-enrolment