Pensions dashboards: initial guidance

Overview

Published: 22 June 2022

Last updated: 18 June 2025

See all updates

18 June 2025

In response to the latest guidance from the Money and Pensions Service (MaPS), feedback from the industry, and ongoing developments, we’ve made further updates to our Pensions Dashboards guidance to help you stay on track to compliance.

17 December 2024

Updates throughout the guidance to bring it in line with external developments and address industry feedback.

12 April 2024

Link to DWP guidance on annualised accrued value calculations added to information to provide to members.

26 March 2024

Rewrite of when your scheme needs to connect with dashboards to cover the new staged timeline for schemes to connect.

14 July 2023

Failing to comply with pensions dashboards duties updated to include information on how trustees and scheme managers will be expected to demonstrate that they have had regard to the guidance on staging timelines.

8 June 2023

Rewrite of when your scheme needs to connect with dashboards to cover the new deadline and staging timeline for schemes to connect.

15 March 2023

Significant updates throughout the guidance to incorporate the Pensions Dashboards Regulations 2022 and Money and Pensions Service standards.

20 July 2022

Updated guidance following government response to consultation on Draft Pensions Dashboards Regulations 2022.

As a pension trustee or scheme manager, you will need to connect with and supply pensions information to savers through dashboards. This is your duty required by the Pensions Dashboards Regulations 2022.

The Department for Work and Pensions (DWP) has set out a staged timetable for schemes to connect to the dashboard digital architecture. Schemes are asked to connect over time according to their size and type. All schemes in scope must be connected by 31 October 2026 at the latest.

There is significant work involved to comply with your dashboards duties and you may need to engage third-party providers to help you with this work, such as an administrator or an integrated service provider (ISP). You should work with your advisers to assess the impact of the changes and plan how you will meet your dashboard duties.

We will update this guidance when necessary to reflect further developments and the industry’s experience with dashboards. Find out more about how to stay up to date with developments.

What are pensions dashboards?

Pensions dashboards are digital services – apps, websites or other tools – which savers will be able to use to see their pension information in one place. This includes information on their State Pension. Pensions dashboards will not show pensions that are already being paid.

A saver will use dashboards to issue a search of the records of all connected pension schemes, to confirm whether or not they are a member. For simplicity in this guidance, we use the term ‘saver’ to refer to users of the dashboards, and ‘member’ to refer to those who have been matched by schemes.

Dashboards aim to help members plan for retirement by:

- finding their various pensions and reconnecting them with any lost pension pots

- understanding the value of their pensions in terms of an estimated retirement income

The Money and Pensions Service (MaPS) will develop and host its own pensions dashboard on the MoneyHelper website. The MoneyHelper dashboard will be the first to be available to the public. Other organisations will also be able to develop and host their own dashboards at a later stage. This will be subject to approval by the Financial Conduct Authority (FCA).

For pensions dashboards to work, MaPS is building a digital architecture which will connect pensions dashboards to pension schemes. You can find out more about the digital architecture on the MaPS website.

Which schemes are in scope?

Dashboards duties will apply to the trustees or scheme managers of:

- registrable occupational pension schemes with 100 or more relevant members

- public service pension schemes

A relevant member is an active, deferred or pension credit member. Members who are receiving benefits (pensioners) or whose benefits have been cashed in to provide a tax-free lump sum, purchase an annuity or drawdown income are not relevant members. However, members who have taken an uncrystallised funds pension lump sum (UFPLS) should still be considered in scope for dashboards.

The FCA has made corresponding rules for FCA-regulated pension providers in respect of personal and stakeholder pension schemes.

Common in and out of scope scenarios

- If your scheme’s main administration is in the UK, it is in scope of the regulations, even if some sections are administered outside the UK. However, if your scheme’s main administrator is based outside of the UK, it is not in scope.

- If your scheme is in the process of buying out, you will remain in scope until the buy-out is complete and the number of relevant members falls to zero. For example, when all relevant members of the occupational pension scheme have their own insurance policy. The duty to find and return the information for these members will move to the buy-out provider who will be subject to the Financial Conduct Authority’s (FCA) regulation.

- If your scheme is in the process of winding up, you are still in scope, unless the number of relevant members falls to zero. However, there are some exemptions to the information to provide to your members.

- If the whole of your scheme starts an assessment period with the Pension Protection Fund (PPF) before your connection deadline, you will be out of scope of the regulations for the duration of the assessment. However, if any sections of your scheme are not in assessment, the entire scheme is still in scope, but there are some exemptions to the information to provide to your members.

- If your scheme has members with additional voluntary contribution (AVC) arrangements, you need to work with the AVC provider(s) to identify which members are relevant, based on the scheme’s trust deed and rules, and the specific AVC arrangement details.

Your role and legal duties

You will be required to:

- register your scheme with MaPS and connect to dashboards by a specific deadline

- receive personal information on savers, and search and match members to their pensions (‘find requests’)

- provide members with information about their pension through the dashboard of their choosing upon request (‘view requests’)

- co-operate with MaPS when preparing to connect, maintain records and report certain information to us and MaPS

You will need to do all the above in compliance with standards published from time to time by MaPS and have regard to the DWP’s guidance on connection, considering the:

- staged timetable

- guidance issued by MaPS

- guidance issued by The Pensions Regulator (TPR)

Working with advisers and providers

You will need to work with several organisations to get connected to dashboards. Typically, this will involve providers assisting you with your data preparation and those assisting you with connection to the digital architecture (referred to in this guidance as ‘connection providers’), which may include your administrator, software providers, Integrated Service Providers (ISP), actuary, and legal advisers. It could also include employers (to improve the availability and quality of personal data) and external data providers (for example AVC providers if you do not hold full details of the AVC entitlement with the main scheme information).

