Automatic enrolment: An explanation of the automatic enrolment process

Automatic enrolment detailed guidance for employers no. 5

Accompanying resources

Information to workers

Summary of information requirements in a quick-reference table format

The different types of worker

Diagram of the different categories of worker and the criteria for each category

Employer duties and safeguards

At-a-glance summary of the duties and safeguards

Please note: This guidance is linked to

Appendix A: Summary of automatic enrolment process

How to save this page as a PDF

On this page

About this guidance

This guidance is aimed at professional advisers and employers with in-house pensions professionals. Trustees, managers and pension scheme providers should also familiarise themselves with the automatic enrolment process.

It contains information on the law surrounding automatic enrolment. To aid understanding, we have split the guidance into two sections.

The section entitled How to automatically enrol describes the process an employer must follow to make an eligible jobholder an active member of an automatic enrolment pension scheme. It contains lists of the information an employer is required to provide as part of the new employer duties in relation to automatic enrolment.

The section entitled After completing automatic enrolment explains an employer’s ongoing responsibilities once they have completed the initial stages of the process.

Employers reading this guidance should have already read the following guidance in this series:

- Detailed guidance no. 1 – Employer duties and defining the workforce

- Detailed guidance no. 2 – Getting ready

- Detailed guidance no. 3 – Assessing the workforce

- Detailed guidance no. 3a – Postponement

In addition, it will be helpful for employers to be familiar with the content in Detailed guidance no. 4 – Pension schemes that is relevant to them.

We recognise that many employers will already have pension provision for their workers, and that this will often match or exceed the minimum requirements contained in the duties. In these cases, such employers may just need to check that the minimum requirements are covered in their existing processes.

It will be helpful to employers to be familiar with the different categories of workers. These are explained in detail in Detailed guidance no. 1 – Employer duties and defining the workforce or a quick reminder is available in the Key terms.

This guidance forms part of the latest version of the detailed guidance for employers (published June 2021).

Changes from last version

We have updated this guidance to incorporate some of the content on automatic enrolment of an eligible jobholder to whom the transitional period for schemes with defined benefits was applied, that was previously part of the previous version of guidance no.3b.

This guidance from the previous version has been retired as the transitional period ended on 30 September 2017.

Paragraph numbers have changed as a result of these amendments.

An employer has ongoing responsibilities

Introduction

1. Automatic enrolment is one of the key employer duties. The core requirement is that employers must make arrangements so that their eligible jobholders become active members of an automatic enrolment pension scheme from their automatic enrolment date1.

2. An employer must automatically enrol any eligible jobholder working for them either from the automatic enrolment date2, or from the end of the postponement period (where they have chosen to use postponement), unless they:

- are already an active member of a qualifying scheme with that employer, or

- meet the conditions for any of the exceptions from the employer’s automatic enrolment duty. The exceptions are described in Detailed guidance no. 1 – Employer duties and defining the workforce

3. Whilst all of the exceptions change the automatic enrolment duty if the relevant conditions are met, the way the duty is changed varies according to the exception. In some circumstances the employer is given the choice whether to comply with the duty or not, while in other circumstances the duty is removed altogether.

4. Whether the employer is required to automatically enrol an eligible jobholder or has chosen to, they must follow the automatic enrolment process. The process required to automatically enrol an eligible jobholder into an automatic enrolment pension scheme is described in paragraphs 11 to 48. The arrangements that an employer must make are set out in law.

Automatic enrolment is one of the key employer duties

5. Employers, trustees, managers and providers of pension schemes alike should familiarise themselves with the automatic enrolment process. It is likely that some changes to the existing process of joining will be necessary for an existing pension scheme to be able to be used, even if the scheme rules currently allow immediate enrolment.

6. Paragraphs 51 to 78 outline what happens after automatic enrolment has been completed.

7. If an employer is given an opt-in notice by a jobholder they must arrange active membership of an automatic enrolment scheme. (Opting in is explained in Detailed guidance no. 6 – Opting in, joining and contractual enrolment.) They are required to follow the automatic enrolment process to achieve this.

8. When reading this guidance and applying it to opting in, the following terms apply:

- for ‘eligible jobholder’ read ‘jobholder’

- for ‘automatic enrolment’ read ‘enrolment’

- for ‘automatically enrolled’ read ‘enrolled’

- for ‘automatic enrolment date’ read ‘enrolment date’.

9. The employer must automatically re-enrol any eligible jobholders who have come out of pension saving, on a three-yearly cycle (‘cyclical automatic re-enrolment’). The employer must also automatically re-enrol jobholders immediately when certain events have caused a jobholder’s active membership of a qualifying scheme to cease (‘immediate automatic re-enrolment’). (Cyclical and immediate automatic re-enrolment are explained in Detailed guidance no.11 – Automatic re-enrolment.) Employers must follow the automatic enrolment process to automatically re-enrol their jobholders (eligible and non-eligible).

10. When reading this guidance and applying it to automatic reenrolment, the following terms apply:

- for ‘eligible jobholder’ read ‘jobholder’ when applying it to immediate re-enrolment when certain events have caused a jobholder’s active membership of a qualifying scheme to cease

- for ‘automatic enrolment’ read ‘automatic re-enrolment’

- for ‘automatically enrolled’ read ‘automatically re-enrolled’

- for ‘automatic enrolment date’ read ‘automatic re-enrolment date’

11. In rare cases an employer may be automatically enrolling an eligible jobholder to whom they had applied the transitional period for schemes with defined benefits at their staging date. This may happen in respect of a worker who:

- had the transitional period for schemes with defined benefits applied to them at the employer’s staging date

- did not meet the eligible jobholder criteria on either:

- 1 October 2017 (where the transitional period was in effect for the full period up to and including 30 September 2017) or the deferral date if postponement at the end of the transitional period was used, or

- The day after the conditions for the transitional period to apply ended (where the transitional period ended early before 30 September 2017) or the deferral date if postponement at the end of the transitional period was used, and

- meets the eligible jobholder criteria on a date after the day after the transitional period ended (or the deferral date if postponement at the end of the transitional period was used).

