The relevant pay reference period for the purposes of the minimum contribution entitlement

Automatic enrolment detailed guidance for employers no. 4 Appendix C

This document accompanies: Detailed guidance no. 4 – Pension schemes

How to save this page as a PDF

The relevant pay reference period for the purposes of the minimum contribution entitlement

The minimum contribution requirement which is part of the criteria to be met if the defined contribution (DC) scheme is to be a qualifying scheme or an automatic enrolment scheme is that under the scheme rules or governing documentation:

- the employer must make contributions in respect of the jobholder

- a total minimum contribution, however calculated, must be at least 8% of the jobholder’s qualifying earnings in the relevant pay reference period

- a minimum employer’s contribution, however calculated, must be at least 3% of the jobholder’s qualifying earnings in the relevant pay reference period

These contribution levels were gradually increased in three steps over the period 1 July 2012 to 6 April 2019.

Qualifying earnings is a reference to earnings of between £6,240 and £50,2701, made up of any of the following components of pay that are due to be paid to the worker:

- salary

- wages

- commission

- bonuses

- overtime

- statutory sick pay

- statutory maternity pay

- ordinary or additional statutory paternity pay

- statutory adoption pay

The key words in the minimum contribution requirement are ‘however calculated’. This means that the scheme rules can provide for the contribution entitlement in different ways. One way is if the scheme rules or governing documentation explicitly define pensionable pay as the amount of the jobholder’s qualifying earnings in the relevant pay reference period.

Where the rules or governing documentation of a minimum requirement pension scheme do explicitly state that:

- the employer’s contribution is 3% of the amount of the jobholder’s qualifying earnings in the relevant pay reference period, and

- the jobholder’s contribution is 3% of the amount of the jobholder’s qualifying earnings in the relevant pay reference period

it will be necessary to identify the relevant pay reference period.

1. The term ‘pay reference period’ is used in two different ways in the employer duties. Here we describe how to identify the relevant pay reference period for the purposes of calculating the minimum contribution requirements, part of the qualifying criteria described in paragraphs 48 to 68 of Detailed guidance no. 4 – Pension schemes. From 1 November 2013 a pay reference period can be defined in one of three ways:

- A 12 month period (although there are circumstances where it will be shorter) aligned to an employer’s duties start date2. This is the definition of a pay reference period that has applied since 1 July 2012. (An employer with a staging date before 1 November using this definition can choose to switch to one of the alternative definitions below providing the scheme rules or governing documentation provide for the use of those different definitions)

- A period equal in length to the usual interval between payments of the jobholder’s regular wage or salary. This is broadly the same as the definition of a pay reference period aligned to tax weeks or months which an employer may choose to use for assessment of worker category

- A period equal in length to the period by reference to which the jobholder is paid their regular wage or salary. This is broadly the same as the definition of a pay reference period aligned to the period by reference to which a worker is paid their regular wage or salary which an employer may choose to use for assessment of worker category.

2. If the scheme rules or governing documentation explicitly define pensionable pay as the amount of the jobholder’s qualifying earnings in the relevant pay reference period, then the rules may provide for one or all of these different definitions of a pay reference period for the purposes of calculating the minimum contribution entitlement.

3. We describe each of these definitions of a pay reference period in relation to a minimum requirement pension scheme in the paragraphs below.

Definition of pay reference period aligned to the employer’s duties start date

4. Under this definition the pay reference period for the purposes of calculating the minimum contribution entitlement is defined as a period of 12 months that starts on the employer’s duties start date, or on each subsequent anniversary of the duties start date, and ends on the day before the anniversary of the employer’s duties start date.

5. In some cases the pay reference period will be shorter in length either because of when it starts or when it ends.

6. The first pay reference period starts on the first day on or after the duties start date that the person is both a jobholder and an active member of a qualifying scheme. Active membership may be as a result of automatic enrolment, re-enrolment or enrolment (opt-in). In this case the first day that the worker is both a jobholder and an active member of a qualifying scheme will be the automatic enrolment date, re-enrolment date or enrolment date (opt-in).

7. Or, active membership may be as a result of the employer using contractual enrolment or the worker may already be an active member on the employer’s duties start date having previously joined the scheme prior to the duties start date. In this latter case the first day that the worker is both a jobholder and an active member of a qualifying scheme will be the first day that they are a jobholder after active membership has started or after the employer’s duties start date.