Talk to them as soon as you can about their dashboards plans and how they can support you. Early engagement will help them plan their workload and improve their ability to support you.

You may need to procure new services or update your provider contracts. This will take time and may hold up your preparations if you do not address this early.

The dashboards duties apply to trustees and scheme managers. While you can use third parties to help you meet your duties, you will ultimately remain accountable for ensuring that your scheme is connected to dashboards on time and that you are (and remain) compliant with the requirements. You need to be available to make any decisions required for your providers to progress their work and you should put in place robust ways to monitor this progress. Where they are supporting other clients with similar connection deadlines, make sure they have enough capacity to deliver.

For more information, see our guidance on the selection, appointment, management and replacement of any suppliers.

Discussion points with third parties

Here is a list of areas that you may wish to discuss with your third-party providers. There will be more points that are specific to your scheme. We encourage you to keep a record of your enquiries, the response and any decisions made.

- Roles and responsibilities. It is important to be clear about the roles and responsibilities of those who are supporting you to meet your duties, and ensure there are no gaps in the process.

- Awareness of compliance requirements. When delegating any work to third parties, make sure they are aware of the relevant compliance requirements, for example the standards set by MaPS.

- Data review and improvement plan. Good data quality is fundamental to your dashboards duties. It is vital to work with your administrators to review and set up improvement and data control plans.

- Monitoring progress. You should have a process in place to receive regular reports in line with the legal requirements and other information you need to consider for reporting purposes, such as MaPS standards. We recommend that pensions dashboards are a regular agenda item at your board meeting to monitor the progress.

MaPS standards

MaPS has set the standards relating to the provision of data through pensions dashboards and the digital architecture needed to support this. These standards provide the rules and controls that will facilitate the smooth ongoing connection to pensions dashboards. MaPS has published their approved standards which schemes and providers must use to connect to the dashboards architecture and facilitate ongoing connection and associated reporting.

Trustees and scheme managers need to be aware of the requirements in these standards and ensure that your connection providers and scheme administrators are meeting them. You should also make sure that connection providers and administrators are closely aware of any developments in this area.

The topics covered in these standards are as follows.

- Data standards: set out in detail how schemes receive data from the dashboards architecture and return appropriate data to dashboards. You should be working with your scheme administrators to deliver any required improvements to your members’ personal and value data. You should be ensuring that the data is available, accurate and accessible, in line with these standards. More detail can be found in ‘preparing data for matching and for value data’.

- Reporting standards: set out information you need to ensure is generated, recorded and supplied, that MaPS and TPR can monitor the effectiveness of pensions dashboards and compliance with regulations. Some of these standards took effect from April 2025 (such as keeping records against all the data requirements specified in the reporting standards) with the remainder taking effect at a later date, which is subject to the testing period. You should be familiar with the record-keeping requirements set out in the standards and work with your third-party providers to ensure you are complying with them. Find more detail in record-keeping.

- Technical standards: set out how pension schemes (or their connection providers) interface with the dashboards architecture and user-facing pension dashboards. You should be seeking assurance from your connection providers that they are meeting these standards.

- Code of connection: sets out the connection, technical, security, service and operational standards you need to meet to connect to the digital architecture. This includes the timeframes you have to return data and the availability of the scheme’s connection to dashboards. You should be seeking assurance from your connection providers that they are meeting these standards.

Are you ready to connect to pensions dashboards? Register now for our free webinar on 3 December 2025 at 2:30pm, designed to help medium and smaller schemes prepare for connection.

Pensions dashboards: short films

Why do savers need pensions dashboards? We’ve been speaking to savers about their pensions experiences and how dashboards will help them in their planning.

When your scheme needs to connect with dashboards

All schemes with 100 or more relevant members at the scheme year end between 1 April 2023 and 31 March 2024 must connect to pensions dashboards.

The Department for Work and Pensions (DWP) has set out a staged timetable for schemes to connect to the digital architecture. Schemes are asked to connect over time according to their size and type.

Check your 'connect by' date

If you have more than one type of scheme, you should check the date for each.

Is your 'connect by' date

Master Trusts

| Number of active and deferred members | Connect by |

|---|---|

| 20,000 or more | 30 April 2025 |

| 5,000 to 19,999 | 31 May 2025 |

| 1,000 to 4,999 | 30 June 2025 |

Defined contribution (DC) schemes used for automatic enrolment

| Number of active and deferred members | Connect by |

|---|---|

| 5,000 or more | 31 May 2025 |

| 1,000 to 4,999 | 30 June 2025 |

Defined benefit schemes, all other DC schemes, all hybrid schemes (including hybrid master trusts)

| Number of active and deferred members | Connect by |

|---|---|

| 20,000 or more | 31 May 2025 |

| 5,000 to 19,999 | 30 June 2025 |

| 2,500 to 4,999 | 31 August 2025 |

| 1,500 to 2,499 | 30 September 2025 |

| 1,000 to 1,499 | 30 November 2025 |

CDC schemes

| Number of active and deferred members | Connect by |

|---|---|

| All sizes | 30 September 2025 |

Public service schemes

| Number of active and deferred members | Connect by |

|---|---|

| All sizes | 31 October 2025 |

Schemes with 100 to 999 relevant members

| Number of active and deferred members | Connect by |

|---|---|

| 750 to 999 | 31 January 2026 |

| 600 to 749 | 28 February 2026 |

| 400 to 599 | 31 March 2026 |

| 320 to 399 | 30 April 2026 |

| 250 to 319 | 31 May 2026 |

| 195 to 249 | 30 June 2026 |

| 155 to 194 | 31 July 2026 |

| 125 to 154 | 31 August 2026 |

| 100 to 124 | 30 September 2026 |

Deciding when to connect

All schemes in scope must be connected by 31 October 2026, at the latest.