12. As a result of the employer choosing to apply the transitional period to the eligible jobholder, the automatic enrolment duty is amended for the eligible jobholder. Where the transitional period was in effect for the full period up to and including 30 September 2017 (ie the employer did not end it early), under the amended duty the employer must make arrangements so that the eligible jobholder becomes, either:

- an active member of a defined benefits automatic enrolment scheme from the day after the end of the transitional period (1 October 2017), or

- a ‘defined benefits member’3 of a hybrid automatic enrolment scheme from the day after end of the transitional period (1 October 2017).

13. Where the conditions for the transitional period stopped being met and the transitional period was ended early before 30 September 2017 then under the amended duty he employer must make arrangements so that the eligible jobholder becomes either:

- an active member of a defined benefits automatic enrolment scheme from the day after the conditions stopped being met, or

- an active member of a defined contribution or personal pension automatic enrolment scheme, with effect from the eligible jobholder’s automatic enrolment date or the deferral date if postponement is used, or

- a ‘defined benefits member’3 of a hybrid automatic enrolment scheme from the day after the conditions stopped being met, or

- an active member of a hybrid automatic enrolment scheme where all the benefits accruing in respect of their membership are money purchase, with effect from the eligible jobholder’s automatic enrolment date or the deferral date if postponement is used, or

- an active member of a defined benefits or hybrid automatic enrolment scheme, with effect from the eligible jobholder’s automatic enrolment date or the deferral date if postponement is used, where:

– the scheme meets the conditions so that it is permitted to meet the money purchase qualifying requirements in order to be a qualifying scheme, and

– the defined benefit provisions of the scheme do not meet the test standard or the other alternative qualifying requirements for a defined benefit scheme.

14. The key differences between the amended duties in paragraphs 12 and 13 and the usual duty are the type of scheme that must be used for automatic enrolment, and the date from which active membership of that scheme must start. When reading this guidance and applying it to the automatic enrolment of an eligible jobholder who meets the conditions in paragraph 11 above, an employer should be aware of three modifications:

- ‘automatic enrolment date’ means:

- ‘1 October 2017’ (where the transitional period was in effect for the full period up to and including 30 September 2017), or

- ‘The day after the conditions stopped being met’ (where the transitional period was ended early before 30 September 2017 and the automatic enrolment pension schemes is a defined benefits scheme), or the deferral date if postponement is being used for a jobholder in these circumstances, or

- ‘the employer’s first enrolment date’4, likely to be the staging date (where the transitional period was ended early before 30 September 2017 and the automatic enrolment pension schemes is not a defined benefits scheme), or the deferral date if postponement is being used for a jobholder in these circumstances.

- the ‘joining window’ (the period of time in which to complete the process of automatic enrolment is amended (see paragraph 16), and

- the automatic enrolment scheme being used must meet certain additional requirements (see paragraphs 56 to 65)

How to automatically enrol

15. Having identified an automatic enrolment duty in respect of an eligible jobholder, the process for automatically enrolling eligible jobholders into an automatic enrolment scheme consists of a number of steps set out in law.

16. The law also sets out the time limit for completing automatic enrolment. Before the end of what is known as the ‘joining window’ (the six week period from the eligible jobholder’s automatic enrolment date5), the employer must:

- give information to the pension scheme about the eligible jobholder

- give enrolment information to the eligible jobholder

- make arrangements to achieve active membership for the eligible jobholder, effective from their automatic enrolment date. They can do this by making arrangements with either:

- the trustees or managers of an occupational pension scheme to create active membership under the scheme rules, or

- the provider of a personal pension scheme, to ensure that the eligible jobholder is given the information about the policy that is deemed to exist between them and the pension scheme provider.

17. These steps are not sequential and can be done in any order.

18. The employer is also required to keep certain records of this process of automatic enrolment. For more information on the records to keep, see Detailed guidance no. 9 – Keeping records.

19. In addition, where an employer is automatically enrolling an eligible jobholder to whom they had applied the transitional period, the automatic enrolment scheme must meet certain extra conditions. More information on this can be found at paragraphs 56 to 65.

Information an employer must give

Information to the pension scheme about the eligible jobholder

20. A key feature of an automatic enrolment scheme is that the eligible jobholder must not be required to provide information to either join or remain a member. It is the employer’s responsibility, working with the pension scheme trustees, managers or pension scheme provider, to achieve active membership for the eligible jobholder.

21. The employer must give certain personal information about the eligible jobholder to the pension scheme trustees, managers or pension scheme provider. They must do this before the end of the joining window.

22. This is the minimum amount of information required to achieve active membership, although its provision alone does not necessarily mean that active membership has been established. The employer should be aware that the trustees, managers or provider of the pension scheme may require more information, depending on the scheme rules, as long as this does not act as a barrier to automatic enrolment. See Detailed guidance no. 4 – Pension schemes for more information.

Who to give the information to

23. For personal pension schemes: the information must be given to the pension scheme provider (often an insurance company).