8. As a result the first pay reference period may be a period of less than a year.

Examples of duties start dates

Adam's automatic enrolment date is 12 May 2019. His employer's duties start date was 11 October 2017. Adam's first pay reference period is 12 May 2019 to 10 October 2019.

Orla became an active member of a qualifying scheme on 23 July 2020. Her employer's duties start date was 21 February 2018. On this date Orla was an entitled worker. In March her earnings increased and on 1 March 2018 Orla was a jobholder. Her first pay reference period is 1 March 2018 to 20 February 2019.

Sol gave his employer an opt-in notice on 9 February 2021. His enrolment date is 23 February 2021. His employer's duties start date was 15 April 2018. His first pay reference period is 23 February 2021 to 14 April 2021.

9. The pay reference period ends earlier than the day before the anniversary of the employer’s duties start date if the worker ceases to be a jobholder. If this happens the pay reference period ends on the day that jobholder status ceases, and so in this case may be less than a year. In these circumstances the next pay reference period starts on the day jobholder status is regained.

Example of reductions and increasing hours

Amir's automatic enrolment date is 12 September 2018. His employer's duties start date was 1 November 2017. His first pay reference period is 12 September 2018 to 31 October 2018. The next pay reference period is 1 November 2018 to 31 October 2019.

However, in April 2019 Amir reduces his hours and as a result his earnings drop and he becomes an entitled worker from 16 April 2019. This ends the pay reference period that started on 1 November 2018 on the day that jobholder status ceased (ie 15 April 2019).

In August 2019 Amir increases his hours and his earnings increase above the lower level of qualifying earnings. Amir becomes a jobholder again from 19 August. The next pay reference period is 19 August 2019 to 31 October 2019 (assuming Amir retains jobholder status).

10. The pay reference period also ends earlier than the day before the anniversary of the duties start date if the worker ceases to be an active member of a qualifying scheme. This could be because the worker leaves employment, opts out or ceases membership of the pension scheme voluntarily or it could be because the scheme ceases to be a qualifying scheme. Where active membership of a qualifying scheme ceases, the pay reference period ends on the day that the active membership of a qualifying scheme ceased.

Examples of contractual enrolment and leaving employment

Lucy became an active member of a qualifying scheme with her employer through contractual enrolment on 5 January 2020. Lucy is 23 and has earnings above the earnings trigger for automatic enrolment and so meets the eligible jobholder criteria. Her employer's staging date was 7 February 2018. Lucy ceased active membership under the scheme rules on 3 March 2020. Her first pay reference period was 5 January 2020 to 6 January 2020. Her next pay reference period was 7 February 2020 to 3 March 2020.

Amy's automatic enrolment date was 23 May 2019. Her employer's staging date was 1 June 2018. Her first pay reference period was 23 May 2019 to 31 May 2019.

The next pay reference period was 1 June 2019 to 31 May 2020.

Amy leaves employment on 17 September 2019. This ends the pay reference period that started on the anniversary of the employer's staging date (ie 1 June 2019) on the day that Amy leaves employment.

11. Finally the pay reference period ends earlier than the day before the anniversary of the duties start date if the definition of pay reference period is being changed to one of the other options. In this case it ends the day before the start of the first pay reference under the new definition. More information on switching from one definition to another can be found in the section 'Changing from one definition of a pay reference period to another' below.

12. The legislative requirement means that entitlement to contributions is in a specific pay reference period – the relevant pay reference period. Each pay reference period in the period whilst the jobholder is an active member of the minimum requirement pension scheme, is a relevant pay reference period.

Definition of a pay reference period aligned with tax weeks or months

13. Under this definition the pay reference period for the purposes of calculating the minimum contribution requirement is defined as a period equal in length to the usual interval between payments of the jobholder’s regular wage or salary, commencing:

- where the person is paid monthly, on the first day of a tax month

- where the person is paid weekly, on the first day of a tax week

- where the person is paid at intervals of multiple weeks, on

- 6 April; or

- the first day of the tax week which commences immediately after the expiry of a pay interval period beginning on 6 April

- where the person is paid at intervals of multiple months, on

- 6 April; or

- the first day of the tax month which commences immediately after the expiry of a pay interval period beginning on 6 April.