The DWP has published guidance on connection: the staged timetable, aiming to reduce risks to delivery and help manage capacity in industry.

You must have regard to the DWP guidance and the separate onboarding process guidance that has been published by the Money and Pension Service (MaPS). This means you must read these and take them into account when making decisions around connection. We expect schemes to connect in line with the timeline set out in this guidance. Not following the guidance could expose you to greater risk of not being able to comply with your dashboards duties.

You will be expected to demonstrate how you’ve had regard to the guidance. Find further details on failing to comply with pensions dashboards duties.

Changing your connection plan

In exceptional circumstances, you may be unable to connect your scheme in line with your date in DWP’s guidance. If you are planning to connect your scheme more than 30 days before or after your ‘connect-by’ date, you need to discuss your intention with your connection provider in the first instance and you should have regard to MaPS’ change of connection plans process and guidance.

MaPS will notify us of your updated ‘connect-by’ date, which we will reflect in our communications to you.

You must be connected by the 31 October 2026.

Changes to scheme size

The deadline still applies if your scheme changes size, unless you fall out of scope of the requirements entirely, for example if all your members become pensioner members.

If you did not have 100 or more relevant members at scheme year end 2023 to 2024 but you then have 100 or more relevant members on or after 1 April 2024, you will be required to connect by the later of:

- six months after the end of the scheme year in which that threshold was reached

- 31 October 2026

You should also have regard to the DWP guidance on connection, even if your scheme falls into scope on or after 1 April 2024.

Schemes which exist on or after 1 April 2024

If your scheme comes into existence on or after 1 April 2024, and you have 100 or more relevant members, you will be required to connect by the later of:

- six months after the end of the scheme year in which that threshold was reached

- 31 October 2026

You should also have regard to the DWP guidance on connection, even if your scheme falls into scope on or after 1 April 2024.

Schemes with multiple sections

You have to connect the whole scheme at the same time. This includes schemes that have multiple sections or members with additional voluntary contributions (AVCs). Where you are unable to connect all sections at the same time, we expect you to consider whether you need to report this breach to us. Refer to our breach of law guidance for further details.

Schemes in Pension Protection Fund (PPF) assessment

Schemes that start PPF assessment before the connection deadline are not required to connect by the deadline. If the scheme exits PPF assessment but does not enter the PPF, it will need to connect by the later of:

- the connection deadline

- six months from the end of the assessment period

This only applies where the whole scheme is in PPF assessment. If only a section of your scheme is in assessment, your connection duties still apply.

If your scheme has already connected, but then starts a PPF assessment, you should stay connected and be able to match your members. However, you do not need to return value data while the scheme is in assessment. Instead, use the appropriate flags in MaPS’ data standards, which provide an explanation to the member.

Voluntary connection for smaller schemes

Registrable occupational pension schemes with 99 or fewer relevant members are currently not in scope of the regulations (see section which schemes are in scope for more details), but they can apply to MaPS to connect on a voluntary basis. Once MaPS has granted permission to connect voluntarily, the scheme will need to connect by the date agreed with MaPS and comply with all the requirements that apply to schemes in scope.

Therefore, if you decide to connect voluntarily, you must ensure that your scheme is able to find members and send them data as soon as you are connected and remain connected. You can find more information in the your role and legal duties section, and the ongoing connection and record-keeping requirements section.

Trustees and scheme managers are responsible for the decision to connect on a voluntary basis as well as the scheme’s compliance, and you should be clear on these ongoing legal duties when making the decision.

Talk to your administrator or provider if you would like to connect voluntarily.

You will need to follow MaPS standards and guidance. Refer to the MaPS website, where further information and guidance on this process will be provided in due course.

Deferral applications

The window for applications to defer the connection deadline of 31 October 2026 has now closed.

Connecting to pensions dashboards

You need to have a digital interface in place to connect your scheme to the digital architecture. You also need to complete a number of steps before you connect.

The Money and Pensions Service (MaPS) is facilitating the ordered connection of a community of voluntary participants which includes connection providers who are in turn facilitating schemes to connect, having regard to the staged connection approach set out in the Department for Work and Pensions (DWP) guidance, as well as a number of direct-connecting schemes.

Choosing a digital interface

Your digital interface could be provided by:

- building your own interface if the scheme is administered in-house

- using an interface built by your scheme’s third-party administrator or software / IT supplier

- using an interface provided by a third-party integrated service provider (ISP)

In most cases, the scheme will be using a connection provider, who will complete a testing process with MaPS to prove that they fulfil the technical requirements set out in the DWP regulations and can meet MaPS standards, including the Code of Connection and Technical standards.

When selecting a connection provider, you should ensure that they can provide a service suitable for your scheme needs, for example, that they are able to support your matching policy. You can find out more about this in the working with advisers and providers section.

You will be required to provide your connection provider with certain information to enable your scheme’s registration and connection to take place on your behalf. You need to understand what the connection provider requires from you, and the timings of this. This includes:

- sharing your scheme’s registration code(s)

- providing your scheme’s Pension Scheme Registry Number (PSRN)

- ensuring that they are aware of your connection date as per guidance and any changes to this timeline

You can find out more about the steps to connection when connecting through a third-party on MaPS’s website.