24. For occupational pension schemes: the information must be given to the pension scheme trustees or managers.

Giving the information

25. The information must be given in writing. Someone acting on the employer’s behalf, such as an independent financial adviser, benefit consultant, accountant or bookkeeper can send the information, but it remains the employer’s responsibility to make sure it is provided, on time, and is correct and complete.

Information to the pension scheme about the eligible jobholder

For each eligible jobholder who is being automatically enrolled, it is mandatory for the employer to give the trustees, managers or providers of the pension scheme, the eligible jobholder’s:

- name

- gender

- date of birth

- automatic enrolment date6

- postal residential address.

National Insurance number (NINO) – if the employer does not have the eligible jobholder’s NINO, they can provide it to the pension scheme at a later date. This must be within six weeks of the employer receiving it.

Employers should also give the following information, unless the pension scheme does not require it. The eligible jobholder’s:

- postal work address

- work email address (if one exists)

- personal email address (if the employer holds this information)

- gross earnings in any pay reference period

- the value of any contributions payable to the pension scheme by the employer and the eligible jobholder in any pay reference period (where this information is available to the employer. The value can be shown as a fixed amount or a percentage of any qualifying earnings or pensionable pay due to the eligible jobholder).

Enrolment information to the eligible jobholder

26. Once enrolled into an automatic enrolment pension scheme, an eligible jobholder can decide to opt out of the pension scheme. It is important they are able to make an informed decision. The employer must provide the eligible jobholder with certain enrolment information, before the end of the joining window, that tells them:

- that they have been, or will be, automatically enrolled and what this means to them

- of their right to opt out and their right to opt back in.

An eligible jobholder’s right to opt out

Automatic enrolment into an automatic enrolment scheme is compulsory, but ongoing membership is not. A jobholder has the right to opt out of pension scheme membership, but cannot opt out of automatic enrolment. For more information on managing the opt-out process, see Detailed guidance no. 7 – Opting out.

Giving the information

27. The information must be given in writing. ‘Giving’ information, in the regulator’s view includes:

- sending hard copy information by post or internal mail

- handing over hard copy information by hand

- sending information in the body of an email

- sending information in pdf attachments or other attachments by email.

28. Someone acting on the employer’s behalf, such as an independent financial adviser, benefit consultant, accountant or bookkeeper can send the information, but it remains the employer’s responsibility to make sure it is provided, on time, and is correct and complete.

29. Where an employer is giving information to a worker by post, they should allow sufficient time for the delivery of the letter in the ordinary course of post, in order that the information can be given before the end of the specified time limit for giving information. More information on ‘giving’ information and the point at which it can be considered ‘given’ can be found in Detailed guidance no. 10 – Information to workers.

30. There is nothing that prevents the employer, or an agent acting on their behalf, from preparing the information ahead of the eligible jobholder’s automatic enrolment date.

Mandatory information to the eligible jobholder about automatic enrolment

The employer must give the following enrolment information to each eligible jobholder who is being automatically enrolled within the joining window. This information is prescribed in regulations. The text in bold below provides a further explanation from the regulator.

About being automatically enrolled

- a statement that the jobholder has been, or will be, enrolled into a pension scheme

- the jobholder’s automatic enrolment date, automatic re-enrolment date or enrolment date7

- the value of any contributions payable to the pension scheme by the employer and the eligible jobholder in any applicable pay reference period. The value can be shown as a fixed amount or a percentage of any qualifying earnings or pensionable pay due to the eligible jobholder in any pay reference period

- If the pension scheme chosen for automatic enrolment is a DC occupational pension scheme or personal pension scheme, a statement advising the jobholder of the phased increase in contributions as part of the introduction of the reform. More information about the phased increase in contributions can be found in Detailed guidance no. 4 – Pension schemes

- a statement that any contributions payable to the scheme by the eligible jobholder have been, or will be, deducted from any qualifying earnings or pensionable pay due to the eligible jobholder

- confirmation as to whether tax relief will be given on employee contributions

About the eligible jobholder’s right to opt out and opt back in

- a statement that the eligible jobholder has the right to opt out of the pension scheme during the opt-out period

- if the start and end of the opt-out period are known by the employer: the start and end date of the opt-out period for the eligible jobholder

- if the start and end of the opt-out period are not known by the employer: a statement that the opt-out period is to be determined in accordance with regulation 9(2) or (3) of the Occupational and Personal Pensions Schemes (Automatic Enrolment) Regulations 2010: This means that the opt-out period will start on the latest of:

- the date this enrolment information is given, or

- the date active membership is established for an occupational scheme or the date the terms and conditions are given to the eligible jobholder for a personal pension scheme

- the source from which the opt-out notice may be obtained

- a statement that opting out means that the eligible jobholder will be treated for all purposes as not having become an active member of the pension scheme on that occasion

- a statement that after a valid opt-out notice is given to the employer, any contributions paid by the eligible jobholder will be refunded to the eligible jobholder by the employer

- a statement that where the eligible jobholder opts out, the eligible jobholder may then choose to opt in, in which case the employer will be required to arrange for that eligible jobholder to become an active member of an automatic enrolment pension scheme once in any 12-month period

- a statement that a written notice from the worker must be signed by the worker or, if it is given by means of an electronic communication, must include a statement that the worker personally submitted the notice

- a statement that after the opt-out period, the eligible jobholder may cease to make contributions towards their pension scheme in accordance with the scheme rules

- a statement that an eligible jobholder who opts out or ceases active membership will normally be automatically re-enrolled into an automatic enrolment pension scheme by the employer, in accordance with section 5 of the Pensions Act 2008. Broadly this means every three years, although in some special circumstances it will be earlier.

31. Templates are available for you to use. These templates are one way that an employer may choose to communicate the information. An employer may add their own wording or use their own templates as long as the underlying requirements in the box above are met.