14. A ‘pay interval period’ is defined under the legislation as a period equal in length to the usual interval between payments of the worker’s regular wage or salary and each whole multiple of that period.

15. This is broadly similar to one of the definitions of a pay reference period that can be used for the purposes of assessing the earnings of a worker (as part of the assessment of the worker) – the definition aligned to tax weeks or months (see Detailed guidance no. 3 – Assessing the workforce). However, there is a difference as the length of the pay reference period for the purposes of assessment is defined as:

- equal in length to the usual interval between payments of the person’s regular wage or salary, or

- a week

whichever is the longer.

16. The effect of this difference is twofold. If there is no usual interval between the payments of regular wage or salary, then in our view the pay reference period for assessment defaults to being one week in length. However, under the definition of a pay reference period for the purposes of calculating the minimum contribution entitlement described in paragraph 13, if the employer is unable to say that there is a usual interval between payments of the jobholder’s regular wage or salary then they cannot use this definition of a pay reference period for the purposes of calculating the minimum contribution entitlement.

17. Secondly, if the usual interval between payments of a worker’s regular wage or salary is less than a week, for example two days then the length of the pay reference period for assessment for that worker will default to one week. The pay reference period will start on the first day of the tax week because, in our view, the worker is treated as weekly paid for the purposes of the employer duties.

18. However, under the definition of a pay reference period for the purposes of calculating the minimum contribution entitlement, where the usual interval between the payment of regular wage or salary is less than one week, there is no provision for it to default to a week with an inferred start date. Therefore, where the usual interval between payments of wage or salary is less than a week the employer cannot use this definition of a pay reference period for the purposes of calculating the minimum contribution entitlement.

19. Where an employer is able to apply this definition of pay reference period for the purposes of calculating the minimum contribution entitlement and the scheme provides for its use, the length and pay reference period start and end dates are the same as described in paragraphs 49 to 89 in Detailed guidance no. 3 – Assessing the workforce for the corresponding definition of pay reference period for the purposes of assessing the worker. The only exception is if the definition of pay reference period for the purposes of calculating the minimum contribution entitlement is being changed to one of the other options. In this case a pay reference period ends the day before the start of the first pay reference period under the new definition. More information on switching from one definition to another can be found in the section 'Changing from one definition of a pay reference period to another' at paragraph 42 below.

20. The employer will know the usual pay reference period calendar ie the start and end dates of the pay reference periods in the tax year, but the legislative requirement means that entitlement to contributions is in a specific pay reference period – the relevant pay reference period.

21. The first relevant pay reference period is the first whole pay reference period that starts on or after the date that the worker becomes both a jobholder and an active member of a qualifying scheme for the first time. Active membership may be as a result of automatic enrolment, re-enrolment or enrolment (opt-in). In this case the first day that the worker is both a jobholder and an active member of a qualifying scheme will be the automatic enrolment date, re-enrolment date or enrolment date (opt-in).

22. Or, active membership may be as a result of the employer using contractual enrolment or the worker may already be an active member on the employer’s duties start date having previously joined the scheme prior to the duties start date. In this case the first day that the worker is both a jobholder and an active member of a qualifying scheme will be the first day that they are a jobholder after active membership has started, or after the employer’s duties start date.

Examples of monthly and weekly salaries

The usual interval between payments of Fran’s regular wage or salary is four-weekly. Fran is 48 years old and her salary is above the earnings trigger for automatic enrolment. She became an active member of a qualifying scheme on her first day of her employment (29 March) as a result of contractual enrolment. 29 March therefore is the first day that Fran is both a jobholder and an active member of a qualifying scheme. 29 March falls within the pay reference period of 8 March to 4 April. The first day of the next pay reference period is 5 April. The pay reference period starting on 5 April is the first whole pay reference period which falls on or after 29 March. The first relevant pay reference period for Fran starts on 5 April and will either end on 5 April or 2 May depending upon the date the qualifying earnings for that pay reference period are payable (see page 12 for more information about the pay reference periods at the tax year change).

The usual interval between payments of Mark’s regular wage or salary is monthly. On the employer’s cyclical automatic enrolment date Mark is an eligible jobholder who must be automatically re-enrolled. He is re-enrolled from the cyclical automatic enrolment date of 6 October. This is the first day of the pay reference period of 6 October to 5 November (see monthly calendar, Detailed guidance no. 3 – Assessing the workforce, Appendix A: Pay reference periods). This pay reference period starting on 6 October is the first whole pay reference period which falls on or after 6 October. The first relevant pay reference period for Mark is 6 October to 5 November.