If you are considering building your own interface, be aware that connecting to the digital architecture will be a significant undertaking and you should engage with MaPS at the earliest opportunity. It will typically require specialist resource and experience to meet the standards that MaPS sets and will be subject to extensive testing. You can find more information about this in MaPS’ connection hub.

Whichever approach you take, you remain accountable for ensuring your scheme is connected to dashboards on time and that it remains compliant. You should ensure robust processes are in place for the selection, appointment, management and replacement of any suppliers.

Preparing your data for connection

You have legal duties for providing the required data to matched members. MaPS data standards set out how you provide this data, with the type, length and format requirements for key data (for example, how dates should be formatted). You need to ensure your data is prepared in the correct format to enable your chosen connection provider to connect smoothly. You will also need to prepare your data for matching and for up-to-date value information of members’ pensions.

If your scheme is using multiple providers to assist with your dashboard duties and the member data will be processed between these providers, you may find it helpful to perform a data mapping exercise. This will help you to understand where data is held (for example, whether member data will be held by your connection provider) and agree who will be performing certain tasks in contractual arrangements. It is a requirement for the General Data Protection Regulation (GDPR) purposes to complete a data protection impact assessment (DPIA) and keep a record of roles. If you already have a DPIA, you may need to update it.

MaPS has published its DPIA, regarding the processing of personal data as part of its role in delivering the Pensions Dashboards Programme (PDP.) You may wish to consider this document when preparing your scheme’s DPIA.

Registration codes

The registration code(s) is a unique code that we will provide to your scheme, to enable you (or your connection provider on your behalf) to complete the registration process and connect to the digital architecture in line with MaPS’ Code of Connection.

The purpose of the registration code(s) is to ensure the safety of the digital architecture by only allowing regulated entities to connect. They also ensure that compliance data (management information and reporting data) is correctly attributed to your scheme.

As the trustee or scheme manager you are responsible for handling the registration code(s), including securely providing these to your relevant connection provider. It is important that the codes we issue are kept safe until you use them.

We will supply two unique registration codes for your scheme to the trustee whom you have nominated in Exchange as the Pensions Dashboards Primary Contact, or the scheme manager in the case of a public service pension scheme. This will be around five months in advance of your ‘connect-by’ date. Please note that the registration codes will expire shortly after this ‘connect-by’ date.

Each connection provider will only require one registration code from your scheme to connect the section(s) of your scheme they are responsible for. If you are using only one connection provider, you will only need to use one registration code, and the other will expire in due course.

The following illustrations depict common scenarios your scheme may come across regarding registration codes.

Common scenarios

- If your registration code has been lost or misplaced, your Pensions Dashboard Primary Contact (nominated trustee or scheme manager) will need to contact our customer support team to obtain a new code. The previous code will be cancelled.

- If you are planning to connect significantly earlier than your ‘connect-by’ date, you will need to follow the MaPS process to notify them of your new target date. MaPS will notify us of your new date and we will issue you with your registration code(s) ahead of this date.

- If you are planning to change your ‘connect-by’ date to a later date, you will need to follow the MaPS process to notify them of your new target date. MaPS will notify us of your new date and we will issue you new registration code(s) if necessary.

- If your scheme has members with additional voluntary contribution (AVC) arrangements and your AVC providers will connect these arrangements to the dashboards on your behalf, your AVC providers will need to use one of your registration code to connect these sections. If your AVC provider is sending the data to your primary administrator instead, you do not need to provide them with a registration code. For more detailed guidance, please refer to the section 'Connection of multiple sections'.

- If your scheme is segregated, you will need to connect all relevant sections using the PSR number of the ‘parent’ scheme as registered with TPR. We will supply the registration code to the trustee nominated as the Pensions Dashboards Primary Contact for the ‘parent’ scheme in our records. You need to work with the connection providers for each of the segregated sections to understand how your scheme will be connected to the dashboard as a whole. For more detailed guidance, please refer to the section 'Connection of multiple sections'.

Connection to the live environment

Once you or your connection provider are ready to connect to the live environment, a specific connection date will need to be agreed with MaPS. This process will be handled by the connection provider. Once your scheme is connected to the live environment, you must be able to:

- receive personal data through ‘find requests’ that are issued by a saver

- use this data to find members’ pensions in your records (‘match’)

- provide pensions information to members through dashboards (‘respond to view requests’)

There may be some requirements that you are unable to meet as soon as you have completed connection during the onboarding and user testing phase. For example, if you are using more than two connection providers, they may not be able to connect you on the same date. You should take prompt and effective action to investigate and correct any issues during this testing stage, including identifying any underlying causes. If you consider that the issues identified are materially significant, we expect you to consider if you need to report this to us [refer to our Breach of Law guidance for further details]. You do not have to report to us if this issue is not of material significance.

Connection of multiple sections

If your scheme has multiple sections, you need to understand how each section will be connected.

You may choose to connect all your sections through the same connection provider or use more than one connection provider. Each connection provider will need one unique registration code.

You will need to work with your administrators, additional voluntary contribution (AVC) providers, and your connection providers to agree the suitable connection solutions, depending on your own circumstances. You can check the Financial Conduct Authority register for current contact details of your AVC provider, if your provider is FCA regulated.

If you are using more than one connection provider and each use a different ISP, each ISP will require a unique registration code to connect the section(s) that they are responsible for on behalf of the scheme. This includes your AVC providers, which will use your registration code to connect your AVC sections.