32. Nothing prevents an employer including the information that must be given to a worker who is not being automatically enrolled in a combined notice, so that all the information requirements are discharged in one go (unless opt in or re-enrolment occurs).

33. In practice, this would mean adding the information about the right to join a pension scheme for entitled workers, as the information about the right to opt in to an automatic enrolment scheme is already included in the enrolment information. This may be appropriate when at the first assessment of the worker, for example, at an employer’s duties start date, the worker’s first day of employment or the deferral date if postponement is being used at either of these dates, the eligible jobholder criteria are met and an automatic enrolment duty is triggered.

34. If considering including this information, an employer should consider the appropriateness of adding this information to the enrolment information for their workers. This includes a judgement about the ability of the workforce to absorb the level of detail in one go, and about the relevance of the information to the worker. More detail about the information requirements for an employer can be found in Detailed guidance no. 10 – Information to workers.

Making arrangements for active membership

35. It is the employer’s responsibility to make arrangements to establish active membership of the pension scheme for the eligible jobholder. These arrangements differ depending on the type of pension scheme the employer chooses to use.

In an occupational pension scheme

36. It is up to the employer to communicate with the trustees to establish active membership for the eligible jobholder.

37. Active membership for an occupational pension scheme means that the eligible jobholder is in pensionable service under the pension scheme. This means service by the eligible jobholder in any employment (to which the scheme relates), which qualifies them for pension (or other) benefits under the scheme.

38. The rules of the pension scheme will state what creates membership or pensionable service, eg often the rules may say that membership starts as soon as employment starts.

39. Often, the provision of the jobholder information to the pension scheme on its own will not be enough to create active membership, unless the rules of the pension scheme expressly defines active membership as being created by the receipt of this information. If they do not, active membership is created by whatever the rules stipulate.

40. An employer will need to find out from the pension scheme the date on which active membership is achieved. This is important as they will need it to work out the start of the period during which the eligible jobholder can opt out.

41. Regardless of what point in the joining window active membership is created for the eligible jobholder, it must take effect from the automatic enrolment date. Pensionable service under the pension scheme must be backdated to that date.

42. Contributions are due and must be calculated on earnings paid from the automatic enrolment date. If the eligible jobholder is making contributions, the employer must deduct their contributions from every pay after the automatic enrolment date. Paragraphs 56-63 have more information.

In a personal pension scheme

43. Personal pension schemes are contract-based, meaning they are made up of an agreement between the provider of the scheme and the scheme member. The member is given the key features information about the personal pension, including the terms and conditions of the agreement. The member then agrees to it.

44. For automatic enrolment, it will be up to the employer and the pension scheme provider to establish that agreement on behalf of the eligible jobholder.

45. To fulfil their automatic enrolment duty, the employer must make arrangements with the pension scheme provider so that the eligible jobholder is given the terms and conditions of the contract into which they are being entered to become an active member of the pension scheme.

46. These terms and conditions must be given to the eligible jobholder during the joining window. They can be part of the key features information that the provider must issue under the Financial Conduct Authority (FCA) rules.

47. Whilst in practice the provider may give the terms and conditions, it remains the employer’s responsibility under the law to make arrangements for this to happen.

48. The eligible jobholder is deemed by law to have entered into the agreement, with effect from their automatic enrolment date on the later of:

- the date the pension scheme provider gives them the terms and conditions of the contract, or

- the date the employer gives them the enrolment information.

49. Employers should be aware that this alone does not create active membership of the pension scheme. An active member of a personal pension scheme is a person for whom there is an agreement in place between the pension scheme provider and the employer about employer contributions (part of the minimum requirements for personal pension schemes).

50. If the eligible jobholder is being automatically re-enrolled, or the jobholder who is being enrolled is already a member of a personal pension scheme with that employer, and the employer wants to use that scheme to fulfil their re-enrolment or enrolment (opt-in) duty, they may choose to use a modified automatic enrolment process. Under this modified process the employer must make arrangements with the scheme provider so that:

- the scheme becomes an automatic enrolment scheme and

- the jobholder becomes an active member of that scheme.

51. This may mean that the terms and conditions do not need to be given as there may not be any need to put new agreements in place, just simply to reactivate the existing agreements. More information about this alternative process can be found in Detailed guidance no. 6 – Opting in, joining and contractual enrolment and Detailed guidance no.11 – Automatic re-enrolment.

52. Regardless at what point or by which process in the joining window active membership is created for the eligible jobholder, it must take effect from the automatic enrolment date.

53. Contributions are due and must be calculated from the automatic enrolment date. If the eligible jobholder is making contributions, the employer must deduct their contributions from every pay after the automatic enrolment date. Paragraphs 71-78 have more information.

Mandatory information to be included in the contract

54. The minimum information that the terms and conditions of the agreement must contain is listed below. If there are other terms and conditions that the pension scheme provider usually issues, these can also be included in this agreement. There is no need for separate documents.

Terms and conditions of the contract between the pension scheme provider and the eligible jobholder

The terms and conditions that the agreement must contain as a minimum are to:

- explain the purpose of the personal pension scheme

- specify the services to be provided by the personal pension scheme provider

- specify the value of any contributions payable by the eligible jobholder, where this information is available to the pension scheme provider

- specify the charges payable to the pension scheme provider

- in the absence of a choice made by the eligible jobholder, explain the investment strategy adopted by the pension scheme provider for the contributions made by the eligible jobholder and employer.