The usual interval between payments of Tom’s regular wage or salary is weekly. His automatic enrolment date is 15 April 2015. This falls within the pay reference period of 12 April to 19 April. The first day of the next pay reference period is 20 April. The pay reference period starting on 20 April is the first whole pay reference period which falls on or after 15 April. The first relevant pay reference period for Tom is 20 April to 26 April.

23. Each pay reference period between the first relevant pay reference period and the last pay reference period is a relevant pay reference period.

24. The last relevant pay reference period is the pay reference period in which the worker ceases to be a jobholder, or in which active membership of the qualifying scheme ceases. Active membership of a qualifying scheme could be because the worker leaves employment, opts out or ceases membership of the pension scheme voluntarily or it could be because the scheme ceases to be a qualifying scheme.

Examples of opting out

The usual interval between payments of Fran’s regular wage or salary is four-weekly. After the start of employment Fran chooses as part of her flexible benefits package to reduce the amount of her pension contributions to below the minimum contribution entitlement. As a result active membership of a qualifying scheme has ceased (although active membership of the scheme as a non-qualifying scheme may continue). The date that active membership of the qualifying scheme is 1 January. This falls within the pay reference period of 14 December to 10 January. This pay reference period is therefore the last relevant pay reference period for Fran.

The usual interval between payments of Mark’s regular wage or salary is monthly. After his automatic re-enrolment Mark opts out of the qualifying scheme on 10 October. This falls in the pay reference period of 6 October to 5 November which is the same pay reference period in which Mark was both a jobholder and an active member of a qualifying scheme for the first time (opt-out can only take place after active membership has been established). The last relevant pay reference is therefore the pay reference period of 6 October to 5 November.

The usual interval between payments of Tom’s regular wage or salary is weekly. His automatic enrolment date is 15 April. Tom opts out of the automatic enrolment scheme on 12 May. This falls within the pay reference period of 11 May to 17 May. This pay reference period is therefore the last relevant pay reference period for Tom.

25. Where active membership starts part way through a pay reference period as a result of automatic enrolment or re-enrolment, and the jobholder opts out in the same pay reference period this will have the effect of changing the entitlement due under the scheme for that pay reference period. (See example below.)

Another example of opting out of a scheme

Consider Tom again. The usual interval between payments of Tom’s regular wage or salary is weekly. His automatic enrolment date is 15 April 2015. This falls within the pay reference period of 12 April to 19 April. The first day of the next pay reference period is 20 April. The pay reference period starting on 20 April is the first whole pay reference period which falls on or after 15 April. The first relevant pay reference period for Tom is 20 April to 26 April.

Tom opts out of the automatic enrolment scheme on 19 April. This falls within the pay reference period of 12 April to 19 April. This pay reference period is therefore the last relevant pay reference period for Tom.

26. The change in entitlement means that there is an entitlement to a contribution in the pay reference period in which active membership started. The entitlement is to a contribution of the amount of the qualifying earnings in the whole pay reference period and so there is no pro-rata contribution calculation.

27. This does not occur where automatic enrolment or re-enrolment is from the first day of a pay reference period. Postponement can be used to ensure that automatic enrolment takes effect from the start of a pay reference period. The employer can choose their cyclical automatic re-enrolment date to be the first day of a pay reference period.

28. Where the worker becomes an active member of the minimum qualifying pension scheme and a jobholder part way through a pay reference period and then voluntarily ceases active membership of scheme under the scheme rules in the same pay reference period the same change in entitlement will occur (see example below). This is more likely to be relevant where the pay reference period is longer than a month in length.

Example of voluntarily ceasing active membership

The usual interval between payments of Judy’s regular wage or salary is bi-annual. Her automatic enrolment date is 22 June. This falls within the pay reference period of 6 April to 5 October. The first day of the next pay reference period is 6 October. The pay reference period starting on 6 October is the first whole pay reference period which falls on or after 22 June. The first relevant pay reference period for Judy is 6 October to 5 April.

After her automatic enrolment date Judy voluntarily ceases active membership of the scheme under the scheme rules on 15 August. This falls within the pay reference period of 6 April to 5 October. This pay reference period is therefore the last relevant pay reference period for Judy.