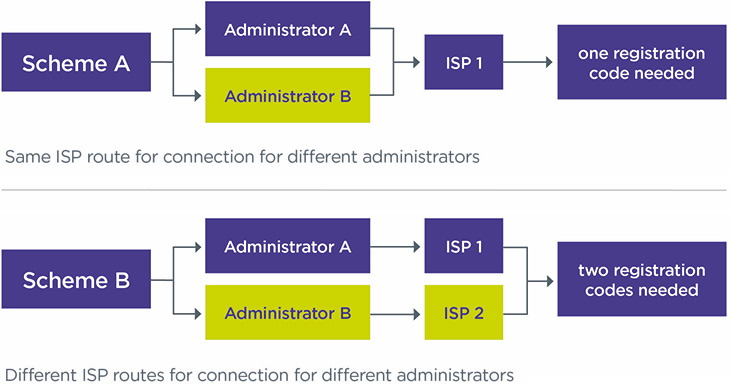

For example, if your scheme has defined benefit (DB) and defined contribution (DC) sections that are managed by different administrators with different ISPs, each ISP will need a unique registration code from you. However, if both administrators use the same ISP, only one registration code is needed to connect the different sections of the scheme. See Figure 1.

Figure 1: number of codes needed for connection depending on the number of ISPs used

Matching people with their pensions

When a saver uses a pensions dashboard, you will receive certain personal data from the digital architecture. You will need to use the data to search your records and determine if you have a pension for them. This process is called ‘matching’.

Information included in the ‘find request’

The potential member will be verified by GOV.UK One Login before they can issue a ‘find request’. This means you can be confident the saver is who they say they are.

Once a potential member has been successfully verified, their details are added to other information they have provided, to be used for ‘find requests’. This may include National Insurance number, previous names, addresses, email address(es) and mobile phone number(s).

Schemes will receive a ‘find request’ with all provided information, to match the saver to their pensions. If a saver successfully proves their identity, the find request will always include the following core identity information:

- first name

- last name

- date of birth

- email address

One Login will also check any provided UK address that it exists and has an association with the saver, through credit records.

More detail on the data that schemes will receive is provided in MaPS’ identity service page.

Preparing your data for matching

You need to ensure the quality of data is good enough to enable you to match savers with their pensions. You should interrogate your data to consider the extent to which it is:

- complete and accurate

- digitally searchable for dashboards purposes

If your data is not reliable, you risk returning data for the wrong person or not finding a pension record when you should. This may lead to enforcement action being taken against you by us, or the Information Commissioner’s Office (ICO).

You should audit your data and discuss with your administrator or other advisers which items are most suitable for you to use. You should put a plan in place to improve data and digitise this data if needed.

You should understand your obligations under data protection law and have processes in place for protecting scheme data. This includes being able to manage your data to comply with data protection legislation and to address any breaches. You can find out more about your duties in our code of practice.

Matching, combining or comparing data from multiple sources requires a Data Protection Impact Assessment (DPIA) under UK General Data Protection Regulation (GDPR), so you may need to produce one. If you already have a DPIA, you may need to update this. You can find out more about DPIAs on the ICO website.

Setting the criteria for matching

You should decide what data to use to match members to their pensions (your ‘matching criteria’), based on your scheme’s data quality and availability. It is vital that your scheme’s matching criteria is in line with the level of confidence that you have in the quality of your data.

You will be required to keep a record of your matching policy for at least six years from the end of the scheme year in which the decision is taken. You should record the matching criteria you are using for the scheme generally. You are not expected to record the criteria used for each individual search.

Your matching criteria may evolve over time. It’s anticipated that many schemes will use last name, date of birth and National Insurance numbers for matching. However, if you are not satisfied with the quality of these data items, you will need to decide how great this risk is and whether you want to use any of these items in the ‘matching criteria’. You could widen your matching criteria to include further data items such as first name, alternative names, personal email address or postcode. This should increase your confidence that you are matching to the right person, without increasing the risk that you fail to find someone when you should.

When your data quality has improved, you can update your 'matching criteria' accordingly. You should keep a change record including why this is the best option for your scheme, any changes made, and the reasons behind this.

See further record-keeping requirements on matching in ongoing connection and record-keeping requirements.

To help schemes, the Pensions Administration Standards Association (PASA) has published guidance around data and matching. You may wish to refer to this guidance when deciding on your approach to matching.

Match is found

If you are confident that you have found a member’s pension record using the information they provided, you have ‘made a match’.

You must create and register a unique identifier, also known as Pension Identifier (PeI), with the digital architecture, to meet MaPS’ technical standards. The PeI does not contain any pensions information but acknowledges that there is a match. The member can then ask to view their information and you should return the relevant data directly to the dashboard. For more information, see information to provide to members.

If someone leaves your scheme or retires, you need to remove their match from the digital architecture by ‘de-registering’ their PeI as soon as possible.

Possible match is found

In some cases, you might not be certain enough that you have ‘made a match’ to release a member’s pension data.

For example, the National Insurance number and date of birth match, but the last name doesn’t. This could happen if a member has married but failed to notify the scheme of their new last name.

In these circumstances, you should return a ‘possible match’ to the member. You must create and register a PeI. In this case the system will only send a message to inform the member that they may have a pension, but that they need to provide more information via the given contact details to confirm this. You can do this by using an appropriate code, that the data standards provide more information on. If they do not make contact within 30 days, you must delete their personal information and deregister the PeI.

If a match is subsequently confirmed, you would need to notify MaPS that the match is now confirmed and provide the relevant data to the dashboard when you are asked to.

Match cannot be found

If you determine that you do not hold a pension for the saver, including following the ‘possible match’ process, you must delete the personal information provided as there are no legal reasons to keep it and you will otherwise breach the GDPR requirements.