Summary of automatic enrolment

55. Figures 1 and 2 in Appendix A illustrate the process for completing automatic enrolment.

Employers who use the transitional period for schemes with defined benefits: Additional features of the automatic enrolment scheme to be used

56 In some cases, an employer may be automatically enrolling an eligible jobholder:

- who had the transitional period for schemes with defined benefits applied to them at the employer’s staging date

- for whom the transitional period was in effect for the full period up to and including 30 September 2017 (ie the employer did not end it early),

- who did not meet the eligible jobholder criteria on 1 October 2017 or the deferral date if postponement at the end of the transitional period was used, and

- who meets the eligible jobholder criteria on a date after 1 October 2017 (or the deferral date if postponement at the end of the transitional period was used)

57 In these cases, then under the amended automatic enrolment duty, the employer is required to make arrangements by which the eligible jobholder becomes either:

- an active member of a defined benefits automatic enrolment scheme, or

- a defined benefits member8 of a hybrid automatic enrolment scheme

58. In other words the automatic enrolment scheme must be one which will provide the eligible jobholder with defined benefits. Certain defined benefits automatic enrolment schemes are permitted to meet the defined contribution qualifying requirements in order to be a qualifying scheme, provided the scheme meets certain conditions. For more information on the qualifying requirements for defined benefit pension schemes see paragraphs 80 to 97 of Detailed guidance no. 4 – Pension schemes.

59. If the defined benefit automatic enrolment scheme being used is one of these schemes and does not also meet the test standard or the other alternative qualifying requirements for a defined benefit scheme, it cannot be used to fulfil the amended automatic enrolment duty above at the end of the transitional period.

60. There is similar provision if the appropriate qualifying requirements for the provisions of the hybrid automatic enrolment scheme which apply to a defined benefits member are the defined benefit qualifying requirements. Certain of these hybrid automatic enrolment schemes are also permitted to meet the money purchase qualifying requirements in respect of those provisions in order to be a qualifying scheme.

61. If this is the case and those provisions also do not meet the test standard or the other alternative qualifying requirements for a defined benefit scheme, then this hybrid automatic enrolment scheme cannot be used to fulfil their automatic enrolment duties at the end of the transitional period for any worker to whom it was applied. For more information on the qualifying requirements for hybrid pension schemes see paragraphs 98 to 101 of Detailed guidance no. 4 – Pension schemes.

62. In some cases, an employer may be automatically enrolling an eligible jobholder:

- who had the transitional period for schemes with defined benefits applied to them at the employer’s staging date

- for whom the transitional period was ended early (ie before 30 September 2017),

- who did not meet the eligible jobholder criteria on the day after the conditions stopped being met or the deferral date if postponement at the end of the transitional period was used, and

- who meets the eligible jobholder criteria on a date after the day after the conditions for the transitional period stopped being met (or the deferral date if postponement at the end of the transitional period was used)

63 When the transitional period ends early because the conditions stopped being met, the employer is not restricted to using an automatic enrolment scheme with defined benefits for workers to whom they had applied the transitional period. The employer can choose to use a defined contribution automatic enrolment scheme or the defined contribution benefits in a hybrid scheme.

64 Unlike in the case where the transitional period ran for the full period up to an including 30 September an employer can use a defined benefits automatic enrolment scheme or a hybrid automatic enrolment scheme with defined benefits, where:

- the scheme meets the conditions so that it is permitted to meet the defined contribution qualifying requirements in order to be a qualifying scheme, and

- the defined benefit provisions of the scheme do not meet the test standard or the other alternative qualifying requirements for a defined benefit scheme

65 However, if they do, they should note that the amended duty that applies when using this type of scheme means that active membership must start from the eligible jobholders original automatic enrolment date or the deferral date if they have used postponement (as described at paragraph 13e).

After completing automatic enrolment

66. Once automatic enrolment has been completed, an employer will have ongoing responsibilities either:

- with the pension scheme, as the jobholder remains a member of the scheme, such as paying contributions, or

- to manage the opt-out process, if the jobholder chooses to opt out of the pension scheme, and

- to keep records (see Detailed guidance no. 9 – Keeping records).

Deducting and paying pension contributions

67. The employer will need to calculate and pay their own contributions as well as calculating, deducting and paying the jobholder’s contributions (if they are making any) to the automatic enrolment scheme. They must do this for as long as the jobholder remains in employment with that employer and is an active member of the pension scheme.

68 The actual process of calculating and paying contributions is unchanged by any of the new employer duties. The rules or governing documentation of the pension scheme determine what contributions are due in relation to the eligible jobholder.

69. As part of setting up the scheme, the employer should understand the contributions to be paid and the components of pensionable pay from which the contribution is to be calculated. This may involve discussion with the pension provider or it may involve reviewing the provider’s online or hard copy information. They should also agree the due date(s) for the payment of contributions.

70. However, the new duties have introduced a requirement for employers to deduct contributions. They have also amended certain time limits for paying contributions over to a scheme during the joining window and opt-out period and an employer should understand the impact of these when agreeing the due date(s) for payment with their provider. (More information about opting out and opt-out periods is in Detailed guidance no. 7 – Opting out.)

Required deduction of contributions

71. The employer must, on or after the automatic enrolment date, deduct any contributions payable by the eligible jobholder under the scheme rules or governing documentation from any qualifying earnings or pensionable pay due to the eligible jobholder.

72. Active membership must start from the automatic enrolment date or the deferral date (if postponement was used). Where the worker is one to whom the employer had applied the transitional period for schemes with defined benefits active membership must start from either the day after the transitional period ended, the original automatic enrolment date or the deferral date (if postponement was used at the end of the transitional period) depending upon the applicable amended automatic enrolment duty that applies.