Definition of a pay reference period aligned to tax week or months at the change in the tax year

29. Where the usual interval between payments of a worker’s regular wage or salary is a week or a multiple of a week there are overlapping pay reference periods around the 6 April each year. In most circumstances however, the last pay reference period is ended early on 5 April to avoid this overlap. This is exactly the same as for the corresponding definition of a pay reference period as described in paragraphs 137 to 147 of Detailed guidance no. 3 – Assessing the workforce).

30. Where the last pay reference period of the tax year is ended on 5 April it is as a result of qualifying earnings not being payable during this period. As a result, the contribution entitlement during this period will be nil.

31. Where the last pay reference period of a tax year is not ended on 5 April it runs alongside the first pay reference period in the next tax year. In this case contributions will be due for both pay reference periods.

Definition of pay reference period aligned with the period by reference to which the jobholder is paid their regular wage or salary

32. Under this definition the pay reference period for the purposes of calculating the minimum contribution entitlement is defined as a period equal in length to the period by reference to which the jobholder is paid their regular wage or salary, commencing on the first day of that period.

33. This is broadly similar to one of the definitions of pay reference period that can be used for the purposes of assessing the earnings of a worker as part of the assessment of the worker – the definition aligned to the period by reference to which the worker is paid their regular wage or salary (see Detailed guidance no. 3 – Assessing the workforce). However, there is a difference as the length of the pay reference period for the purposes of assessment is defined as:

- in the case of a person who is paid their regular wage or salary by reference to a period of a week, the period of one week, or

- in the case of a person who is paid their regular wage or salary by reference to a period longer than a week, that period.

34. The effect of this difference is minimal. It means that jobholders who are paid their regular wage or salary by reference to a period of less than a week will have a pay reference period for the purposes of calculating the minimum contribution entitlement equal to this length. However, under the corresponding definition of a pay reference period for assessment such jobholders do not have a pay reference period.

35. The pay reference period for the purposes of calculating the minimum contribution entitlement starts on the first day of the period by reference to which the worker is paid their regular wage or salary. If the definition of pay reference period is being changed to one of the other options, the pay reference period ends the day before the start of the first pay reference period under the new definition. More information on switching from one definition to another can be found in the section 'Changing from one definition of a pay reference period to another' below..

36. The legislative requirement means that entitlement to contributions is in a specific pay reference period – the relevant pay reference period.

37. The first relevant pay reference period is the first whole pay reference period that starts on or after the date that the worker becomes both a jobholder and an active member of a qualifying scheme for the first time. Active membership may be as a result of automatic enrolment, re-enrolment or enrolment (opt-in). In this case the first day that the worker is both a jobholder and an active member of a qualifying scheme will be the automatic enrolment date, re-enrolment date or enrolment date (opt-in).

38. Or, active membership may be as a result of the employer using contractual enrolment. In this latter case the first day that the worker is both a jobholder and an active member of a qualifying scheme will be the first day that they are a jobholder after active membership has started or after the employer’s duties start date.

Examples of pay reference periods

Piers’ employer has identified that the period by reference to which he is paid his regular wage or salary is a four week period that starts on a Tuesday. Piers’ automatic enrolment date is 22 January 2018. This falls within the pay reference period of 8 January to 4 February. The first day of the next pay reference period is 5 February. The pay reference period starting on 5 February is the first whole pay reference period which falls on or after 22 January. The first relevant pay reference period for Piers is 5 February to 4 March.

Charlie’s employer has identified that the period by reference to which he is paid his regular wage or salary is a week that starts on a Saturday. Charlie’s 22nd birthday is 6 June 2019 and on this date he meets the criteria to be an eligible jobholder. His employer has decided not to use postponement and so 6 June 2019 is Charlie’s automatic enrolment date. This falls within the pay reference period of 1 June to 7 June. The first day of the next pay reference period is 8 June. The pay reference period starting on 8 June is the first whole pay reference period which falls on or after 6 June. The first relevant pay reference period for Charlie is 8 June to 14 June.

39. Each pay reference period between the first relevant pay reference period and the last pay reference period is a relevant pay reference period.