Schemes with multiple sections or administrators

If your scheme has multiple sections and there are different administrators for some of your sections, you need to work with all your administrators to agree the most suitable approach for your scheme in the following situations.

- Where there are discrepancies in the data quality for each of the sections, you may want to have more than one set of ‘matching criteria’.

- Where a member has multiple benefits across your scheme and has been successfully matched for one section, but a ‘possible match’ for another, you will need to consider the level of information to provide to the member.

- Where you have multiple sections with different administrators, you must consider which contact information is provided to the member. This may depend on the approach of your connection routes.

If your scheme has a very complex benefit structure, you may also consider performing a data mapping exercise to understand where data is held, who is involved in providing it, as well as any gaps. Where necessary, you should consider updating contractual agreements with your providers. You may wish to consider the toolkit that PASA has published, if your scheme has sections including AVCs.

Information to provide to members

You will have to supply the following information to your members via pensions dashboards.

- Administrative data. This includes the scheme name, the dates the member was in it, the name and contact details for the administrator and, if available, the employer’s name. You will also need to provide a member’s date of birth to enable dashboards to show the time to retirement (the date of birth itself will not be shown on dashboards).

- Value data. This provides details of how much pension the member has built up already and how much they may have when they retire (their ‘estimated retirement income’). You should utilise the codes that are provided in MaPS data standards to provide contextual information which helps members make sense of the provided value data.

- Signpost data (referenced as ‘additional data’ in MaPS data standards). These are hyperlinks to websites where the member can see other useful information about the scheme, such as information on costs and charges, the scheme’s statement of investment principles and the scheme’s implementation statement.

You can find the detailed requirements for view data in the data standards.

When you should provide the data

Administrative and signpost data

You must return administrative and signpost data immediately after a view request is received.

For new members who request view data within the first three months of joining the scheme, you will need to provide the administrative data as soon as you can and no later than three months after the member joined the scheme.

Value data and contextual information

You must provide value data, along with relevant contextual information, immediately if it is based on a statement provided to a member in the last 13 months, or a calculation made for the member in the last 12 months (for example if there was a previous request made on a dashboard). Where this is not the case, you will have three working days to return value data, along with the relevant contextual information, where all benefits provided to the member are defined contribution (DC) benefits. You will have 10 working days in all other cases, such as defined benefits (DB) and hybrid benefits, where the value is calculated by reference to both DB and DC elements.

For new members, you are required to provide the value data, along with relevant contextual information, as soon as you can. This should be no later than when you first produce a statement of the members’ benefits for them, or 12 months from the end of the first full scheme year they have been in the scheme, whichever is soonest.

What value data and contextual information you should provide

The values (including estimated retirement income) that you need to supply will depend on the status of the member and the benefit type.

The table details what data you should provide. If you have a complex benefit structure you should speak with your administrators about what data you should provide.

| Benefit / member type | Accrued value (information regarding the pension or benefits built up to date by the member) | Projected value (information regarding the pension, benefits or other income the member may receive based on continued contributions, earnings or service) | ||

|---|---|---|---|---|

| Pot | Annual income | Pot | Annual income | |

| DC | Yes | Yes | Optional | Yes (unless the members fall into the exemptions to this) |

|

Active DB including public service (Public service schemes may present two blocks of data) |

If benefit is designed to provide a lump sum | Yes | No | Yes |

|

Deferred DB including public service (Public service schemes may present two blocks of data) |

If benefit is designed to provide a lump sum |

Yes (simplified option in certain circumstances) |

No | No |

| Active cash balance | Yes | Yes (unless the sole purpose is to provide a lump sum on retirement) | Yes | Yes (unless the sole purpose is to provide a lump sum on retirement) |

| Deferred cash balance | Yes | Yes (unless the sole purpose is to provide a lump sum on retirement) | No | No |

| Active collective DC | No | Yes | No | Yes |

| Deferred collective DC | No | No | No | Yes |

| Hybrid benefit | Where the benefit is calculated by reference to both DB and DC elements, you can return one or more sets of values, which may be based on DB, DC, cash balance or collective DC methodology depending on which you consider best represents the members’ benefits. | |||

You also need to provide certain contextual information to help the members make sense of the value information. MaPS data standards have set out the standard format and codes for this information, which includes:

- the date to which the value relates

- the date from when a benefit is payable

- whether more than one retirement date has been used to calculate the value

- whether there is a spouse’s or civil partner’s benefits attached to the pension

- whether the benefits would increase or decrease in payment

- why a value is not available

Preparing value data

You need to ensure that the quality of your data is sufficient to meet your dashboards duties. This includes ensuring that:

- administrative data you provide is accurate

- value data is calculated in line with the legal requirements and is sufficiently recent (see below for more information)

- data is digitised so it can be returned through the digital architecture

You should audit your data, put a plan in place to improve data and make any changes required to your systems and processes.

Whether they are DC or DB, the values you give should be from either:

- a benefit statement provided to the member in the last 13 months

- a calculation made for the member in the last 12 months

This applies whether or not a calculation has been done in response to an earlier view request.

You will need to consider how you ensure that data returned to members is recent. If you have performed a calculation or provided the member with a statement within the time periods as above, you should return value information immediately. If you do not have up-to-date information available, you need to decide how you will provide this. You will only have three working days where all benefits provided to the member are DC, or 10 working days in any other case (including for hybrid benefits) to calculate a value on request. Therefore, it may be more efficient to put in place a process to revalue deferred pensions annually or automate the calculation of values in your administration system. Speak to your administrator and other advisers or suppliers to decide how you will deliver recent data, and where it might be possible to improve current systems.