73. This means that, contributions are due on that part of the earnings paid from the automatic enrolment date (or one of the dates in paragraph 72 above where the transitional period for schemes with defined benefits has been applied) to the end of the pay reference period, and in each subsequent pay reference period, unless the scheme rules or governing documentation provide otherwise.

74. Where the scheme rules or governing documentation do not provide otherwise and the automatic enrolment date falls within a pay reference period, this will mean that for the first payment, contributions will need to be calculated on part-period earnings.

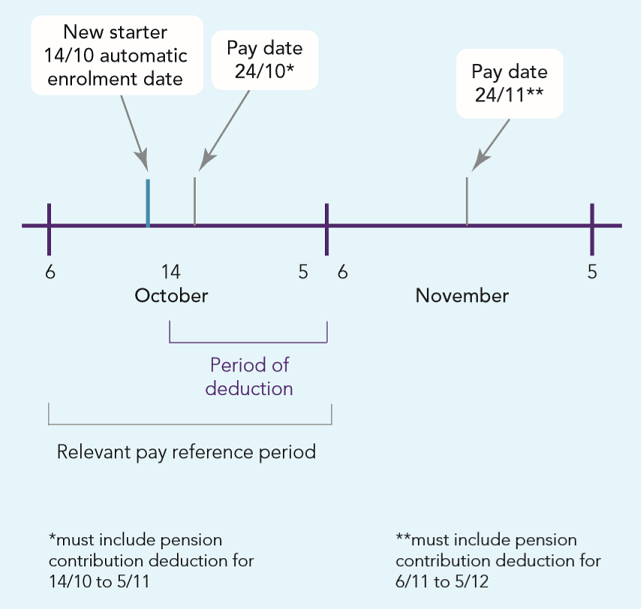

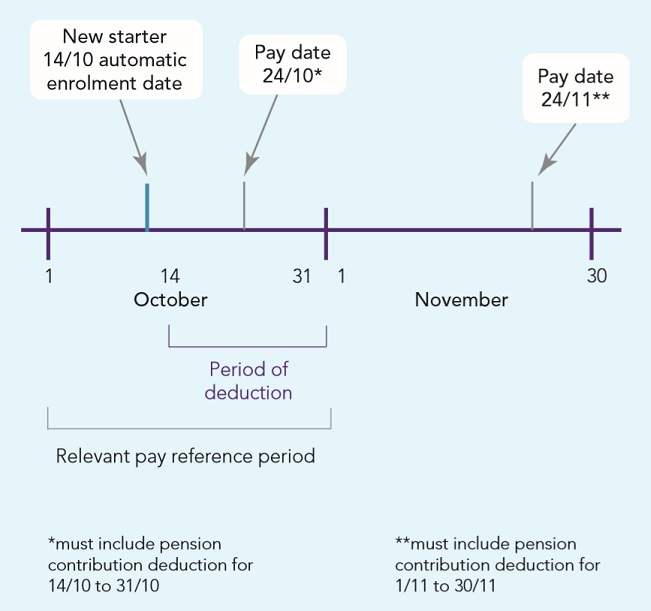

75. Employers should note that this is different to assessing the category of worker, where earnings for the whole pay reference period are assessed (see examples 1a and b).

Examples 1a and 1b use the same facts. In example 1a the definition of a pay reference period for assessment is aligned to tax weeks or months. In example 1b the definition of a pay reference period for assessment is aligned to the period by reference to which the worker is paid their regular wage or salary.

Example [1a] of pay reference period for assessment aligned to tax weeks or months

This example uses a pay reference period that is a month in length.

Example [1b] of an assessment aligned to the period by reference to which the worker is paid their regular wage or salary

This example uses a calendar monthly pay reference period, starting on the first day of the calendar month.

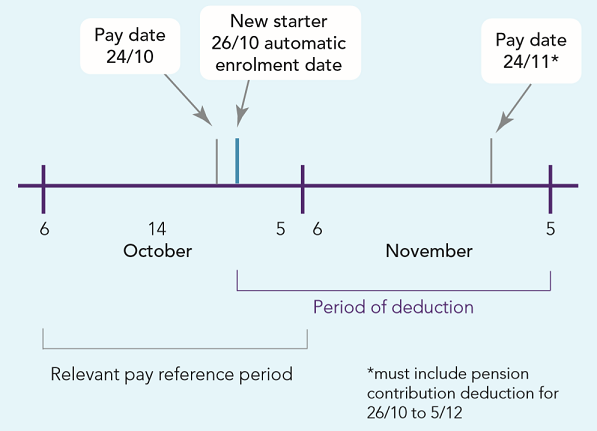

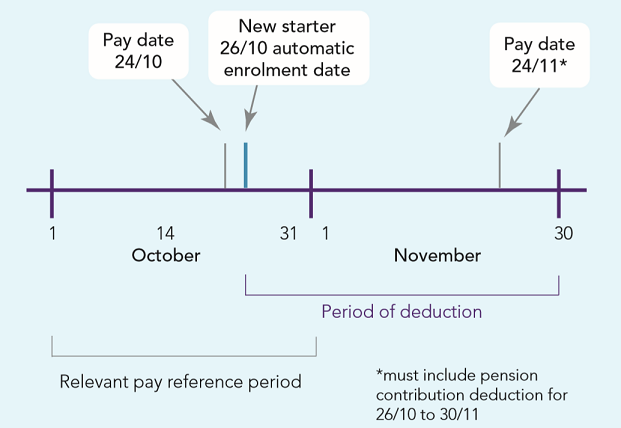

76. It may also mean that the first contribution payment is in respect of a period longer than a pay reference period, depending on when the automatic enrolment date falls (see examples 2a and 2b).