40. The last relevant pay reference period is the pay reference period in which the worker ceases to be a jobholder, or in which active membership of the qualifying scheme ceases. Active membership of a qualifying scheme could be because the worker leaves employment, opts out or ceases membership of the pension scheme voluntarily or it could be because the scheme ceases to be a qualifying scheme.

Examples of last relevant pay reference periods

Piers’ employer has identified that the period by reference to which he is paid his regular wage or salary is a four-week period that starts on a Tuesday. Piers’ automatic enrolment date was 22 January 2018. Piers decides to opt out of the scheme on 20 February 2015. This falls within the pay reference period of 5 February to 4 March. This pay reference period is therefore the last relevant pay reference period for Piers.

Charlie’s employer has identified that the period by reference to which he is paid his regular wage or salary is a week that starts on a Saturday. Charlie’s automatic enrolment date is 1 June 2019. Charlie leaves employment on 15 August 2019. This falls within the pay reference period 10 August 2019 to 16 August 2019. This pay reference period is therefore the last relevant pay reference period for Charlie.

41. Just as described under the definition of a pay reference period aligned to tax weeks or months, where the date the worker is a jobholder and an active member is part way through a pay reference period and the worker opts out, or voluntarily ceases active membership under the scheme rules in the same pay reference period the entitlement due under the scheme for that pay reference period is changed.

Changing from one definition of a pay reference period to another

42. An employer can choose to change from using one definition of a pay reference period to one of the other two definitions described provided the scheme provides for the different definitions of pay reference period for the purposes of calculating the minimum contribution entitlement. For example, changing from a definition aligned to tax weeks or months to a definition aligned to the period by reference to which the worker is paid their regular wage or salary.

43. If an employer determines to change from using one definition of a pay reference period, then unlike in the case of the assessment process, there are no overlapping pay reference periods at the time of the change. This is because under the legislation the ‘old’ pay reference period is ended the day before the start of the first pay reference period under the new definition.

44. There is nothing that prevents an employer, provided the scheme rules provide for the different definitions from using one definition of a pay reference period for some workers and another definition of a pay reference period for other workers.

Part-period contribution calculations for members

45. Where the definition of pay reference period for the purposes of calculating the minimum contribution entitlement under the pension scheme rules is either:

- the definition of pay reference period aligned with the period by reference to which the jobholder is paid their regular wage or salary, or

- the definition of pay reference period aligned to the employer’s duties start date

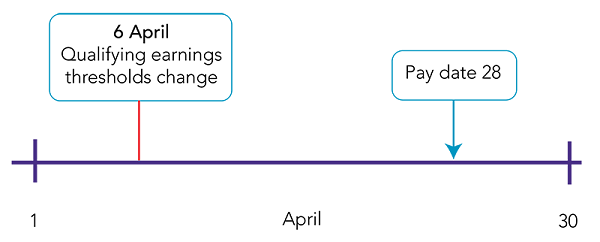

46. A part-period contribution calculation will arise in April each year if the qualifying earnings thresholds change on 6 April (see the example below).

Example of minimum contribution entitlement

(Where the definition of pay reference period for the purposes of the minimum contribution entitlement is aligned to the period by reference to which the worker is paid their regular wage or salary.)

This example uses a pay reference period that is a month in length starting on the first day of the calendar month. It illustrates the pension contribution calculation for a member of a pension scheme with these rules in April.

In a scheme with these rules the contribution rule is that a total contribution of 8% of qualifying earnings in the period 1 April to 30 April is due. As qualifying earnings have changed on 6 April this means the pension contribution calculation is a part period calculation of 5 days at the old qualifying earnings thresholds and 25 days at the new qualifying earnings thresholds.

47. In these cases postponement cannot be used to avoid such part-period calculations. If the employer’s payroll does not process pro-rated contributions, the employer, pension provider and payroll provider should agree how best to deduct the amount due.

Footnotes

[1] These figures are for the 2023 to 2024 tax year. The DWP intends to announce the figures for the next tax year in early 2024. Following the DWP’s announcement, you will find these figures in the earnings threshold section.

[2] For employers who had a staging date between 2012 and 2018, the 12 month period is aligned to their staging date. These employers should read references to ‘duties stat date’ in this section of the appendix as a reference to ‘staging date’.

Related content

Automatic enrolment detailed guidance

1. Employer duties and defining the workforce

3b. Having completed the assessment

5. Automatic enrolment process