There may be limited circumstances (for example, the pension provider is subject to a Pension Protection Fund (PPF) assessment period, or an action or decision is outstanding from the member) where you are unable to provide value data. In this case you will need to choose from the reasons provided in MaPS data standards and provide the member with a way of getting in touch.

DC values

DC projected values should be calculated in line with the Financial Reporting Council actuarial standards (known as AS TM1) for statutory money purchase illustrations. DC accrued annual income should also be calculated by reference to AS TM1, but leaving out the impact of future contributions and fund growth. The Department for Work and Pensions has developed guidance on how to calculate the annualised accrued value for DC schemes, including available methods. See annualised accrued value calculations for pensions dashboards.

You do not have to provide a projected value if the member is within two years of retirement or where all the following apply:

- the accrued value (to money purchase benefits) was less than £5,000 when last calculated and provided to the member

- no contributions (including transfers and pension credits) have been made since

- the scheme has informed the member that further projections will not be given unless further contributions are made

You can still provide a projected value in these situations if you choose to.

DB values

You should calculate DB values in line with scheme rules, without taking into account possible increases in earnings.

However, for the first two years of being connected, you can provide a simplified calculation of deferred benefits revalued using an adjustment method you consider to be appropriate (for example, using inflation figures). You can only do this if providing a value in line with scheme rules would be disproportionately expensive or take too long, and you are confident the alternative value provided would not be misleading. You must also confirm in the information you provide that you are using this basis for calculation, in line with the data standards. During these two years you should deliver the data and system improvements required to be able to provide a value in line with scheme rules.

If the member’s DB benefits have different tranches, you can choose to either provide one single value (showing a common retirement date) or separate values for each tranche (with their own retirement date). If you return separate values, you will need to provide a start and end date for each separate value.

Public service values

Public service schemes, excluding judiciary and local government schemes, will need to provide two sets of values that reflect the McCloud remediation process – one for each option they can select at retirement.

Schemes in PPF assessment/wind-up/buyout

If your scheme, or a section of your scheme, goes into PPF assessment after you’ve connected to the digital architecture, you will need to remain connected. However, you are only required to provide administrative data and messaging confirming the scheme, or section, is in PPF assessment using the appropriate codes in the data standards.

Schemes, or sections of schemes, in the process of winding up will need to connect to the digital architecture and provide administrative data, but do not have to provide value information to members (though they can do so voluntarily). If your scheme has entered into a buyout process, but has not yet triggered wind-up, then you should still meet the requirements for providing value information.

Schemes with multiple sections or benefit types

If you have multiple sections with different administrators, you need to work with each of them to understand and agree who will be providing value information, and how they will provide it. As a trustee, you need to ensure that the information being provided to the digital architecture, across different sections and administrators, is consistent and in line with legal requirements.

If your scheme has members with benefits across different sections or benefit types, for example, a DB element and an AVC value, you are legally required to present this to the member using the same illustration date.

In many situations, schemes may not yet be using the same illustration date across all their sections or benefit types. In some complex situations, schemes may take a considerable time and effort to align the illustration date. If your scheme is in this situation, and likely to be in breach when your scheme connects to dashboards, you should consider our guidance and assess whether to report a breach of law to us.

It is important that the value information presented to members is recent, clear, accurate and understandable, and the accrued and projected value for the same benefits have the same illustration date.

Ongoing connection and record-keeping requirements

There is a requirement for ongoing connection, which is explained in further detail in the Money and Pensions Service (MaPS) code of connection. You need to be able to demonstrate to MaPS that you are able to comply with this. If you are using a connection provider to assist your connection, your provider will handle this requirement on your behalf.

Your scheme must target availability of at least 99.5% of the time, 24 hours each day, seven days of the week, measured on a calendar monthly basis. This means if you are considering something that may potentially disrupt connection, such as a change of administrator or IT provider, you should plan this carefully to minimise disruption. MaPS are regularly updating their guidance on their connection hub, which you should monitor to understand this requirement. Additionally, you should maintain a robust audit trial, which includes the planning process and any risk management measures put in place, for example, in the case of a change of administrator.

For any scheduled unavailable time, such as maintenance work or change of provider, you will need to notify MaPS at least five working days in advance.

You will also need to:

- update your systems when MaPS makes any updates or changes to standards

- keep the scheme’s information on the Governance Register up to date

If you fail to meet MaPS standards and requests, your scheme could be automatically disconnected. This may have regulatory consequences for you and we may take compliance and enforcement action.

Record-keeping requirements

The key information that requires recording (and later reporting through MaPS reporting standards), includes:

- number of connections your scheme has used to connect to the digital architecture (for example, if you have multiple sections with different providers)

- number of your relevant member records which have been connected

- number of your relevant member records which have not yet been connected

- number of view requests received and the time taken to respond to each one

- start and end time of each instance where your scheme’s ability to find members was unavailable, along with the reasons for any unavailability

- in the situation where you are unable to perform the functions to return value data to members, you need to capture the start and end time of each instance where your scheme was unable to do this, along with the relevant reasons

- in the situation where your scheme is only able to return part of the value data items, you need to capture the number of value data items where they were unavailable and the relevant reasons

- number of value data items that are not provided within the timescales set out in the regulation

You should keep records of complaints related to pensions dashboards for six years. This should include volumes, the nature of complaints and outcomes. The records should be accessible to MaPS and The Pensions Regulator upon request.

Considerations when recording the complaints

- The nature of the complaints could be about a missing pension on dashboards or inaccurate value information that was provided via dashboards.