Examples 2a and 2b use the same facts. In example 2a the definition of a pay reference period for assessment is aligned to tax weeks or months. In example 2b the definition of a pay reference period for assessment is aligned to the period by reference to which the worker is paid their regular wage or salary.

Example [2a] of pay reference period for assessment is aligned to tax weeks or months

This example uses a pay reference period that is a month in length.

Example [2b] of an assessment aligned to the period by reference to which the worker is paid their regular wage or salary

This example uses a calendar monthly pay reference period, starting on the first day of the calendar month.

77. An employer may use postponement to avoid such part-period calculations.

78. If an employer is not using postponement, they will need to ensure that their payroll processes can calculate contributions on part period earnings.

79. Part period contributions may also arise whilst the worker remains a member of the automatic enrolment scheme. For more information see Appendix C of Detailed guidance no. 4 – Pension schemes.

Time limits

80. The timely ongoing payment of contributions is fundamental to pension saving. Employers should therefore note the changed time limits set out below.

Occupational pension schemes

81. Trustees and managers of occupational pension schemes will operate a schedule of payments, as required by law. This schedule is usually agreed with the employer. It will set out the due dates for paying jobholder contributions (if any) and employer contributions to the scheme, and the amount of those contributions.

82. There is an additional requirement in the law where contributions are deducted from earnings for the payment of these deductions across to the trustees or managers of an occupational pension scheme.

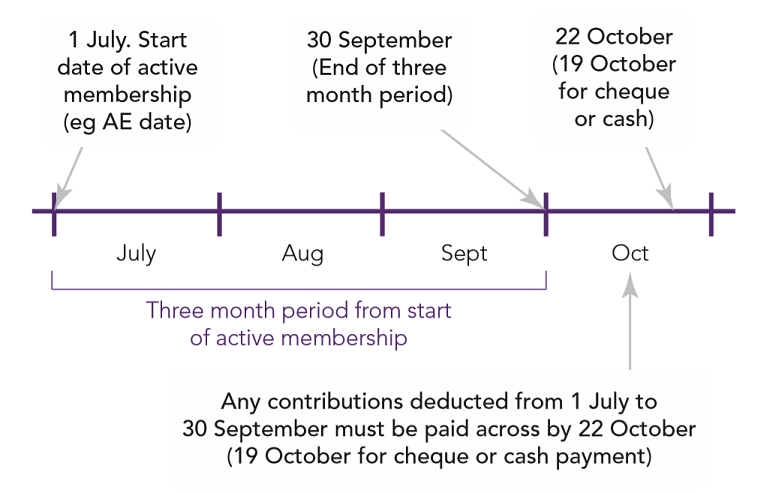

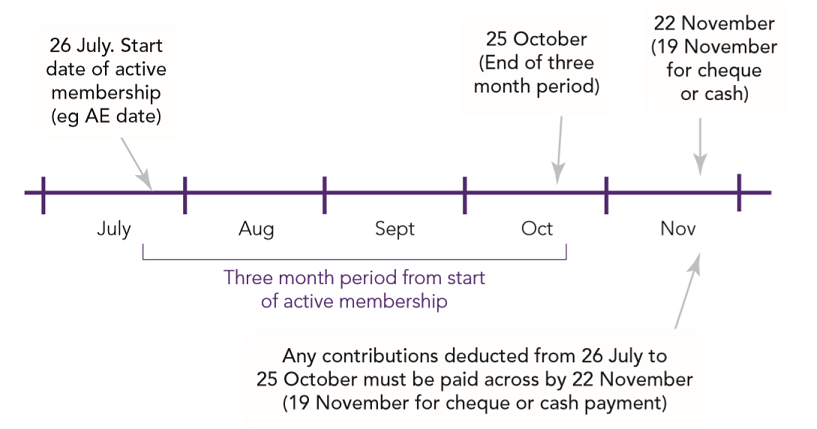

83. Where a person becomes an active member of a qualifying scheme (as a result of automatic enrolment, re-enrolment, enrolment (opt-in) or as a result of contractual enrolment) or where an entitled worker becomes an active member of a non-qualifying scheme after giving the employer a joining notice, any contributions deducted in the three month period starting from the start date of active membership must be paid across to the scheme by the 22nd day (for electronic payments) or 19th day (for cheque or cash payments) of the month after the last day of that three month period (illustrated below).

Example 3 (figure)

Example 4 (figure)

84. Any other contributions that have been deducted from pay must be paid across to the trustees or managers of the pension scheme by the 22nd day (for electronic payments) or 19th day (for cheque or cash payments) of the month after deduction.

85. It is important to note that in the case of occupational pension schemes, the due date for payment of contributions (both eligible jobholder contributions deducted from salary and employer contributions) is the date or dates agreed on the relevant schedule, operated by the scheme trustees or managers, for the payment of contributions.

86. The employer should not agree a due date for paying eligible jobholder contributions deducted from pay later than this to ensure that this additional requirement in the law is always met.

For personal pension schemes

87. To use a personal pension scheme for automatic enrolment there will have to be direct payment arrangements in place. The due dates for the payment of employer contributions is whatever date is set out under these arrangements.

88. The due date for paying any eligible jobholder’s contributions to the scheme is set out in law:

- where a person becomes an active member of a qualifying scheme (as a result of automatic enrolment, re-enrolment, enrolment (opt-in) or as a result of contractual enrolment) or where an entitled worker becomes an active member of a nonqualifying scheme after giving the employer a joining notice any contributions deducted in the three month period starting from the start date of active membership must be paid across to the scheme by the 22nd day (for electronic payments) or 19th day (for cheque or cash payments) of the month after the last day of that three month period

- any other contributions that have been deducted from pay must be paid across to the trustees or managers of the pension scheme by the 22nd day (for electronic payments) or 19th day (for cheque payments) of the month after deduction.

Further assessing of the worker’s category

89. In practice, as long as the eligible jobholder remains in active membership of the automatic enrolment pension scheme, there is no need to assess whether qualifying earnings are payable as described in Detailed guidance no. 3 – Assessing the workforce, even if earnings fall below the earnings trigger.

90. The rules of the pension scheme will determine what contributions are due in relation to the eligible jobholder and, if earnings fall, may mean that in relation to that eligible jobholder, no contributions are paid for that period.

91. If active membership ceases at the jobholder’s request at any stage after the automatic enrolment date, enrolment date or re-enrolment date, or if the scheme ceases to be a qualifying scheme in relation to the worker then in practice there is no need for the employer to assess earnings again until their re-enrolment date. This is because the employer will not have to re-enrol that worker until their three-yearly re-enrolment date.

92. If the worker who was enrolled (ie they opted in) following the automatic enrolment process opts out or ceases membership on their own account, and the worker has never been an eligible jobholder, the employer will need to assess the worker again. This is to identify the first time that the criteria to be an eligible jobholder are met after active membership has ceased, and therefore when automatic enrolment is triggered.

93. If the worker is aged between 16 and 74 and has not already been given the information about the right to opt in to an automatic enrolment scheme for jobholders and the right to join a pension scheme for entitled workers, the employer must give the worker this information within six weeks of membership ceasing.

94. The employer will also have to assess the worker again on the:

- cyclical automatic re-enrolment date,

- date they are given an opt-in or joining notice

- the day after active membership of a qualifying scheme has ceased and it was not at the workers request (immediate reenrolment)

- the date the employer and worker agree that a notice to end employment (resignation or dismissal) is withdrawn

95. More information about cyclical re-enrolment and immediate re-enrolment can be found in Detailed guidance no.11 – Automatic re-enrolment.

What next?

Any employer who has an automatic enrolment, enrolment or reenrolment duty must also have processes in place to deal with any jobholders who wish to opt out.

Detailed guidance no. 7 – Opting out explains when the right to opt out applies, the timescales involved and the process an employer must follow, if they receive an opt-out notice.

In addition to record-keeping for automatic enrolment, there are other records an employer must keep in relation to the new duties, see Detailed guidance no. 9 – Keeping records.

Key terms

Summary of the different categories of worker

The table below is a quick reminder of the different categories of worker. These are explained in detail in Detailed guidance no. 1 – Employer duties and defining the workforce.

| Category of worker | Description of worker |

|---|---|

| Worker | An employee or someone who has a contract to perform work or services personally, that is not undertaking the work as part of their own business. |

| Jobholder |

A worker who:

|

| Eligible jobholder |

A jobholder who:

|

| Non-eligible jobholder |

A jobholder who:

|

| Entitled worker |

A worker who:

|

Footnotes

[1] The transitional period for schemes with defined benefits allowed an employer to delay the automatic enrolment of certain eligible jobholders into a scheme with defined benefits. The transitional period ended on 30 September 2017. Paragraphs 11 to 14 have more information about the amended duty. References throughout this guidance to ‘schemes with defined benefits’ in relation to the transitional period for these schemes includes both defined benefit pension schemes and hybrid pension schemes where a defined benefit pension is offered.

[2] Under the amended duty for certain of the eligible jobholders to whom the employer had applied the transitional period for schemes with defined benefits at their staging date, active membership must start from a date other than the automatic enrolment date. See paragraph 14 for more.

[3] A ‘defined benefits member’ of a hybrid automatic enrolment scheme is an active member of that scheme where all the benefits accruing in respect of their membership are not money purchase benefits.

[4] An employer’s first enrolment date is only relevant to an employer that applied the transitional period for schemes with defined benefits to one or more eligible jobholders. The first enrolment date is the date that the employer first had an eligible jobholder.

[5] Except in the case described in paragraph 11. In these circumstances the joining window is either:

- 1 October 2017 to 11 November 2017, where the transitional period was in effect for the whole period up to and including 30 September 2017, or

- a six week period that starts on the day after the conditions stopped being met, where the transitional period was ended early before 30 September 2017

[6] If giving this information to the pension scheme about a jobholder who is opting in, replace with enrolment date. If giving this information to the pension scheme about a jobholder who is being automatically re-enrolled, replace with: automatic re-enrolment date. If giving this information to the pension scheme about a jobholder being automatically enrolled but who had the transitional period for schemes with defined benefits, replace with: 1 October 2017 (where the transitional period did not end early) or the day after the conditions stopped being met; the employer’s first enrolment date or the deferral date as appropriate (where the transitional period ended early before 30 September 2017).

[7] If giving this information to the pension scheme about a jobholder being automatically enrolled but who had the transitional period for schemes with defined benefits, replace with: 1 October 2017 (where the transitional period did not end early) or the day after the conditions stopped being met; the employer’s first enrolment date or the deferral date as appropriate (where the transitional period ended early before 30 September 2017). If the employer has applied the transitional period for schemes with defined benefits the employer should replace with the date active membership must take effect from under the applicable amended automatic enrolment duty that applies to the employer.

Related content

Automatic enrolment detailed guidance

1. Employer duties and defining the workforce

3b. Having completed the assessment

Now reading: 5. Automatic enrolment process