- You should seek to understand the root cause of the issues – eg if this is due to a system or process issue with your administrator or ISP, or whether this is due to issues with the underlying data. This will enable you to better understand your member’s experience and identify potential areas of non-compliance or need for improvement. This will also help you understand if there are systemic issues which may have a wider impact for the running of your scheme.

- For the outcome of the complaints, it is important to include how you resolve the complaints and when it was resolved.

- You should also record remedial actions taken in respect of underlying issues and when this was carried out.

You will also need to keep a record of:

- how you have carried out steps set out in guidance on connection, or other steps you’ve taken to achieve connection

- how you have carried out steps to remediate any issues which may occur, and how you are monitoring the progress of your plan for these

- your matching criteria

You will need to keep a record of this information for at least six years from the end of the scheme year to which it relates.

Reporting requirements

The routine reporting of the information set out in MaPS’ reporting standards is not yet required. MaPS will give notice of when this requirement will come into effect, though this is not expected to be before October 2025.

Once routine reporting is required, you will need to report certain information through the digital architecture to help MaPS and us to monitor your compliance with legal requirements and the performance of the digital architecture.

You need to work with your third-party providers to ensure your system is able to generate, record and report the data as required. You should keep these data records for six years.

Your existing duties to make breach of law reports as appropriate still apply. We have expanded our reporting breaches guidance to include specific dashboard examples which include circumstances where a provider should consider reporting a breach to us.

Failing to comply with pensions dashboards duties

We have set out our approach to compliance in our compliance and enforcement policy.

You will be expected to demonstrate how you have had regard to the guidance on connection. This means, but is not limited to, the following.

- You should not make final decisions about connecting and whether to follow the 'connect by' date until you have engaged with the guidance.

- You must be able to demonstrate that you have adequate governance and processes for making such decisions. The reasoning for your decisions should be clearly considered and documented, as well as how relevant risks are identified, evaluated and managed.

- You should make sure that you have access to all the relevant information before making decisions and acting upon them. Keep clear and accurate audit trails to demonstrate the decisions made, the reasons for them and the actions taken.

Preparing to connect: checklist

You can use this checklist to ensure you are on track to meet your duties. We encourage trustees and administrators to work together and use the checklist.

Download a Word version of the dashboards preparation checklist| Preparation checklist | Relevant guidance | Your status comments |

|---|---|---|

| Start now: general tasks | ||

|

Establish pensions dashboards as a regular agenda item at board meetings |

||

| Check your 'connect by' date | When your scheme needs to connect with dashboards | |

|

Discuss pensions dashboards with your administrator and other relevant parties (such as software provider, actuary, legal adviser, employer, additional voluntary contribution provider) to develop and agree practical delivery plan according to your scheme-specific situation |

||

|

Explore your route to connection – either building your own interface or using a (new or existing) third-party solution |

Connecting to pensions dashboards - choosing a digital interface | |

| Decide when to connect your scheme, taking relevant guidance into consideration, and assessing the risks associated with your decision | When your scheme needs to connect with dashboards | |

|

If required, appoint new suppliers or revise contracts for existing suppliers |

Connecting to pensions dashboards - choosing a digital interface | |

| Start now: data tasks to match people with their pensions | ||

|

Understand what personal data you will receive from the digital architecture to help you match members to their pensions |

Matching people with their pensions | |

| Assess the quality and digital accessibility of personal data in your records | Matching people with their pensions | |

| Consider which data items you will use to confirm matches are made or that there are possible matches | Matching people with their pensions | |

|

Where your member personal data needs improving, put plans in place to deliver the improvements |

Matching people with their pensions | |

| Start now: data tasks to provide information to members | ||

| Understand what data you will need to return to members and by when | Information to provide to members | |

| Assess the quality and digital accessibility of the data that will be provided to your members | Information to provide to members | |

| Consider how you will calculate the value data so that it is provided in line with dashboard requirements – calculated in line with AS TM1 or scheme rules, and sufficiently recent | Information to provide to members | |

| Where value data is not in line with dashboard requirements, put plans in place to ensure you can meet your dashboard duties | Information to provide to members | |

| Ongoing actions | ||

| Stay up to date with developments to the regulations, Money and Pensions Service standards and relevant guidance | Stay in touch with developments | |

| Check that your team and suppliers are on track to deliver | Overview - working with advisers and providers | |

| Record key decisions and progress as per your existing governance processes | Ongoing connection and record-keeping requirements | |

| Review and update your Data Protection Impact Assessment (DPIA) in line with your data improvement plan | Matching people with their pensions - preparing your data for matching | |

Stay in touch with developments

We will contact each pension scheme in scope for pensions dashboards before their 'connect by' date. Make sure your contact details for the chair of trustees or nominated scheme contact are up to date on Exchange.

Subscribe to our Regulatory Round-Up e-newsletter to be kept up to date on changes to this guidance.

You can also sign up to the Money and Pension Service (MaPS) Pension Dashboards Programme newsletter to keep up to date with their work.

Further information and guidance will be published throughout the course of the programme development to help schemes connect to dashboards. We will update our guidance accordingly.

Useful resources

- Pensions Dashboards Regulations 2022

- Department for Work and Pensions guidance on connection: the staged timetable

- MaPS approach to dashboards standards

- Financial Reporting Council Actuarial Standards Technical Memorandum 1 (AS TM1) – the methodology used to calculate projected values in defined contribution pensions

- Compliance and enforcement policy for pensions dashboards

- Assess whether to report a breach of the law

- Pensions Administration Standards Association (PASA) guidance on dashboards